The rise of Payment Finance (PayFi) is reshaping how money moves across the global economy. With the PayFi sector now valued at over $2.27 billion and processing more than $148 million in daily transaction volume as of December 2025, blockchain-powered payment networks are rapidly replacing slow, fragmented legacy systems with real-time, programmable financial rails.

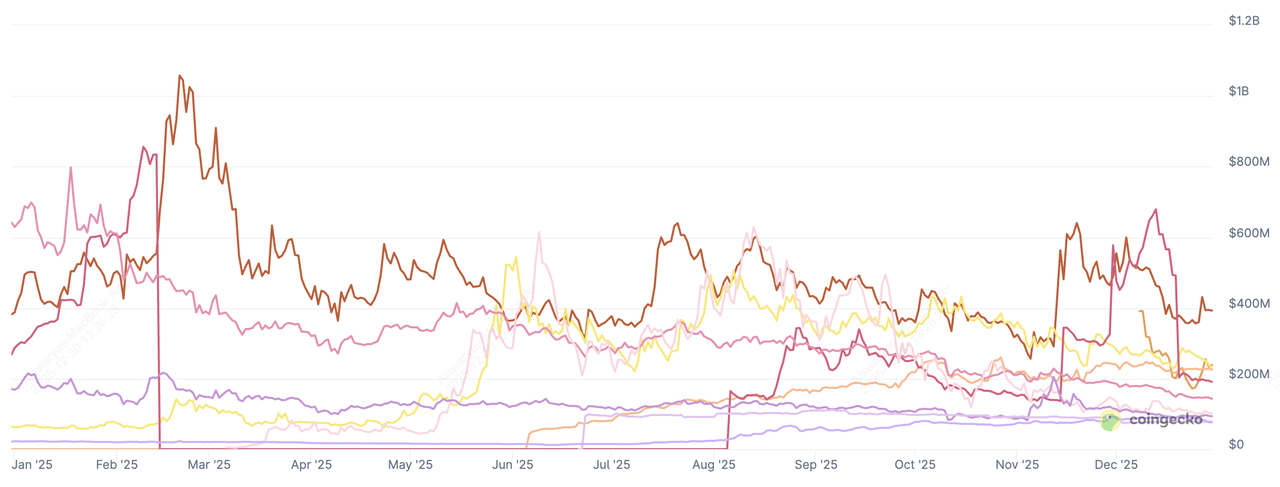

Market cap of leading PayFi coins | Source: CoinGecko

As adoption accelerates, PayFi is emerging as one of the most important pillars of Web3, bridging

stablecoins,

real-world assets, and

on-chain liquidity. In this article, we break down the top PayFi crypto projects to watch in 2026, highlighting the platforms driving real-world adoption, institutional interest, and the future of global payments.

What Is PayFi and Why Is It Gaining Momentum in 2026?

Payment Finance (PayFi) is a new financial model that uses blockchain technology to modernize how money moves, settles, and earns value. Instead of relying on slow, fragmented banking rails, PayFi enables real-time, programmable payments powered by stablecoins, smart contracts, and tokenized real-world assets (RWAs).

At its core, PayFi transforms money from a passive store of value into an active financial tool. Payments that once took days can now settle in seconds. Capital that once sat idle in accounts can be deployed instantly for lending, trade, or yield generation, all on-chain and without intermediaries.

This shift is gaining traction fast. Global payment volumes now exceed $1.8 quadrillion annually, yet traditional systems remain costly, slow, and opaque. In contrast, on-chain payment networks are scaling rapidly: stablecoin market capitalization has surpassed $170 billion, and on-chain settlement volumes increasingly rival those of major card networks. These trends are pushing enterprises, fintechs, and institutions toward PayFi as a more efficient financial backbone.

Can PayFi Take on TradFi (Traditional Finance) in 2026?

PayFi is gaining momentum because it solves structural problems that legacy finance cannot:

• Instant settlement: Payments finalize in seconds instead of days, improving cash flow and reducing counterparty risk.

• Capital efficiency: Tokenized assets and smart contracts allow capital to be reused, collateralized, or redeployed in real time.

• Global reach: Businesses can move value across borders without correspondent banks, high FX fees, or long delays.

• Programmable finance: Payments, lending, and revenue sharing can be automated through smart contracts.

• Regulatory alignment: Modern PayFi systems integrate compliance, identity, and auditability at the protocol level.

