World Mobile (WMTX) is at the forefront of the

DePIN (Decentralized Physical Infrastructure Network) movement, building the world’s first mobile network owned and operated by its users. By leveraging blockchain technology and unlicensed spectrums, World Mobile eliminates the need for expensive, centralized telecom giants. As of February 2026, the project has scaled to over 100,000 AirNodes globally, serving 3 million daily active users and processing over 600TB of data daily.

In this article, you will learn what World Mobile is, how its multi-layer node architecture works, the utility of the

WMTX token on its dedicated Layer 3 chain, why it is a leading player in the 2026 DePIN narrative, and how to

buy World Mobile Token (WMTX) on BingX.

What Is World Mobile Token (WMTX) DePIN Project?

Insert tweet: https://x.com/wmchain/status/2018263624754647351

World Mobile is a decentralized telecommunications network that provides affordable, high-speed connectivity to underserved and remote regions. Unlike traditional Mobile Network Operators (MNOs) that struggle with the high cost of rural infrastructure, World Mobile uses a sharing economy model. Local entrepreneurs can host "AirNodes," low-cost hardware that provides internet access, and earn rewards in return.

The ecosystem operates on the World Mobile Chain (WMC), a high-performance Layer 3 blockchain built on

Base. Originally launched on

Cardano, the project evolved in late 2025 to its current L3 architecture to support the high throughput and low latency required for global telecom operations.

As of early 2026, World Mobile has achieved an unprecedented level of real-world utility within the DePIN sector, having successfully deployed over 100,000 AirNodes across multiple continents to provide essential internet access. This robust infrastructure currently supports more than 3 million daily active users who depend on the network for daily connectivity, particularly in underserved regions.

The economic momentum of the ecosystem is exceptionally high: its native utility token, WMTX, currently holds a market capitalization of $75.55 million while generating a massive $1.73 billion in 24-hour trading volume as of early February 2025. This results in a staggering Volume-to-Market Cap ratio of 2,313%, indicating that the entire circulating supply of WMTX changes hands over 23 times daily. Such high turnover frequently outperforms the DePIN sector average by eightfold, signaling immense investor confidence and deep liquidity as the project bridges the global digital divide.

How Does World Mobile Work?

World Mobile replaces the centralized telco model with a decentralized, multi-layered architecture where participants are incentivized to maintain the network's integrity and coverage.

1. The Three-Layer Node System

The network functions through a hierarchy of nodes that handle everything from physical signals to blockchain security:

• AirNodes: The "last-mile" providers. These are hardware devices from simple routers to towers that provide wireless connectivity to local users. AirNode operators earn rewards based on the data traffic they process.

• EarthNodes: The backbone of the World Mobile Chain. They use a Delegated Proof of Stake (DPoS) mechanism to validate transactions, secure data, and provide decentralized services like DIDs (Decentralized Identifiers).

• Aether Nodes: The bridge between decentralized coverage and traditional telecom systems. They handle the "interconnect" to legacy networks and ensure regulatory compliance in each operating country.

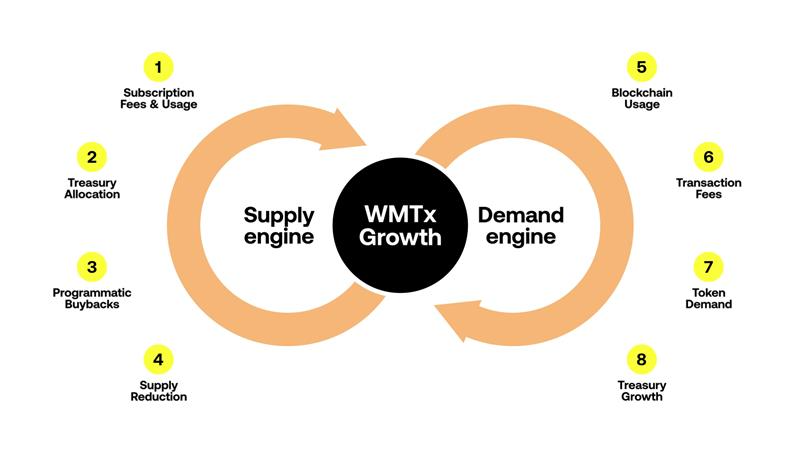

2. The Sharing Economy and Reward Model

When a user pays for data or calls, the revenue flows into the ecosystem. This revenue is used to buy back WMTX from the market, which is then distributed as rewards to node operators and stakers. This creates a circular economy where network growth directly benefits token holders.

