Traditional finance (TradFi) is the global legacy financial system you already use every day, including banks, stock exchanges, payment networks, insurers, brokers, and regulators. It runs on centralized infrastructure, enforced by laws and intermediaries, and it powers most global money movement and capital markets.

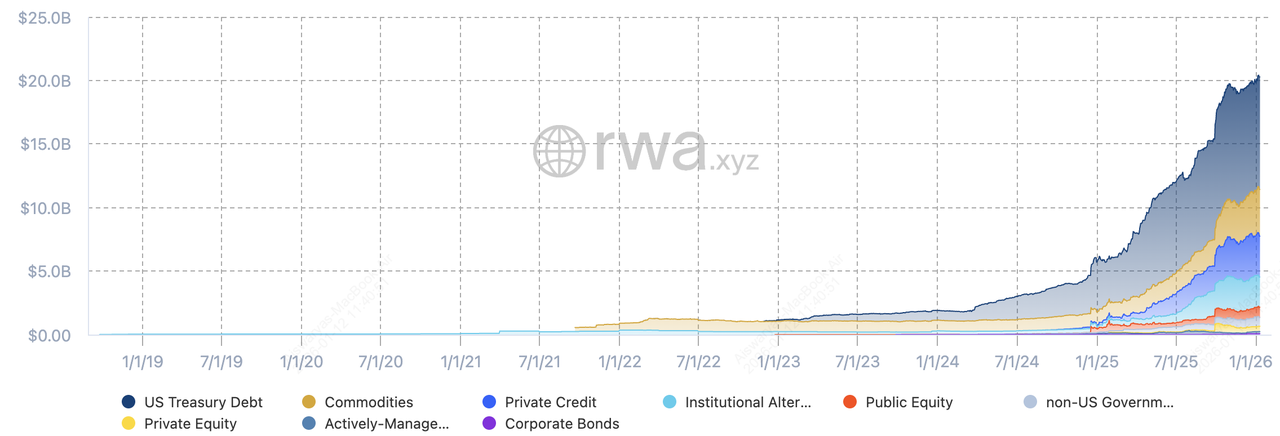

Total value of tokenized RWAs on-chain | Source: RWA.xyz

In 2026, TradFi is rapidly moving on-chain, which means rebuilding parts of that system using blockchain rails, so assets like U.S. Treasuries, money market funds, stocks, and even settlement workflows can be issued, held, transferred, and used in programmable markets. The result is a growing “bridge layer” between TradFi and crypto where stablecoins become the payment rail, and

tokenized real-world assets (RWAs) become the investable product layer. This shift is already measurable: as of January 2026, RWA.xyz tracks over $20 billion in distributed on-chain RWA value and over $307 billion in stablecoin value, showing how quickly crypto rails are becoming a parallel financial layer.

In this article, you will learn what TradFi is, why on-chain TradFi is growing in 2026, and how to trade TradFi instruments like stocks, gold, forex, and indices using crypto on BingX.

What Is TradFi (Traditional Finance)?

TradFi, short for traditional finance, is the financial system you already use every day, like banks, stock markets, payment networks, insurance companies, and regulators. It’s the system that handles your salary, your savings account, your credit card, and your stock investments. Everything runs through licensed institutions that hold your money, process your transactions, and make sure the rules are followed.

Because of this setup, you don’t really control the system yourself, your bank or broker does. That’s why they can reverse payments, freeze accounts, or block certain transactions if required by law. It provides safety and consumer protection, but it also means things can be slower, cost more, and be limited by borders, paperwork, and office hours.

What Are the Largest and Most Traded TradFi Instruments?

Traditional finance is dominated by a few massive, highly liquid markets that collectively move tens of trillions of dollars every day:

1. Stocks and Equity Indices

Public equities are the backbone of TradFi. This includes shares of companies like Apple, Microsoft, NVIDIA, and Tesla, as well as stock indices such as the S&P 500, Nasdaq-100 (QQQ), and Dow Jones. U.S. stock markets alone trade over $500 billion per day on average, making equities the most followed and analyzed asset class globally.

