Introduction

A

stablecoin is a form of cryptocurrency engineered to keep its value steady compared to a particular asset or a group of assets. While cryptocurrencies like

Bitcoin and

Ethereum are known for their price swings, stablecoins are intended to provide consistency and predictability, making them especially useful for trading, saving, and various financial operations. Stablecoins are digital tokens pegged to fiat currencies like the US dollar, which are essential in the decentralized finance (DeFi) space.

The

Solana blockchain has rapidly become a central hub for stablecoin activity thanks to its lightning-fast transaction speeds and minimal fees. On Solana, stablecoins are used for trading, payments, and as reliable stores of value, making them fundamental to the platform's growth and usability. This growth is further fueled by the surge in memecoin trading, particularly on platforms like

Pump.fun, which has led to a significant uptick in on-chain activity.

Solana DEXs (decentralized exchanges) such as

Jupiter,

Raydium, and

Orca have seen increased usage as traders move between

memecoins and stablecoins, highlighting the importance of stablecoins as liquidity anchors and safe havens within the volatile Solana ecosystem.

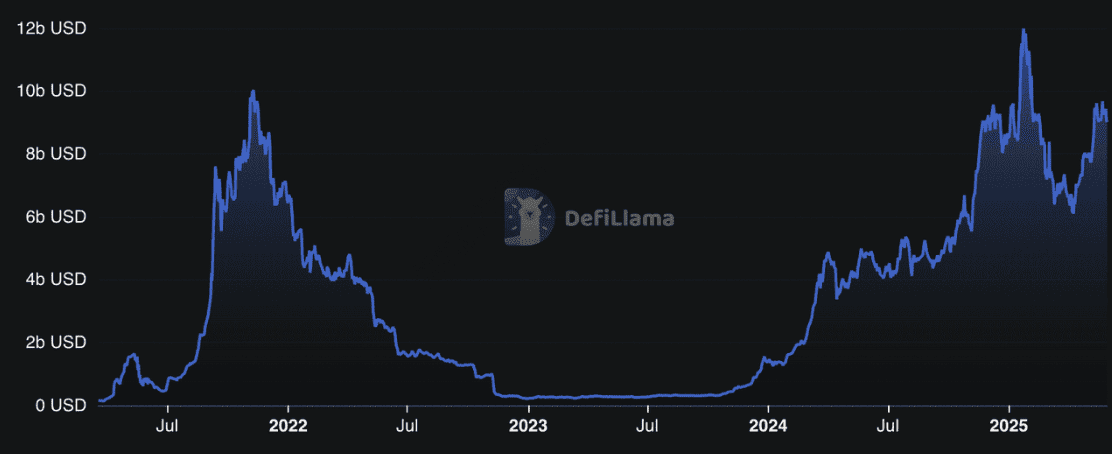

Exploring the Solana Ecosystem

Solana DeFi TVL | Source: DefiLlama

Solana's reputation as a leading blockchain is built on its remarkable speed, low costs, and strong energy efficiency. The platform's architects designed it with scalability and user experience in mind, understanding that true mass adoption of blockchain technology requires both seamless interaction and minimal fees for participants.

At the core of Solana's performance is its unique approach to consensus, combining Proof of History (PoH) with Proof of Stake

(PoS). This allows the network to confirm blocks in as little as 400 milliseconds, a significant improvement over the block times seen on Bitcoin or Ethereum, resulting in a much smoother and faster experience for users.

SOL, the network's native token, enables holders to stake with validators who process transactions. Validators share rewards with stakers, aligning incentives so that everyone benefits from a secure and efficient network.

Solana sets itself apart with three standout innovations:

• High Throughput: The network is capable of handling between 50,000 and 65,000 transactions per second, making it one of the fastest blockchains available.

• Low Cost: Users enjoy extremely low transaction fees, with the average cost sitting at just $0.00025 per transaction, far less than most competitors.

• Energy Efficiency: Solana's architecture is designed to minimize resource use, with each transaction consuming a fraction of the energy required by other major networks: in some cases, less than half the energy of a single Google search.

