Haedal Protocol is one of the first liquid staking platforms built natively on

Sui, aiming to unlock the full potential of SUI by combining capital efficiency, staking rewards, and DeFi usability. As the ecosystem prepares for its $HAEDAL token launch and community

airdrop, this guide covers everything you need to know — from what Haedal is and how it works,

tokenomics, how to claim your $HAEDAL airdrop, and what’s coming next for the protocol.

What Is Haedal Protocol ($HAEDAL)?

Haedal Protocol is a liquid staking platform built for the

Sui ecosystem, designed to make staking more flexible, accessible, and DeFi-friendly. Instead of requiring users to lock their $SUI tokens and wait for long unbonding periods, Haedal allows users to stake $SUI and instantly receive haSUI, a liquid staking derivative that continues to earn

staking rewards.

The goal of Haedal is to unlock liquidity and utility for staked SUI. haSUI tokens can be freely traded or used across

DeFi protocols without sacrificing staking yield. This means users can put their capital to work while still supporting the Sui network.

Key Features of Haedal Protocol:

• Instant Liquidity for Staked SUI: When you stake on Haedal, you immediately receive haSUI, which can be used in DeFi without waiting for unbonding periods.

• Earn Rewards While Staying Flexible: haSUI continues to earn staking rewards, giving you both yield and utility.

• DeFi Integration Ready: haSUI is designed to be used across lending, swapping, and farming protocols.

• Multiple Unstaking Options: Users can choose between instant unstaking via HMM or traditional unstaking, depending on their needs.

• Transparent and Secure: With real-time validator performance tracking, users can see how their delegated stake is performing.

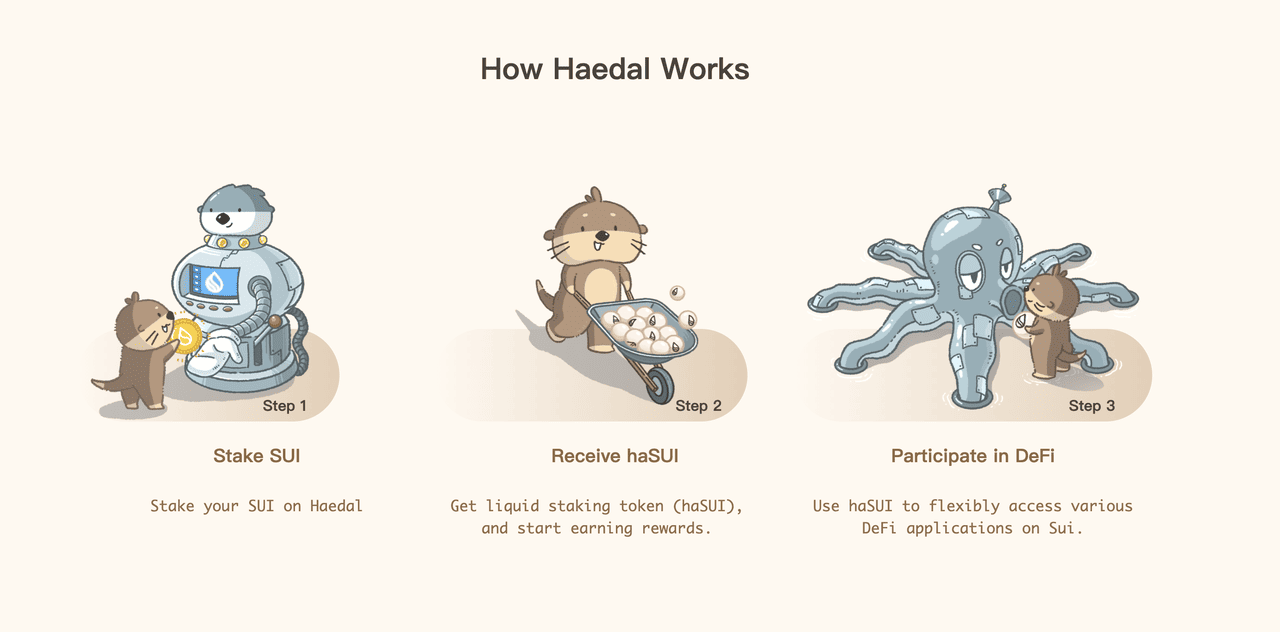

How Does Haedal Protocol Work?

