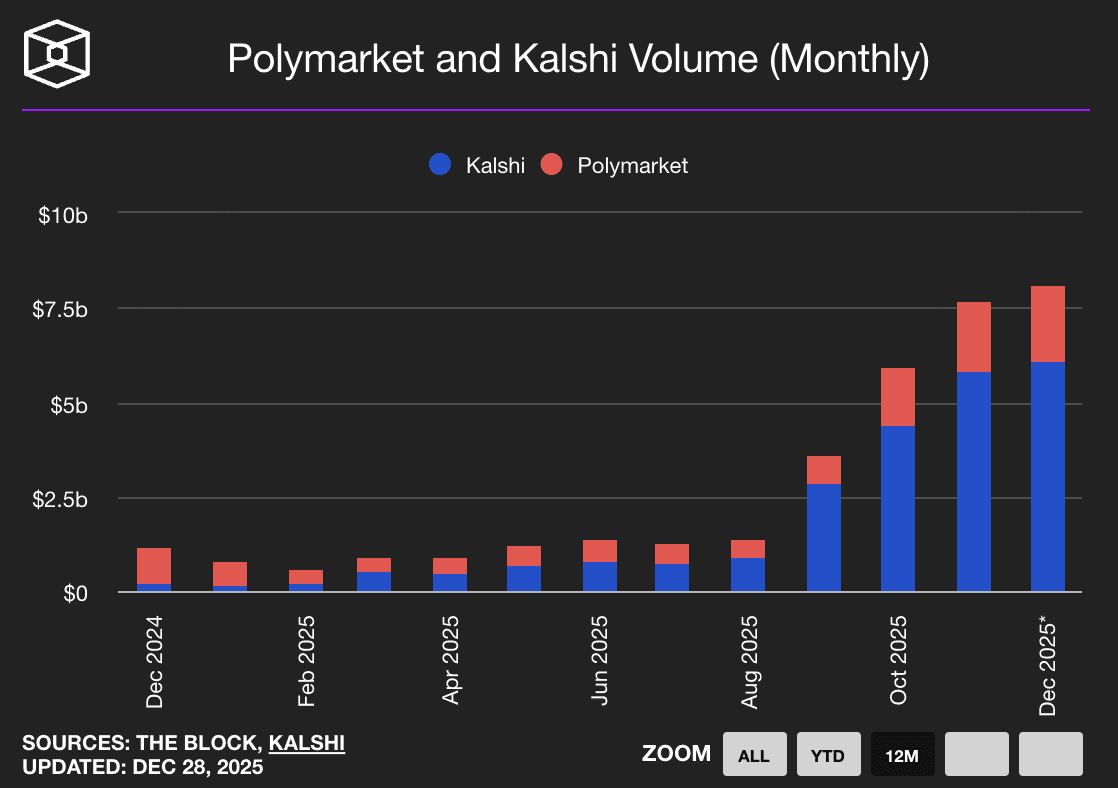

Prediction markets are platforms where users trade contracts on the outcomes of future real-world events, aggregating collective wisdom to produce probabilistic forecasts often more accurate than polls or experts. In 2026, these markets exploded in popularity, with combined volumes across major platforms like Kalshi and

Polymarket exceeding $40 billion in 2025 alone, driven by events in politics, economics, sports, entertainment, and crypto.

