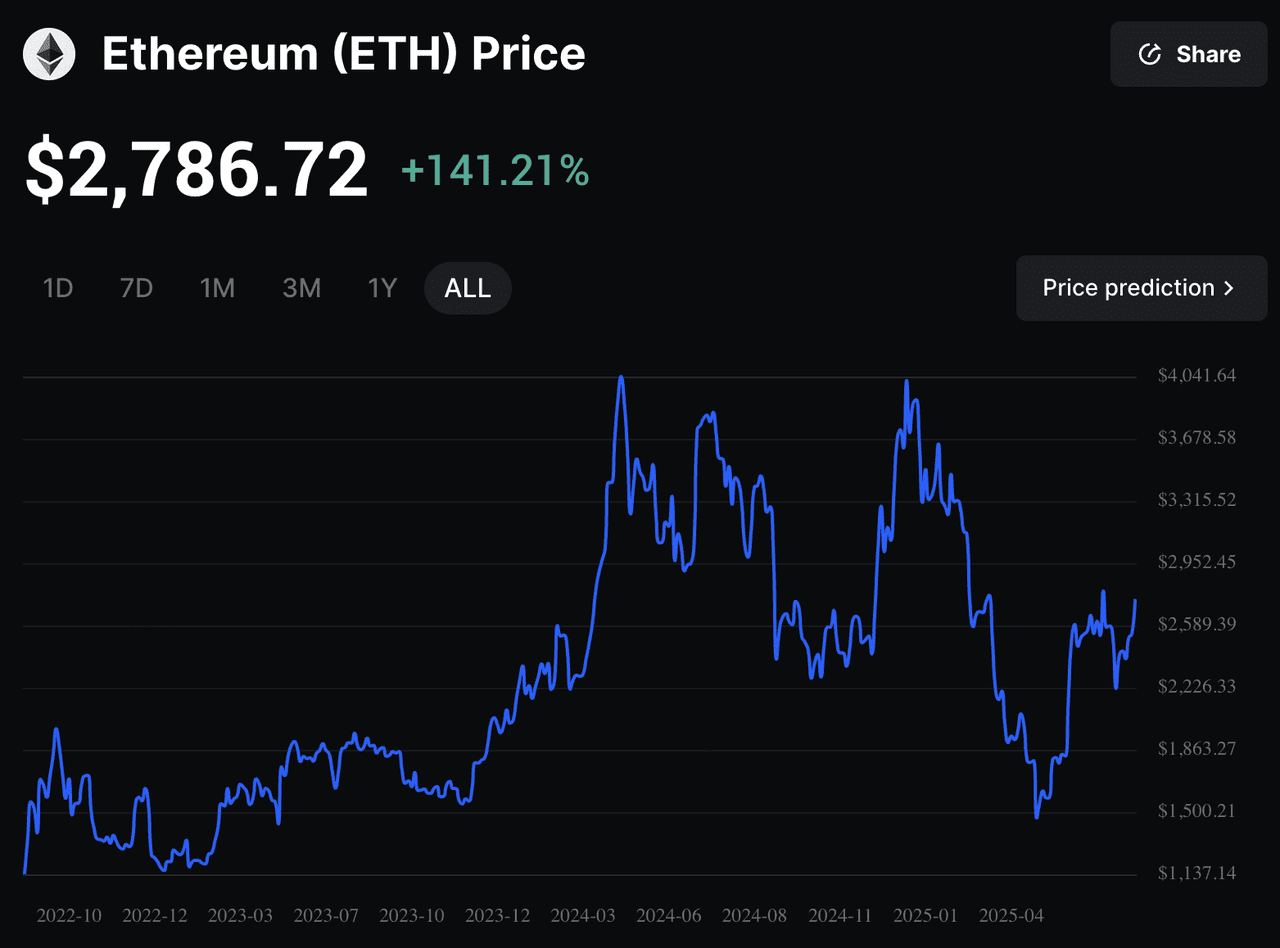

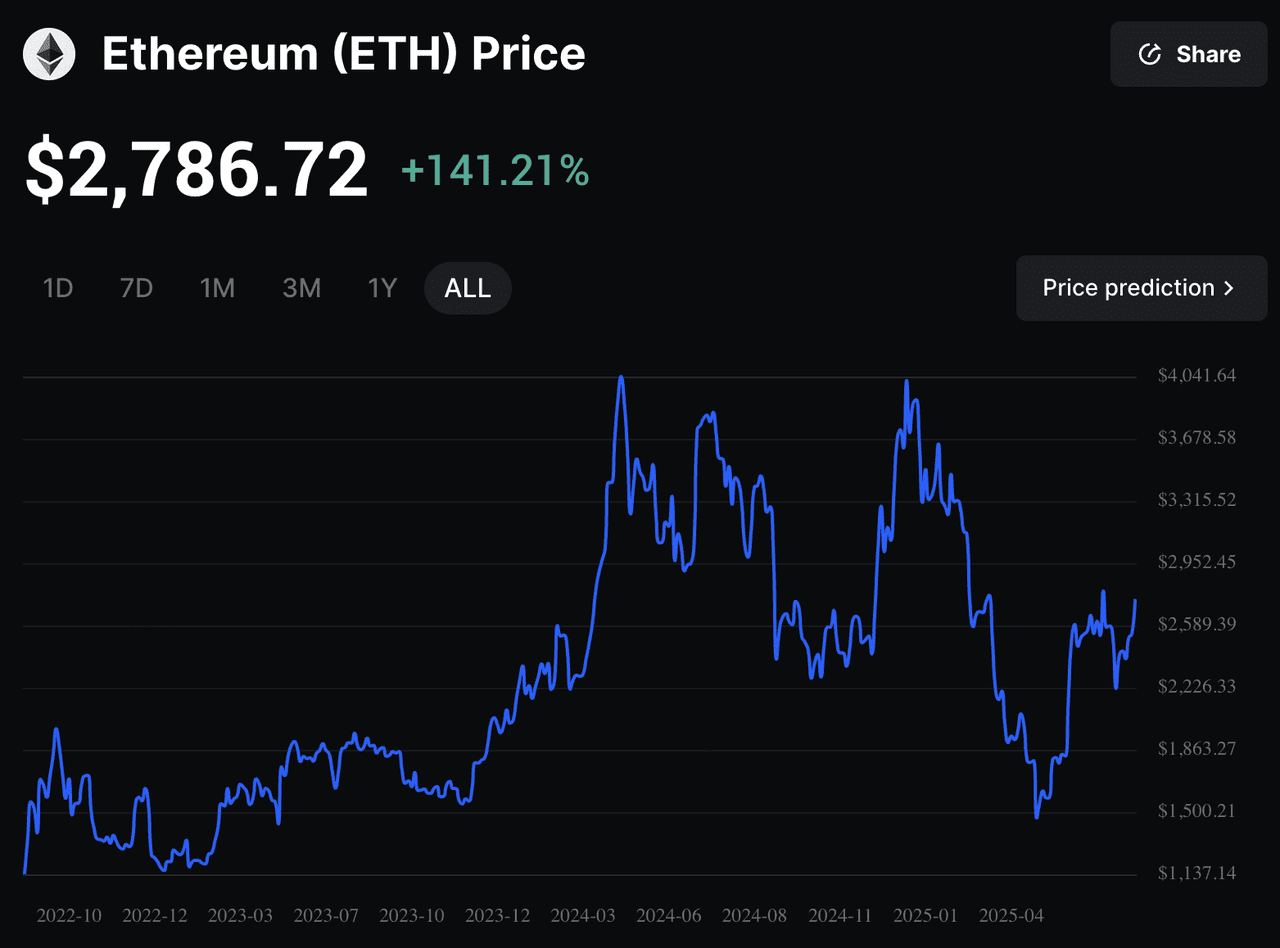

Ethereum is emerging as a preferred corporate treasury asset in 2025 as companies seek alternatives to traditional reserves and

Bitcoin corporate treasuries. Beyond price appreciation, firms are turning to Ether (ETH) for

staking yields around 3%–4%, programmable smart contracts, and its central role in DeFi. Several analyst outlooks cluster around ~$6,500 for end-2025 if ETF-driven institutional flows and

Ethereum Layer-2 activity continue, with some longer-term notes floating $10k+ scenarios under stronger adoption.

