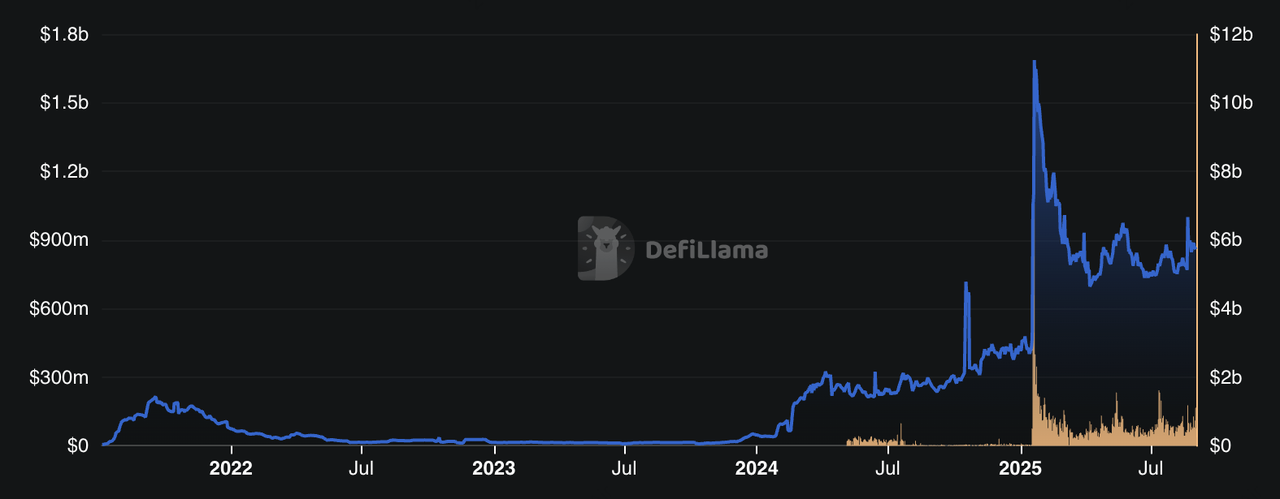

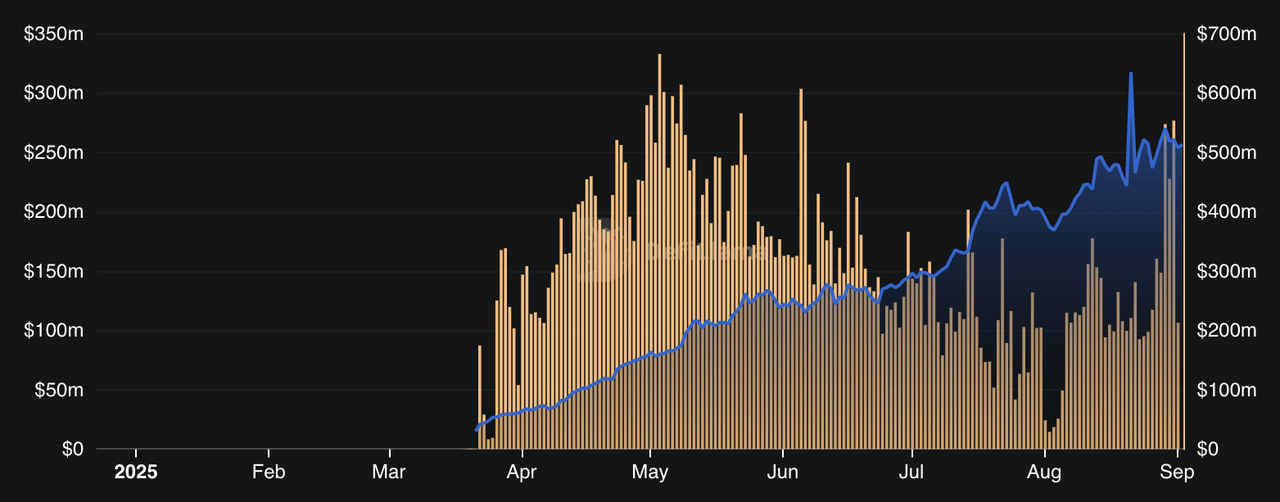

Whether you're farming yield, trading memecoins, or looking for the next IDO, Solana DEXs offer a vibrant, low-latency playground for all types of users in 2025.