From a user’s perspective, staking with Haedal feels simple: deposit your $SUI, receive liquid haSUI in return, and use it freely across DeFi while still earning staking rewards. There’s no need to worry about validator management or unbonding delays—Haedal handles the complexity for you.

Behind the scenes, Haedal operates through a thoughtfully designed system built on three interconnected components:

Liquid Staking Engine

This is the heart of Haedal’s product. When users deposit $SUI, Haedal automatically delegates the assets to a curated set of

validators and issues haSUI at a 1:1 ratio. This derivative token represents your staked position and continues to accrue staking rewards while remaining fully liquid and usable across DeFi protocols.

Withdrawal System

Users who want to convert haSUI back to $SUI can do so in two ways:

• Regular Unstaking: Burn haSUI and wait through Sui’s protocol-defined unbonding period to receive your $SUI.

• Instant Unstaking: Sell haSUI directly via Haedal’s Haedal Market Maker (HMM) for immediate liquidity—ideal for users who need flexibility without delay. This dual exit option ensures that users can tailor their unstaking experience based on urgency and market liquidity.

Performance Vaults & Governance

To further align incentives, Haedal introduces haeVault, a vault system that tracks validator performance and reward distribution transparently. Users can also participate in the governance process by locking HAEDAL tokens to mint veHAEDAL, which influences voting rights and long-term ecosystem direction.

Together, these components make Haedal not just a staking solution—but a liquid, composable, and yield-enhancing platform purpose-built for the Sui ecosystem.

What’s the Tokenomics of Haedal Protocol ($HAEDAL)?

The HAEDAL token powers the Haedal ecosystem by incentivizing participation, enhancing yield strategies, and enabling on-chain governance. Its utility is centered around the veHAEDAL model, which encourages users to lock their tokens in exchange for greater influence and rewards.

By converting HAEDAL to veHAEDAL, users gain access to:

• Staking Rewards: Earn continuous weekly rewards by locking HAEDAL into veHAEDAL.

• Reward Boosting: Amplify yield from Haedal’s farm modules based on your veHAEDAL balance.

• Governance Rights: Vote on DAO proposals, protocol upgrades, and strategic direction.