Spot Ether ETFs were approved in the U.S. in mid-2024 and began trading on July 23, 2024, opening mainstream rails for exposure. The

Pectra hard fork which went live on May 7, 2025 further improved UX and rollup economics, e.g., EIP-7702 smart-account features and higher blob throughput, supporting the case for increased on-chain activity.

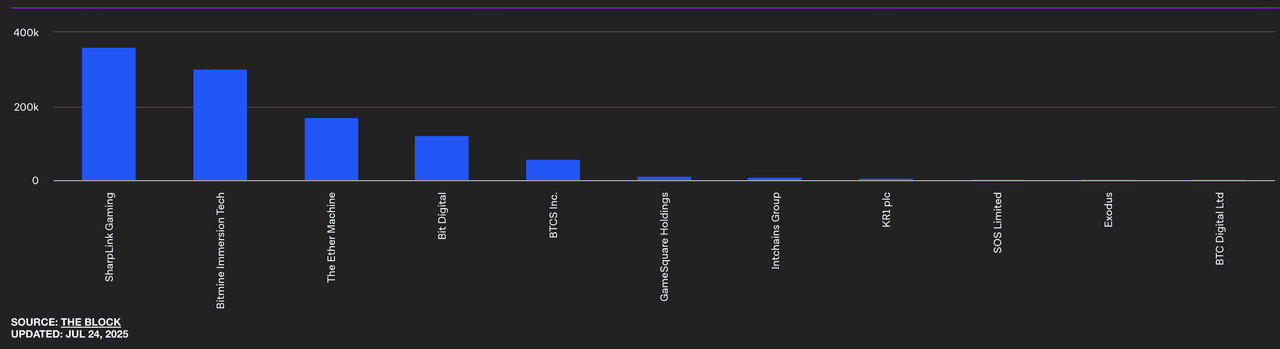

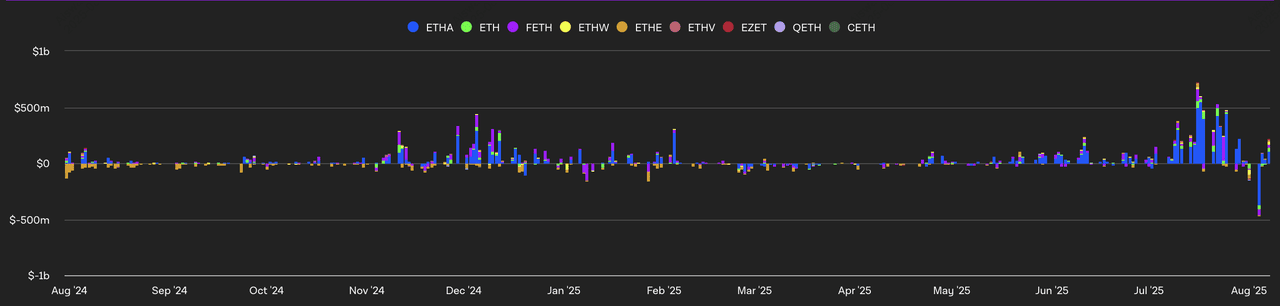

Corporate ETH holdings | Source: TheBlock

Public-company ETH treasuries have climbed fast but remain concentrated. Recent tallies show roughly a dozen listed firms disclosing ~1.0 million ETH (≈0.83% of circulating supply) as of late July 2025, up sharply from under 116,000 ETH at end-2024. Leaders include SharpLink Gaming, BitMine Immersion, Coinbase, Bit Digital, and BTCS, with strategies often centered on staking and validator operations; Reuters separately estimates at least ~966,000 ETH held by corporates overall by end-July. Gaming/media names like GameSquare have also added ETH, reflecting broader interest beyond crypto-native firms. The growing push for U.S.

Ethereum staking ETFs, alongside existing staking-enabled products in Canada and Europe, could further accelerate institutional ETH accumulation by combining price exposure with yield generation.