Beyond its technical strengths, Solana has become a magnet for innovation, fostering a rapidly expanding DeFi ecosystem and a thriving NFT marketplace. This combination of speed, affordability, and vibrant community makes Solana one of the most attractive platforms for developers and users alike.

Why are Stablecoins Gaining Traction on Solana?

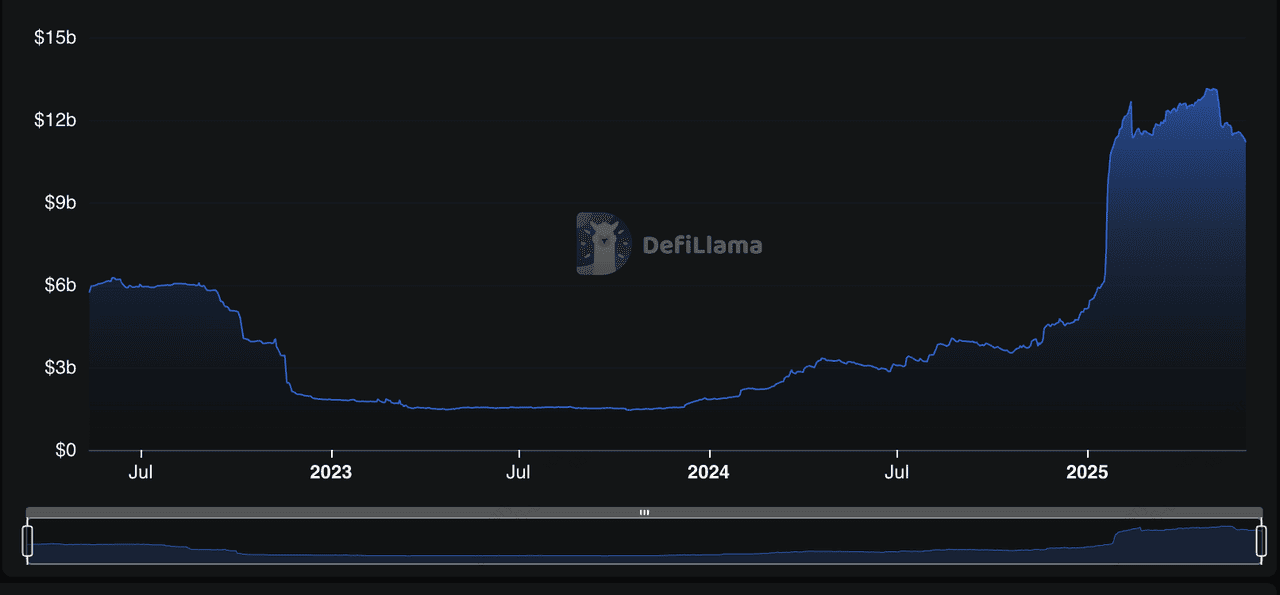

Total stablecoin market cap | Source: DefiLlama

Solana has the third-largest stablecoin market cap among blockchain ecosystems, after

Ethereum and

TRON. As of late May 2025, the total market cap of stablecoins in the Solana ecosystem exceeds $11 billion.

Solana’s high throughput, processing tens of thousands of transactions per second, and minimal transaction costs make it ideal for stablecoin use cases like microtransactions, cross-border payments, and DeFi trading. This enables users to move funds quickly and affordably, without the delays or high costs often seen on other blockchains.

In addition, stablecoins like

USDC and USDT benefit from strong liquidity on Solana, allowing for seamless swaps, lending, and

yield farming with minimal slippage. Their integration across

major DeFi protocols further enhances usability. Combined with Solana’s global accessibility and upcoming

performance upgrades (like Firedancer), these features make the network a preferred platform for both retail users and institutions looking to transact with stable, dollar-pegged assets.

The Most Popular Stablecoins in the Solana Ecosystem

Solana’s high-speed, low-cost blockchain has become a thriving environment for stablecoins, supporting a wide range of use cases from trading to DeFi. Below are the most popular stablecoins actively used across the Solana ecosystem.

