Proof-of-Work (PoW) is a way blockchains pick who gets to write the next block by requiring verifiable computational “work.” It’s energy-intensive but time-tested, used by Bitcoin and many older chains. In 2025, PoW assets still command a huge share of crypto: CoinGecko’s PoW category shows $2.13 trillion total market cap recently, with broad, liquid markets across majors and mid-caps.

Market cap of top PoW cryptocurrencies | Source: CoinGecko

In this article, you’ll explore the top Proof-of-Work (PoW) cryptos to mine in 2025, how they differ on technology and profitability, how to choose the right mining targets, and practical tips for trading PoW assets on BingX with risk controls.

What Is Proof-of-Work (PoW) Consensus and How Does It Work?

Proof-of-Work (PoW) is a consensus mechanism that allows blockchains to operate without a central authority. Instead of trusting banks or intermediaries, the network relies on independent “miners” who use computing power to verify transactions and propose new blocks. To add a block, miners must solve a cryptographic puzzle by repeatedly hashing the block data with different inputs until they find a valid result below the network’s current difficulty target. The miner who succeeds first broadcasts the block to the network, earning newly issued coins and transaction fees as a reward.

This process is intentionally computationally expensive. Because adding or altering past blocks would require re-doing the same work across the entire blockchain, PoW makes tampering economically impractical. The more miners participate, the greater the total hashrate, the combined computing power securing the network, and the harder it becomes for any single attacker to control it. For example,

Bitcoin’s hashrate has grown from millions of hashes per second in its early years to exahashes per second today, reflecting a dramatic increase in network security.

PoW is most commonly associated with Bitcoin, but many other networks such as

Litecoin,

Dogecoin,

Monero, and

Kaspa also use it. While the model requires significant energy and specialized hardware, it remains one of the most tested and resilient approaches to decentralized security, particularly for storing and settling high-value transactions.

How Does Mining Coins on a Proof-of-Work (PoW) Network Work?

1. Users create and broadcast transactions, such as sending cryptocurrency from one wallet to another.

2. Miners gather these pending transactions and package them into a proposed block.

3. Every miner then begins searching for a valid “nonce,” a number that makes the block’s hash meet network requirements.

4. They combine the block data and nonce and run it through a hashing algorithm like SHA-256.

5. If the resulting hash is below the network’s difficulty target, the block is considered valid.

6. The miner who finds the valid hash first broadcasts the completed block to the network.

7. Other miners independently verify the block’s legitimacy and confirm that the rules were followed.

8. The valid block is added to the chain, the network state updates, and the winning miner receives the block reward and transaction fees.

Why Are Proof-of-Work Cryptos Gaining Traction in 2025?

After several years of market experimentation with alternative consensus models, Proof-of-Work is regaining momentum as both institutions and retail traders seek proven security, transparent issuance, and high-liquidity networks.

1. Institutional Money Is Flowing into PoW-Backed ETFs

Proof-of-Work is seeing renewed interest in 2025 as investors return to assets with long security track records, transparent issuance, and deep liquidity. Bitcoin and

Ethereum Spot ETFs opened the door for regulated crypto exposure in 2024, and by late 2025 Bitcoin ETFs alone reported nearly $150 billion in assets under management. Issuers are now pursuing

Litecoin ETFs,

Dogecoin ETFs, and even basket-style PoW ETF products, giving risk-conservative investors exposure to mined assets without the operational complexity of self-custody. For institutions, PoW’s predictable monetary policy and on-chain history, particularly for Bitcoin, Litecoin, and Dogecoin, are key drivers.