Discover how Ethereum is becoming a top corporate treasury asset in 2025, with public companies like SharpLink Gaming and Bit Digital leading the shift from

Bitcoin to ETH. Learn more about the top companies holding Ethereum in their corporate treasuries.

What Is an Ethereum Corporate Treasury?

An Ethereum corporate treasury is when a company decides to hold Ether (ETH), the native cryptocurrency of the Ethereum network, as part of its financial reserves. Instead of keeping all their cash in traditional assets like fiat currencies, bonds, or stocks, these companies allocate a portion of their balance sheet to ETH. This reflects a strategic move to embrace digital assets and take advantage of Ethereum’s unique capabilities.

So how does it work? Companies buy ETH on the open market or through institutional-grade platforms and then manage these holdings like any other treasury asset. Some choose to simply hold (HODL) ETH as a long-term store of value, while others actively deploy their ETH into Ethereum’s DeFi ecosystem to earn additional yield. For example, ETH can be staked to support the network and generate passive rewards, or it can be supplied to lending protocols to earn interest.

This strategy comes with several key advantages:

1. Staking Rewards: Unlike Bitcoin, Ethereum’s proof-of-stake (

PoS) mechanism allows holders to earn annual yields of 3–5% by locking up their ETH. This creates a steady passive income stream while helping secure the network.

2. Programmability: Ethereum isn’t just a currency; it’s a platform for building decentralized applications. Holding ETH enables companies to participate in smart contracts and DeFi protocols, unlocking new ways to grow treasury assets.

3. Decentralized Finance (DeFi) Exposure: By holding ETH, companies can access a wide range of DeFi services like lending, borrowing, and liquidity provision, tools that traditional finance cannot yet offer at the same scale.

4. Investor Confidence: Publicly holding ETH signals to shareholders and the market that a company is forward-thinking and aligned with blockchain innovation, potentially attracting crypto-savvy investors.

In simple terms, an Ethereum corporate treasury isn’t just about sitting on digital coins but also about putting ETH to work in a way that blends financial strategy with cutting-edge blockchain technology.

Top 10 Largest Public Companies Holding Ethereum

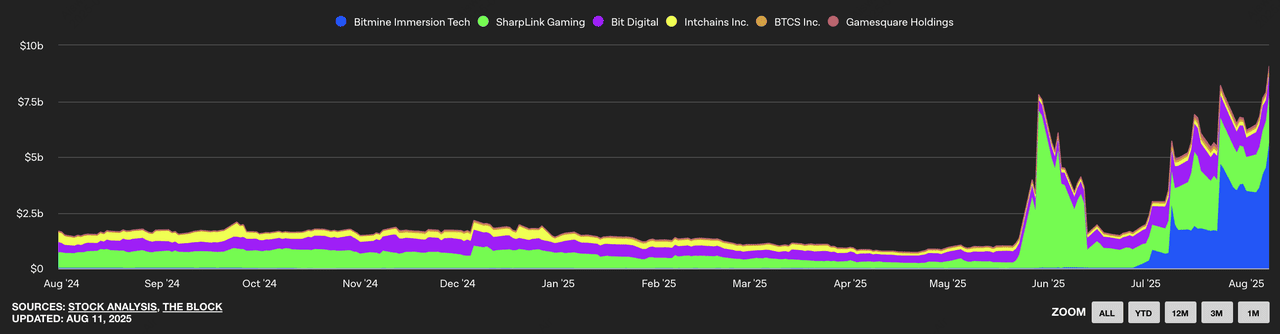

Stacked market caps of Ethereum treasury companies | Source: TheBlock

Here are the top public firms leading Ethereum’s corporate treasury movement in 2025:

1. BitMine Immersion Technologies (NASDAQ: BMNR)

BitMine Immersion Technologies has surged ahead in the ETH treasury race, now holding 833,137 ETH, valued at roughly $2.9 billion as of August 2025. The Texas-based blockchain infrastructure firm, formerly focused on

Bitcoin mining, pivoted to Ethereum after raising $1.8 billion in a major share offering, acquiring hundreds of thousands of ETH within weeks. Chaired by Tom Lee, BitMine aims to control 5% of Ethereum’s total supply, combining large-scale validator operations with immersion-cooled infrastructure. This aggressive accumulation strategy positions BitMine as the largest corporate ETH holder globally and a central player in the growing tokenized asset and staking economy.