Decentralized Exchanges (DEXs) in the Solana Ecosystem: An Overview

Solana DEXs,

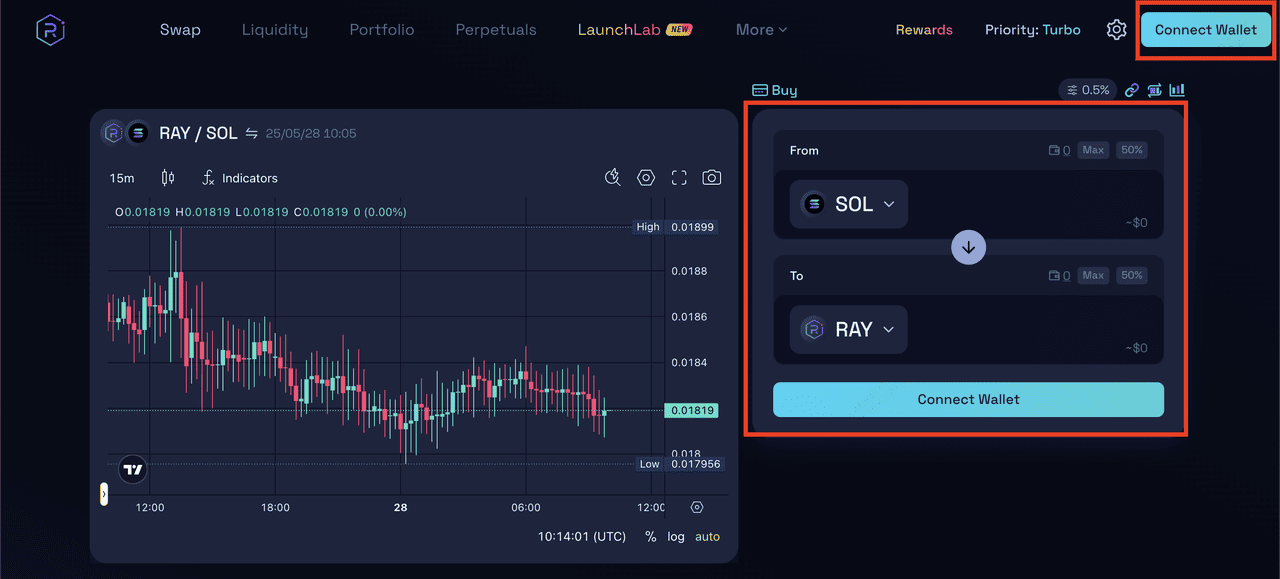

decentralized exchanges on the Solana blockchain, let you swap tokens directly from your

wallet without the need for a middleman. Everything runs on smart contracts, which means there’s no centralized party holding your funds or approving your trades.

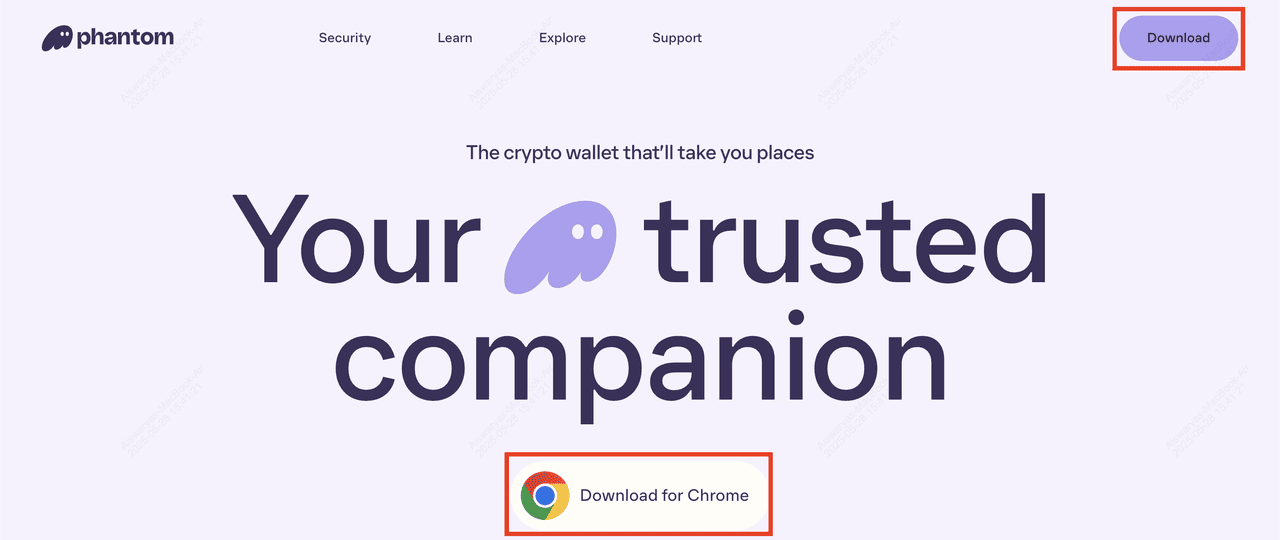

Unlike centralized exchanges (CEXs), where you need to deposit your crypto first, Solana DEXs allow you to trade directly from your

self-custody wallet like

Phantom or

Solflare. Your keys, your coins, at all times.