2. Foreign Exchange (Forex)

Forex is the largest financial market in the world, with over $7.5 trillion in daily trading volume. Major currency pairs like EUR/USD, USD/JPY, and GBP/USD are used for international trade, central-bank policy, and global capital flows.

3. Government Bonds and Treasuries

Markets for U.S. Treasury bills, notes, and bonds form the foundation of global finance. They are used as risk-free benchmarks, collateral for banks, and yield instruments for investors managing trillions of dollars in capital.

4. Commodities Like Gold, Oil, Silver, Natural Gas

Commodities are essential to both financial markets and the real economy. Gold and silver are used as monetary hedges, while oil and natural gas power global industry. These markets trade hundreds of billions of dollars daily across futures and spot exchanges.

5. Derivatives - Futures, Options, Swaps

Most TradFi trading does not happen in cash markets but in derivatives, which allow hedging, speculation, and leverage. Futures and options on stocks, commodities, interest rates, and forex are core tools for institutions and traders worldwide.

These five categories are the core engines of global finance, and they are now being recreated on blockchain rails through tokenized assets, stablecoins, and crypto-settled perpetuals. This transition is not happening by accident: it reflects growing demand for faster settlement, 24/7 trading, global access, and programmable finance, which is why TradFi is increasingly moving on-chain in 2026.

TradFi Moving On-Chain in 2026, and How Does It Work?

By 2026, traditional finance is no longer just experimenting with blockchain but it is actively moving core market infrastructure on-chain. Tokenized Treasury funds, digital stocks, on-chain gold, stablecoin settlement, and blockchain-based clearing systems are now being used by banks, asset managers, and crypto exchanges to make global markets faster, more liquid, and more programmable. This shift is creating a new hybrid financial layer where legacy assets operate on crypto rails.

In crypto conversations, “TradFi” is often used as a shorthand contrast to DeFi, where blockchain protocols and smart contracts replace many middlemen. TradFi prioritizes compliance, consumer protection, and stability, but it can also bring higher friction, restricted access, and slower settlement.

Taking

TradFi on-chain means shifting traditional financial markets onto blockchain infrastructure so assets become programmable through smart contracts, composable across on-chain applications, faster to settle than legacy systems, and more accessible through fractional ownership and global distribution. This turns stocks, bonds, commodities, and currencies into digital instruments that can move, trade, and integrate with other financial tools in near real time, rather than being locked inside slow, siloed banking and brokerage systems.

1. Traditional assets are legally wrapped: Real-world assets like Treasury bills, stocks, ETFs, gold, and funds are placed inside a regulated issuer or SPV and held by a qualified custodian.

2. Blockchain tokens are issued: For every asset held off-chain, an equivalent on-chain token is created to represent its economic value.

3. Real-time pricing is maintained: Oracles and data providers feed stock prices, NAVs, interest accruals, dividends, and maturity schedules onto the blockchain so tokens track real markets.

4. Stablecoins handle settlement: Trades settle using

USDT and other

stablecoins, which act as digital cash for

on-chain markets and now exceed $307 billion in circulation.

5. Trading becomes 24/7 and global: Because settlement happens on blockchain rails, assets can trade around the clock, with fractional sizes and cross-border access where permitted.

6. Compliance is built into code: KYC, transfer limits, investor eligibility, and reporting rules are enforced by smart contracts instead of manual back-office systems.

7. Assets become programmable and composable: The same tokenized stock, bond, or commodity can be traded, used as collateral, or integrated into DeFi and exchange products.