2. SharpLink Gaming (NASDAQ: SBET)

SharpLink Gaming remains a dominant Ethereum treasury holder among public companies, with 480,000 ETH valued at roughly $1.7 billion as of July 2025. The Minneapolis-based iGaming and sports betting technology firm, chaired by Ethereum co-founder Joseph Lubin, has staked about 95% of its holdings and is developing Ethereum-powered stablecoin payout systems for its gaming platforms. Backed by significant capital raises, including an $83 million funding round in June 2025, SharpLink’s yield-focused approach and deep integration of ETH into its payment infrastructure reinforce its long-term commitment to Ethereum’s ecosystem.

3. Bit Digital (NASDAQ: BTBT)

Bit Digital, a Nasdaq-listed crypto mining and staking company, pivoted its corporate treasury strategy in mid-2025 by selling 280 BTC and raising $172 million in a public equity offering to accumulate over 100,603 ETH. This move positioned the firm as one of the largest publicly traded Ethereum holders globally. Bit Digital’s focus now centers on maximizing staking yields and supporting Ethereum’s role in tokenization, with plans to expand its ETH holdings further as part of a broader strategy to move away from Bitcoin dependency.

4. Coinbase Global, Inc. (NASDAQ: COIN)

Coinbase, the largest U.S. cryptocurrency exchange and institutional custodian, holds 137,300 ETH valued at about $507 million as of August 2025. Its ETH position is split between corporate treasury reserves, operational liquidity, and assets backing institutional products. Coinbase operates around 11% of all staked ETH, making it a critical infrastructure provider in Ethereum’s proof-of-stake network. This dual role as both a major holder and staking operator underscores its broader commitment to supporting Ethereum’s ecosystem growth and security.

5. BTCS Inc. (Nasdaq: BTCS)

BTCS Inc. (Nasdaq: BTCS) is a U.S.-based Ethereum-first blockchain infrastructure company holding 70,028 ETH valued at about $255–$270 million as of July 2025. The firm recently boosted its reserves by 14,240 ETH through its “DeFi/TradFi Accretion Flywheel” strategy, which combines traditional capital markets tools with decentralized finance. This included closing a $10 million above-market convertible notes issuance at a 198% premium to its share price. BTCS leverages its ETH holdings to generate yield and revenue via NodeOps (staking) and Builder+ (block building), positioning itself as one of the most operationally and financially leveraged Ethereum plays in the public markets.

6. Galaxy Digital Holdings (NASDAQ: GLXY)

Galaxy Digital, led by crypto investor Mike Novogratz, currently holds about 90,521 ETH valued at roughly $150 million as of June 30, 2025, down from over 155,000 ETH at the end of Q1 following a portfolio rebalancing. The New York–based crypto investment bank uses its ETH holdings for staking, collateral, and tokenization services, alongside a diversified portfolio that includes Bitcoin,

Solana, and

stablecoins. While the firm increased its BTC reserves significantly in Q2, Novogratz has publicly stated that Ethereum could outperform Bitcoin in the near term, pointing to the network’s expanding ecosystem and innovation pace.

7. GameSquare Holdings (NASDAQ: GAME)

GameSquare Holdings, an esports media and marketing company, has expanded its Ethereum strategy under a revised $250 million digital treasury cap, up from the previous $100 million limit. As of August 2025, the firm holds 15,630 ETH valued at about $56.9 million, with recent acquisitions bringing total purchases to over 10,000 ETH under the expanded program. Working with strategic partners like Ryan Zurrer of Dialectic, GameSquare deploys ETH into yield-bearing DeFi platforms via its proprietary Medici platform, targeting annualized returns of 8–14%, well above standard staking yields.

