Crypto markets are driven by emotion. When prices pump,

FOMO spreads fast. When prices dump, panic selling takes over. The Crypto Fear & Greed Index (FGI) is a simple way to measure that crowd emotion on a 0–100 scale, so you can trade with more discipline and less hype.

Key Takeaways

1. The Fear & Greed Index turns market sentiment into a single score from 0 (Extreme Fear) to 100 (Extreme Greed).

2. It’s mainly built around

Bitcoin sentiment and uses signals like volatility, volume/momentum, social activity, dominance, and search trends.

3. It’s best used as a context tool, not a “buy/sell button.” Pair it with price action, trend structure, and risk rules.

What Is the Crypto Fear & Greed Index Sentiment Indicator?

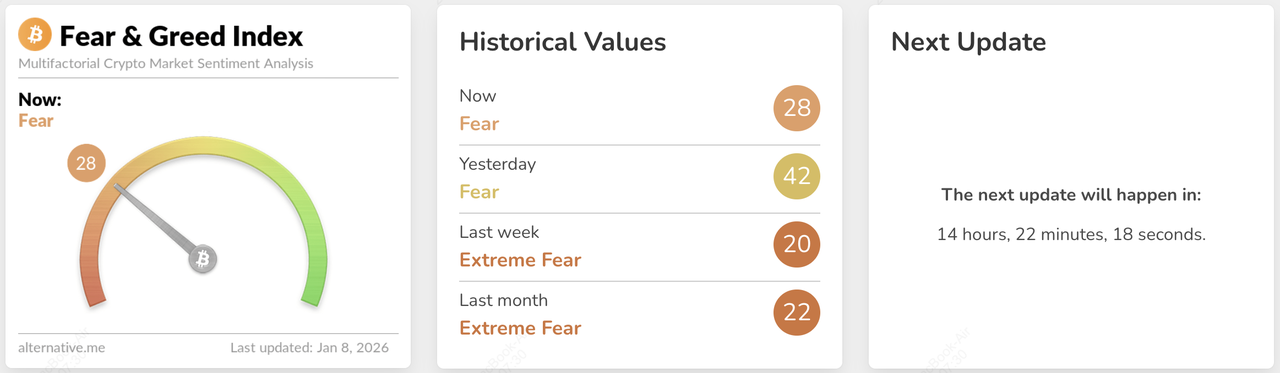

Crypto Fear & Greed Index by Alternative.me

The Crypto Fear & Greed Index is a market sentiment indicator that tracks whether traders are acting fearful (risk-off) or greedy (risk-on). It converts multiple market and behavior signals into one number between 0 and 100.

The Crypto Fear & Greed Index was created because financial markets, especially cryptocurrency markets, are driven not just by fundamentals like adoption or technology, but by human emotions. When traders are scared, they sell quickly, often pushing prices down further than logic would suggest. When traders are greedy, they buy impulsively, often driving prices up to unsustainable levels. This emotional cycling can make crypto markets highly volatile and unpredictable for new traders.

The Fear and Greed Index can convert multiple market and behavioral signals into this single snapshot, helping traders understand not just price movement, but the mood behind it. Some of these signals include price volatility, trading volumes, trends in social media chatter, and

Bitcoin’s market dominance, each offering a piece of the emotional puzzle.

The crypto version of this index was popularized by Alternative.me, which calculates it daily and provides historical charts that help show how sentiment has shifted over time, especially around major bull runs and crashes. By watching the Fear & Greed Index, you get a quick read on whether the market crowd is acting cautiously or impulsively, helping you make more disciplined and less emotional trading decisions.

What Is the Fear & Greed Index Scale?

The Crypto Fear & Greed Index ranges from 0 to 100 and is typically divided into five sentiment zones. Each zone reflects how the majority of traders are feeling, and how that emotion often shows up in price behavior.

1. 0–24: Extreme Fear

This zone signals panic and capitulation.

• Traders are highly pessimistic and focused on avoiding further losses.

• Selling pressure is strong, often driven by bad news, sharp price drops, or

liquidations.