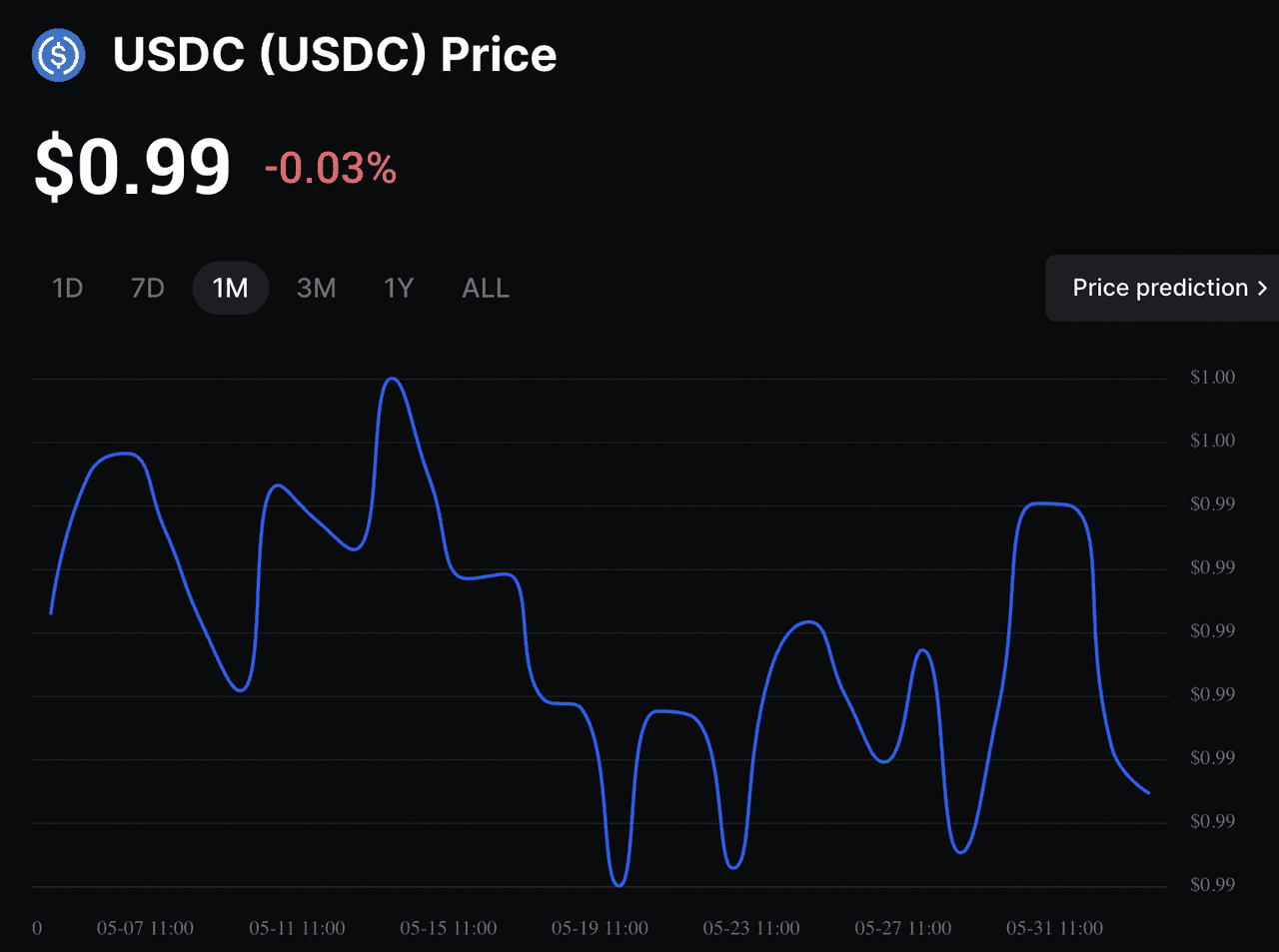

1. USD Coin (USDC)

USDC price on BingX | Source:

BingX

Among the most prominent stablecoins on Solana,

USD Coin (USDC) stands out as the clear leader. USDC is highly regarded for its transparency and strong backing by US dollars and Treasury securities, making it a trusted choice for both individuals and developers. As of May 2025, USDC is the dominant stablecoin used in the Solana ecosystem, accounting for 72.70% market dominance and a market cap of over $8 billion. Its deep liquidity and broad integration across DeFi protocols have cemented its status as the go-to stablecoin on Solana. Whether you're swapping tokens, earning yield, or making payments, USDC offers stability and reliability.