The company has also launched a $10 million NFT yield strategy, acquiring Ethereum-based digital art and collectibles that can generate DeFi-based income, with proceeds earmarked for reinvestment into ETH or core media operations. This integrated approach positions GameSquare as a blockchain-forward media-tech enterprise, using active yield generation to strengthen its balance sheet and support platform growth.

8. Marathon Digital Holdings (NASDAQ: MARA)

As of August 2025, Marathon holds approximately 41,200 ETH (~$144 million) after steadily increasing its Ethereum exposure since Q1. The company continues to integrate ETH into its renewable energy-powered staking infrastructure, aligning with its broader sustainability and diversification strategy. Marathon also deploys part of its ETH in DeFi liquidity pools and restaking protocols, aiming to enhance returns beyond base staking yields.

9. Tesla, Inc. (NASDAQ: TSLA)

Tesla’s Ethereum position remains at around 29,500 ETH (~$103 million), unchanged since late 2024. While the automaker has not disclosed new ETH purchases in 2025, it continues to use part of its holdings in staking and to pilot Ethereum-based payment channels for vehicle and charging network transactions. ETH remains a small but strategic element of Tesla’s blockchain innovation portfolio, complementing its work with

Dogecoin-based payments.

10. CleanSpark, Inc. (NASDAQ: CLSK)

CleanSpark now holds 25,870 ETH (~$90 million) as of August 2025, up from 24,300 earlier in the year. The renewable energy–focused miner combines BTC mining with ETH staking, validator operations, and selective DeFi participation. The company emphasizes that its Ethereum activities are powered by low-carbon energy sources, positioning ETH as a yield-generating, sustainability-aligned asset in its treasury mix.

Why Are Companies Adding ETH to Their Treasuries?

Companies are increasingly adding Ethereum (ETH) to their treasuries because it offers unique advantages that go beyond simply holding a digital asset. Unlike Bitcoin, which primarily serves as a store of value, Ethereum provides utility and income opportunities within its growing ecosystem.

• Yield Opportunities: Since Ethereum transitioned to proof-of-stake, companies can lock up their ETH to help secure the network and earn passive income. Staking rewards currently range between 3% and 5% annually, meaning a company holding 100,000 ETH could earn $8–12 million in additional revenue per year at today’s prices.

