Resolv Protocol is reimagining what a

stablecoin can be, and over 50,000 users have already joined the mission. Backed by a $10 million seed round, the protocol combines real

DeFi yield with crypto-native design to deliver a new kind of digital dollar: one that’s independent from fiat, transparent, and built entirely on-chain.

At the center is USR, a delta-neutral

yield-bearing stablecoin backed by

ETH,

BTC, and

derivatives. It stays pegged to the U.S. dollar by hedging price exposure using perpetual futures. This means you can mint or redeem USR 1:1 for stablecoins, all while earning yield from crypto markets, not from banks or treasuries.

To protect the peg, Resolv separates risk from stability. The RLP (Resolv Liquidity Pool) absorbs market volatility and rewards users with leveraged yield. Over $1.7 billion in mints and redemptions have been processed so far, with more than $10 million in real yield paid to users, all on-chain.

Resolv launched $RESOLV, the protocol’s governance and rewards token, in June 2025. With the Token Generation Event (TGE) live and airdrops in progress, it’s catching the attention of both seasoned DeFi users and

airdrop hunters looking to maximize their earnings.

This guide breaks down how Resolv works, what makes it unique, and how you can qualify for and claim your $RESOLV tokens during the ongoing airdrop.

What Is Resolv Protocol (RESOLV) and How Does It Work?

Resolv is a decentralized stablecoin protocol designed for the next generation of DeFi. Instead of using fiat-backed assets like

USDC or relying on overcollateralized debt models, Resolv uses a crypto-native strategy to maintain price stability and generate yield, all on-chain.

At the center of the protocol is USR, a stablecoin pegged to the U.S. dollar and backed by ETH and BTC. What makes USR different is its delta-neutral strategy: Resolv holds spot ETH and BTC while shorting them with perpetual futures. These opposing positions cancel out price swings, helping USR stay stable while generating yield from

staking and funding rates.