As stablecoins, real-world asset tokenization, and institutional blockchain adoption accelerate, PayFi is evolving from a niche innovation into core financial infrastructure. In 2026, it stands at the intersection of payments, DeFi, and global finance, reshaping how money moves, settles, and works in the digital economy.

Top PayFi Crypto Projects to Watch in 2026

As PayFi adoption accelerates across payments, lending, and real-world asset settlement, a new group of blockchain projects is emerging to power this transformation, each playing a distinct role in shaping the future of on-chain finance. Here are some of the best PayFi projects to keep an eye on:

1. Huma Finance (HUMA)

Category: PayFi Infrastructure / On-Chain Credit

Huma Finance is one of the most advanced PayFi protocols, designed to bring real-world payment financing on-chain through tokenized cash flows and stablecoin-based liquidity. It enables businesses to unlock immediate liquidity by converting future receivables, such as invoices or payment streams, into on-chain assets, removing the need for traditional credit intermediaries.

As of 2026, Huma has processed over $8.8 billion in total transaction volume, supports more than 93,000 active depositors, and manages over $130 million in active liquidity. Its infrastructure powers real-time settlement, cross-border payments, and capital-efficient financing using stablecoins, making it one of the most mature implementations of PayFi in production.

Why Huma stands out:

• Proven scale: Over $8.8 billion in cumulative payment volume processed

• Real-world yield: 12–18% sustainable yield generated from real economic activity

• Institutional-grade design: Built-in compliance, risk controls, and structured finance models

• Deep integrations: Supports Solana-based liquidity, stablecoin rails, and enterprise payment partners

By combining real-world receivables, on-chain settlement, and regulated financial structures, Huma demonstrates how PayFi can move beyond experimentation into production-grade financial infrastructure, positioning it as one of the most credible and impactful PayFi projects heading into 2026.

2. Stable (STABLE)

Category: PayFi Stablecoin Infrastructure

Stable (STABLE) is a next-generation stablecoin protocol built to power real-world payments, on-chain settlement, and capital-efficient liquidity at scale. Designed specifically for PayFi use cases, Stable enables businesses and institutions to move, store, and deploy capital using a USD-denominated asset that combines price stability with native yield generation.

As of end-December 2025, the Stable ecosystem supports over $234 million in circulating supply, with more than $33 million in daily trading volume and a fully diluted valuation exceeding $1.3 billion. Unlike traditional stablecoins that sit idle, STABLE integrates yield directly into its design, allowing users to earn returns from real-world payment flows, treasury operations, and tokenized financial activity.

Stable's key differentiators include:

• Yield-bearing stablecoin model: Earn protocol-generated yield from real payment activity rather than speculative emissions.

• Native USD settlement: Transactions settle directly in

USD₮ with predictable fees and sub-second finality.

• Institutional-grade infrastructure: Built for high-volume usage with compliance-ready architecture and audited reserve transparency.

• Composable PayFi integration: Designed to plug seamlessly into on-chain payment systems, treasury management tools, and DeFi protocols.

Powered by its own purpose-built network, StableChain, STABLE is positioned as a foundational settlement layer for PayFi, supporting everything from merchant payments and cross-border remittances to treasury operations and on-chain liquidity management. As adoption of programmable money accelerates, STABLE stands out as a core building block for scalable, real-world financial infrastructure.

3. Alchemy Pay (ACH)

Category: Payment Infrastructure and Fiat–Crypto Gateway

Alchemy Pay is a global payment infrastructure provider that connects traditional fiat systems with the crypto economy, enabling seamless on- and off-ramps for digital assets. As one of the most widely integrated payment gateways in Web3, it plays a critical role in PayFi by allowing users and merchants to move value between fiat and crypto in real time.

As of 2026, Alchemy Pay supports fiat-to-crypto and crypto-to-fiat transactions across 170+ countries, processing payments through bank transfers, cards, and local payment methods. The network supports major blockchains and stablecoins, enabling businesses to accept crypto while settling in local currency, or vice versa, with minimal friction.

Key strengths of Alchemy Pay include:

• Market cap: $37.6 million with over $6 million in daily trading volume

• Global reach: Supports fiat payments across 170+ regions

• Compliance-first design: Integrated KYC/AML and regulatory frameworks

• Multi-chain support: Compatible with major blockchains and stablecoins

• Enterprise adoption: Used by leading platforms for fiat on/off-ramps and crypto payments

Alchemy Pay plays a critical role in the PayFi stack by acting as the bridge between traditional money and on-chain liquidity. Its infrastructure enables real-world commerce, such as merchant payments, remittances, and fiat settlement, to flow directly into decentralized ecosystems. As PayFi adoption accelerates, Alchemy Pay’s ability to connect compliant fiat rails with programmable crypto liquidity positions it as a foundational gateway for mass-market adoption.

