November 2025 is shaping up to be a busy month for token unlocks as analysts estimate roughly $2.1 billion in tokens will be released across multiple projects, with

SUI leading the list, with an estimated $146.55 million unlocking on Nov 1. These scheduled releases with a mix of cliff unlocks and vesting releases increase circulating supply and can create short-term liquidity pressure, catalyst events, or simply be already-priced-in moments depending on project specifics and market conditions.

November 2025 features big-money token releases (in the millions) plus events that could dramatically boost a token's available supply. November will spotlight how ecosystems like layer-1s,

DeFi protocols, and

memecoin platforms handle fresh tokens amid broader crypto sentiment. This means more tokens are entering the market in November, which can sometimes create price swings if demand doesn't keep up.

This month will test how well different markets can absorb fresh supply. Some tokens may face selling pressure, while others could hold steady if buying interest and community support remain strong. Our detailed review of the November 2025 unlock schedule highlights the main projects driving this surge and flags the tokens most at risk from the extra supply pressure.

What Are Token Unlocks?

Token unlocks are scheduled releases of tokens that were previously locked under a vesting schedule, often reserved for project teams, early investors, or community incentives. These lockups are designed to align long-term commitment with project growth and prevent large sell-offs at launch. When an unlock occurs, the circulating supply of a token increases. If recipients sell, it can create downward pressure on prices, especially if the unlock is large relative to existing float.

These mechanisms encourage long-term alignment by preventing immediate token dumps post-launch. When unlocked, the token's circulating supply rises, which can dilute value if recipients sell quickly. However, tokens might flow into staking, liquidity pools, or cold storage, bolstering the network instead. Discover the top crypto token unlocks in November 2025, including

SUI,

SOL,

HYPE and more, and learn how these events may impact market volatility and trading opportunities.

Why Do Token Unlocking Events Matter?

Token unlocks represent critical stress tests for cryptocurrency projects, providing immediate insights into market resilience and investor confidence. When new supply is effectively absorbed through mechanisms such as staking, liquidity provision, or long-term retention, it signals robust demand and alignment with the project's fundamentals.

Conversely, if unlocked tokens lead to significant sell-offs, this can undermine market sentiment, exacerbate volatility, and exert downward pressure on prices. With approximately $2.1 billion in token releases scheduled for November 2025, the month is poised to be one of the most dynamic and challenging periods of the year, offering both risks and opportunities for market participants. Here's a quick primer on why they can move markets:

1. Supply Shock - A one-time cliff can suddenly boost circulating supply; if recipients sell, it creates immediate downward price pressure.

2. Info Signal - Recipients (ex. team vs. advisors vs. early backers) reveal incentives and conviction. Team-heavy unlocks often signal downward price pressure more than ecosystem-focused ones.

3. Liquidity Context - In thin markets even modest unlocks amplify price swings. Deep liquidity can swallow them whole.

4. Pre-Priced Events - Many are announced far in advance and partially baked into prices. Post-unlock on-chain flows (ex. to exchanges) are key for spotting real selling.