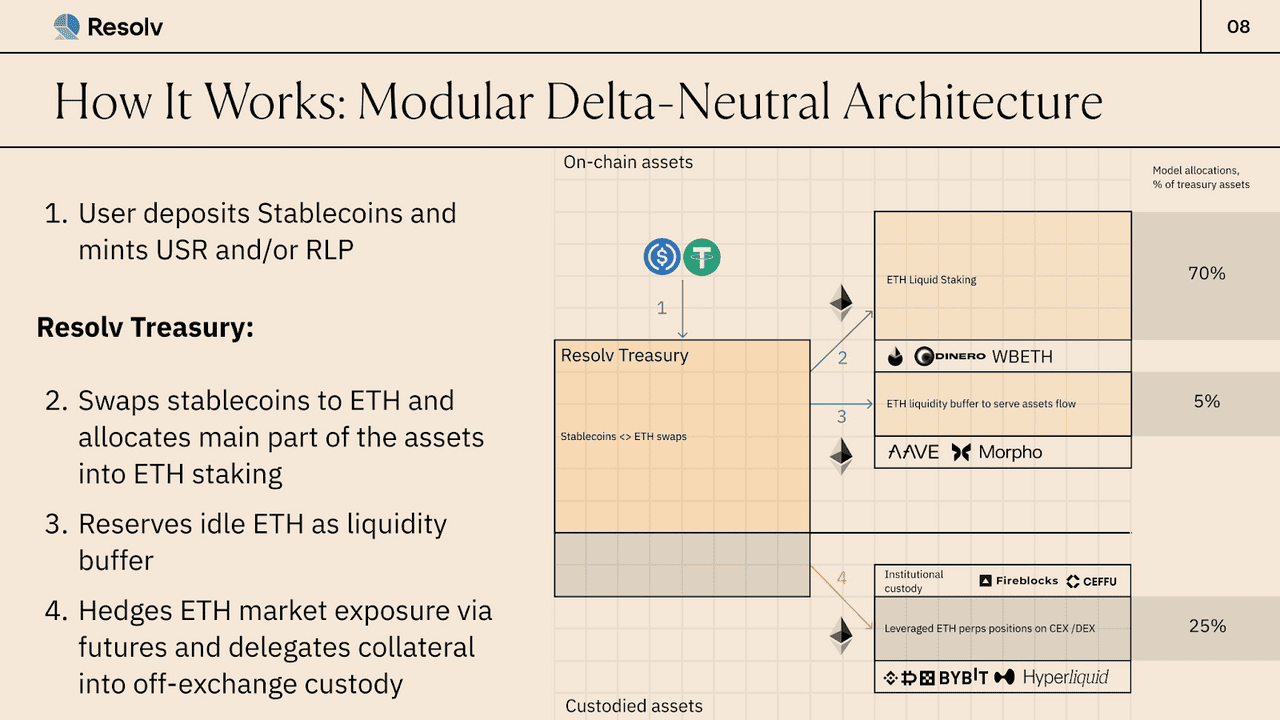

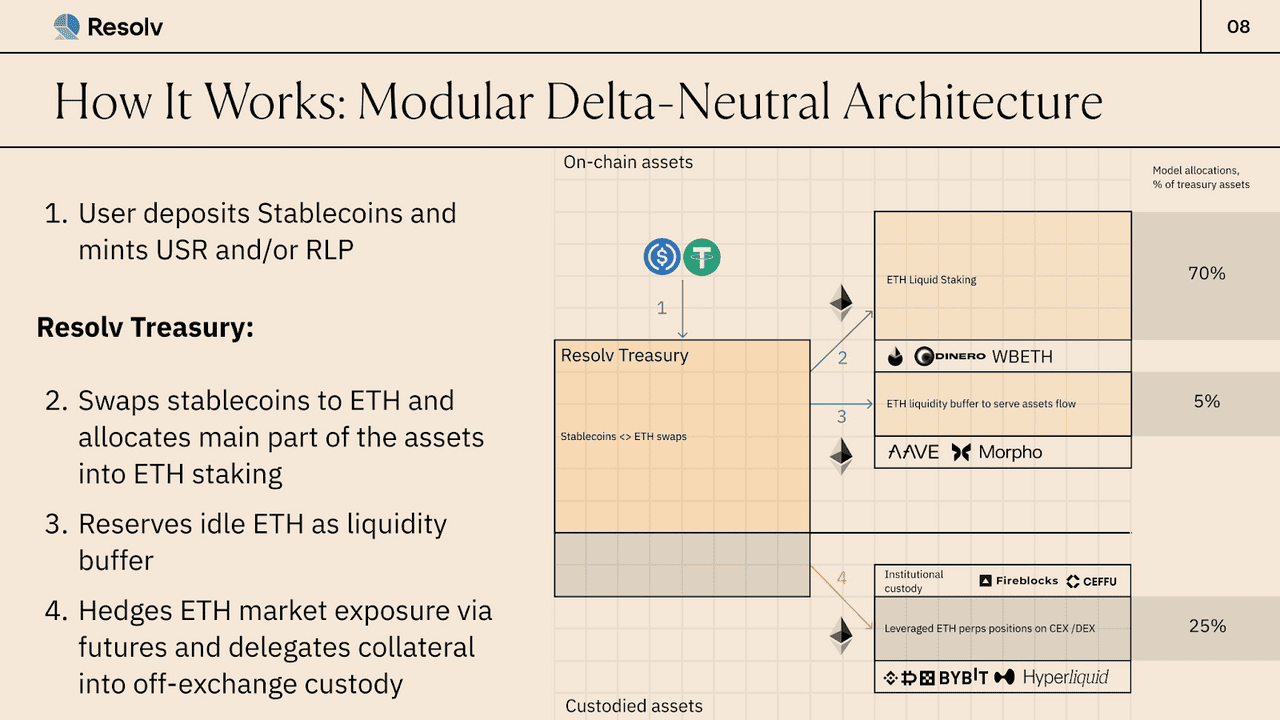

How Resolv Protocol works | Source: Resolv

The Resolv ecosystem is powered by three core tokens:

• USR: A stablecoin backed by a delta-neutral portfolio of crypto assets.

• stUSR / wstUSR: Yield-bearing versions of USR. Stake USR to earn daily rewards.

• RLP: The Resolv Liquidity Pool token. It takes on the protocol’s risk and earns higher rewards in return.

This separation of risk and stability is key. USR remains stable and accessible, while RLP absorbs volatility and enables leveraged yield strategies. Over $1.7 billion in USR mints and redemptions have been processed, with $10M+ in yield distributed to users, all fully transparent and auditable on-chain.

By combining smart hedging, capital efficiency, and real yield, Resolv offers a new model for stablecoins, one built for crypto, not the traditional financial system.