A simple mental model:

TradFi asset + legal structure + custody + price/oracle + smart contract rails = on-chain representation

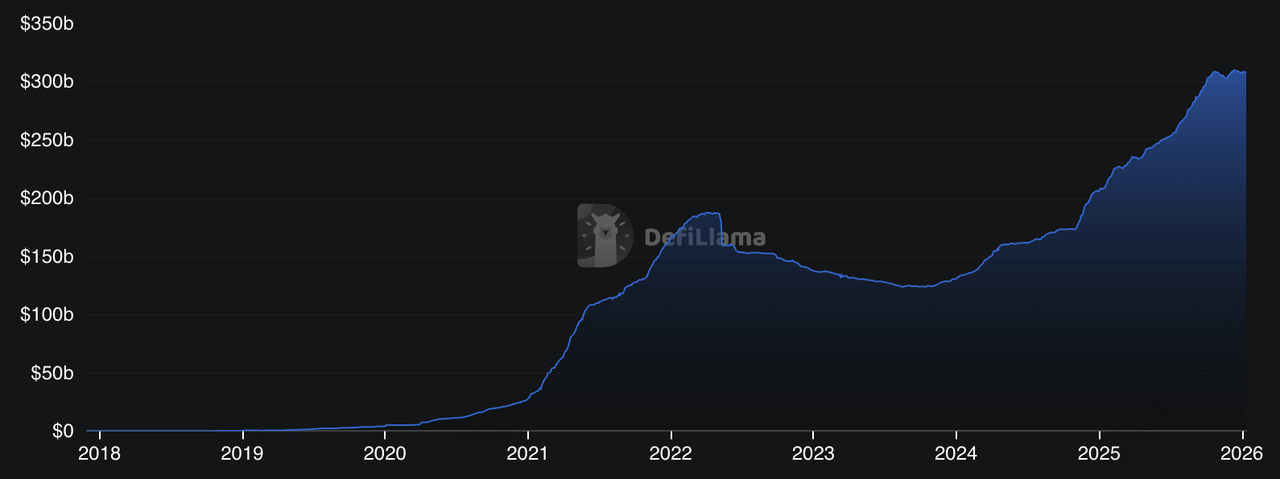

This is why stablecoins matter too. Tokenized assets need on-chain “cash” for settlement, and stablecoins have become the dominant settlement layer in crypto markets, valued at over $307 billion as of January 2026, as per data on DefiLlama.

What Are the 5 Most Important On-Chain TradFi Use Cases in 2026?

By 2026, traditional finance on-chain has expanded far beyond simple tokenized bonds, now covering everything from government debt and stocks to commodities, currencies, and index exposure, creating a full

crypto-native mirror of global financial markets.

1. Tokenized Treasury Bills and Money-Market Funds

These remain the gateway product for institutions and crypto investors moving capital on-chain. Tokenized T-bills and money-market funds offer familiar risk profiles, transparent yield, and daily liquidity, making them ideal for parking stablecoin balances in interest-bearing, low-volatility assets instead of idle cash.

2. Tokenized Public Stocks and Indices - xStocks

Total value of tokenized stocks on-chain | Source: RWA.xyz

Tokenized equities and ETFs let you trade price exposure to listed companies and stock indices using blockchain rails. This includes single-stock tokens, such as

Tesla,

Apple,

NVIDIA, or

Meta, as well as index products like the

Invesco QQQ tokenized ETF. RWA.xyz tracks tokenized public stocks at nearly $812 million in total value with over $2.5 billion in monthly transfer volume, showing that on-chain equity trading is no longer niche. That said, most of these products provide economic price exposure rather than shareholder rights, meaning they often behave more like blockchain-settled derivatives than traditional stock ownership.