4. Canton Network (CC)

Category: Institutional Blockchain & Regulated Asset Infrastructure

Canton Network is a purpose-built blockchain designed to bring regulated financial markets on-chain, combining the privacy of traditional financial systems with the efficiency of decentralized infrastructure. Unlike public blockchains, Canton enables permissioned interoperability, allowing financial institutions to transact securely while maintaining regulatory compliance and data confidentiality.

As of 2026, Canton has emerged as one of the most institutionally adopted blockchain networks, supporting tokenized real-world assets (RWAs), regulated payment rails, and capital markets infrastructure. The network’s native token, CC, has a market capitalization of approximately $4.6 billion, with over $31 million in daily trading volume, reflecting growing institutional interest and on-chain activity.

Key benefits Canton offers include:

• Privacy-preserving architecture: Enables regulated institutions to transact on-chain without exposing sensitive data publicly.

• Institutional-grade tokenization: Used for issuing and settling tokenized U.S. Treasuries, funds, and financial instruments.

• High-performance settlement: Designed for large-scale financial activity with predictable execution and low latency.

• Interoperability by design: Connects banks, asset managers, and infrastructure providers within a shared, compliant network.

Canton’s real-world adoption accelerated after major institutions, including DTCC and leading global financial firms, began using the network to tokenize U.S. Treasury assets and settlement workflows. With over $4.6 billion in circulating value and growing institutional participation, Canton has positioned itself as a foundational layer for regulated on-chain finance.

As PayFi matures, Canton plays a critical role by enabling compliant, large-scale capital flows between traditional finance and blockchain infrastructure, bridging the gap between legacy markets and the future of programmable finance.

5. Stellar (XLM)

Category: Blockchain Infrastructure / Cross-Border Payments

Stellar is one of the most established blockchain networks powering PayFi use cases at global scale. Designed specifically for fast, low-cost value transfer, Stellar serves as a foundational settlement layer for cross-border payments, stablecoin issuance, and tokenized asset movement.

As of 2026, the Stellar network processes millions of transactions daily, supports over $6.9 billion in market capitalization, and settles payments in under 7.5 seconds at an average cost of less than $0.001 per transaction. Its architecture makes it particularly suited for high-volume, low-cost payment flows, an essential requirement for PayFi adoption.

Why Stellar matters for PayFi:

• Real-time settlement: Near-instant transaction finality enables same-day global payments and treasury operations.

• Built-in compliance: Native support for KYC, AML, and asset controls makes Stellar suitable for regulated financial institutions.

• Stablecoin-native design: Widely used for

USDC and other fiat-backed tokens, enabling seamless on-chain payments and treasury management.

• Enterprise-grade scalability: Supports large-scale remittances, payroll, and cross-border settlement at minimal cost.

Stellar’s infrastructure is already used by financial institutions, fintechs, and NGOs for remittances, treasury management, and tokenized asset issuance. Its combination of low fees, regulatory compatibility, and global reach positions it as a core settlement layer for PayFi, bridging traditional finance with blockchain-native payment systems at scale.

6. Solana (SOL)

Category: High-Throughput Blockchain

Solana is one of the most important infrastructure layers powering PayFi at scale. Designed for high-speed, low-cost transactions, Solana enables real-time settlement for payments, stablecoins, and on-chain financial applications, making it a natural backbone for PayFi systems that require speed, reliability, and global reach. In 2025, Solana has also emerged as a leading platform for tokenized real-world assets, including

tokenized equities and funds. Projects issuing on-chain representations of U.S. stocks and ETFs are increasingly choosing Solana due to its high throughput, low fees, and ability to support institutional-grade settlement. The growth of

tokenized stocks on Solana leveraging the network as a key settlement layer not only for payments, but also for tokenized capital markets where high-volume, low-latency transactions are critical.

As of 2026, Solana processes tens of millions of transactions per day, supports sub-second finality of around 400 ms, and maintains average transaction costs below $0.001, making it one of the most cost-efficient blockchains in production. With a market capitalization of over $69 billion and daily on-chain volumes exceeding $3.7 billion, Solana has become a preferred settlement layer for stablecoin payments, tokenized assets, and real-time financial applications.

Why Solana matters for PayFi:

• High-throughput settlement: Capable of processing thousands of transactions per second, enabling real-time payments and liquidity movement.