How Does the RESOLV Token Work?

The $RESOLV token is the core governance and rewards token of the Resolv ecosystem. It lets you vote on protocol changes, earn staking rewards, and unlock higher point-earning tiers within the platform.

You can stake your RESOLV tokens to receive stRESOLV, a staked version that powers the protocol’s reward system. With stRESOLV, you don’t just earn passive yield, you also boost your Resolv Points, qualify for future airdrops, and gain access to governance votes.

RESOLV Token Allocation

RESOLV has a fixed

total supply of 1 billion tokens, designed to support long-term growth while rewarding early users and active participants.

• 10% – Airdrop (Season 1): Fully unlocked at the TGE. Top

wallets are subject to a short-term unlock schedule to avoid sudden sell pressure.

• 40.9% – Ecosystem & Community: Supports long-term incentives, integrations, and user growth. Up to 10% is unlocked at TGE, with the rest released gradually over 24 months.

• 26.7% – Team & Contributors: Reserved for protocol developers and early builders. Tokens have a 1-year cliff, followed by 30 months of linear vesting.

• 22.4% – Investors: Backers and seed round participants. Tokens are subject to a 1-year cliff and 24-month linear vesting afterward.

By staking RESOLV, you earn a points boost based on the dollar value of your staked tokens. The longer you stake, the more you earn. If you hold stRESOLV for a full year or more, your reward multiplier can reach up to 2x. It’s a smart way to grow your share of rewards while staying aligned with the protocol’s long-term success.