November 2025 Token Unlocks: The Big Picture

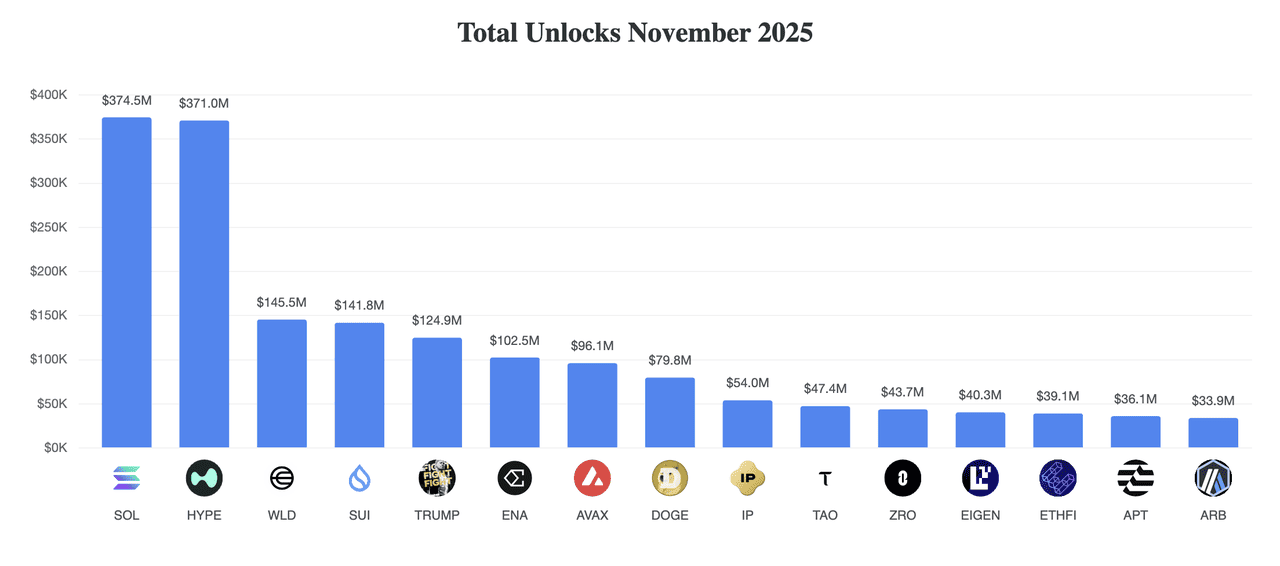

Tokens Unlocking in November 2025: Key Highlights

• According to

CryptoRank data, an estimated $2.1B in unlocks is set for the month dominated by cliff events like SUI.

•

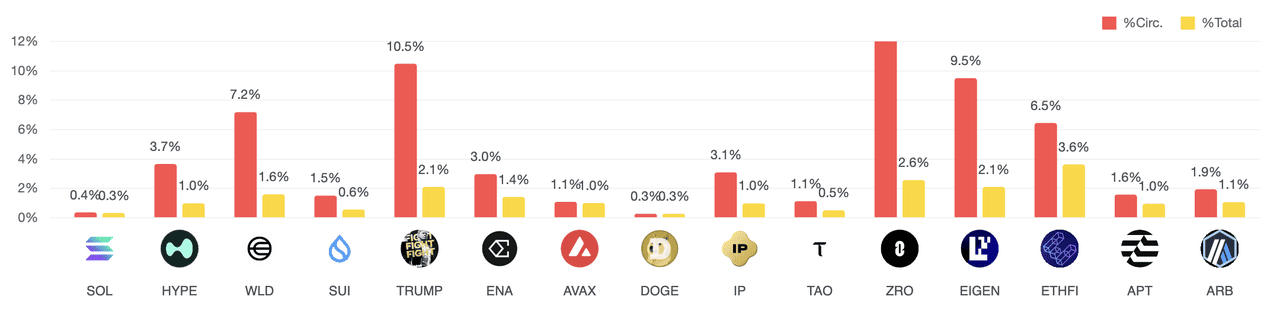

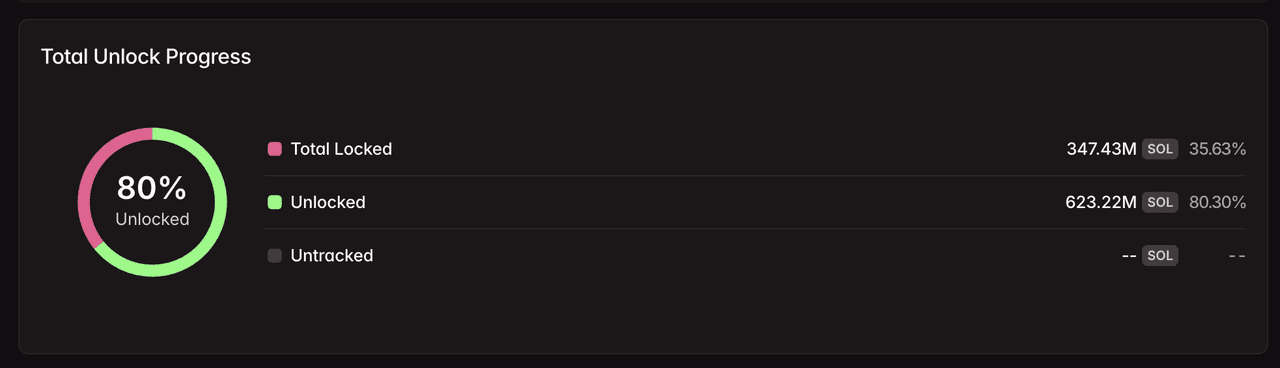

$SOL (Solana) - Maintains its lead in the November unlock schedule with a release valued at $374.52 million. This event adds 0.37% to its circulating supply and represents 0.33% of total supply.