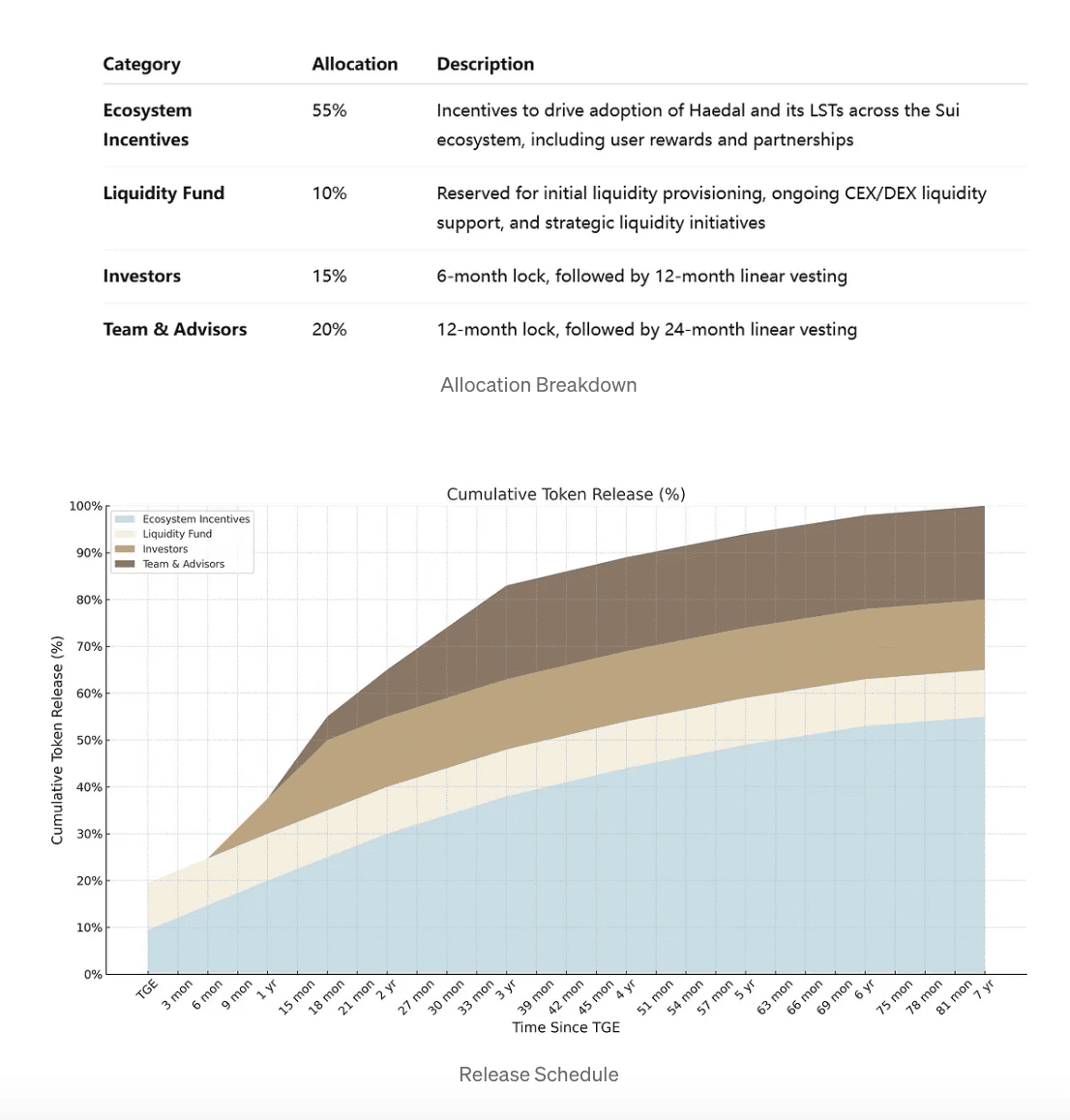

Token Allocation Breakdown

• Total Supply: 1,000,000,000 (1 billion HAEDAL)

• Ecosystem Incentives: 55% (550 million tokens) — Drive adoption across the Sui ecosystem through user rewards, strategic partnerships, and growth initiatives.

• Liquidity Fund: 10% (100 million tokens) — Reserved for initial liquidity provisioning, centralized and decentralized exchange support, and ongoing liquidity strategies.

• Investors: 15% (150 million tokens) — Allocated to early backers with a 6-month lockup followed by 12-month linear vesting.

• Team & Advisors: 20% (200 million tokens) — Reserved for core contributors and advisors, with a 12-month lockup followed by 24-month linear vesting.

At launch, the initial circulating supply will be 19.5% of the total. This includes early ecosystem incentives, listing campaigns, and liquidity maintenance reserves, designed to bootstrap growth from day one.

When is the Haedal ($HAEDAL) Airdrop?

Haedal Protocol is distributing 5% of the total $HAEDAL supply to early community members, active users, and ecosystem partners. All airdrop tokens are fully unlocked and claimable at TGE — no vesting, no delays.

Token Claim Opens:

April 29, 2024 at 12:00 PM UTC Eligible users can begin claiming their tokens from this time via the official airdrop portal.