2. Tether (USDT)

USDT price | Source:

BingX

Tether (USDT) is another major player in the Solana ecosystem. As the world's largest stablecoin by market capitalization, USDT enjoys widespread acceptance and high liquidity. USDT is the second-most popular stablecoin in the Solana ecosystem, with a market cap of over $2 billion as of May 2025. On Solana, USDT is used for everything from trading to cross-border payments, providing users with a familiar and versatile stable asset. Its strong presence ensures that users can move funds quickly and efficiently, taking full advantage of Solana's speed and low fees.

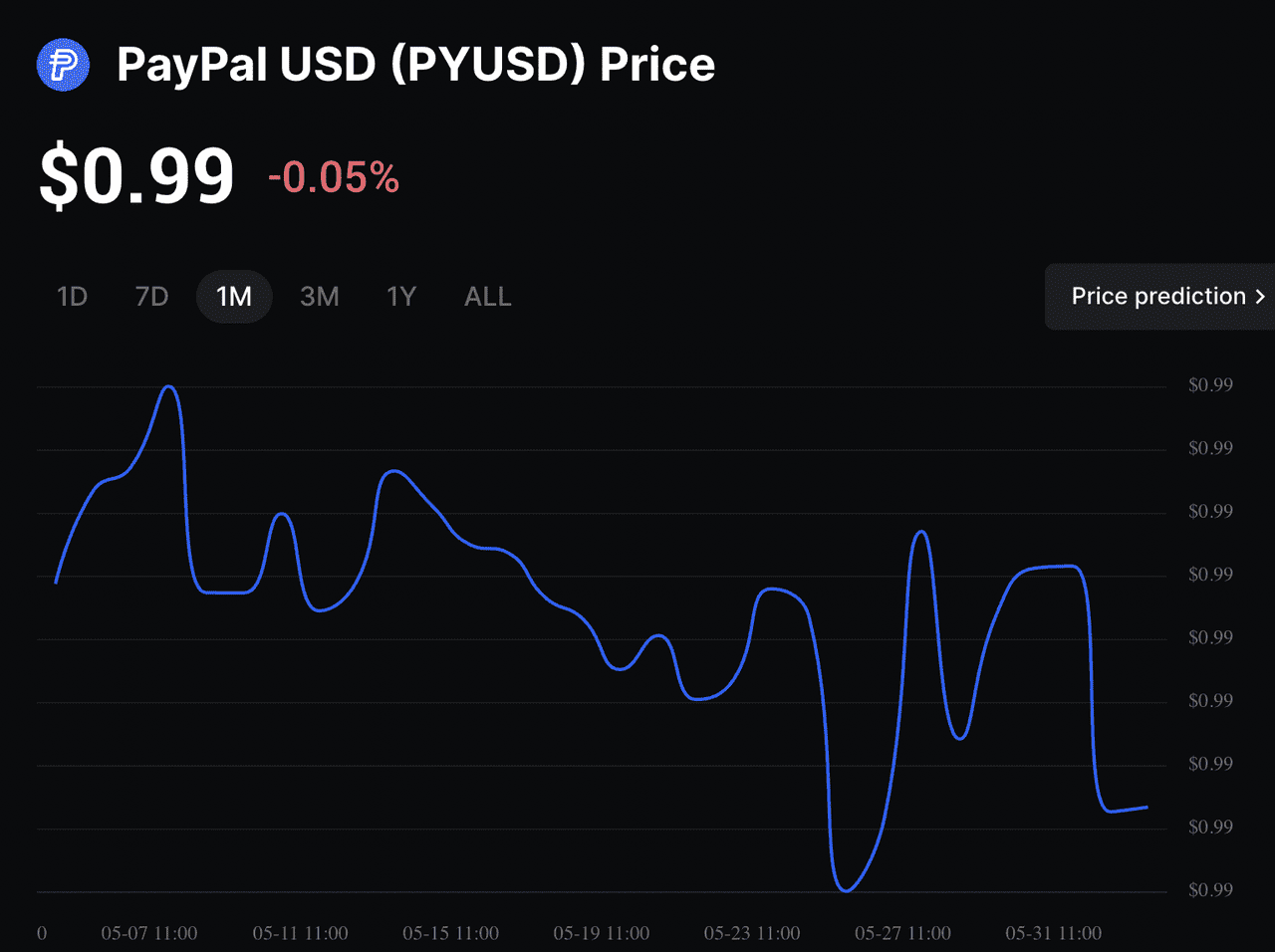

3. PayPal USD (PYUSD)

PYUSD price on BingX | Source:

BingX

A newer addition to the Solana stablecoin lineup is

PayPal USD (PYUSD), launched in partnership with Paxos. PYUSD is fully regulated and leverages Solana's advanced token extensions for enhanced functionality. Its integration with PayPal's global payment network makes it an attractive option for users seeking seamless access to both traditional