•

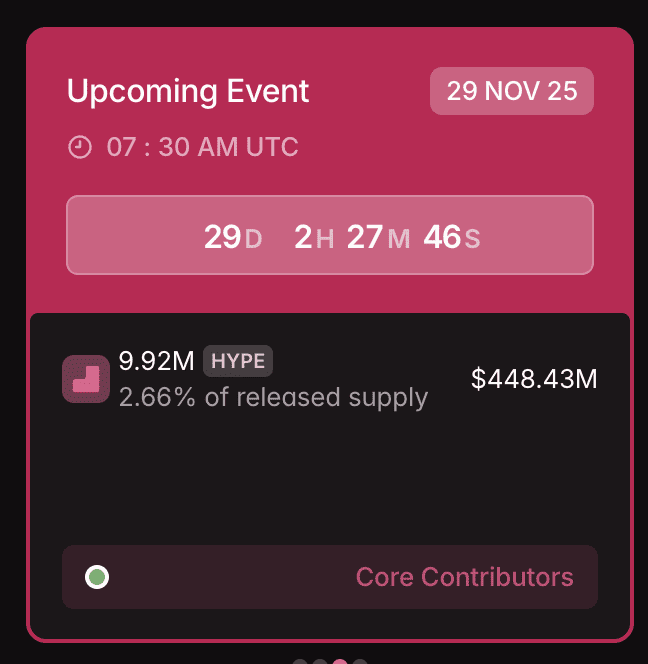

$HYPE (Hyperliquid) - Follows closely behind with a near-equal unlock worth $370.98 million. The release increases circulating supply by 3.66% and accounts for 0.99% of the total token supply.

•

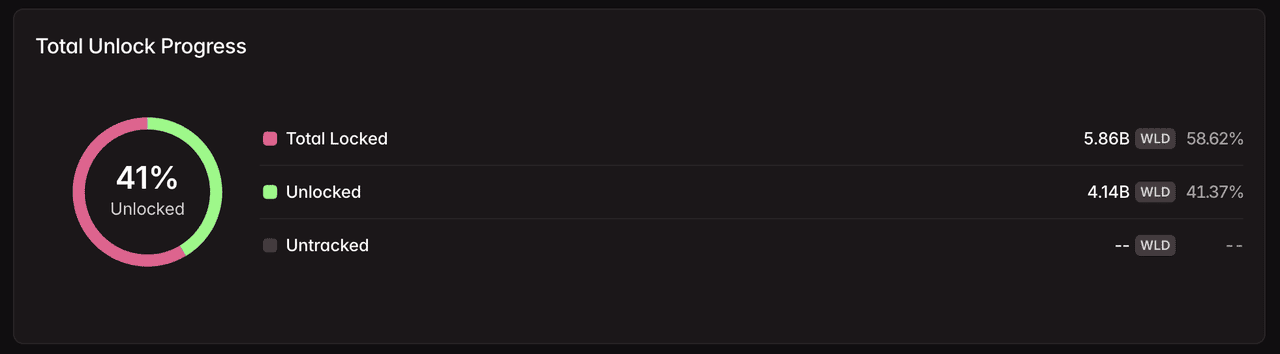

$WLD (Worldcoin) - Takes the third position with an unlock valued at $145.47 million. This significant release adds 7.19% to the circulating supply and represents 1.60% of the total supply.