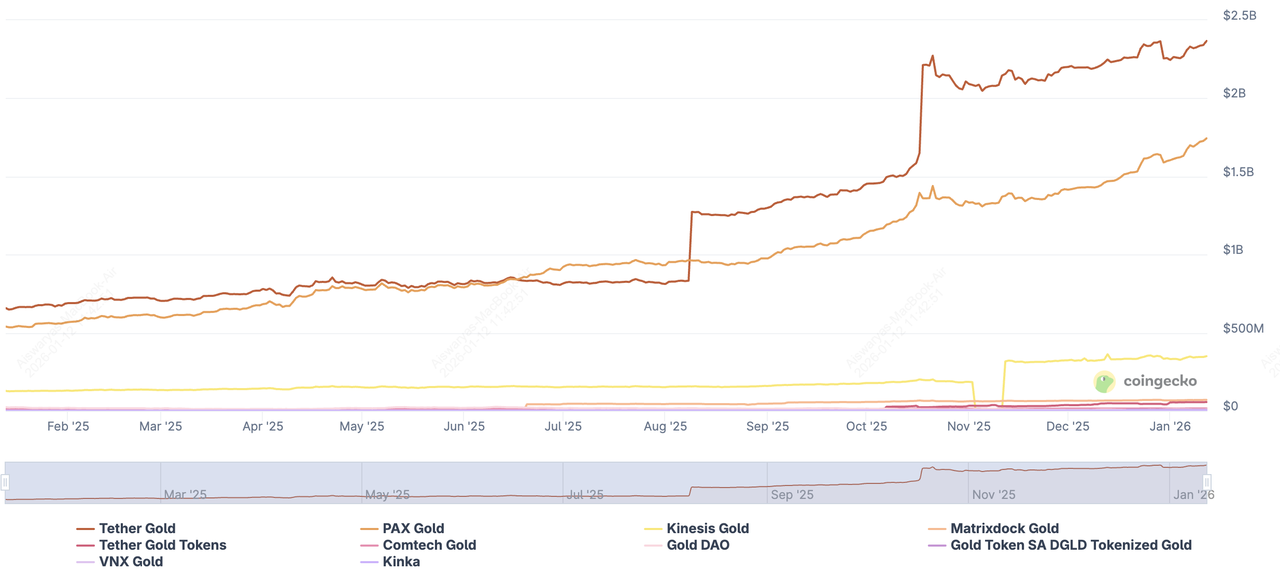

3. Tokenized Commodities, Including Gold and Silver

Market cap of leading tokenized gold projects | Source: CoinGecko

Tokenized commodities have become one of the fastest-growing on-chain TradFi segments. Physical assets like gold and silver are now represented by blockchain tokens backed by vaulted metal, allowing investors to hold, trade, and even use precious metals as collateral in DeFi. This brings traditionally slow, storage-heavy assets into 24/7 global markets with fractional ownership and instant settlement.

4. Tokenized Forex and Synthetic Currency Markets

Foreign exchange is also moving on-chain through tokenized or synthetic versions of major fiat pairs. These allow traders to gain exposure to EUR, GBP, and JPY using stablecoins as margin, opening up crypto-native FX trading without relying on bank rails.

5. Stablecoins as the Settlement and Collateral Layer

Total market cap of stablecoins | Source: DefiLlama

Stablecoins remain the foundation of the entire on-chain TradFi stack. With over $307 billion in total market cap and more than 220 million holders tracked by RWA.xyz, stablecoins act as the digital cash that settles tokenized stock trades, backs commodity positions, and serves as collateral for on-chain lending, futures, and structured products. Without stablecoins, tokenized Treasuries, stocks, and commodities could not function as a unified, liquid financial system.

Together, these use cases show how TradFi on-chain in 2026 is no longer just about tokenizing a few bonds but also about recreating a full, multi-asset financial market on blockchain rails, where stocks, gold, currencies, and cash all interact in real time.

TradFi vs. TradFi On-Chain: Key Differences

While both systems are built around the same real-world assets like stocks, bonds, commodities, and currencies, the way those assets are issued, traded, and settled changes dramatically when TradFi moves onto blockchain rails.

| Feature |

Traditional Finance (TradFi) |

TradFi On-Chain |

| Market structure |

Centralized institutions (banks, brokers, exchanges, clearing houses) control trading and settlement |