3. Privacy and Data Sovereignty

Every interaction on the World Mobile Chain is end-to-end encrypted. Through integrations like Atala PRISM, users retain full control over their digital IDs and personal data, a stark contrast to traditional providers that often monetize user information.

What Is the World Mobile Token (WMTX) Token Used For?

Source: World Mobile on X

WMTX is the native utility token and the lifeblood of the World Mobile Chain. Its value is tied to the actual utility and expansion of the telecom infrastructure.

• Network Gas: Every transaction, call, or data session on the WMC requires WMTX as gas.

• Staking Rewards: Holders can delegate WMTX to EarthNodes to secure the network and earn a share of transaction fees and protocol inflation.

• Node Operation: Operators must stake WMTX, e.g., 100,000 for EarthNodes, to qualify for processing data and earning rewards.

• Governance: WMTX holders can vote on protocol upgrades, reward structures, and expansion into new regions via the World Mobile DAO.

What Is World Mobile (WMTX) Tokenomics?

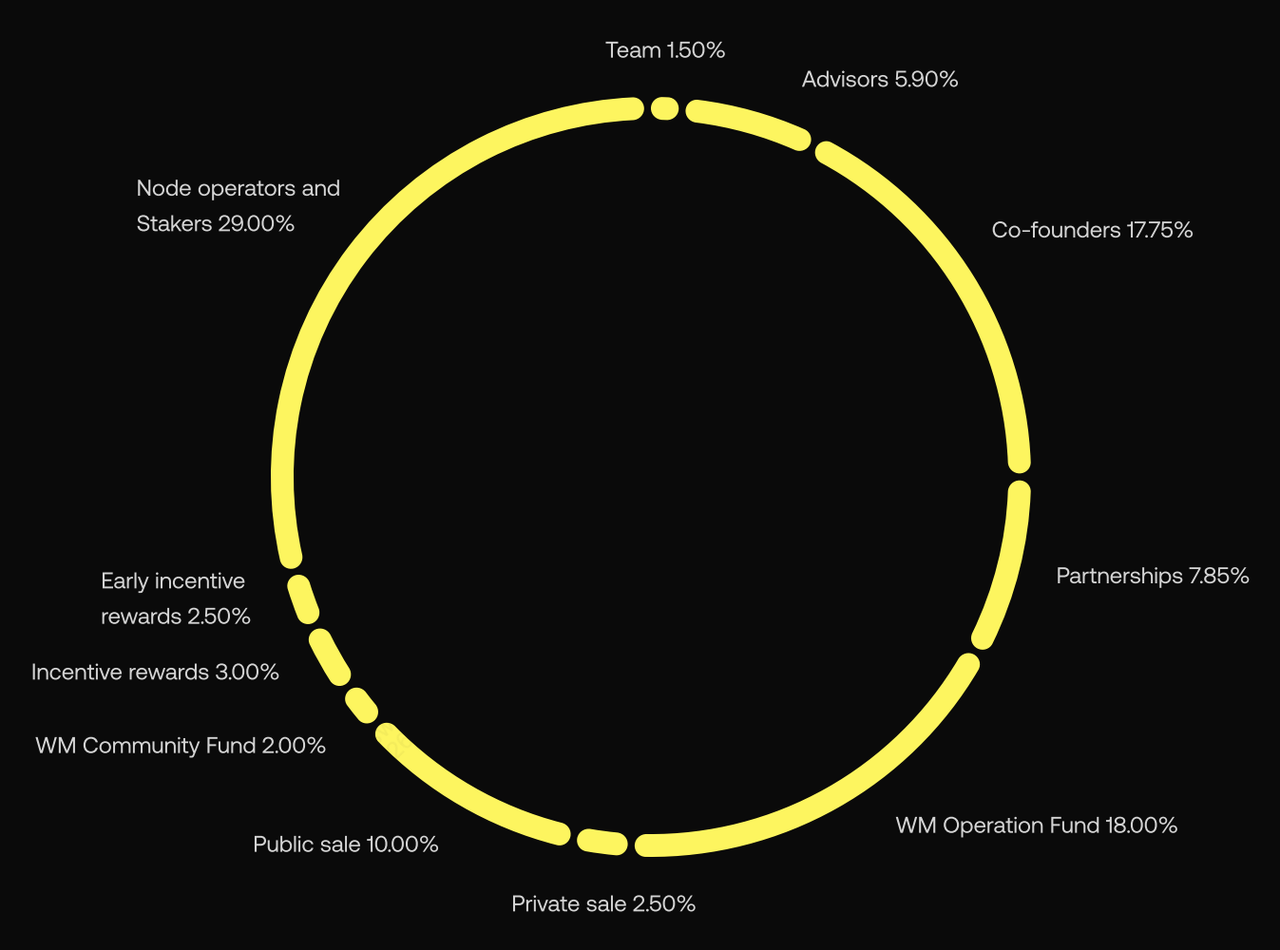

WMTX token distribution | Source: World Mobile Token whitepaper

World Mobile Token (WMTx) has a fixed maximum supply of 2,000,000,000 (2 billion) tokens, with a decelerating emission schedule designed to reach zero inflation by Year 2030.

• Node Operators and Stakers (29.00%): The largest allocation, reserved for securing the network and incentivizing early infrastructure participants.

• Co-Founders & Team (19.25%): Allocated to the core developers with a standard 12–18 month lock-up and 24-month linear vesting.

• World Mobile Operations Fund (18.00%): Dedicated to the long-term rollout and maintenance of physical network infrastructure.

• Public Sale (10.00%): Distributed to early adopters to decentralize token ownership from the outset.

• Partnerships (7.85%): Set aside for strategic alliances with telecommunications companies and regional governments.

• Advisors (5.90%): Rewarding strategic contributors in legal, technical, and business development roles.

• Incentive & Early Staking Rewards (5.50%): Used to jumpstart network activity and reward early vault participants.

• Private Sale (2.50%): Early-stage capital raised for project development, subject to vesting schedules.

• Community Fund (2.00%): Reserved for grants to support unconnected communities in building their own network nodes.