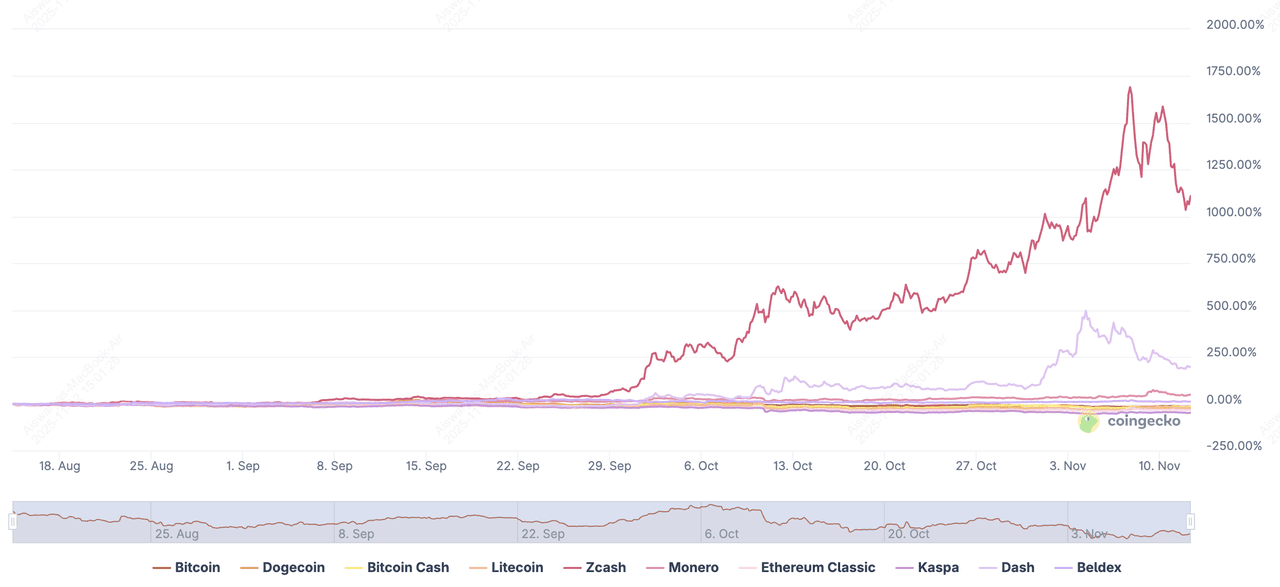

2. Privacy-Focused PoW Chains Are Rallying

Retail traders have shifted toward PoW assets as 2025’s “privacy season” gained momentum.

Dash,

Zcash, and

Monero saw sharp breakouts in Q4, driven by rising concerns around surveillance and centralized data control. Dash surged over 50% in 24 hours, added $1 billion in market cap in just three days, and reached price levels not seen since 2022, fueled by more than $2 billion in daily trading volume. Zcash (ZEC) and Monero (XMR) also recorded triple-digit weekly gains as demand climbed for censorship-resistant transactions and fast settlement. For traders, PoW privacy coins combine real-world utility, established uptime, and liquid markets.

3. Mobile-Mining Narratives Are Onboarding New Retail Users

User-facing products are also driving curiosity around mined assets.

Pi Network returned to the spotlight by clearing millions of new

KYC approvals, launching a DeFi testnet with AMM + DEX functionality, and aligning toward ISO 20022 standards used by global banking systems. While Pi does not use PoW, its viral growth has pushed new users to research “real” mining, often leading them toward Bitcoin, Litecoin, and other PoW currencies with transparent issuance and open blockchain settlement.

In short, PoW is gaining traction in 2025 because institutions want ETF-friendly exposure, retail traders are rotating into privacy-centric networks, and consumer-focused platforms are onboarding new audiences into the mining ecosystem. Rather than aging out, PoW is being treated as a mature, verifiable security model for securing high-value digital money and censorship-resistant transactions.

What Are the Best PoW Cryptos to Mine?