Assets are issued and moved on public or permissioned blockchains with smart-contract settlement |

| Settlement speed |

T+1 to T+3 days for most stocks and bonds |

Near-instant or same-block settlement using stablecoins |

| Trading hours |

Limited to exchange hours and time zones |

24/5 global markets, Monday to Friday |

| Payment Methods |

Requires bank accounts, brokers, and regional approvals |

Uses crypto wallets and stablecoins; fractional and global access where permitted |

| Minimum trade size |

Often one full share, lot sizes, or high capital requirements |

Fractional ownership possible, even for high-priced stocks or gold |

| Cash leg |

Bank wires, clearing systems, and correspondent banks |

Stablecoins like USDT and USDC act as digital cash |

TradFi is built around centralized institutions such as banks, brokerages, exchanges, clearing houses, and custodians that control access, hold assets, and process transactions through regulated but often slow and fragmented infrastructure. Trades in stocks, bonds, or commodities typically settle through multiple intermediaries, operate only during market hours, and rely on bank-based payment rails, which can lead to delays, high costs, and geographic restrictions for global investors.

TradFi on-chain keeps the same real-world assets and legal structures but moves trading, settlement, and record-keeping onto blockchain rails. Tokenized stocks, bonds, gold, and currencies can be issued, traded, and settled using stablecoins and smart contracts, enabling 24/7 markets, near-instant settlement, fractional ownership, and global access where permitted. The result is a hybrid financial system that combines the regulatory foundation of traditional finance with the speed, transparency, and programmability of crypto infrastructure.

In short, TradFi on-chain keeps the real-world legal structure of traditional finance but replaces its slow, fragmented infrastructure with programmable, always-on blockchain rails. This is why banks, asset managers, and crypto platforms are increasingly using stablecoins and tokenized assets to connect global capital to 24/7 crypto markets in 2026.

How to Trade TradFi On-Chain with BingX

BingX lets you access traditional financial markets, including stocks, commodities, and currencies, directly through crypto rails, using USDT settlement, 24/7 trading, and both spot and futures instruments.

1. Trade Tokenized Gold and Tokenized Stocks on the Spot market

XAUT/USDT trading pair on the spot market powered by BingX AI insights

Spot trading is ideal if you want simple buy-and-hold or swing-trading exposure to traditional assets without leverage. On BingX, this includes tokenized stocks (xStocks) and tokenized precious metals such as gold and silver, which track real-world prices while settling in USDT.

1. Log in to BingX and deposit USDT into your Spot wallet.

2. Go to Spot Trading from the main menu.

4. Choose a

Market order to buy or sell instantly, or a Limit order to set your preferred price.