•

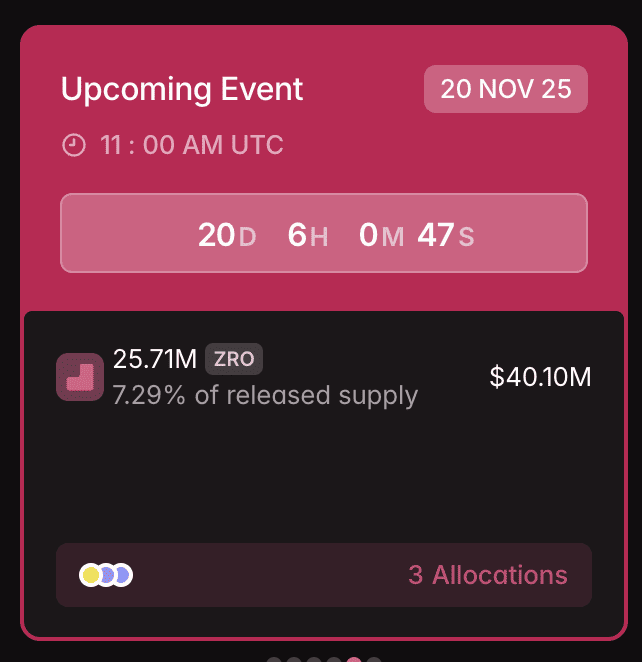

$ZRO (LayerZero) - Experiences the most dramatic supply expansion, with over 25.7 million tokens unlocking, valued at $43.70 million. This event boosts circulating supply by 23.13%, equating to 2.57% of the total supply.

•

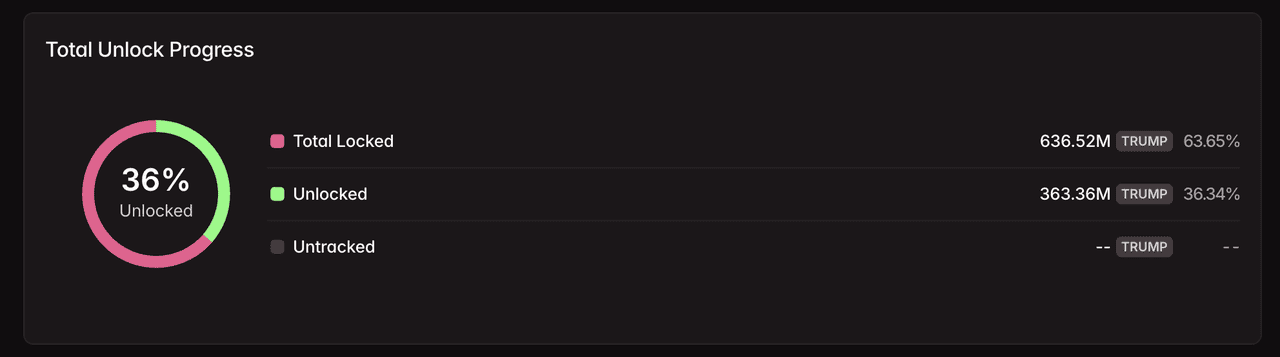

$TRUMP (OFFICIAL TRUMP) - Faces a considerable unlock valued at $124.92 million, resulting in a 10.48% increase in circulating supply and accounting for 2.10% of the total token base.

•

$EIGEN (EigenLayer) - Sees a prominent unlock valued at $40.32 million, adding 9.50% to its circulating supply and representing 2.10% of total supply.