With mining profitability swinging wildly based on hardware costs, electricity rates, and network difficulty, a handful of Proof-of-Work cryptocurrencies continue to stand out in 2025 for strong liquidity, predictable issuance, and active user demand.

| Coin |

Consensus / Algorithm |

Supply Model |

Key Advantage |

| Bitcoin (BTC) |

PoW – SHA-256 |

21M max, halving every 4 yrs |

Most secure and liquid PoW network; ETF demand |

| Dogecoin (DOGE) |

AuxPoW w/ Litecoin (Scrypt) |

~5B DOGE minted/yr (fixed) |

High liquidity + strong retail demand; ETF filings |

| Litecoin (LTC) |

PoW – Scrypt |

84M max, halvings |

Fast, cheap payments; high regulatory acceptance |

| Zcash (ZEC) |

PoW – Equihash |

21M max, halving cycle |

Advanced privacy (Halo 2, shielded addresses) |

| Monero (XMR) |

PoW – RandomX (CPU-optimized) |

Tail emission: 0.6 XMR/block |

Default private transactions; ASIC-resistant |

| Dash (DASH) |

PoW – X11 + masternodes |

~18.9M cap |

Instant, final settlement via ChainLocks |

| Kaspa (KAS) |

PoW – kHeavyHash on blockDAG |

Emission tapers toward zero |

“Fast PoW” (~1s blocks), high throughput |

| Pi Network (PI) |

Federated (SCP-style, not PoW) |

KYC-based unlocks |

Mobile-first network with DeFi testnet & ISO-20022 push |

1. Bitcoin (BTC)

Bitcoin remains the reference PoW asset, secured by ~1,000+ EH/s of network hashrate and record difficulty, under a design that targets ~10-minute blocks and a fixed 21 million supply with post-2024 block rewards at 3.125 BTC. Operational security is measurable: hashrate and difficulty have hovered near all-time highs in late 2025, while the U.S. spot-ETF wave has deepened liquidity, BlackRock’s IBIT alone is nearing $100B AUM, and aggregate spot ETFs continue to post record inflows, making BTC the primary institutional gateway to PoW exposure. Practically, beginners should watch hashrate/difficulty trends, rising levels = stronger miner participation, alongside ETF flows and miner revenue to gauge security and liquidity conditions around difficulty adjustments and halving-driven issuance.

2. Dogecoin (DOGE)

Dogecoin pairs a simple, high-throughput PoW design with AuxPoW merged mining alongside Litecoin, proposed in 2014 and implemented in 2015, so LTC miners can secure DOGE at effectively no extra energy cost, materially strengthening network hashrate resilience. Its monetary policy is mechanically predictable: a fixed 10,000 DOGE block reward every ~1 minute, around 5.26 billion DOGE issued per year, with 1-minute blocks supporting fast settlement and deep exchange liquidity. In 2025, regulated access is expanding: the first U.S.

spot Dogecoin ETF (Rex-Osprey’s DOJE) launched in September with a strong debut, and Bitwise’s Dogecoin ETF removed its “delaying amendment,” positioning it to go effective absent SEC objection, developments that can channel additional institutional flow into DOGE’s already active spot/perp markets.

3. Litecoin (LTC)

Litecoin secures its network with scrypt-based PoW, produces blocks roughly every 2.5 minutes, and reduced issuance to 6.25 LTC after its August 2, 2023 halving, supporting fast settlement and low average fees (typically well under $0.01) across more than 250,000 daily transactions. With 84 million max supply and more than a decade of near-perfect uptime, LTC has become a reliable payments layer and key participant in the AuxPoW ecosystem alongside Dogecoin. In November 2025, it trades with deep CEX liquidity and is drawing institutional attention as issuers pursue Spot Litecoin ETF approvals, mirroring the demand pattern that drove capital into Bitcoin and ETH ETF markets.

4. Zcash (ZEC)

Zcash is a PoW chain using the memory-hard Equihash algorithm, designed to be ASIC-resistant early on and mined like Bitcoin but with a different hashing function. Its 2022 NU5 upgrade rolled out Halo 2 zero-knowledge proofs (eliminating trusted setup), a new Orchard shielded pool, and Unified Addresses with auto-shielding, making private payments far simpler for regular users and improving wallet compatibility. In late 2025, ZEC became the top-performing privacy coin, surging from roughly $70 to over $700 in five weeks, a 700% gain, triggering more than $50M in short liquidations in a single day and vaulting its market cap to around $11B. Analysts cite rising demand for regulated, auditable privacy, a mid-November halving that cuts issuance to 0.78125 ZEC per block, and growing shielded-pool adoption (now 30%+ of supply) as catalysts behind Zcash’s renewed institutional narrative.