Snapshot Timing: Eligibility snapshots were taken randomly across the past two quarters, so activity throughout that period may have contributed to your airdrop allocation.

Note on Campaign Rewards: Some rewards from Haedal’s pre-launch campaigns may be distributed separately by third-party partners, and therefore might not appear in this airdrop distribution.

Step-by-Step Guide: How to Claim Haedal ($HAEDAL) Airdrop

Who's Eligible?

• Core Community Members & Supporters: Moderators, ambassadors, content creators, and other active community builders.

• Haedal Product Users: Those who used haSUI, haWAL, haeVault, and integrated Haedal LSTs in DeFi protocols on Sui.

• Community Partners: Members of allied Sui-based ecosystems, including Bucket, Cetus, DeepBook, Hippo, Navi, Scallop, Walrus, and others.

• Campaign Participants: Users who joined pre-launch campaigns or community events. (Note: Rewards from some campaigns are handled by third parties and may be distributed separately.)

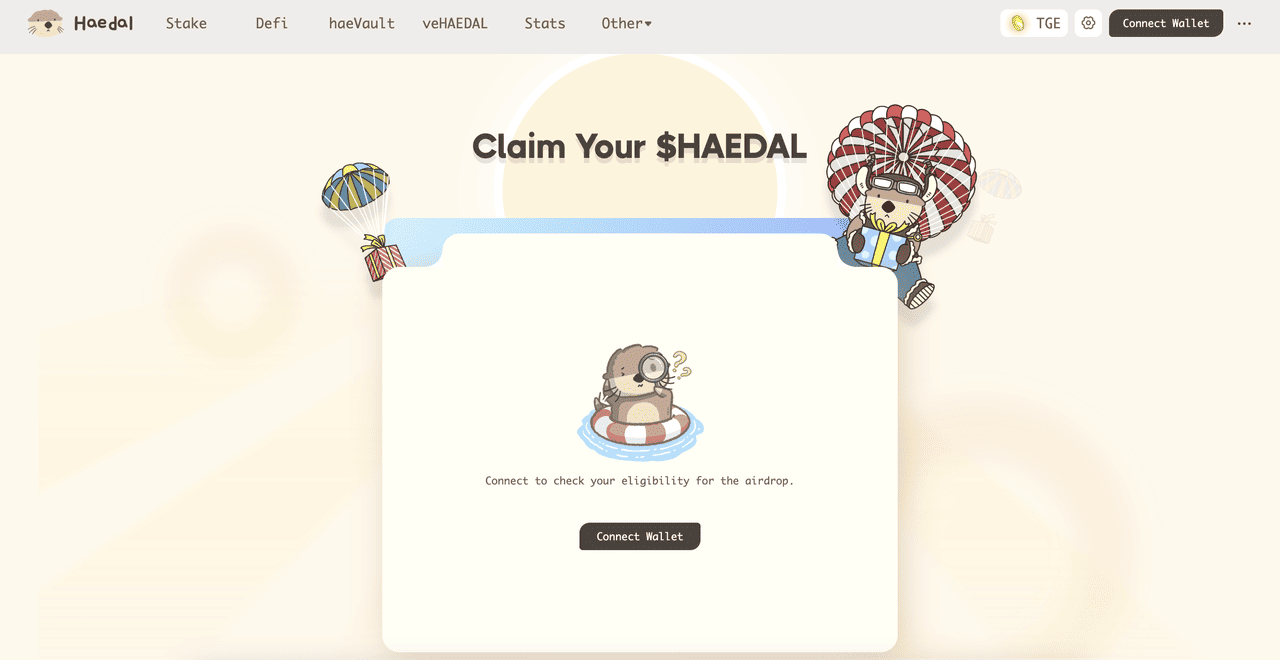

Step 2: Claim Your Tokens Eligible participants can claim their airdrop at the official portal:

haedal.xyz/airdrop

Claim Your $HAEDAL if Eligible

Note: No additional action or lock-up is required for this airdrop. Participants receive 100% of their allocation at TGE.