and digital finance. The third-most popularly used stablecoin in the Solana network, PYUSD has market cap of over $226 million within the Solana ecosystem. PYUSD is quickly gaining traction, offering another layer of stability and convenience for Solana users.

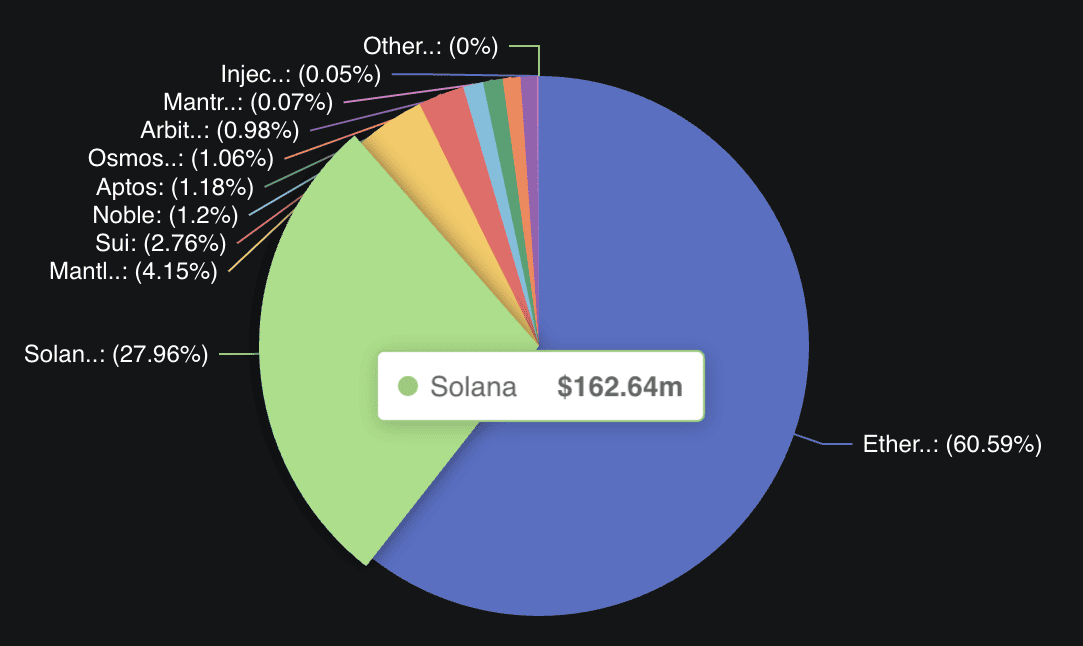

4. Ondo US Dollar Yield (USDY)

USDY's market share on Solana | Source: DefiLlama

USDY is a yield-generating stablecoin issued by

Ondo Finance and backed by U.S. Treasury bills and bank demand deposits. Built with multi-chain support, launched on Ethereum first in August 2023 and later expanded to Solana,

Arbitrum,

Sui,

Aptos, and others, USDY accrues yield daily directly into its redemption value, distinguishing it from traditional non-yield-bearing stablecoins. As of May 30, 2025, it surpassed $1 billion in TVL and has a market cap near $585 million, with a 24-hour trading volume of about $1.14 million; it's accessible to both U.S. and non-U.S. users after a compliance period. USDY has a market cap of over $177 million in the Solana ecosystem.