• Many investors exit positions emotionally rather than rationally.

What it usually means: Prices may be oversold and trading below perceived fair value. Historically, extreme fear has appeared near market bottoms, though prices can remain weak for some time before recovering.

2. 25–49: Fear

This zone reflects caution and uncertainty.

• Traders are hesitant to buy and prefer to stay on the sidelines.

• Confidence is low, but outright panic has faded.

• Volatility may remain elevated, but selling pressure is less aggressive than in extreme fear.

What it usually means: The market is still fragile. This phase is often associated with early accumulation by long-term investors, while short-term traders remain defensive.

3. 50: Neutral

This zone indicates a balanced market mindset.

• Buyers and sellers are relatively evenly matched.

• Market sentiment is neither strongly bullish nor bearish.

• Prices often consolidate or move within a range.

What it usually means: The market is waiting for a catalyst, such as macro news, economic data, or a major crypto-specific event, to establish the next direction.

4. 51–74: Greed

This zone signals growing optimism and confidence.

• Traders are increasingly willing to take risk.

• Buying activity rises, often driven by positive price momentum.

• FOMO (fear of missing out) begins to influence behavior.

What it usually means: Prices may be approaching overvaluation, especially if momentum accelerates quickly. While trends can continue higher, risk also starts to increase.

5. 75–100: Extreme Greed

This zone reflects euphoria and excessive risk-taking.

• Traders are highly confident and expect prices to keep rising.

• Leverage usage often increases.

• Warning signs and downside risks tend to be ignored.

What it usually means: Markets may be overheated, with prices stretched far above recent averages. Extreme greed has historically appeared near market tops and often precedes corrections or sharp pullbacks, though timing can vary.

Important: A low score doesn’t guarantee an immediate bounce, and a high score doesn’t guarantee an immediate crash. The index can stay extreme for long stretches depending on the market cycle.

How the Crypto Fear & Greed Index Works: Data Sources Considered

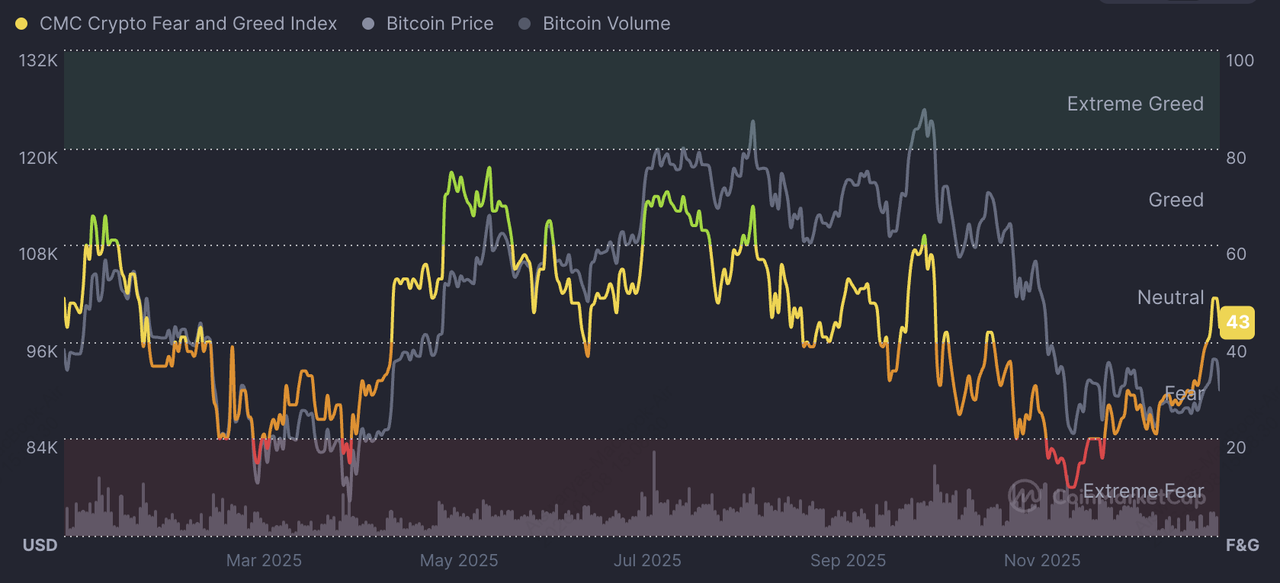

Coinmarketcap's Fear and Greed Index indicator

The index blends several sentiment proxies and market signals, commonly including:

1. Volatility - fear rises when volatility spikes

2. Market momentum and volume

3. Social media activity/sentiment

4. Bitcoin dominance (BTC.D) - risk-off often pushes capital back to BTC

5. Google Trends/search interest

A widely cited weighting model used for the crypto FGI is:

1. Volatility: 25%

2. Market momentum/volume: 25%

3. Social media: 15%

4. Bitcoin dominance: 10%

5. Trends, e.g., Google Trends: 10%

6. Surveys: 15% (not always active; some sources note this component may be paused)

Alternative.me also notes the index is built as an at-a-glance sentiment gauge and focuses on Bitcoin for the current index.

How Can Beginners Read the Fear & Greed Index Correctly?

The Fear & Greed Index tells you how the majority of traders are feeling, not what the price is guaranteed to do next. A low or high reading reflects crowd emotion, which often lags price action and should be used as context, not a prediction.

Extreme readings signal higher risk, not automatic buy or sell points. When fear or greed stays elevated for a long time, prices can continue moving in the same direction; this is why position sizing,

stop-losses, and patience become more important than trying to time exact tops or bottoms.

When used properly, the index helps you pause, reduce emotional reactions, and make decisions based on market conditions rather than hype or panic, leading to more disciplined and consistent trading behavior.

How to Use the Fear & Greed Index to Trade Crypto

The Fear & Greed Index works best as a decision-support tool. It helps you understand market psychology so you can size risk, time entries better, and avoid emotional mistakes, rather than trying to predict exact tops or bottoms.

1. Use It as a Regime Filter, Not a Trigger

Before placing any trade, use the index to answer one key question:

Is the market crowd acting fearful (risk-off) or greedy (risk-on)?

This simple check helps you avoid two common beginner mistakes:

• Buying near tops because everyone is excited (FOMO).

• Selling near bottoms because everyone is panicking.

How to apply it in practice:

• During Fear: Be patient and avoid reacting emotionally to sharp price swings, as volatility and false bounces are common. Focus only on high-quality setups near strong support levels rather than chasing short-term rebounds.

• During Greed: Shift your mindset from maximizing upside to protecting capital, as prices may already be stretched. Be more selective with new entries and quicker to take profits or tighten risk as optimism peaks.

Think of the index as setting the rules of the environment you’re trading in.

2. Contrarian Strategy: Buy Fear, Sell Greed, with Confirmation

This is the most popular way traders use the index, but it only works when done carefully.

Basic idea:

• Extreme Fear (0–24): Consider accumulating gradually, not all at once.

• Extreme Greed (75–100): Consider reducing exposure, taking partial profits, or tightening stops.

Why “gradually” matters: Fear can stay extreme for weeks or months. Going all-in too early is one of the fastest ways beginners blow up accounts.

Simple confirmation checklist before acting:

• Price is near a major support or demand zone - previous range low, weekly support.

• Selling pressure is slowing - momentum stops making lower lows.

• You have a clear invalidation level - you know where you’re wrong.

This approach helps you avoid the dangerous assumption:“The index is low, so price must go up now.”

3. Trend-Following Strategy: Trade with the Trend, Use FGI for Position Sizing

Markets don’t always reverse at extremes. In strong bull markets, greed can persist. In deep bear markets, fear can dominate for long periods. Instead of fighting the trend, use the index to decide how aggressive or defensive you should be.

Practical examples:

• Bull trend + Greed: Continue trading in the direction of the trend, but reduce leverage and avoid chasing price as risk increases. Gradually scale out into strength and tighten trailing stops to lock in gains in case momentum fades.

