Sonic’s community has overwhelmingly approved a $150 million U.S. expansion plan (August 20–31, 2025), signaling a bold push into traditional finance. The plan allocates $50M for an S-tracking ETF/ETP with custody managed by BitGo, a leading institutional custodian, and $100M for a Nasdaq DAT/PIPE that will purchase $S tokens on the open market and lock them for three years, showing long-term institutional confidence.

To drive these efforts, Sonic will launch Sonic USA LLC, a Delaware subsidiary with a New York office and dedicated CEO to focus on U.S. policy and partnerships. This move positions the Sonic blockchain for institutional-grade liquidity, stronger regulatory alignment, and greater visibility across both crypto and TradFi markets.

The expansion could accelerate adoption, attract capital, and deepen liquidity. Still, risks remain: the 14.2% token supply increase may dilute holders, ETF/PIPE execution depends on regulation, and throughput claims are vendor-reported. Overall, Sonic looks like a high-upside but execution-dependent Layer-1 play in 2025.

What Is the S Token Utility in the Sonic Ecosystem?

The S token is the native cryptocurrency of the Sonic blockchain, used to power transactions, secure the network, and govern protocol decisions. It powers the Sonic ecosystem and plays several important roles for both users and developers.

1. Gas & Fees: Every transaction on Sonic requires a small fee paid in S, keeping the network secure and spam-free while maintaining low costs, typically less than $0.01.

2. Staking & Validation: Holders can stake S with validators to help secure the network and earn rewards, with target yields of around 3.5% APR at 50% stake, funded initially by reallocating Opera rewards instead of new inflation.

3. Governance: Community members use S to vote on major proposals, such as tokenomics updates, FeeM distribution, or U.S. expansion plans like the ETF/PIPE initiative, giving holders a direct say in the project’s future.

What Changed in Sonic (S) Tokenomics After the Vote?

Sonic’s governance vote reshaped its tokenomics to balance institutional growth and long-term scarcity. The total supply will increase from ~3.41 billion to ~3.89 billion S tokens, adding 472 million tokens, a 14.2% growth, to circulation, while an extra $50 million in S tokens will only be minted if the ETF plan is finalized.

To manage inflation, the network raised the share of gas fees burned, tied its annual 1.5% growth mint to strict burn rules for unused tokens, and reallocated Opera’s block rewards to deliver about 3.5% APR for stakers in the early years without creating new inflation. Together, these adjustments make Sonic’s economics more predictable, deflation-leaning, and institution-ready.

How to Trade Sonic (S) Token on BingX

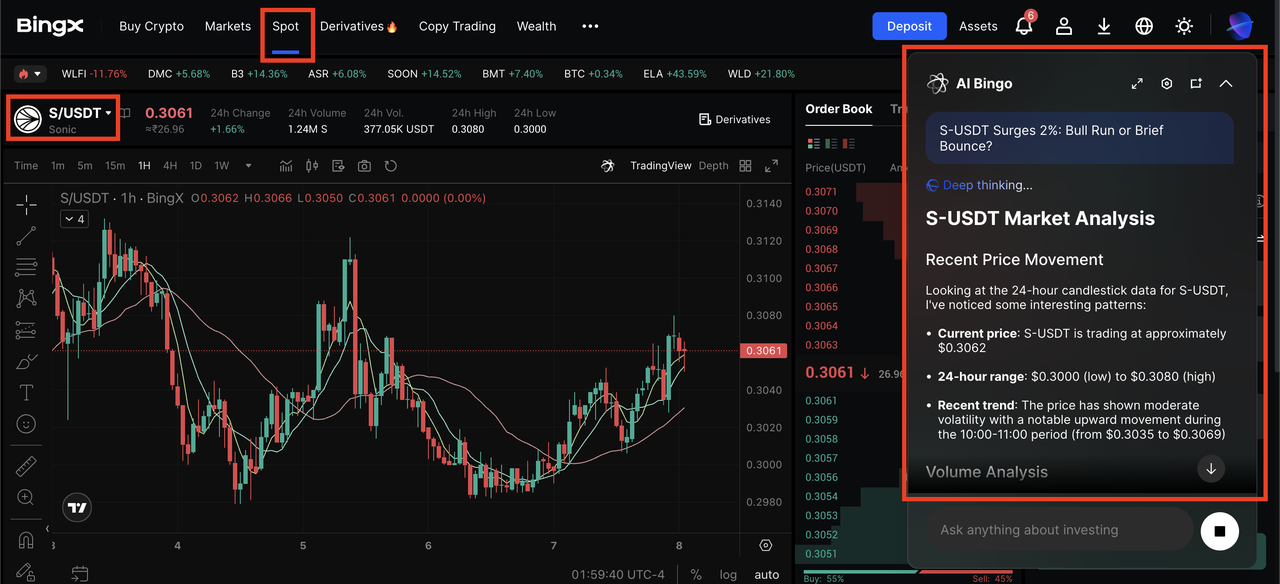

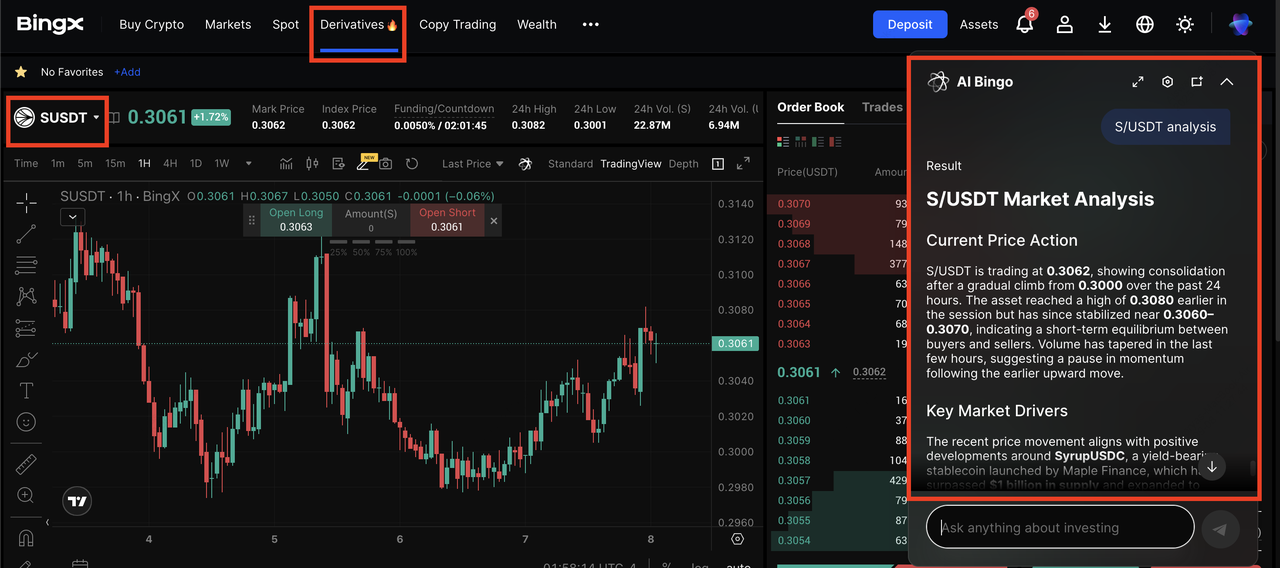

Whether you plan to build a long-term S position or trade volatility around governance and ETF headlines, BingX gives you flexible tools with

BingX AI insights.

1. Buy or Sell S on the Spot Market