Resolv Airdrop Season 1: How to Claim $RESOLV Tokens

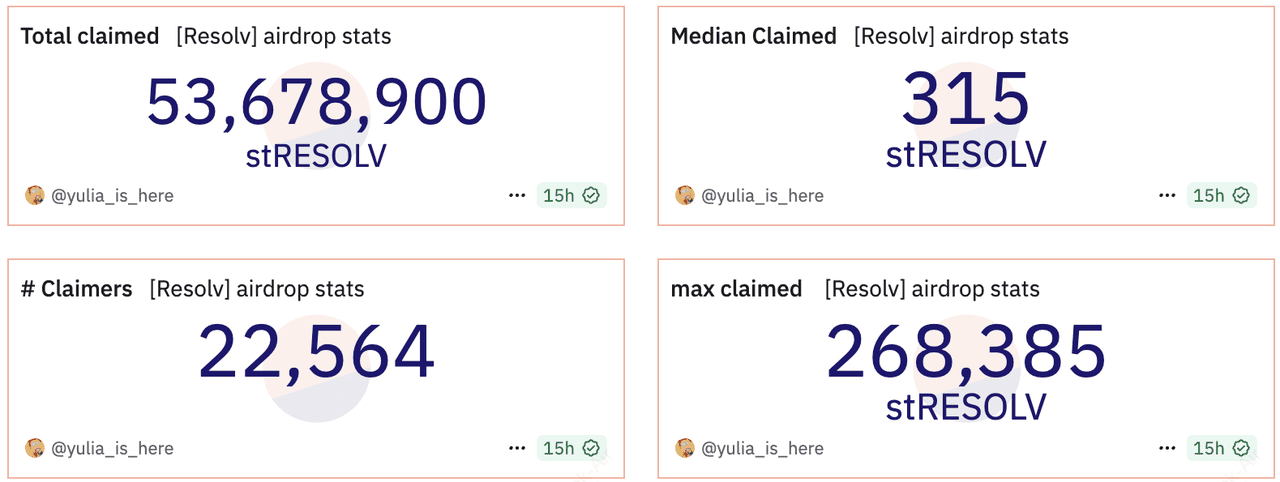

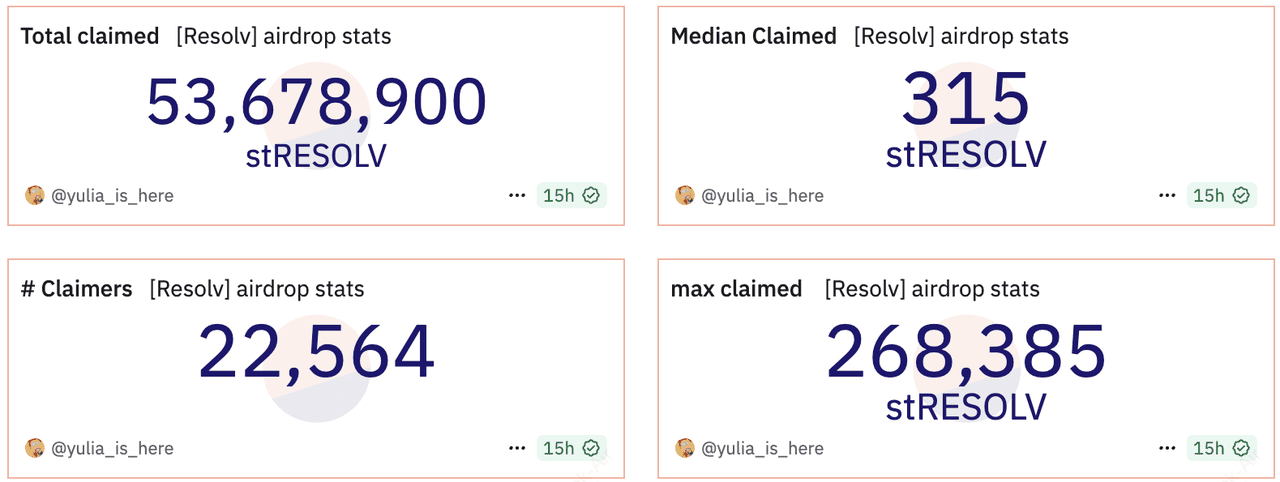

Resolv airdrop stats | Source: Dune Analytics

Resolv’s Season 1 Genesis Airdrop rewarded early adopters who supported the protocol during its initial growth phase. The campaign ran for 9 months, ending in May 2025, with an official snapshot taken on June 4, 2025, at 08:00 UTC.

If you registered and interacted with the protocol before the deadline, you may be eligible to claim rewards. 10% of the total RESOLV supply was allocated to Season 1.

To qualify, you needed to:

1. Earn Resolv Points by holding USR, staking stUSR, or minting RLP

2. Register your wallet and sign the terms between May 9 and May 25, 2025

3. Pass the protocol’s eligibility and sanctions screening

How to Claim Your RESOLV Tokens

If you met the criteria, you can claim your stRESOLV tokens, the staked version of RESOLV, before the June 27, 2025 deadline. Follow these steps:

2. Connect your wallet (MetaMask, Rabby, etc.)

3. Verify your eligibility and sign the airdrop terms

4. Pass the sanctions check

5. Claim stRESOLV tokens into your wallet

6. (Optional) To make RESOLV tradable, unstake stRESOLV, then wait 14 days for the cooldown to end

Claiming stRESOLV not only gives you governance rights and staking rewards, it also boosts your Resolv Points in Season 2.

stRESOLV Explained: What Happens After Claiming

When you claim your airdrop, you don’t receive regular RESOLV tokens right away. Instead, all tokens are distributed as stRESOLV, the staked version of RESOLV. This design rewards long-term holders and encourages active participation in the protocol.

Holding stRESOLV gives you key benefits:

• Boosts Resolv Points: You earn up to a 100% boost on your Season 2 point earnings just by holding stRESOLV.

• Accrues Staking Rewards: You passively earn rewards over time. These will be claimable once exchange listings go live.

• Voting Rights: You get a say in the future of Resolv through governance proposals and community decisions.

If you want to make your tokens liquid and tradable, you’ll need to unstake your stRESOLV. This starts a 14-day cooldown period. After it ends, you must manually claim your unstaked RESOLV tokens. Keep in mind that unstaked tokens stop earning rewards and boosts immediately.

Whether you stake for rewards or unstake for liquidity, stRESOLV gives you flexibility based on your goals.