5. Monero (XMR)

Monero secures its chain with RandomX, a CPU-optimized, ASIC-resistant PoW algorithm designed to keep mining broadly accessible and decentralized, with 2-minute blocks and a permanent 0.6 XMR tail emission since mid-2022. That tail emission translates to sub-1% annual inflation trending toward zero, but guarantees miners predictable long-term rewards—an approach aimed at avoiding the “security budget cliffs” seen in hard-capped PoW models. Demand for private settlement has pushed Monero back near its all-time high: XMR recently traded around $380–$410, only 20% below its $517 peak, even as the wider crypto market sold off over $2 billion in liquidations in October and November. Analysts cite a rotation from other privacy coins, tightening 2026 reporting rules, and Monero’s reputation for default privacy as drivers behind capital inflows and its resilience against broader drawdowns.

6. Dash (DASH)

Dash combines a Bitcoin-style Proof-of-Work chain (X11) with a masternode layer that enables practical, fast payments: InstantSend uses long-living masternode quorums to lock inputs within seconds, and ChainLocks provides block-level finality that prevents chain reorganizations, giving merchants near-instant settlement without waiting for multiple confirmations. Fees usually stay well below a cent, and this speed-plus-finality profile has made Dash attractive in regions where crypto is used for day-to-day spending or mobile point-of-sale. During the privacy-coin rally of late 2025, Dash climbed to three-year highs and posted ~170% weekly gains, as traders rotated into assets with low fees, fast finality, and optional privacy tools like CoinJoin in Dash Core. If payments volumes increase, whether for consumer spending, arbitrage, or remittances, Dash’s combination of low cost and instant finality is designed to compete as a lightweight “digital cash” network.

7. Kaspa (KAS)

Kaspa (KAS) is a high-throughput Proof-of-Work blockchain that uses GHOSTDAG and a blockDAG structure to process multiple blocks per second in parallel, targeting 1 block/sec confirmations. Powered by the kHeavyHash algorithm, its 2024–2025 Crescendo upgrades boosted performance, wallets, and developer tools. Recent network data shows 158M transactions in a day, 5,700+ TPS, and node counts rising from ~300 to 443, with a target of 1,000 for greater decentralization. Kaspa continues to grow through grassroots adoption, more exchange listings, and apps like Kasia, which can send 500,000 encrypted messages for under $1.

Alternate Crypo to Mine: Pi Network (PI)

Technically, Pi Network is not a Proof-of-Work blockchain; it uses a federated consensus model similar to Stellar’s SCP, where network “Nodes” reach agreement through quorum voting instead of competitive mining. Interest spiked again in late 2025 after the team announced a fully open Mainnet date of February 20, 2025, cleared more than 3.36 million additional KYC cases, and launched a DeFi testnet with AMM and DEX tools directly inside the Pi Wallet, allowing users to simulate swaps and liquidity pools without spending real PI. For beginners, the key distinction is that Pi’s “mobile mining” does not provide PoW-style security or token issuance; PI’s transferability, listings, and blockchain maturity should be evaluated independently of mining claims.

How to Choose the Best Cryptocurrencies to Mine

With mining difficulty, hardware costs, and electricity prices changing constantly, the best crypto to mine is the one that offers strong network security, predictable rewards, and real user demand, not just hype.

1. Start with network security: A coin with high hashrate and rising network difficulty is harder to attack, which protects the value of the tokens you mine. Bitcoin and Litecoin are industry benchmarks, but mid-sized PoW networks like Dogecoin and Kaspa also publish real-time hashrate dashboards. Avoid projects where hashrate is dropping sharply, this usually means miners are leaving and security risk is rising.