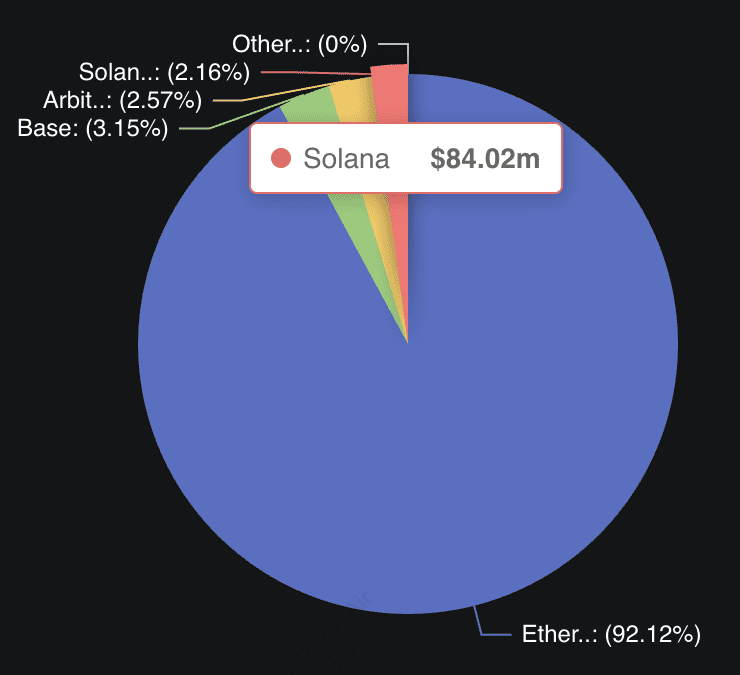

5. Sky Dollar (USDS)

USDS's market share on Solana | Source: DefiLlama

Sky Dollar (USDS) is the rebranded successor to DAI from Maker, now emitted by Sky Protocol as one of the first major DeFi-native stablecoins on Solana. Fully collateralized and soft-pegged to the U.S. dollar, USDS is backed by a diversified mix of crypto and real-world assets held primarily on Ethereum, with cross-chain interoperability enabled via

Wormhole’s Native Token Transfer. As of late May 2025, USDS holds a market cap of around $84 million on Solana, with strong integration into DeFi protocols like

Kamino, Drift, and Save, including incentive programs distributing hundreds of thousands of USDS weekly to liquidity providers.

Read more:

What Are the Emerging and Specialized Stablecoins on Solana?

Beyond the top three, Solana's ecosystem is home to a variety of innovative stablecoins. These include crypto-collateralized options like USDe from Ethena, over-collateralized stablecoins such as USDH from Hubble Protocol, and yield-bearing stablecoins like sUSD from

Solayer. There are also stablecoins pegged to other fiat currencies, such as EURR for euro users. This diversity ensures that Solana users have access to a wide range of stable assets tailored to different needs and preferences.