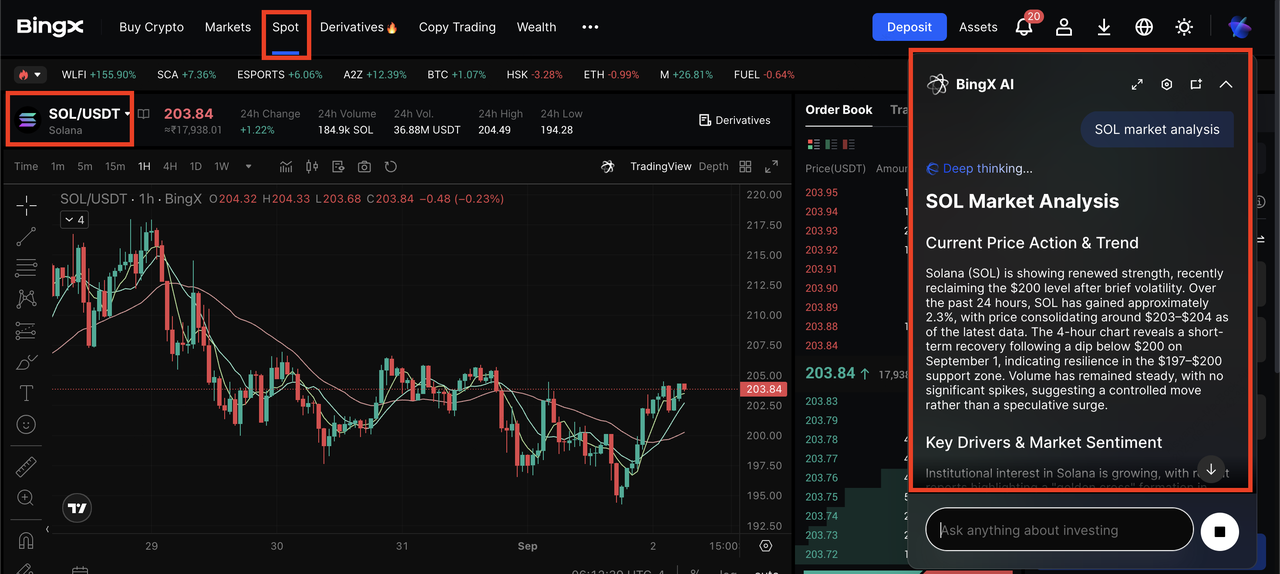

Why Use a Solana DEX?

Solana DEXs offer a fast, low-cost, and flexible way to trade crypto directly from your wallet. With transaction fees typically under $0.01, they’re one of the most affordable options for on-chain trading. You don’t need to sign up, complete

KYC, or trust a centralized platform. Simply connect a

Solana wallet like Phantom or Solflare and start swapping tokens. Solana DEXs are also where many new and trending tokens debut, giving you early access to opportunities often unavailable on centralized exchanges.

But trading on a DEX comes with its own challenges, such as:

• Steeper learning curve: You’ll need to understand slippage, token contracts, and how to safely navigate DeFi tools.

• Smart contract risks: Not all protocols are audited. Bugs and exploits can lead to losses.

Still, if you’re looking to explore DeFi with speed, control, and flexibility, Solana DEXs are a powerful and affordable gateway into the decentralized future.