2. Look for predictable, transparent issuance: Mining rewards come from block subsidies, so you want coins with a clear, long-term supply schedule. Bitcoin and Litecoin both reduce rewards every four years, Monero has a permanent 0.6 XMR “tail emission,” and Zcash/Dash have periodic reductions. If you can model supply, you can estimate future inflation, miner revenue, and whether mining remains profitable.

3. Check settlement speed and user demand: Fast confirmation times matter if you mine and sell frequently or run OTC trades. Dash’s InstantSend and ChainLocks can finalize a payment in seconds, while Kaspa’s blockDAG confirms multiple blocks per second and Litecoin consistently offers cheap transactions. A network that settles quickly and has deep liquidity makes it easier to convert mined tokens into cash.

4. Understand privacy and compliance trade-offs: Privacy coins are popular to mine, but each works differently and affects where you can trade. Zcash uses optional shielded transactions, while Monero is private by default using RingCT and stealth addresses. Because regulations vary by country, always confirm which exchanges support deposits and withdrawals before you start mining.

5. Important note about Pi Network: Pi Network does not use Proof-of-Work even though the app uses the term “mobile mining.” Its federated SCP-style consensus has different security and economic assumptions, meaning no ASICs, GPUs, or real hash competition is involved. Treat Pi as a separate category and evaluate it based on KYC progress, mainnet activity, wallet support, and listings, not traditional mining metrics.

Beyond Crypto Mining: How to Buy and Trade PoW Coins on BingX

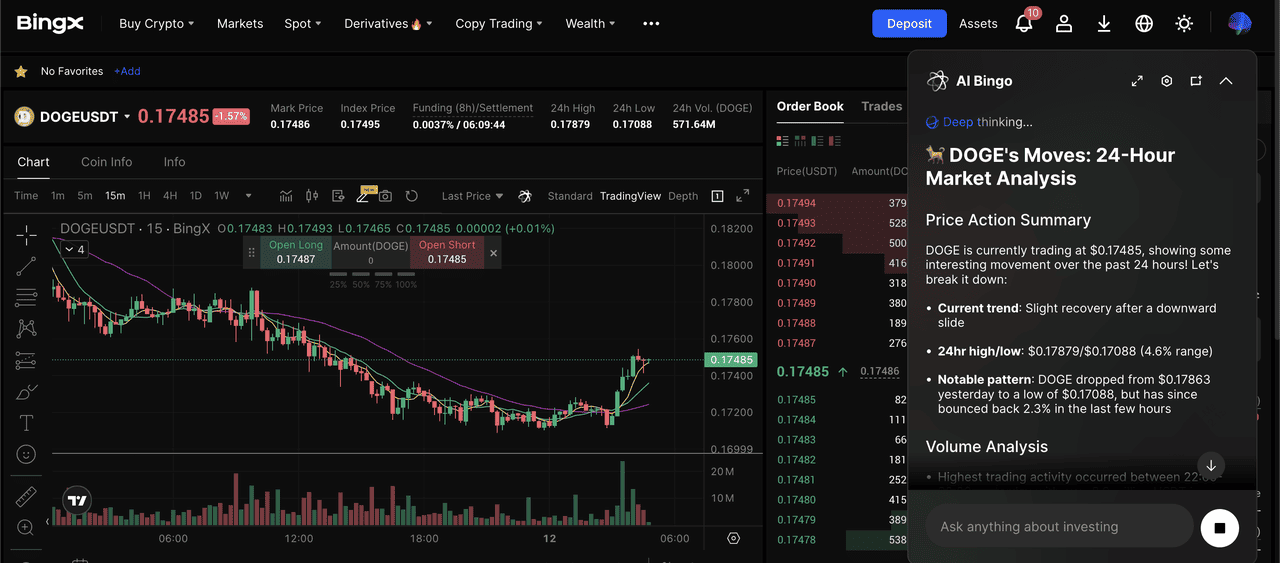

BingX makes it easy to trade mined assets using Spot or Futures markets, and traders can turn on

BingX AI for automated support/resistance mapping, momentum signals, and real-time market analysis.