How to Stake WMTX Tokens on World Mobile Chain

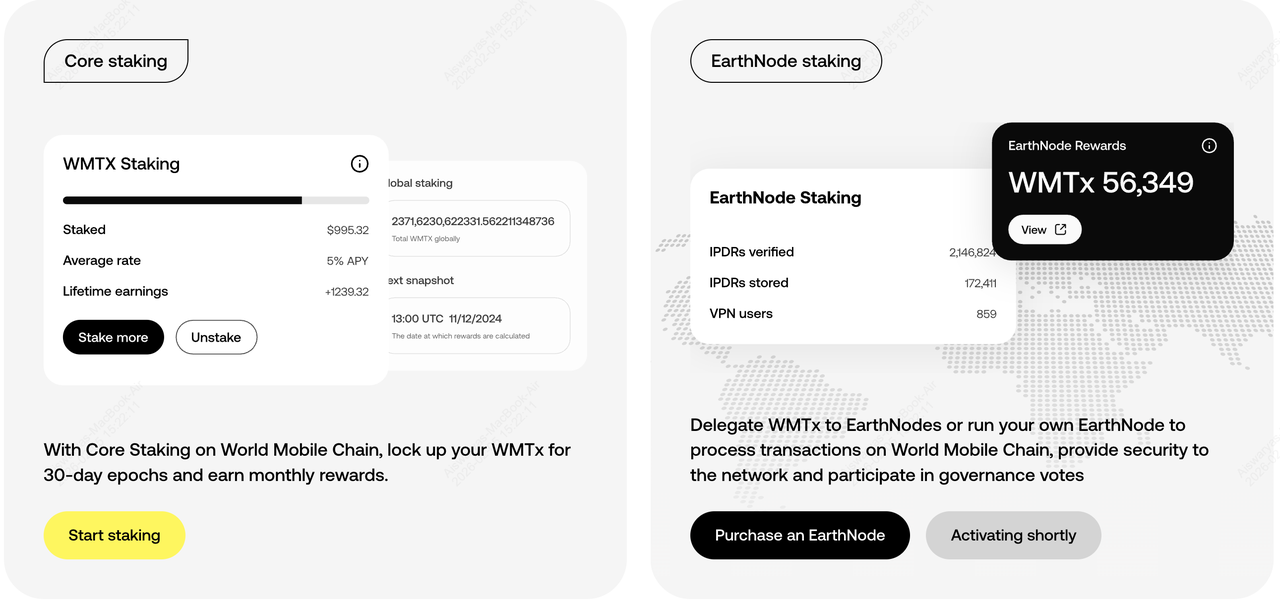

WMTX staking | Source: World Mobile

Staking WMTX on the World Mobile Chain allows you to secure the network’s decentralized infrastructure while earning a share of protocol revenue and network emissions.

1. Acquire WMTX: Ensure you have WMTX tokens in a compatible

non-custodial wallet; for the EVM-based World Mobile Chain,

MetaMask or

Base App are the standard choices. To fund your staking journey, you can easily buy WMTX on the BingX Spot Market using

USDT and then withdraw your tokens directly to your self-custody wallet.

2. Bridge if Necessary: If your tokens are on Cardano or

Ethereum, use the official World Mobile Bridge to move your WMTX to the Base network or the World Mobile Chain (L3).

3. Access the Staking Dashboard: Navigate to the official

World Mobile Staking Portal and click "Connect Wallet" to link your Web3 provider.

4. Select Staking Type: Choose between Core Staking for simpler, 30-day epochs or EarthNode Delegation, delegating to a specific operator to validate transactions.

5. Deposit and Approve: Enter the amount of WMTX you wish to stake, click "Approve" to allow the smart contract to interact with your tokens, and then confirm the "Stake" transaction in your wallet.

6. Monitor and Claim: Track your rewards on the dashboard; while some rewards auto-compound, others must be manually claimed at the end of an epoch or reward cycle.

