On August 13, 2025, OKX announced sweeping changes to its blockchain ecosystem, upgrading X Layer, its

Polygon CDK-powered Layer 2 network, and carrying out a record 65.26 million OKB burn. The upgrade transitions X Layer into a public blockchain with a dedicated focus on

decentralized finance (DeFi), payments, and

real-world asset (RWA) applications.

Alongside the technical overhaul, the one-time burn permanently capped OKB’s supply at 21 million, creating a new scarcity model. The news triggered a 200% price spike in OKB, briefly pushing it to an all-time high, though the lasting effects will depend on adoption of X Layer and its role within the broader crypto ecosystem.

What Is X Layer and How Does It Work?

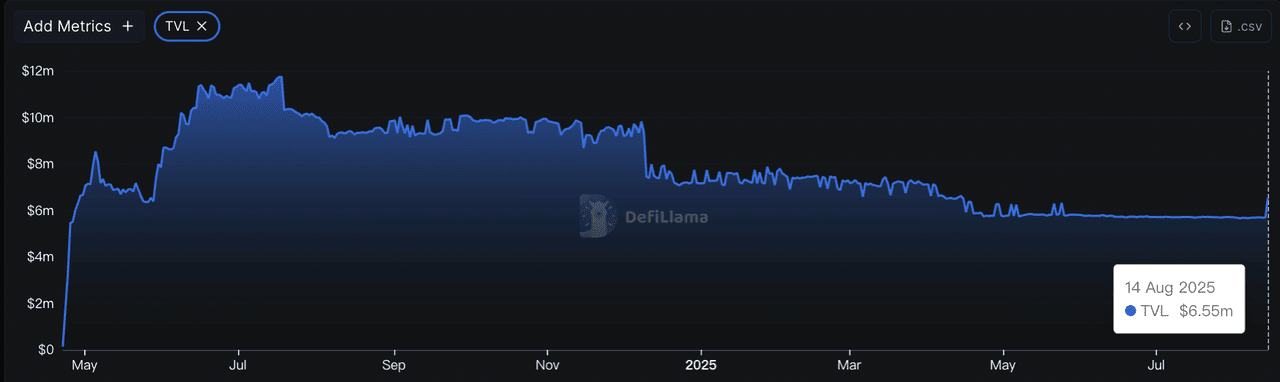

X Layer TVL | Source: DefiLlama

X Layer uses a zkEVM validium architecture, which secures transactions with

zero-knowledge proofs while storing transaction data off-chain. This design offers significantly lower fees, higher scalability, and enhanced privacy compared to traditional

ZK-rollups. The network’s consensus is maintained through sequencers that batch transactions and aggregators that generate validity proofs, ensuring security and correctness before settlement on Ethereum.

As of August 2025, X Layer secures over $6.5 million in

total value locked (TVL) across its DeFi protocols, according to

DeFiLlama. While modest compared to larger Layer 2s, this TVL reflects steady adoption following the August upgrade and growing integration with the OKX ecosystem.

Key Technical Features of X layer chain

• zkEVM Validium Architecture: Combines zero-knowledge proofs with off-chain data storage for lower fees and higher throughput.

• 5,000 TPS Capacity: Increased performance after the August 2025 PP upgrade.

• Near-Zero Gas Fees: Minimal transaction costs for users and developers.

• Full Ethereum Compatibility: Supports existing Ethereum dApps and developer tooling.

• OKB as Gas Token: All transactions on X Layer require OKB, bridged from Ethereum L1 via the official X Layer bridge.

What Are the Major Updates for X Layer in August 2025?

On August 13, 2025, OKX announced a major overhaul of its blockchain ecosystem, combining a network upgrade, tokenomics change, and migration to a unified infrastructure.

1. X Layer PP Upgrade and Ecosystem Integration: The PP upgrade integrated the latest Polygon CDK technology into X Layer, boosting throughput to 5,000 TPS, reducing gas fees to near zero, and improving Ethereum compatibility.

2. $7.6 Billion OKB Token Burn and Supply Cap: OKX executed a one-time burn of 65.26 million OKB, worth around $7.6 billion, cutting the supply by over 50% and fixing it permanently at 21 million tokens. The OKB smart contract was upgraded to remove minting and burning functions, locking supply indefinitely.