• Low and predictable fees: Enables microtransactions, high-frequency settlement, and enterprise-scale payment flows.

• Native stablecoin support: Powers large volumes of USDC and other stablecoin transactions used in payments and remittances.

• Institutional adoption: Used by major financial players for tokenized assets, on-chain settlement, and payment rails.

With its combination of speed, scale, and composability, Solana has become a foundational layer for PayFi infrastructure, supporting everything from consumer payments and merchant settlement to on-chain treasury operations and real-world asset tokenization.

7. Stablecoins Like USDC, PYUSD, USDT

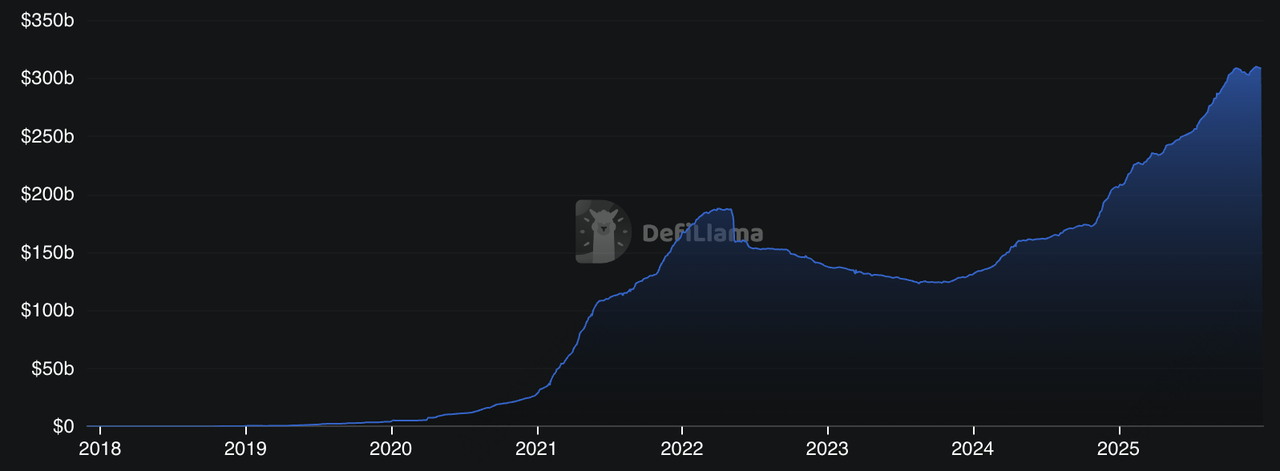

Total stablecoin market cap | Source: DefiLlama

Stablecoins are the core settlement layer of PayFi, enabling fast, low-cost, and programmable value transfer across global financial systems. Unlike volatile crypto assets, stablecoins maintain a stable unit of account, typically pegged to the U.S. Dollar, making them ideal for payments, lending, and treasury operations.

Today, stablecoins power over $307 billion in market cap and settle trillions of dollars annually, increasingly rivaling traditional payment rails. In PayFi systems, stablecoins function as the primary medium for real-time settlement, collateralization, and liquidity provisioning.

Why stablecoins are essential to PayFi:

• Instant settlement: Stablecoins enable near-instant cross-border payments without pre-funding or correspondent banks.

• Capital efficiency: Businesses can deploy stablecoins immediately instead of locking funds in multiple local accounts.

• Reliable unit of account: Pegged value reduces volatility for payments, payroll, and treasury operations.

• Programmable liquidity: Smart contracts enable automated payouts, credit lines, and settlement logic.

Stablecoins such as USDC,

PYUSD, and

USDT now underpin major PayFi workflows, including remittances, on/off-ramps, and B2B payments, by providing always-on liquidity and predictable settlement. As global payment volumes continue shifting on-chain, stablecoins are becoming the default monetary layer powering PayFi’s real-time, programmable financial infrastructure.

How to Trade PayFi Tokens on BingX

BingX makes it easy to access PayFi-related tokens through its AI-powered trading platform, offering both spot and derivatives markets with advanced risk controls and real-time analytics.

How to Buy and Sell PayFi Tokens on BingX Spot

HUMA/USDT trading pair on the spot market powered by BingX AI insights

BingX Spot allows users to easily buy and sell PayFi tokens through a simple, secure interface designed for both beginners and experienced traders.