How to Trade World Mobile Token (WMTX) on BingX

Leveraging

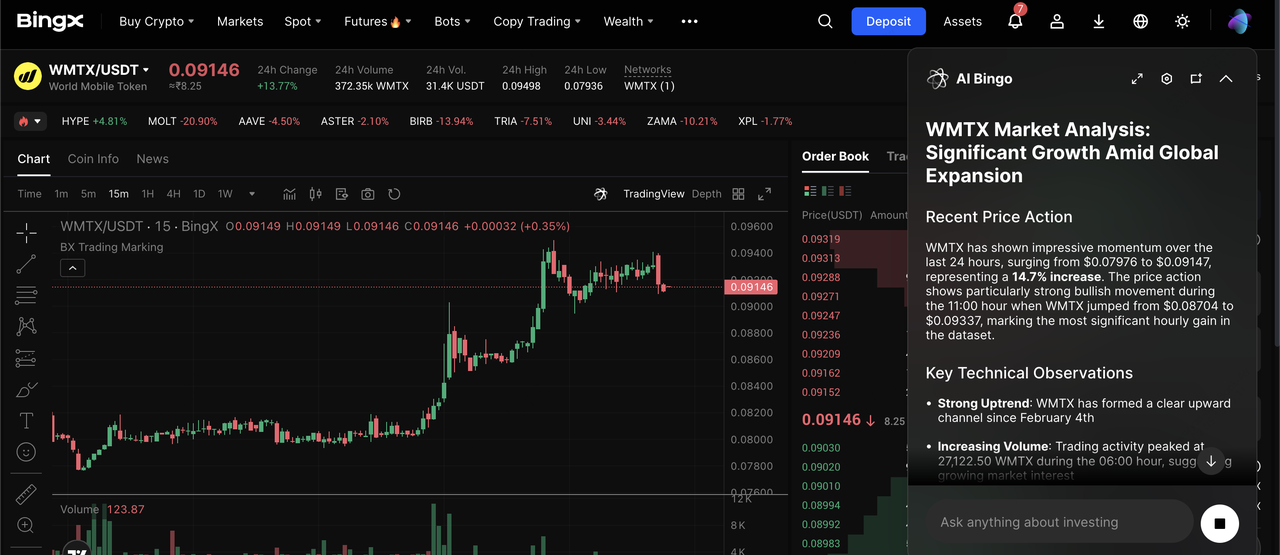

BingX AI’s real-time volatility tracking and liquidity heatmaps, you can optimize your entry and exit points for WMTX across both conservative and high-exposure markets.

Buying and Selling WMTX Tokens on the Spot Market

WMTX/USDT trading pair on the spot market powered by BingX AI insights

The spot market is ideal for long-term holders looking to participate in the World Mobile sharing economy or stake tokens on the WMC.

1. Fund Your Wallet: Deposit USDT into your BingX account, or use the "Quick Buy" feature to purchase stablecoins via credit card or

P2P.

2. Locate the Pair: Navigate to the Spot tab and search for

WMTX/USDT. Use the BingX AI-powered chart to identify support levels.

3. Execute Your Trade: For immediate execution, choose a

Market Order; to target a specific price, e.g., during a pullback, set a Limit Order.

4. Manage Your Assets: Once purchased, you can hold your tokens in your BingX account or withdraw them to a compatible wallet on Base or the World Mobile Chain for staking.

Trading World Mobile Token with Leverage on the Futures Market

WMTX/USDT perpetual contract on the futures market powered by BingX AI insights

For experienced traders looking to capitalize on WMTX's high-volume momentum, BingX Futures offers capital efficiency through leverage.

1. Transfer Margin: Move USDT from your Fund account to your

Perpetual Futures account.

2. Configure Your Trade: Select the

WMTX/USDT Perpetual contract. Choose between Isolated Margin (to limit risk to a single trade) or Cross Margin.

3. Set Leverage & Direction: Select your leverage, e.g., 5x or 10x. Choose "Long" if you anticipate price growth from network expansion, or "Short" if you are hedging against market corrections.

4. Automate Risk Management: Use the BingX

TP/SL (Take Profit/Stop Loss) tool to lock in gains or prevent liquidation during the volatile price swings typical of the DePIN sector.

3 Key Considerations Before Investing in World Mobile Token

Before integrating WMTX into your portfolio, it is essential to evaluate the unique intersection of physical infrastructure risks and blockchain market dynamics that define the DePIN sector.

1. Real-World Infrastructure Dependency: Unlike purely digital assets, WMTX’s value is intrinsically linked to the physical deployment of hardware; successful expansion relies on local AirNode host participation and the overcoming of logistical or regulatory hurdles in diverse global markets.

2. The Circular Buyback Model: The project employs a unique economic loop where fiat revenue from actual telecom users, paying for data and calls, is used to buy back WMTX from the open market to fund rewards, theoretically linking token demand to real-world network utility.

3. Transition and Scalability Risks: While the move to the Base-based Layer 3 in 2025 significantly increased throughput, investors should monitor the public mainnet’s stability and the project's ability to maintain its "first-mover" advantage against emerging competitors in the decentralized telecom space.

Final Thoughts: Should You Buy WMTX in 2026?

World Mobile Token (WMTX) has transitioned from a theoretical concept to a functional global utility in 2026. With 3 million users and a 2026 roadmap focused on upgrading AirNodes to RWA structures, it remains a dominant leader in the DePIN sector.

If you believe in the democratization of the trillion-dollar telecom industry, WMTX offers a unique way to gain exposure to real-world infrastructure growth. However, always remember that despite its utility, WMTX remains a volatile crypto asset; manage your risk and do your own research (

DYOR).

Related Reading