3. OKTChain Phase-Out and Token Migration: The OKTChain network is being retired, with OKT holders able to swap their tokens for OKB during the transition. Once the migration is complete, X Layer will serve as the single blockchain for the ecosystem.

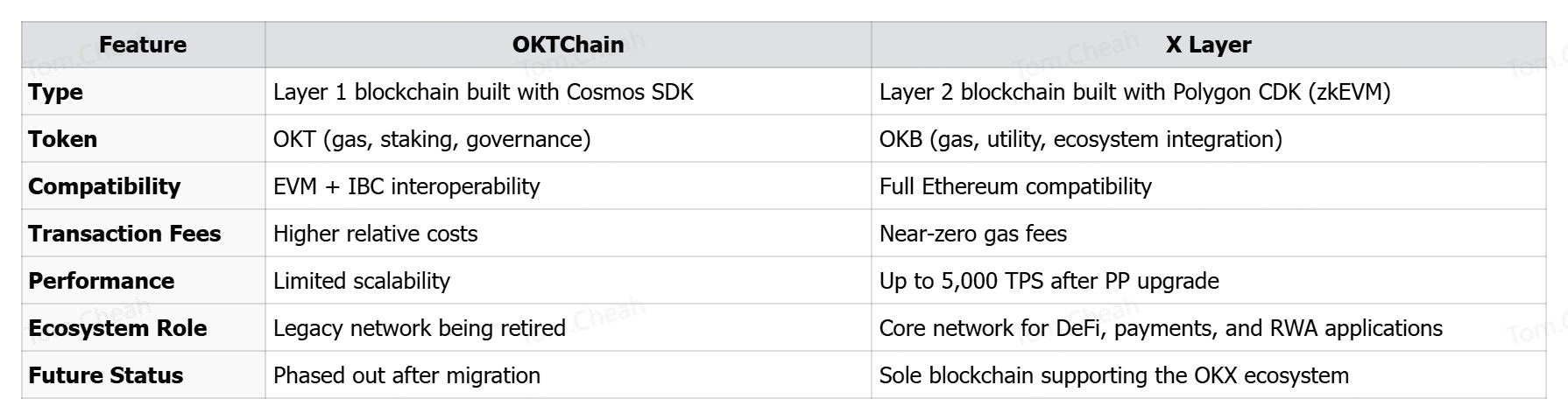

What Are OKT and OKTChain, and Why Are They Being Retired?

OKT is the native token of OKTChain, a Layer 1 blockchain launched by OKX and built with the

Cosmos SDK. It was designed for interoperability with support for both EVM and IBC, enabling decentralized applications,

staking, and cross-chain transfers. OKT served as the chain’s gas token and governance asset.

Over time, however, OKTChain’s role has diminished as X Layer emerged as the primary blockchain for the ecosystem. X Layer offers faster transactions, lower fees, and better integration with Ethereum-based applications, making it a more scalable and future-ready platform for DeFi, payments, and real-world asset (RWA) projects.

As a result, OKX is retiring OKTChain and migrating its users to X Layer. OKT holders can swap their tokens for OKB during the transition period, after which X Layer will operate as the sole blockchain supporting the OKX ecosystem.

X Layer vs. OKTChain: Key Differences and Why the Migration Matters

The replacement of OKTChain with X Layer marks a shift from a Cosmos SDK-based Layer 1 to a Polygon CDK-powered Layer 2 built for speed, cost efficiency, and Ethereum compatibility. Migrating to X Layer consolidates OKX’s infrastructure into one high-performance network that can handle greater transaction volume, deliver cheaper on-chain activity, and connect seamlessly with Ethereum-based dApps.

At the time of writing, OKTChain maintains around $9.3 million in TVL, while X Layer holds over $6.5 million. Although OKTChain currently has the higher figure, X Layer has shown stronger post-upgrade momentum. The migration plan aims to concentrate liquidity and development onto X Layer, streamlining user activity and positioning it as the sole settlement network in the OKX ecosystem.

It also simplifies token usage, with OKB replacing OKT as the unified gas and utility token for the entire network.

What is OKB, the X Layer Token?

OKB is the native

gas and utility token of X Layer, powering all transactions and activity on the network. Following the August 2025 tokenomics overhaul, OKB now has a fixed supply of 21 million tokens after a one-time burn of 65.26 million, with minting and burning functions permanently disabled.

This shift created a

Bitcoin-like scarcity model while expanding OKB’s role in the ecosystem.