Resolv Airdrop Season 2: How to Participate and Earn More Points

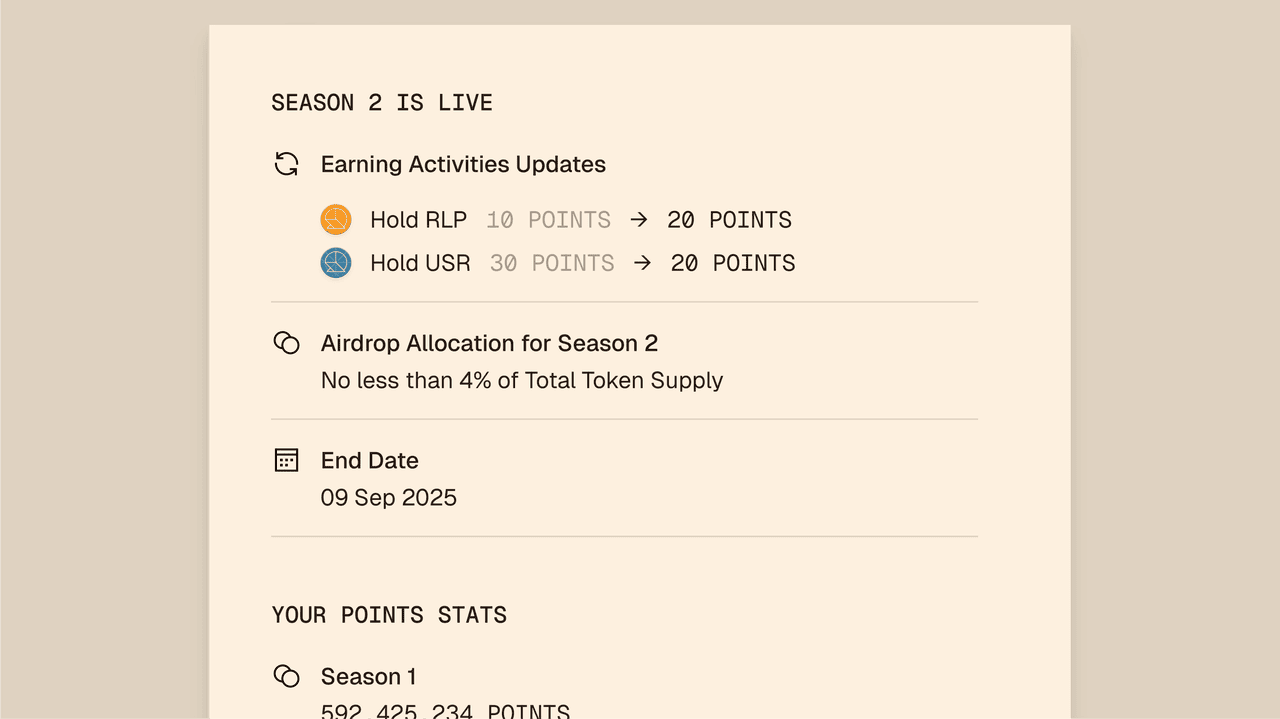

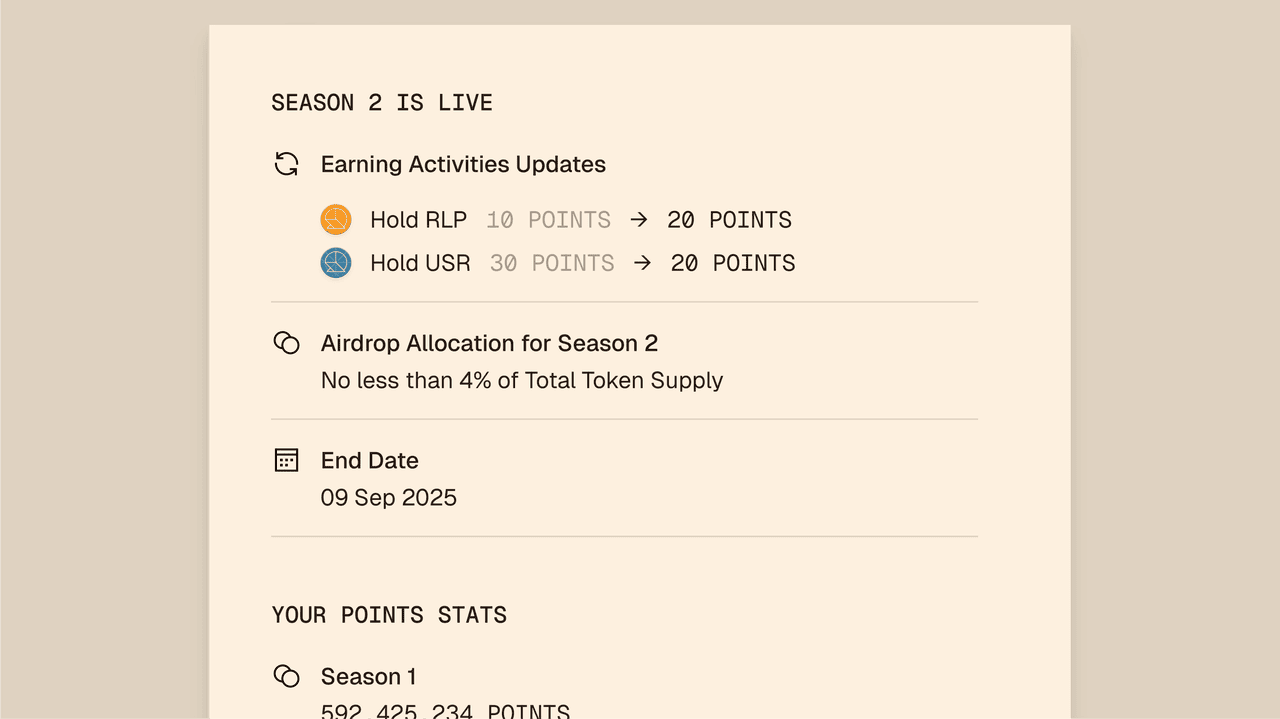

Resolv Protocol season 2 airdrop details | Source: Resolv blog

Season 2 of the Resolv Protocol airdrop runs from May 9 to September 9, 2025. If you missed the first season, this is your chance to earn RESOLV tokens by using the protocol actively. The focus this time is on deeper participation, with no lockups, no minimum deposits, just real usage rewarded with points.

What’s at Stake?

• Minimum 4% of the total RESOLV supply is allocated to Season 2 airdrop participants

• At least 5% total for community distribution

• Points are tracked automatically and can be boosted through various actions

• The more you use Resolv, the more points you earn, and the bigger your future airdrop allocation

How to Earn Daily Points on Resolv: Base Point Activities

Earn daily points for using Resolv core products:

1. Hold USR: 20 points per asset/day

2. Hold RLP: 20 points per asset/day

3. Stake USR (stUSR): 5 points per asset/day

4. Use ecosystem integrations (e.g., Superform, Morpho, Hyperbeat): 5–45 points per day depending on activity

This equal weighting of USR and RLP gives you flexibility to choose your strategy.

How to Boost Your Earnings with Multipliers

Season 2 includes a new set of point boosts that stack with your base earnings:

• stRESOLV Boost: Up to +100% based on your stRESOLV vs TVL ratio