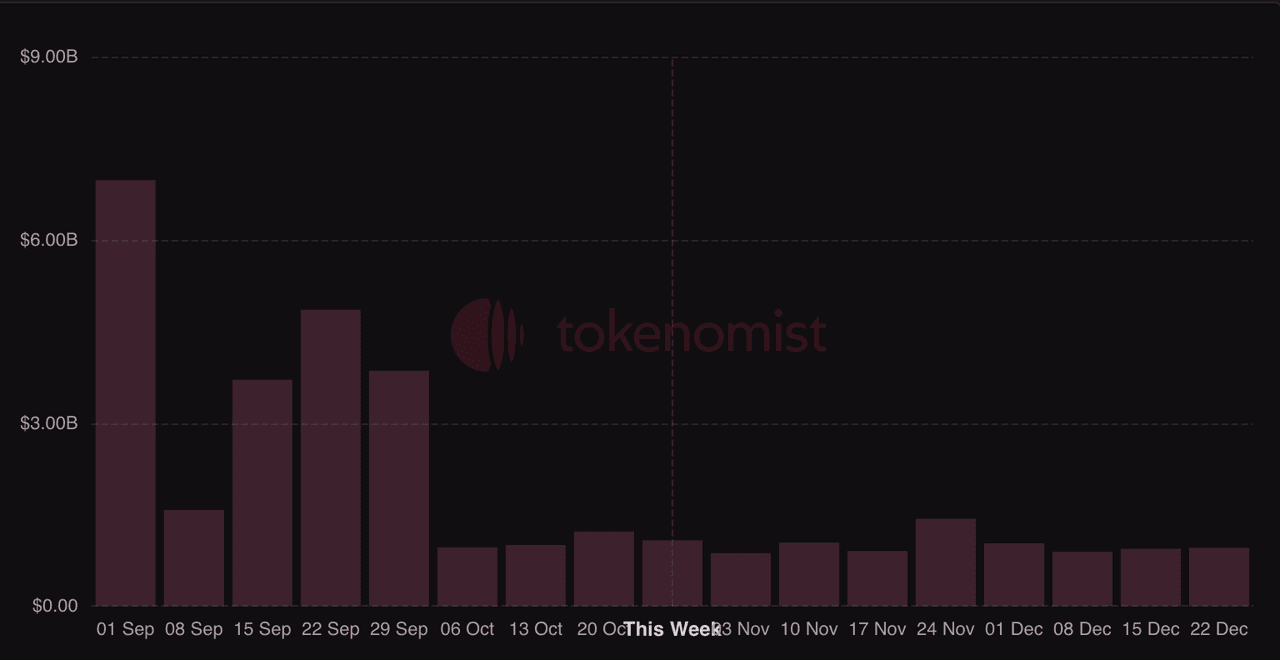

Collectively, according to Tokenomist data, these double-digit supply injections from MAVIA, BB, CONX, ZRO, and REZ are likely to exert a defining influence on market sentiment and price movement over the course of November 2025.

What Are the Top Token Unlocks to Watch in November 2025?

November is packed with major token unlocks across leading projects, and tracking these events is essential for traders to anticipate supply shifts and potential volatility.

1. Solana (SOL)

Date: Throughout November 2025 (Linear Unlock)

Solana dominates November's unlock landscape with a massive linear release valued at $374.52 million, representing a modest 0.37% increase to its circulating supply and 0.33% of total supply. This ongoing distribution adds steady pressure but underscores SOL's deep liquidity, potentially influencing layer-1 adoption trends amid capital rotations. With billions in circulation, the event tests sustained demand in a high-volume ecosystem.

2. Hyperliquid (HYPE)

• Unlock Date: November 29, 2025 (Cliff Unlock)

• Number of Tokens to be Unlocked: Undisclosed volume (~$370.98M value, 3.66% of Circulating Supply)

• Current Circulating Supply: Varies (DeFi-focused)

• Total Supply: High cap with 0.99% unlocked

Hyperliquid's cliff unlock leads in value at $370.98 million, injecting 3.66% into circulation and signaling potential DeFi liquidity shifts. As a top cliff event, it could amplify volatility in derivatives markets, especially if recipients (likely investors or treasury) opt for sales. This release highlights HYPE's role in perpetuals trading, with broader implications for Q4 sentiment.

3. Worldcoin (WLD)

Date: Throughout November 2025 (Linear Unlock)

Worldcoin secures third place with a $145.47 million linear unlock, adding 7.19% to circulating supply and 1.60% of total, a notable dilution for its identity protocol. This sustained release could pressure prices if tied to early backers, but ecosystem incentives might encourage holding. Circulating supply stands at billions, making it a watch for AI-crypto intersections.

4. LayerZero (ZRO)

• Unlock Date: November 20, 2025

• Number of Tokens to be Unlocked: 25.7 million ZRO (23.13% of Circulating Supply)

• Current Circulating Supply: ~111M ZRO (est.)

• Total Supply: 1B ZRO

LayerZero faces the month's starkest supply shock via a $43.7 million cliff on Nov 20, boosting circulation by 23.13% and 2.57% of total supply. This cross-chain bridge token's unlock could ripple through interoperability narratives, with high risk of sell-offs from vested parties testing multichain liquidity.

5. OFFICIAL TRUMP (TRUMP)

Date: Throughout November 2025 (Linear Unlock)

The Official TRUMP token schedules a $124.92 million linear release, injecting 10.48% into circulation and 2.10% of total supply, a politically themed token asset prone to sentiment swings. This ongoing flow may heighten meme-coin volatility, particularly around election cycles, as new tokens enter a speculative market.