Spot Trading PoW Cryptos

DOGE/USDT trading pair on the spot market powered by BingX AI insights

2. Use

Market Orders if you want instant execution at current price, or Limit Orders if you prefer to set your own entry price.

3. For beginners, turning on BingX AI on the chart can highlight trend direction, support/resistance zones, and momentum shifts to help reduce emotional trading.

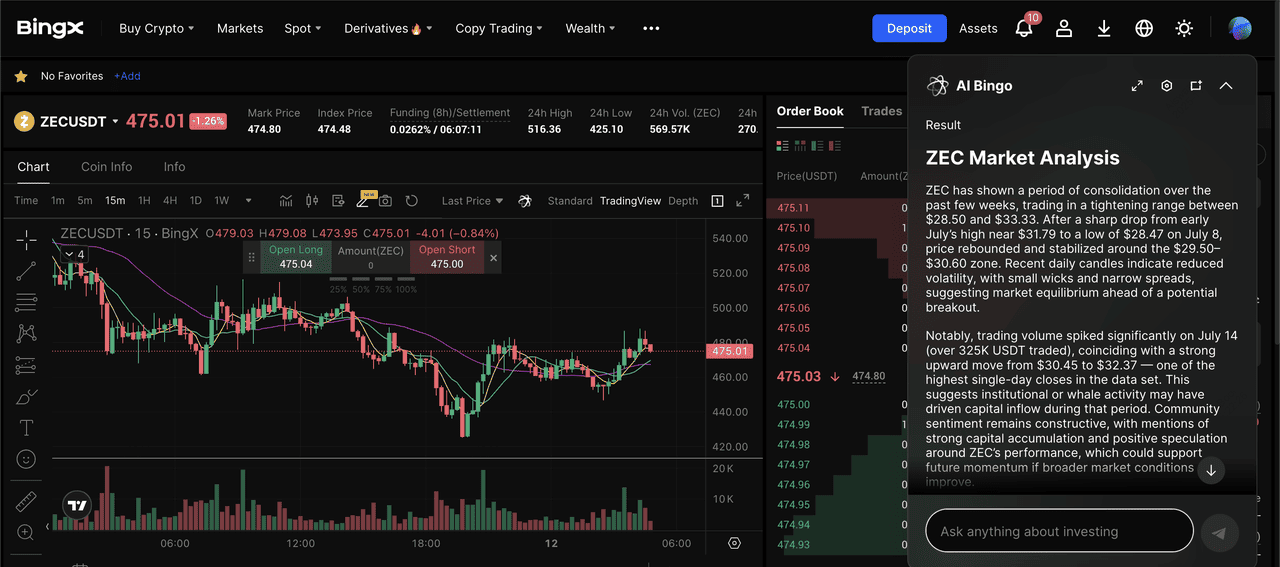

Futures Trading to Trade Mining Cryptos with Leverage

ZEC/USDT perpetual contract on the futures market powered by BingX AI

BingX Futures allows you to trade price direction, and not just buy and hold, so you can open long positions if you think price will rise or short positions if you expect a drop.

1. Set

stop-loss and take-profit before you enter the trade to manage risk, and start with low leverage until you are comfortable with volatility.

What Are the Top Risks of Crypto Mining?

Mining is not just about buying hardware and collecting rewards. Profitability depends on network difficulty, energy costs, regulation, liquidity, and the real economics behind each chain.

1. Mining profit can flip from profitable to unprofitable fast. When network hashrate and difficulty rise faster than price, block rewards generate fewer dollars per kWh. This happened repeatedly in 2024–2025 when Bitcoin mining difficulty hit all-time highs while prices pulled back, forcing weaker miners to power down rigs or sell reserves to stay solvent. If electricity is expensive in your region, a 20–30% spike in difficulty can erase your profit margin overnight.