• Blueprint NFT Boost: +25% if you hold a Resolv Blueprint NFT

• Referee Welcome Boost: +20% if you joined through a referral link

• From Season 1 With Love Boost: +10% if you earned points in Season 1

• Believer Boost: +10% if you joined before the $100M milestone (Dec 16, 2024)

Note: Referrers also earn 10% of the total points generated by referees.

How Your Total Resolv Points Are Calculated

Your total points = Base Points × (1 + Boost 1 + Boost 2 + …)

Example: If you earn 100 base points/day and qualify for +25% NFT boost and +20% referral boost, your daily total becomes:

100 × (1 + 0.25 + 0.20) = 145 points/day

Why Participate in Resolv Airdrop Season 2?

Resolv is positioning itself as the distribution layer for crypto yield, rewarding real usage, not just deposits. By participating in Season 2, you earn points that could convert into RESOLV tokens in future distributions. Plus, you get access to staking rewards, governance, and yield farming opportunities with minimal friction.

The earlier and more actively you participate, the bigger your share. Connect your wallet, interact with the ecosystem, and start stacking those points.

How to Trade RESOLV Tokens on BingX After the Airdrop

After claiming your airdrop, you may want to trade or add to your RESOLV holdings. Token listings are expected to begin around two weeks after the claim window closes, giving the protocol time to prepare liquidity and allow users to complete the unstaking process.