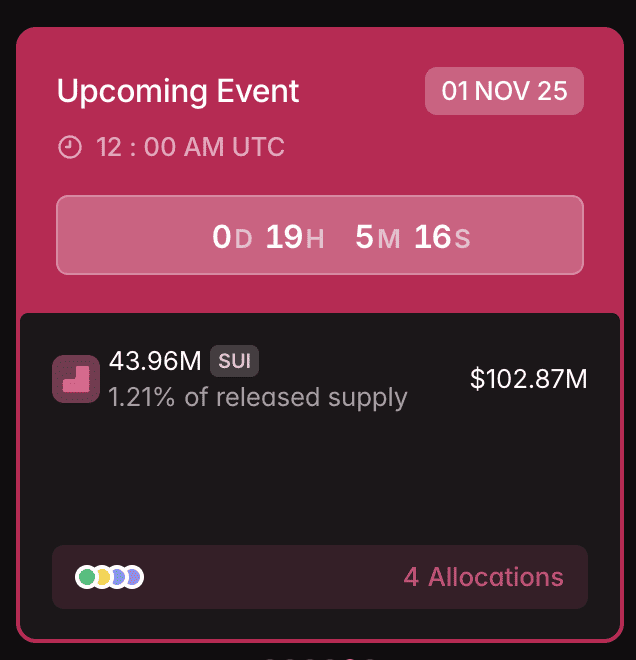

6. Sui (SUI)

• Unlock Date: November 1, 2025

• Number of Tokens to be Unlocked: ~22.5M SUI ($58.23M value, 0.62% of Circulating Supply)

• Current Circulating Supply: ~3.6B SUI

• Total Supply: 10B SUI

Sui kicks off November with a $58.23 million cliff (part of larger $111.86M schedule), adding 0.62% to circulation and 0.23% of total. Early-month pressure could follow mainnet momentum, with allocations to investors and contributors; watch for absorption in this scalable L1.

Other Token Unlocks in Mid and Late November 2025

1. EigenCloud (EIGEN): Nov 1, approximately 36.82M tokens (approximately $43.8M, 12.10% of circulating supply) - decentralized cloud play; watch validator impacts.

2. Aptos (APT): Mid-November, approximately $40M+ (1.6% of supply) - L1 contender; ties to broader adoption trends.

3. Arbitrum (ARB): Various dates, approximately $37M (1.2% of supply) - L2 staple; team/Foundation allocations key.

5. HYPE (Hyperliquid): Late November (Nov 28 - 29), approximately 9.92M tokens (approximately $30M+, 2.97% of supply) under 24-month vesting - "massive" per report and longer-term pressure is likely.

6. SOON (SOON): Nov 23rd is the unlock date and approximately 15.21M tokens (approximately 4.33% of released supply) niche but locally volatile per CoinMarketCap and TradingView.

How Crypto Traders Can Prepare for Token Unlocks

Token unlocks demand proactive strategies to navigate volatility without excessive risk.

1. Check Recipient Addresses and On-Chain Flows: After an unlock, traders should track wallet movements to determine if tokens are transferring to exchanges, indicating potential sell-offs or to cold storage for long-term holding, using resources like public on-chain trackers and BingX AI for real-time insights.

2. Measure Unlock Size as % of Circulating Supply: Evaluate the unlock's impact by calculating it as a percentage of circulating supply rather than absolute USD value, as a $30 million release into a $2 billion market cap token (1.5%) poses far less threat than the same amount into a $100 million cap token (30%).

3. Use Limit Orders: To minimize slippage during volatile periods, implement staggered entry positions and rely on limit orders instead of market orders, allowing gradual accumulation around unlock events.

4. Monitor Announcements for Vesting Tweaks: Keep yourself updated with project updates for potential vesting adjustments, such as delays or staggered releases through official channels and X announcements to adjust your trading strategies accordingly.

5. Execute Timing: Time trades carefully by assessing order book depth pre-unlock while employing small position sizes and monitoring 1- to 5-minute charts during the event and seeking stabilization opportunities post-unlock if key support levels continue to hold.

6. Use the Narrative: Balance supply risks with positive catalysts, such as protocol upgrades or ecosystem developments, by cross-referencing project roadmaps to gauge whether these factors might counteract unlock pressure.