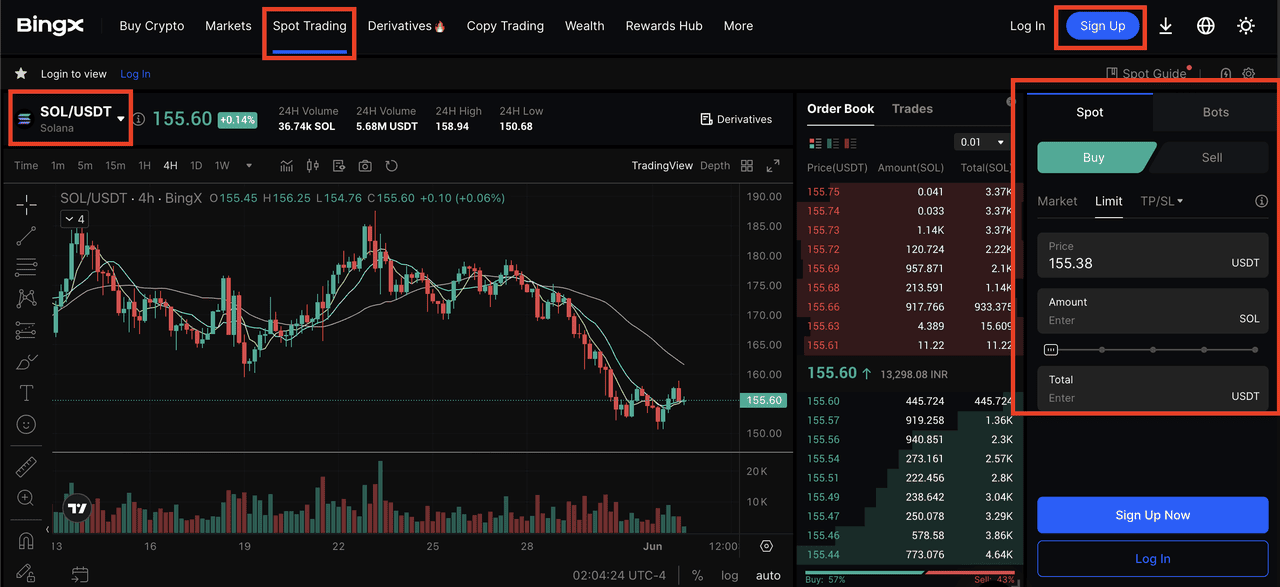

How to Buy Stablecoins and Solana on BingX

Trade SOL on BingX Spot | Source:

BingX

For those looking to buy stablecoins and Solana (SOL), BingX offers a user-friendly and secure platform. BingX supports a wide range of assets, including SOL, USDT, and USDC, making it easy for both beginners and experienced traders to get started. The platform's Solana Swap feature allows users to swap between supported tokens directly on the Solana network, often with no trading fees, further enhancing the cost-effectiveness of using BingX.

Guide to Buying Solana on BingX

1. Create a BingX Account: Begin by signing up for a BingX account. Visit the official BingX website and complete the registration process, which typically involves providing your email and setting a secure password.

2. Complete Security Settings and KYC Verification: After registering on BingX, enhance your account security by enabling two-factor authentication (2FA). Complete the Know Your Customer (KYC) verification if prompted. This step is essential for accessing all features and higher deposit or withdrawal limits.

3. Deposit Funds into Your BingX Account: Choose your preferred deposit method. On-chain deposits (such as via USDT using TRC-20, BEP, ERC, or POLY networks) are recommended for their low fees, often just a few dollars regardless of the amount. Alternatively, you can deposit fiat using credit cards, bank transfer, or P2P, though these methods may incur higher fees.

4. Trade Solana (Spot or Derivatives)

Once your funds are available, you can purchase Solana in two main ways:

• Spot Trading: Buy SOL directly on the spot market.

• Derivatives Trading: Trade SOL futures contracts. BingX offers USDT-M (settled in USDT) and Coin-M (settled in other cryptos like SOL) futures markets.

5. Manage and Secure Your Assets

After purchasing, you can store your Solana and other assets securely in your BingX custodial wallet. For advanced users, consider using Solana Swap for on-chain swaps and DeFi activities. Once you have your assets, you can use them for trading, staking, or participating in the vibrant Solana DeFi ecosystem. BingX provides added security, giving users peace of mind as they explore the opportunities available on Solana.

Conclusion

The Solana ecosystem is home to some of the most widely used and innovative stablecoins in the crypto space. USDC, USDT, and PYUSD lead the way in adoption and utility, offering stability, liquidity, and seamless integration with Solana's fast and scalable blockchain. By choosing BingX as your gateway to Solana and its stablecoins, you can enjoy a smooth trading experience, deep liquidity, and access to the exciting world of DeFi. Start your journey today and discover the benefits of stablecoins and Solana on BingX.

Related Reading