• Gas Token for X Layer: All transactions, from DeFi trades to payments and RWA transfers, require OKB as gas.

• Trading Fee Discounts: Holders enjoy reduced fees on spot, futures, and perpetual markets on the OKX Exchange.

• Exclusive Access: Grants entry to OKX Jumpstart token launches and select ecosystem events.

• Ecosystem Integration: Fully compatible with OKX Wallet and OKX Pay for cross-chain payments and transfers.

• Deflationary Tokenomics: Fixed 21 million supply with no future minting, enhancing long-term scarcity.

OKB is no longer just an exchange token. It is now the central asset of X Layer, directly tied to network growth and utility across DeFi, payments, and emerging blockchain use cases.

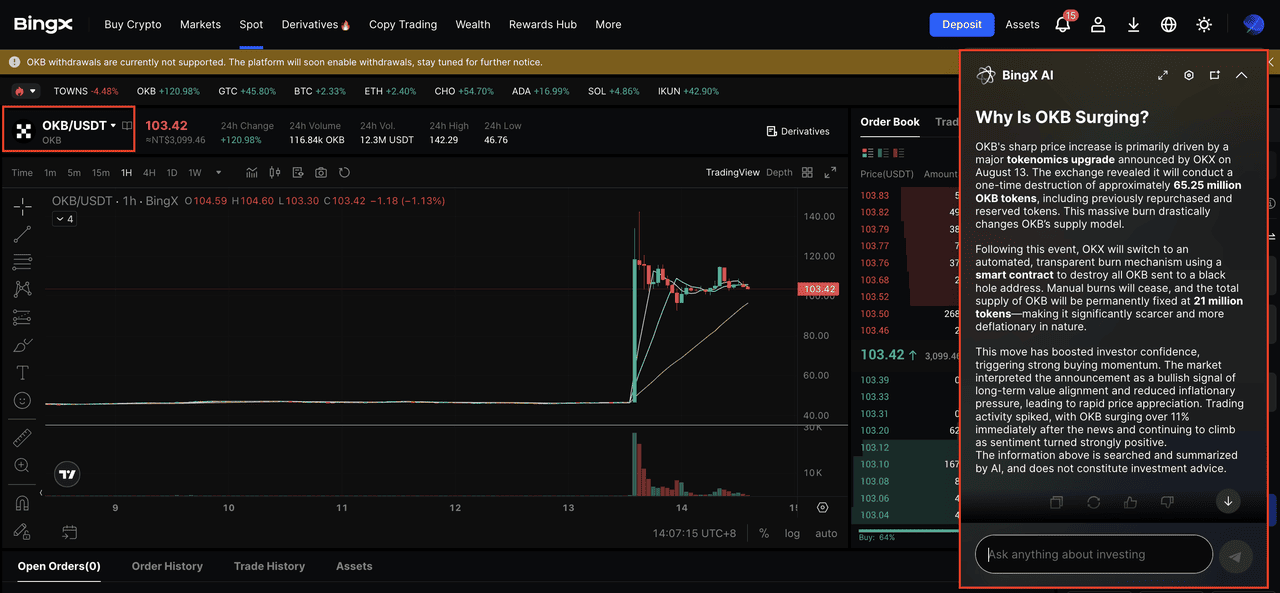

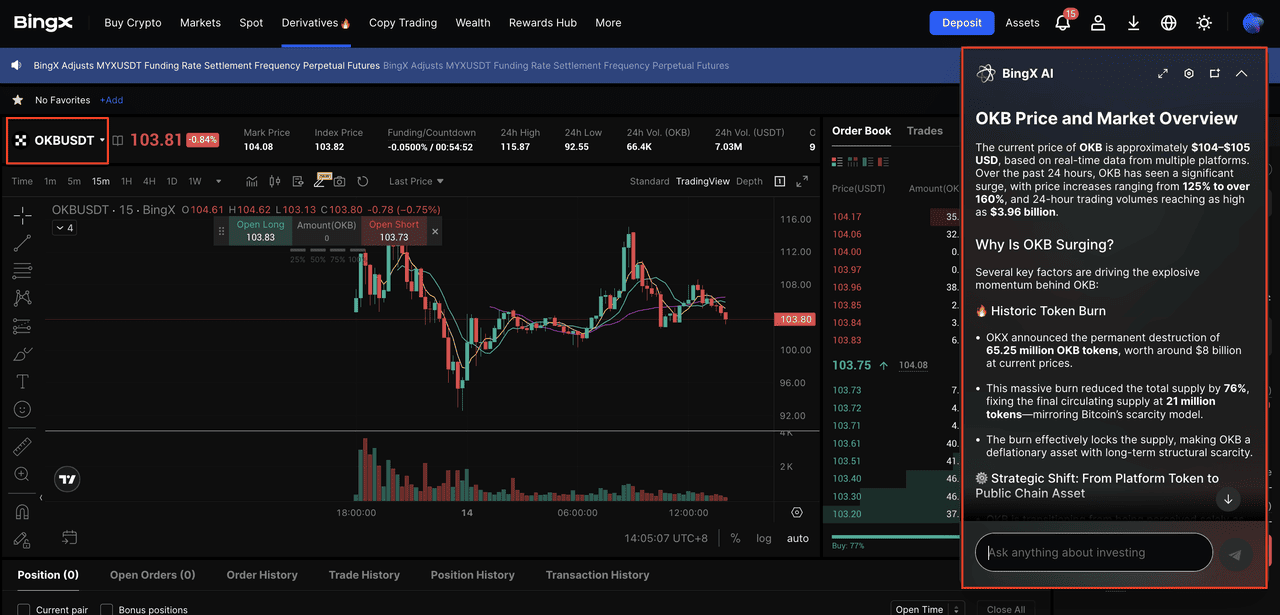

How to Trade OKB on BingX: A Step-by-Step Guide

You can trade OKB on BingX through either the Spot Market or the Perpetual Futures Market, depending on your strategy. BingX also offers AI-powered market insights to help refine your trades.

1. Buy OKB via Spot Trading

Step 1: Go to the Spot Market tab and enter “OKB/USDT” in the search bar.

Step 2: Place a market order to buy instantly at the current price, or set a limit order for your preferred entry price. Spot trading is ideal for long-term holders or those using OKB in the X Layer ecosystem.

Step 3: Use BingX AI to view support and resistance levels, trend direction, and key updates such as the August 2025 token burn and X Layer upgrade.

2. Trade OKB via Perpetual Futures Trading

Step 1: Open the Perpetual Futures tab and search for “OKB/USDT”.

Step 2: Choose your leverage and take either a long or short position with no expiration date. Futures trading is suitable for capturing short-term market moves but requires careful risk management.

Step 3: Use BingX AI for insights on potential price reversals, volatility shifts, and news-driven events to optimize your entry and exit points.

Conclusion