How to Earn more with $HAEDAL Launch on BingX?

Once you claim your tokens, you can trade them on supported exchanges like BingX. BingX also offers an exclusive event to help you earn more with $HAEDAL

Bonus Event 1: Exclusive $USDT Airdrop on BingX - $SIGN Listing Carnival

The

$HAEDAL Listing Carnival is live from April 29 to May 7 —complete simple tasks on BingX to earn your share of s0,000 USDT in rewards.

• Deposit Challenge – Accumulate 100 USDT or more in net deposits to join a 5,000 USDT prize pool.

• Spot Trading Challenge – Trade 100 USDT or more in spot volume and earn from another 15,000 USDT pool.

Bonus Event 2: $HAEDAL Airdrop

BingX is running a limited-time $HAEDAL airdrop event. Here’s how to participate:

• Deadline: May 6, 23:59 (UTC+8)

• 150 winners will receive between $5–$500 in $SIGN

• First-time spot traders will get $5 in $HAEDAL automatically

• More trades = more Gleam entries = higher chances of winning

• Airdrops will be sent to KYC-verified accounts, so make sure to submit your correct BingX UID

Haedal Protocol Future Roadmap

Although Haedal has not published a formal roadmap, its whitepaper and airdrop campaign offer strong hints about where the protocol may be heading. Based on this, we can outline several likely development directions:

• Expansion of Liquid Staking Vaults: Haedal has already introduced haSUI, haWAL, and haeVault, suggesting that additional liquid staking tokens (LSTs) may be added to broaden its composable vault offerings.

• Deeper Integration with Sui Ecosystem: The protocol has emphasized its collaborations with partners such as Cetus, DeepBook, Hippo, Navi, Scallop, and others. Future plans likely include tighter DeFi integrations across Sui-native platforms to boost LST utility.

• Activation of veHAEDAL Governance: As veHAEDAL becomes the core of staking, reward boosting, and DAO voting, we can expect the protocol to activate governance proposals that allow the community to help guide protocol parameters and future product direction.

• Community-Centric Incentives: The airdrop allocation and reward models strongly suggest an ongoing focus on rewarding active users, campaign participants, and ecosystem contributors. Future farming modules and reward multipliers tied to veHAEDAL may play a central role in incentivizing long-term participation.

While a detailed roadmap has not been shared, Haedal’s early product design and incentive structure point toward a long-term vision of becoming a foundational liquid staking and governance layer within the Sui DeFi ecosystem.

Final Thoughts

Haedal Protocol positions itself as a key liquid staking infrastructure on Sui, offering users composable vaults, governance utility via veHAEDAL, and multiple reward streams. With a strong emphasis on ecosystem partnerships and decentralized governance, it aims to bring greater yield efficiency and community alignment to the Sui DeFi space.

Whether you're an active DeFi user, DAO participant, or a yield optimizer, Haedal offers a meaningful role in shaping the liquid staking landscape on Sui. As $HAEDAL launches and veHAEDAL governance kicks in, this could be a project worth watching closely.

Haedal FAQs

Will there be more $HAEDAL airdrop phases?

The current airdrop distributes 5% of the total $HAEDAL token supply and is fully unlocked at TGE. While the project does not explicitly confirm future airdrop phases, 55% of the total supply is allocated to ecosystem incentives—including user rewards and growth initiatives—suggesting that future reward programs may be possible as Haedal continues to expand.

What Wallets Support $HAEDAL?

$HAEDAL is a token on the Sui blockchain, so any Sui-compatible wallet can be used to claim and manage it. To participate in the airdrop, users should visit

haedal.xyz/airdrop and connect a supported Sui wallet. Make sure your wallet is properly set up and has a small amount of SUI to cover transaction fees.