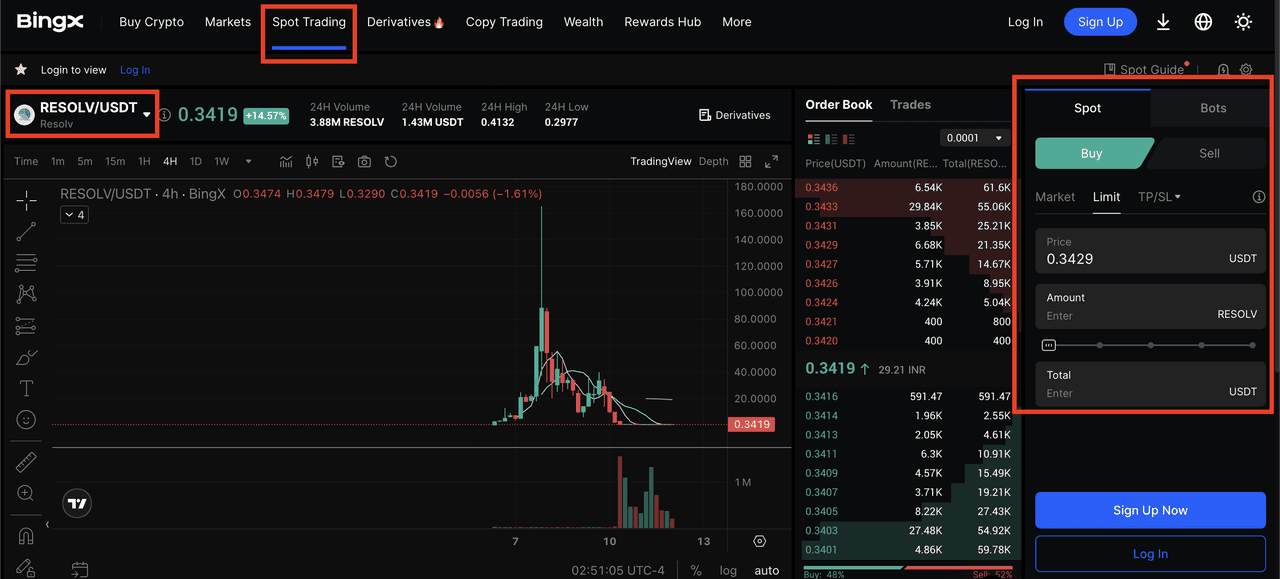

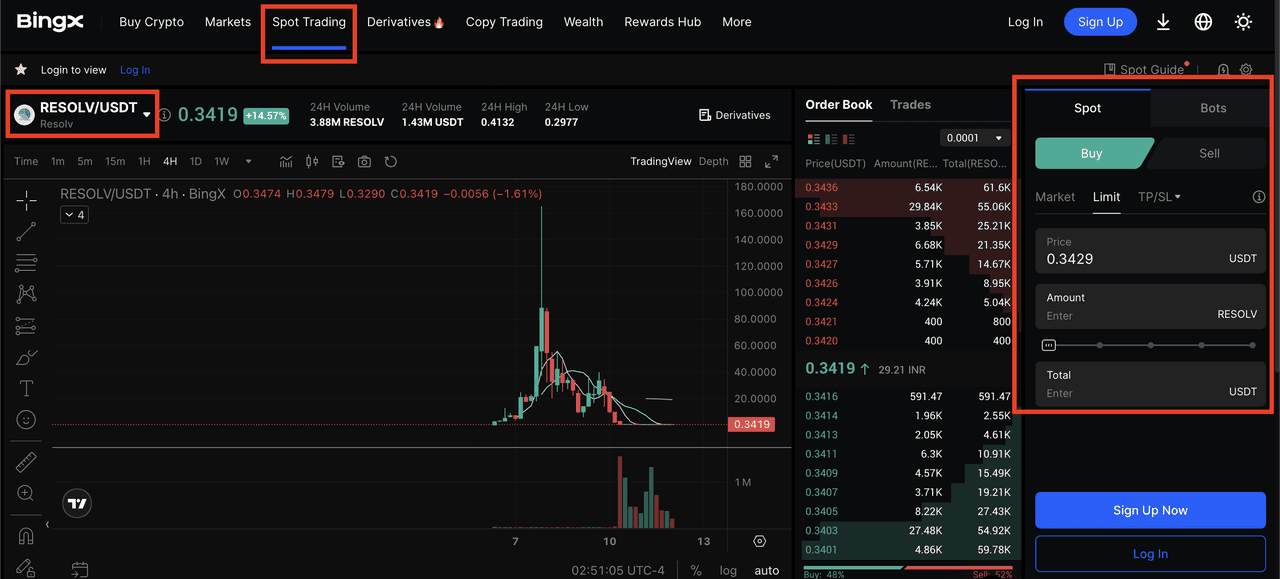

Buy or sell RESOLV tokens on BingX Spot Market

RESOLV will be available for trading on select exchanges, including BingX, where you’ll find spot and potentially futures markets. Follow official announcements to track the listing timeline and supported pairs.