• Bear trend + Fear: Avoid rushing into trades as prices can keep falling despite extreme pessimism. Wait for clear signs of trend or structure improvement before increasing exposure, with capital preservation as the top priority.

Here, the index helps you manage exposure, not direction.

4. Watch Persistence and Shifts, Not Just Today’s Number

A single daily reading can be misleading. What matters more is how sentiment behaves over time. Pay attention to:

• How long the index stays in extreme fear or greed.

• Divergences:

- Price holds steady while fear increases.

- Price stalls while greed keeps rising.

These shifts often signal changing risk conditions before price reacts.

5. Use It for Risk Management: The Most Reliable Use Case

Even when you don’t change your trade direction, the Fear & Greed Index can tell you how much risk to take.

Practical risk adjustments:

• In Extreme Greed: Reduce position size, take partial profits, and tighten stop-losses to protect gains as the risk of a pullback increases. The goal is to lock in profits while staying prepared for sudden reversals.

• In Extreme Fear: Enter positions in smaller increments and spread buys over time rather than committing all at once. Use strict invalidation levels, as fearful markets can remain volatile and depressed longer than expected.

For most traders, this risk-management role is where the index delivers the most consistent value.

How to Check the Crypto Market's Fear & Greed Index

You can track the Crypto Fear & Greed Index through a few widely used platforms that publish daily readings and historical data, helping you understand both current sentiment and how it has evolved over time.

• Alternative.me: This is the original and most commonly referenced source. It updates the index daily, shows the current score, labels the sentiment zone (fear or greed), and provides a historical chart so you can compare today’s reading with past market tops and bottoms.

• CoinMarketCap: CoinMarketCap integrates the Fear & Greed Index into its broader market data pages. This is useful if you want to view sentiment alongside prices, market cap trends, and other crypto metrics in one place.

Practical tip for beginners: Don’t just check the number once and move on. Look at how the index has behaved over the past few weeks or months, whether sentiment is improving, deteriorating, or stuck at an extreme, so you can better judge the current risk environment before making trading decisions.

What Are the Best Indicators to Combine With the Fear & Greed Index?

The Fear & Greed Index measures market psychology, not price direction. To turn sentiment into actionable decisions, you need tools that show what price is actually doing and whether the market structure supports a trade.

1. Trend Structure: Identifies whether the market is in an uptrend, downtrend, or range using moving averages and market structure. This provides directional context for interpreting fear or greed.

2. Momentum Indicators (RSI, MACD): Measure whether buying or selling pressure is strengthening or weakening. Momentum helps assess whether emotional extremes are accelerating or losing force.

3. Support and Resistance Levels: Highlight key price zones where the market has historically reacted. These levels show where sentiment-driven moves are most likely to continue or fail.

4. Volume and Liquidity: Reveal whether price moves driven by fear or greed are supported by real participation. Volume helps distinguish conviction from exhaustion.

5. Catalysts and News Awareness: Track macro events, regulatory updates, and major crypto news that can rapidly shift sentiment. These factors help anticipate sudden changes in market conditions.

How to Combine the Fear & Greed Index With Technical, Momentum Indicators

When trading crypto, the Fear & Greed Index works best when used as context, while other indicators handle confirmation and execution. Instead of asking “Should I buy or sell because of the index?”, a better question is: Does current market sentiment support or warn against this trade idea?

Step 1: Identify the Market Trend First

Start by determining whether the market is in an uptrend, downtrend, or range using moving averages or market structure. This sets the direction you should favor and prevents you from fighting the broader trend. Fear in an uptrend and fear in a downtrend carry very different implications.

Step 2: Read Sentiment to Assess Risk Conditions

Next, check where the Fear & Greed Index sits on the scale. Fearful readings suggest traders are cautious or panicking, while greedy readings indicate confidence or euphoria. Use this to decide how aggressive or defensive you should be, not whether to trade at all.

Step 3: Use Momentum Indicators for Timing

Momentum tools such as RSI (relative strength index) or MACD (moving average convergence divergence) help confirm whether price pressure is slowing, stabilizing, or accelerating. For example, extreme fear combined with improving momentum can suggest selling pressure is easing, while extreme greed with weakening momentum often signals rising risk. Momentum helps turn sentiment into better-timed entries or exits.