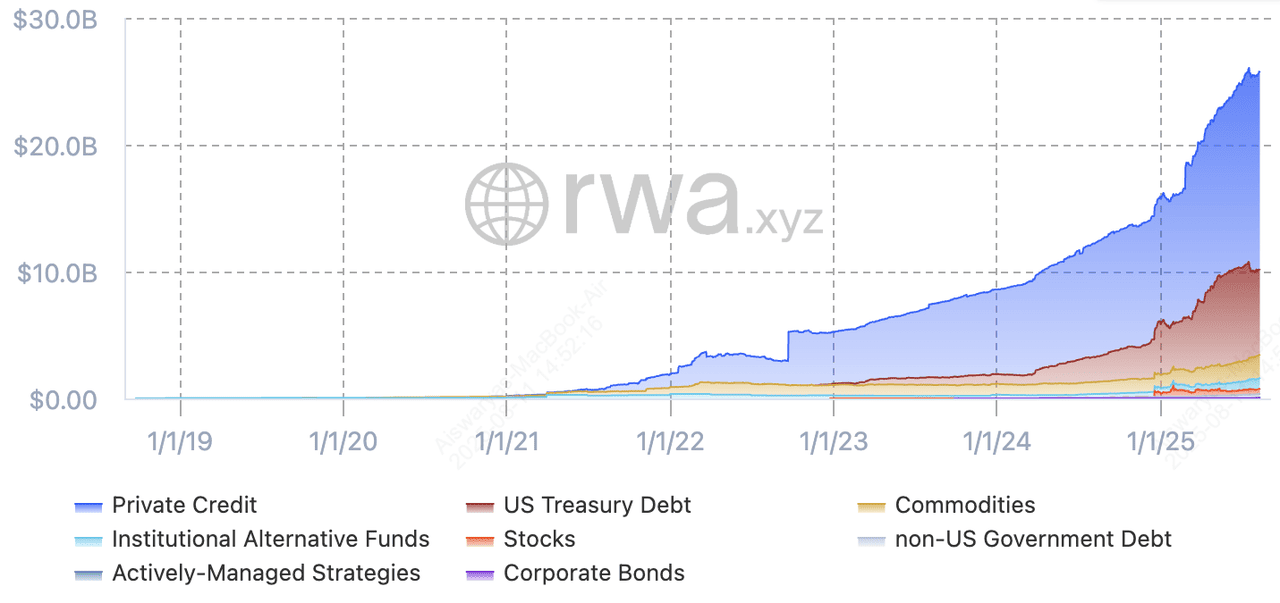

• Tokenization Growth: As of mid-2025, over $25.75 billion in real-world assets (RWAs), like real estate, bonds, commodities, and

equities, have been tokenized on Ethereum, representing about 90% of the

blockchain RWA market. This dominance makes ETH a strategic holding for firms seeking exposure to the

RWA tokenization trend.

• Institutional Products: The launch of spot Ether ETFs and institutional-grade derivatives in 2024 has significantly lowered barriers for companies to gain ETH exposure. Since their debut in July 2024, U.S. spot Ether ETFs have amassed more than $12 billion in assets under management, with over $1.4 billion in net inflows in Q2 2025 alone, reflecting sustained institutional demand. This growth has been further supported by pending applications for staking-enabled Ethereum ETFs, which could combine price exposure with on-chain yield generation and potentially accelerate corporate adoption.

• DeFi Synergies: Companies can deploy ETH into lending protocols like

Aave or

Compound to earn interest, provide liquidity in decentralized exchanges, or participate in

yield farming strategies. This active use of ETH allows treasury assets to generate returns while remaining highly liquid.

What Are the Risks of an Ethereum Corporate Treasury?

While adding Ethereum to corporate treasuries offers new opportunities, it also comes with risks. ETH’s price volatility can impact a company’s quarterly earnings, especially during market downturns. Regulatory uncertainty around staking, DeFi participation, and crypto asset classification adds another layer of complexity. Additionally, actively managing ETH in decentralized finance requires technical expertise and strong risk controls to avoid security breaches or liquidity issues.

Ethereum Corporate Treasury: Future Outlook and Trends

Ethereum’s role as a corporate treasury asset is still in its early stages but growing quickly as more firms recognize its potential beyond a simple store of value. Analysts predict broader adoption in the coming years, driven by Ethereum’s staking rewards, dominance in tokenized RWAs, and deep integration with DeFi. As DeFi protocols mature and regulatory frameworks take shape, ETH could become a core component of diversified corporate treasury strategies.

Key trends to watch include the rise of hybrid treasury models, where companies combine ETH with Bitcoin, stablecoins, and tokenized assets to balance yield opportunities and risk. Increased staking participation is also expected as firms look to earn passive income from their holdings. In addition, clearer regulatory guidance on digital asset accounting, staking, and DeFi engagement will likely encourage more companies to explore ETH as a reserve asset.

While this trend signals a shift toward more dynamic treasury management, it is not without risks. Ethereum’s price volatility, evolving regulations, and the technical complexity of engaging with DeFi can all impact a company’s financial stability. Firms considering ETH should approach this strategy carefully, with robust

risk management and a long-term perspective.

Related Reading

FAQs on Ethereum Corporate Treasuries

1. What is a corporate Ethereum treasury?

A corporate Ethereum treasury refers to a company holding ETH as part of its reserves for yield, diversification, and DeFi engagement.

2. Which company holds the most Ethereum?

As of August 2025, BitMine Immersion (BMNR) holds the largest public-company Ethereum treasury, with approximately 833,137 ETH valued at about $2.9 billion, surpassing all other corporate holders.

3. Why are companies switching from Bitcoin to Ethereum for their treasuries?

Ethereum’s staking rewards, DeFi integration, and programmability offer additional utility beyond Bitcoin’s store-of-value role.

4. How can you track corporate ETH holdings?

Platforms like CoinGecko, The Block, and public company filings provide updated data on corporate ETH reserves.