1. Create or log in to your BingX account and complete identity verification if required.

2. Deposit funds like USDT or other supported assets into your Spot Wallet.

5. Your tokens will be credited instantly to your spot balance and can be held, transferred, or traded further.

How to Long or Short PayFi Tokens on BingX Futures

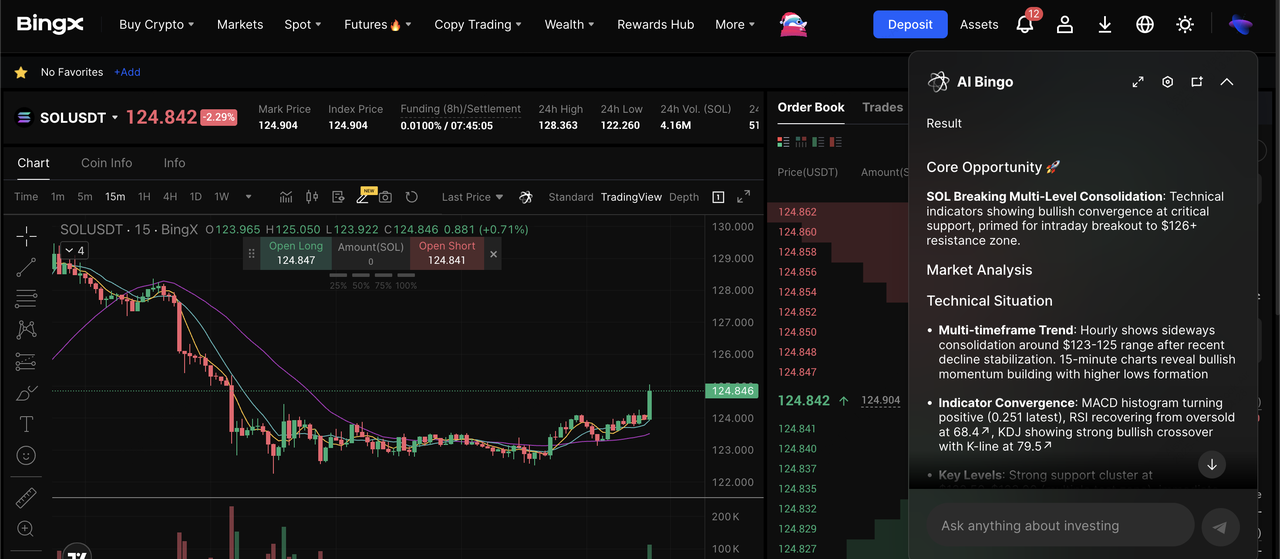

SOL/USDT perpetual contract on the futures market powered by BingX AI

BingX Futures enables traders to take long or short positions on PayFi tokens using leverage, allowing them to profit from both rising and falling market conditions with advanced risk controls.

2. Choose your margin mode (cross or isolated) and set your preferred leverage level.

3. Select your order type (market or limit) and define position size based on your risk tolerance.

5. Open a long or short position based on your market outlook.

6. Monitor key metrics such as

funding rates, liquidation price, unrealized PnL, and margin ratio in real time to manage risk effectively.

BingX’s integrated AI tools help traders

manage risk, optimize entries, and monitor market volatility, making it easier to participate in PayFi markets whether you’re trading spot or derivatives.

Is PayFi the Future of Finance?

PayFi represents a structural shift in how value moves across the global financial system. Traditional payment rails such as SWIFT and correspondent banking still rely on multi-day settlement cycles and layered intermediaries, with cross-border transfers often taking 2–5 business days and incurring average fees of 6% or more, according to data from the World Bank and BIS. In contrast, PayFi infrastructure enables near-instant settlement through on-chain execution, programmable logic, and atomic finality, reducing friction, cost, and operational risk across payment flows.

By combining smart contracts, real-time settlement, and interoperable financial primitives, PayFi transforms payments from a fragmented back-office process into a programmable, on-chain function. Research from McKinsey estimates that up to $120 trillion in global B2B payments could transition toward tokenized and blockchain-based rails over the coming decade. This shift enables faster reconciliation, improved transparency, and more efficient capital usage, while supporting new use cases such as on-chain treasury management, automated compliance, and real-time liquidity routing.

PayFi is not a short-term trend but an emerging financial infrastructure layer that aligns with the digital transformation of global commerce. As regulatory clarity improves and institutional participation increases, PayFi systems are likely to play a growing role in cross-border payments, on-chain capital markets, and enterprise finance. However, adoption will depend on factors such as regulatory alignment, technical resilience, and user trust. For market participants, understanding how PayFi operates, and where its risks and limitations remain, will be essential as this new financial architecture continues to evolve.

Related Reading