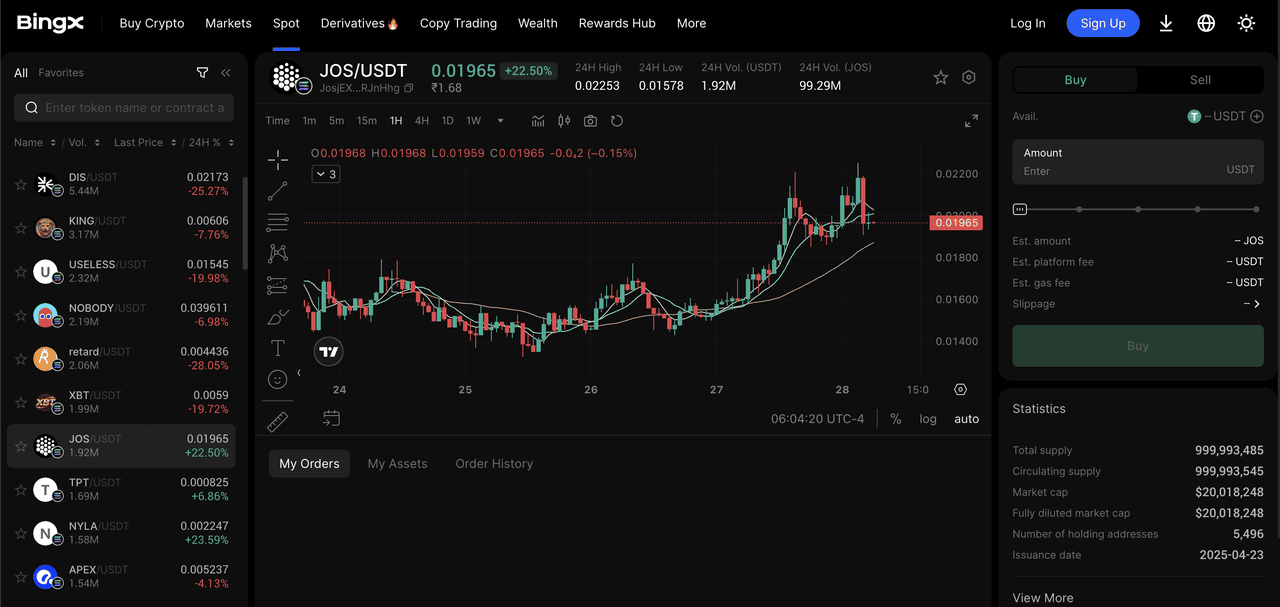

The 5 Best Solana DEXs to Watch in 2025

Solana’s DeFi ecosystem is packed with innovative decentralized exchanges offering fast, low-cost, and feature-rich trading experiences. Here are the top 5 Solana DEXs (decentralized exchanges) to watch in 2025, each bringing something unique to the table, from liquidity aggregation to perpetual trading.

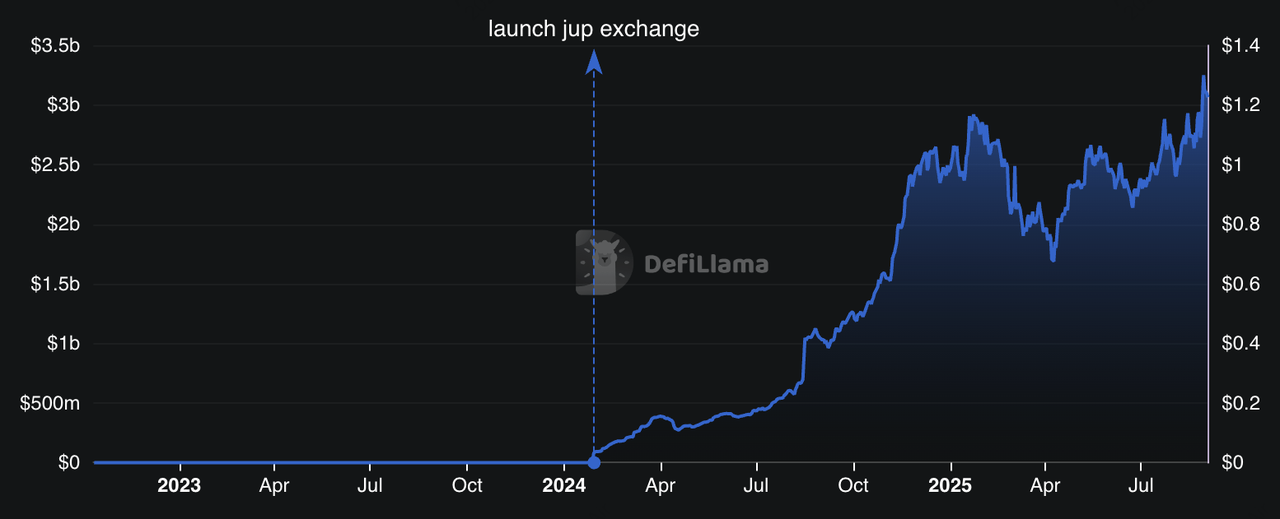

1. Jupiter (JUP): Leading Liquidity Aggregator on Solana