5. After buying, you can hold the tokenized asset for long-term exposure or sell it anytime, just like any crypto asset.

2. Trade Commodities, Forex, Indices, and Stock Perpetuals on the Futures Market

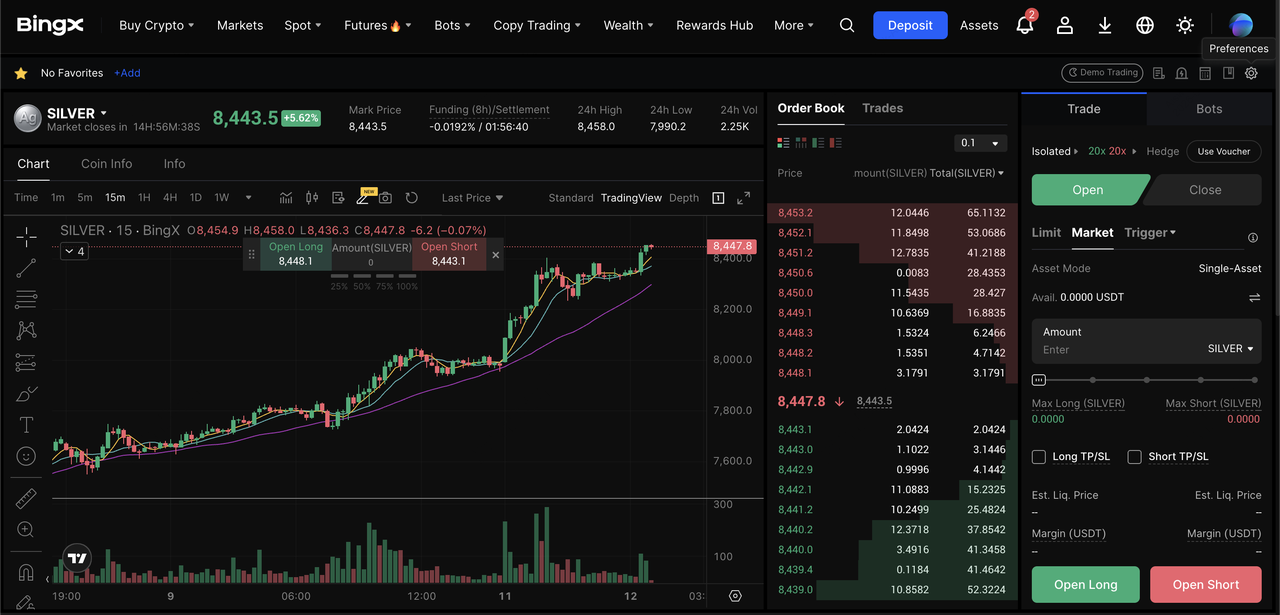

SILVER/USDT perpetual contract on the futures market

For active traders who want leverage, hedging, or the ability to short, BingX offers

USDT-margined perpetual futures linked to major stocks, stock indices, commodities, and forex markets. This includes exposure to assets such as gold,

silver, WTI and

Brent crude oil,

natural gas, major FX pairs, and leading global equities and indices, all without owning the underlying asset.

1. Transfer USDT from your Spot wallet to your Futures wallet.

3. Choose Cross or Isolated margin and set your leverage based on your risk tolerance.

4. Enter a Long position if you expect the price to rise, or a Short position if you expect it to fall.

Risk reminder: Futures trading uses leverage and can amplify losses. Always manage position size and use TP/SL, especially in volatile macro-driven markets.

What Are the Pros and Cons of Trading TradFi Instruments with Crypto?

Trading traditional financial assets on blockchain rails can unlock powerful new capabilities for investors, but it also introduces trade-offs that are very different from using a traditional bank or brokerage.

Pros of Trading Traditional Finance Markets with Crypto

• Faster settlement and simpler operations: Trades can clear in minutes rather than days, with fewer intermediaries and less manual reconciliation.

• 24/5 global markets: Tokenized stocks, commodities, and currencies can trade around the clock from Monday to Friday, not just during exchange hours.

• Fractional access: You can buy small portions of high-priced assets like gold or major tech stocks instead of needing full-share or large lot sizes.

• Programmable finance: Smart contracts can automate margin calls, interest payments, collateral movements, and corporate-action style payouts.

• Composability: The same on-chain asset can be traded, used as collateral, or integrated into DeFi strategies without moving it back to a bank or broker.

Cons of Trading TradFi Assets with Crypto

• Not true ownership in many cases: Tokenized stocks often give price exposure but not shareholder rights such as voting or direct dividends.

• Regulatory uncertainty: What you can trade, and how, depends on your jurisdiction and the issuer’s compliance model.

• Technology risk: Smart contracts, custodians, or platforms can fail or be hacked, creating risks that do not exist in insured brokerage accounts.

• Liquidity fragmentation: Some tokenized assets trade in smaller, more fragmented markets than their traditional counterparts, increasing slippage and volatility.

Final Thoughts

Traditional finance is not being replaced, but it is being rebuilt on blockchain rails. Tokenized Treasuries, on-chain stocks, digital gold, and crypto-settled derivatives show that the global financial system is evolving into a hybrid model, where legacy assets move through programmable, always-on infrastructure. Platforms like

BingX TradFi are part of this shift, giving you crypto-native access to stocks, commodities, forex, and indices through tokenized assets and perpetual futures, all settled in USDT and available 24/7.

That said, trading TradFi instruments on-chain still carries real risks. Product structures vary, liquidity can differ from traditional markets, and futures trading introduces leverage that can magnify losses. Before trading, make sure you understand what kind of exposure you are getting, how the instrument is settled, and how much risk you are taking. Used carefully, on-chain TradFi can be a powerful addition to a modern trading toolkit. but it should always be approached with proper research and disciplined risk management.

Related Reading