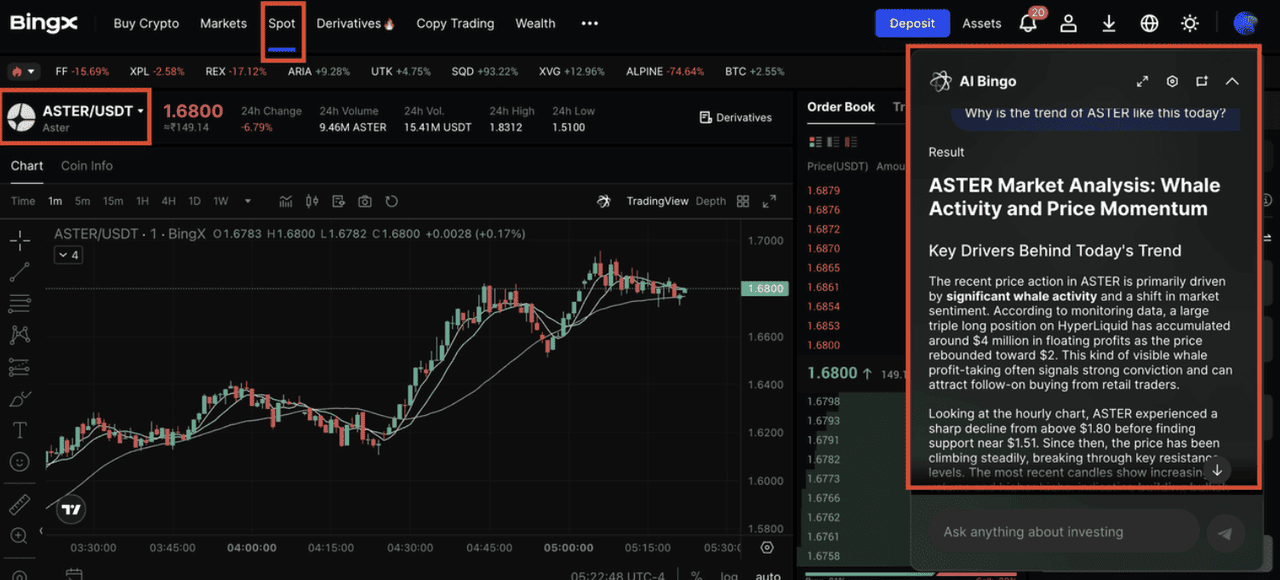

How to Trade Token Unlocks on BingX

ASTER/USDT trading pair on the spot market powered by AI BingX insights

Token unlocks can create sharp, short-lived opportunities or heavy downside risks. To trade them effectively, you need to prepare ahead of time, track supply dynamics, and use BingX tools to manage execution and risk:

1. Know the clock. Most unlocks drop at 00:00 or 12:00 UTC, so plan your orders and liquidity before the hour to avoid chasing volatile moves.

2. Size vs. float matters. Don't just look at the dollar value, focus on the % of circulating supply being unlocked. A 2-3% release in a thinly traded token can hit harder than a larger unlock in a deep market.

3. Track recipient type. Tokens going to team or treasury wallets may stay locked longer, while investor or emissions unlocks are more likely to hit the market quickly. Check vesting dashboards like Tokenomist for wallet details.

4. Use BingX tools.

• Spot & Perps: Short into pre-unlock rallies or buy post-dump stabilization depending on order book conditions.

•

BingX AI: Monitor real-time sentiment, order flow, and volatility alerts to avoid entering at the worst levels.

• Risk controls: Mark invalidation levels, ex. prior day's VWAP or support, use tight leverage, and set alerts 30–60 minutes before and after unlock windows.

5. Mind narrative risk. If the project has upcoming catalysts (mainnet launch, token listing, or governance upgrade), that bullish momentum can absorb new supply. Always cross-check roadmaps and community updates before trading around unlocks.

6. Execution timing matters.

• Before the hour: Use

BingX AI to gauge stress in the order book and place bracket orders with stops and targets.

• During unlock: Watch 1-5m candles to stop cascades and liquidity absorption; keep sizing small in the first 15 minutes.

• After unlock: If price holds above support with spot demand and cooling perp funding, look for mean-reversion longs. If breakdowns continue with rising open interest and negative CVD, stick to trend-following shorts.

Conclusion

November 2025 promises eventful unlocks totaling $2.1B across SUI, SOL and beyond, probing supply absorption and trader confidence. For traders, the key is preparation, including tracking unlock schedules, monitoring liquidity, and using tools like BingX AI to respond in real time.

Remember, token unlocks don't guarantee predictable outcomes: some may trigger heavy selling, while others could be absorbed smoothly. Always approach unlock season with sound risk management, limit exposure to oversized positions, and be prepared for unexpected price swings.

Related Reading