The August 2025 update marks a pivotal shift for the OKX ecosystem. With X Layer now at the center, the network delivers faster transactions, near-zero gas fees, and full Ethereum compatibility, creating a more scalable foundation for DeFi, payments, and real-world asset applications.

The 65.26 million OKB burn not only fixed the token’s supply at 21 million but also transformed it into the unified gas and utility token for the entire network. The phase-out of OKTChain consolidates activity onto a single high-performance Layer 2, streamlining development and user adoption.

For traders, developers, and long-term holders, these changes position OKB and X Layer as integral components of a more efficient and future-ready blockchain ecosystem. The true test will be in how quickly the network attracts adoption and usage in the months ahead.

Related Reading

Frequently Asked Questions (FAQs) on X Layer

1. What is X Layer used for?

X Layer is a Layer 2 blockchain designed for decentralized finance (DeFi), payments, and real-world asset (RWA) applications. It offers faster transactions, near-zero gas fees, and full Ethereum compatibility.

2. How do I move assets to X Layer?

You can migrate assets from OKTChain by swapping OKT for OKB through OKX Wallet’s “Withdraw to X Layer” feature or other officially supported migration tools. The same bridge can be used to transfer ERC-20 tokens from Ethereum to X Layer, with more cross-chain integrations planned. Always verify you are using the official bridge and contracts to avoid scams or loss of funds.

3. What makes X Layer different from OKTChain?

X Layer is a Layer 2 built with Polygon CDK, offering faster speeds, lower fees, and seamless Ethereum integration, whereas OKTChain was a Cosmos SDK Layer 1 with higher fees and slower performance.

4. Do I need OKB to use X Layer?

Yes. OKB is the sole gas and utility token on X Layer, required for all transactions, from smart contract execution to payments.