How to Unlock RESOLV for Trading

All airdropped tokens are distributed as stRESOLV, which must be unstaked to become tradable. Here's how to do it:

1. Unstake stRESOLV in the Resolv app

2. Wait 14 days for the cooldown period to finish

3. Claim your RESOLV tokens

4. Transfer to an exchange like BingX and start trading

Until the cooldown ends, your tokens remain locked and untradable, so plan your liquidity needs ahead of time.

What Are the Risks of Resolv Protocol?

While Resolv introduces a powerful new model for stablecoins, it's important to understand the risks involved before investing or participating further.

1. Smart Contract Risk: Like all DeFi protocols, Resolv relies on

smart contracts. Bugs or exploits could lead to loss of funds, especially in core components like the delta-neutral strategy or staking vaults.

2. Market Volatility: After the TGE, RESOLV may experience sharp price swings, especially with limited circulating supply in the early stages.

3. Liquidity Lock: If you stake your tokens, they remain locked during the 14-day unstaking cooldown. You can’t trade or transfer them during this period.

4. Regulatory Uncertainty: Resolv uses derivatives to hedge its stablecoin positions. While this is fully on-chain and decentralized, it may attract regulatory scrutiny in some jurisdictions.

Always do your own research (

DYOR), use risk management, and stay informed through official Resolv channels.

Conclusion

Resolv offers a fresh approach to stablecoins by using a delta-neutral design backed by ETH and BTC. Instead of depending on fiat reserves or centralized assets, it creates price stability through on-chain derivatives and market-neutral strategies. This model allows users to earn real yield while contributing to a decentralized and transparent ecosystem. With features like USR, RLP, and the staked RESOLV token, the protocol combines capital efficiency with user incentives such as staking rewards, governance rights, and airdrop bonuses.

However, like all DeFi projects, Resolv carries risks. Smart contract vulnerabilities, market volatility, and regulatory uncertainty around derivative-backed stablecoins can impact user experience and token value. Always manage your exposure, understand the cooldown periods for unstaking, and monitor official updates before making long-term commitments. If you're exploring new ways to earn in crypto, Resolv presents a promising opportunity, but it’s important to stay informed and engage responsibly.

Related Reading

FAQs on Resolv Protocol Airdrop

1. What is the RESOLV airdrop snapshot date?

The snapshot for Season 1 was taken on June 4, 2025, at 08:00 UTC. Your wallet balances, staking activity, and earned points at that time determine your airdrop eligibility.

You receive stRESOLV, the staked version of RESOLV. It earns staking rewards, boosts your points, and gives you governance rights. If you want tradable RESOLV, you’ll need to unstake.

3. Can I unstake RESOLV tokens immediately after the airdrop?

Yes, you can start the unstaking process at any time. However, it triggers a 14-day cooldown before your RESOLV becomes available.

4. How long is the unstaking cooldown?

The cooldown period is 14 days. Once it ends, you must manually claim your unstaked RESOLV tokens to make them liquid and tradable.

5. When can I trade RESOLV?

RESOLV was officially listed on BingX on June 10, 2025, under the trading pair RESOLV/USDT. This listing allows you to easily buy and sell RESOLV on a major exchange. The timing came shortly after the airdrop claim window opened, giving early claimants a chance to unlock liquidity after unstaking.

6. Will there be future $RESOLV airdrops?

Yes. Season 2 is currently live and runs through September 9, 2025. More airdrop campaigns are expected as Resolv expands its ecosystem. Stay active to qualify for future distributions.

7. How do boosts impact my Resolv Points?

Boosts multiply your base Resolv Points. For example, staking RESOLV or owning a Blueprint NFT adds extra percentage bonuses. Your total points are calculated as: Base Points × (1 + Boost 1 + Boost 2 + …)

The higher your boosts, the bigger your share of the next airdrop.

How Resolv Protocol works | Source: Resolv

How Resolv Protocol works | Source: Resolv Resolv airdrop stats | Source: Dune Analytics

Resolv airdrop stats | Source: Dune Analytics Resolv Protocol season 2 airdrop details | Source: Resolv blog

Resolv Protocol season 2 airdrop details | Source: Resolv blog Buy or sell RESOLV tokens on BingX Spot Market

Buy or sell RESOLV tokens on BingX Spot Market