2. Miner sell pressure during downturns: When markets fall, miners often sell coins to cover electricity and maintenance costs, creating extra supply on the market. In past cycles, miner capitulation phases have accelerated price drawdowns, especially on smaller PoW chains with thin liquidity. Always check historical miner reserve charts on Glassnode and CryptoQuant, and network difficulty trends before scaling your operation.

3. Hardware and energy sensitivity: ASIC profitability is extremely sensitive to electricity price. At $0.05/kWh, a mid-range Bitcoin ASIC can stay profitable; at $0.12/kWh, the same machine can go negative. GPU-mined coins face added volatility because new hardware releases like Nvidia and AMD architectures can dilute hashpower quickly. Beginners should run profitability simulations using tools like WhatToMine or Minerstat before buying gear.

4. Privacy regulations and exchange risk: Some PoW chains, especially privacy-focused networks like Zcash, Monero, and Dash, face stricter rules depending on country. Exchanges in Japan, South Korea, and parts of the EU have delisted privacy assets, and the EU’s 2027 AML package could restrict some trading pairs. If you plan to mine Zcash (ZEC), Monero (XMR), or Dash (DASH), confirm where you can actually sell or withdraw the coins.

5. Liquidity and market depth: Even if a coin looks profitable on paper, thin liquidity can make it difficult to sell mined tokens at fair market prices. Smaller PoW assets sometimes show large spreads between order books, meaning you may lose 1–3% just by selling. Before mining, check active trading volume on major exchanges; daily volume above $5–$10 million usually indicates healthier liquidity.

6. Consensus differences matter: The term “mobile mining” has caused confusion. Pi Network uses a federated SCP-style consensus, not Proof-of-Work, and does not rely on real hashing or mining rigs. Treat Pi separately from PoW coins when evaluating risk, value, or long-term sustainability; its economics depend on KYC completion, mainnet migration, and exchange listings, not mining difficulty or hardware investment.

Final Word

If you’re new to Proof-of-Work assets, it’s generally safer to start with highly liquid majors like BTC, LTC, and DOGE before moving into more specialized segments such as privacy coins (ZEC, XMR), instant-settlement networks (DASH), fast blockDAG designs (KAS), or hybrid models (CFX).

Pi Network is worth monitoring as a separate, non-PoW ecosystem with different economics and risks. Whatever you choose, size positions carefully, use stop-loss/take-profit tools where appropriate, and always verify trading pairs, liquidity, and withdrawal availability on BingX before committing capital. Remember: crypto markets are volatile, and even well-known PoW coins can experience large drawdowns; never invest money you cannot afford to lose.

Related Reading

FAQs on Mining Cryptocurrencies

1. Is crypto mining still profitable in 2025?

It can be, but profitability depends on electricity cost, hardware efficiency, and network difficulty. Most miners now run modern ASICs or GPUs and use profitability calculators to estimate daily rewards before buying equipment.

2. What hardware do I need to mine PoW coins?

Bitcoin and Litecoin typically require ASICs, while coins like Kaspa, Dogecoin (via merged mining), and Ethereum Classic can use GPUs depending on the network. Always check a coin’s algorithm and recommended hardware before investing.

3. Can you really mine crypto coins from a phone?

Mobile apps labeled as “mining” are usually point-earning simulators or social participation systems—not true PoW, since phones can’t solve mining hashes. Pi Network is the biggest example, but it uses a federated consensus model, not real PoW mining.

4. How do mining pools work?

You contribute your hashpower to a shared pool, earn a proportional share of block rewards, and reduce variance compared to solo mining. Most miners use pools because finding blocks alone is unlikely without large hardware setups.

5. Which PoW coins have unique technology advantages?

Kaspa uses a blockDAG (GHOSTDAG) to confirm blocks in parallel, enabling near-1 block per second speeds. Dash offers InstantSend and ChainLocks for near-instant, reorg-resistant settlement. Zcash uses Halo 2 zero-knowledge proofs and Unified Addresses to make private payments easier and more secure.