Step 4: Anchor Decisions Around Support and Resistance

Look for key support and resistance levels where price has historically reacted. Sentiment becomes most actionable when price reaches these zones, as they often determine whether a move continues or reverses. This prevents emotional trades made in the middle of price ranges.

Step 5: Confirm with Volume and Liquidity

Check volume to see if fear- or greed-driven moves are supported by real participation. Strong volume confirms conviction, while weak volume can signal exhaustion or false moves. Volume adds confidence to trades aligned with both sentiment and structure.

Step 6: Adjust Risk, Not Just Direction

Finally, use the Fear & Greed Index to fine-tune position size, stop-loss placement, and profit-taking. In extreme greed, reduce exposure and lock in gains; in extreme fear, enter gradually and protect against prolonged downside. This is where the index delivers its most consistent value.

A simple way to use the Fear & Greed Index correctly is to separate analysis from risk awareness. Technical indicators tell you what the market is doing, its direction, momentum, and key price levels, while the Fear & Greed Index tells you how risky it is to act at that moment based on crowd emotion. When used together, they help you trade with structure and discipline, reducing emotional decisions and improving risk control in fast-moving crypto markets.

Key Limitations of Using the Crypto Fear and Greed Index

The Fear & Greed Index is a helpful sentiment tool, but it has clear limitations that traders, especially beginners, should understand before relying on it in real trading decisions.

1. It oversimplifies complex market conditions. The index compresses multiple data points into a single number, which can hide important nuances such as sector rotation, liquidity conditions, or differences between spot and derivatives markets.

2. It is a lagging indicator, not a forward predictor. The index reflects recent price action and behavior, meaning sentiment often turns extreme after large moves have already happened. By the time fear or greed peaks, price may already be stabilizing or reversing.

3. It can miss sudden market shocks. Unexpected events, such as regulatory announcements, exchange hacks, macroeconomic surprises, or geopolitical news, can instantly change market direction before the index has time to adjust.

4. It is heavily Bitcoin-centric. Because the index relies largely on Bitcoin data, it may not accurately represent sentiment in specific

altcoin sectors, such as DeFi,

Layer 2s,

memecoins, or

AI tokens, which can move independently.

5. Extreme readings can persist longer than expected. Fear or greed can stay elevated for weeks or even months during strong

bull runs or

bear markets. Acting too early on extreme readings without confirmation can lead to premature entries or exits.

6. It should not be used as a standalone trading signal. The index provides context about emotional risk, not clear buy or sell signals. Using it without price structure, momentum analysis, and risk management increases the chance of emotional or poorly timed trades.

Conclusion

The Crypto Fear & Greed Index is a valuable tool for understanding market psychology; it helps you recognize when fear or euphoria is driving trader behavior and increasing risk. Used correctly, it can improve discipline, reduce emotional decision-making, and add important context to your trading strategy, especially in volatile crypto markets.

However, the index does not predict price movements and should never be used in isolation. Always combine sentiment with price structure, momentum, key levels, and sound risk management. Cryptocurrency trading carries an element of risk, and losses are possible; use the Fear & Greed Index as a guide to manage risk, not as a shortcut to guaranteed outcomes.

Related Reading

FAQs on Using the Fear and Greed Index in Crypto Markets

1. Is Extreme Fear always a buy signal?

Not always. Fear can stay high for long periods, especially in bear markets. Use it as a signal to pay attention, then confirm with price structure and risk rules.

2. Does Extreme Greed mean a crash is coming?

Not necessarily. It often signals higher risk and possible overextension, but markets can stay greedy during strong uptrends.

3. Is the Fear & Greed Index good for beginners?

Yes, because it helps you pause and avoid emotional decisions, but you still need education and risk management.

4. Can you trade crypto using the Fear and Greed index alone?

You shouldn’t. Most guidance treats it as one tool among many, paired with technical/fundamental analysis and a clear plan.