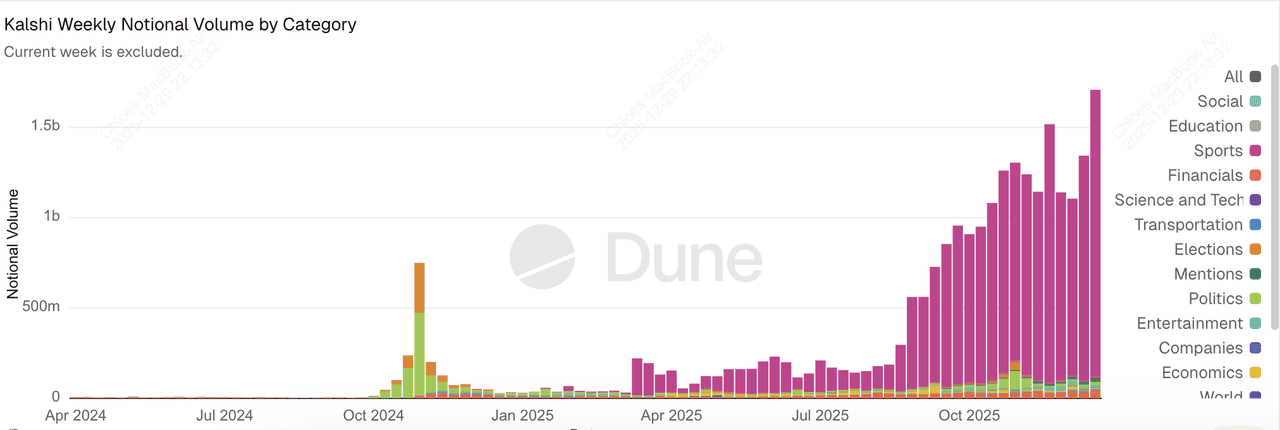

Kalshi is one of the leading U.S. regulated prediction markets and has captured significant shares with weekly volumes reaching $2.3 billion and an $11 billion valuation following a $1 billion funding round, making it accessible for hedging risks or speculating on everything from Fed rates to Oscar winners.

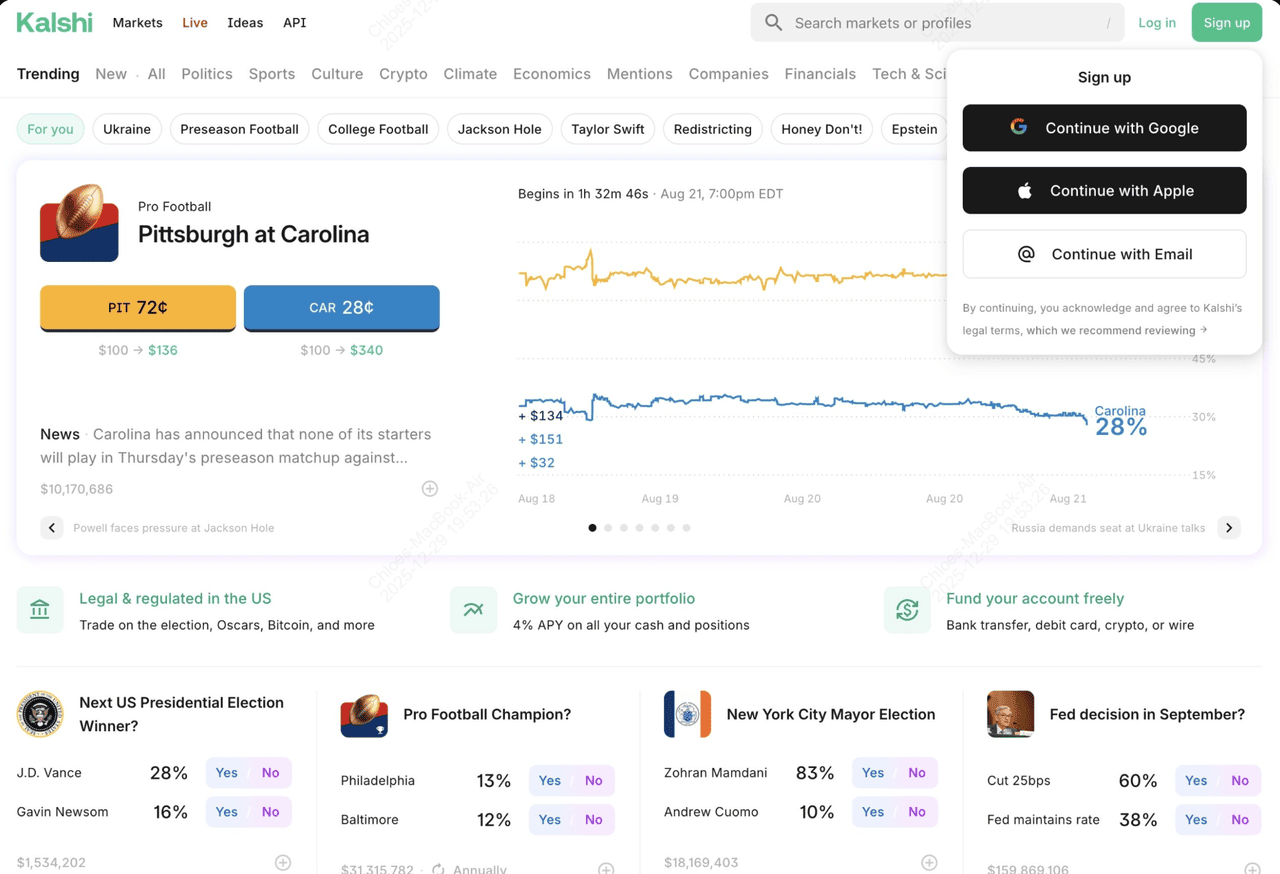

What Is Kalshi Prediction Market?

Kalshi is the first federally regulated prediction market in the U.S., operating as a Designated Contract Market (DCM) where users buy and sell binary event contracts on outcomes ranging from economic indicators and elections to sports championships, awards shows, and cultural trends.

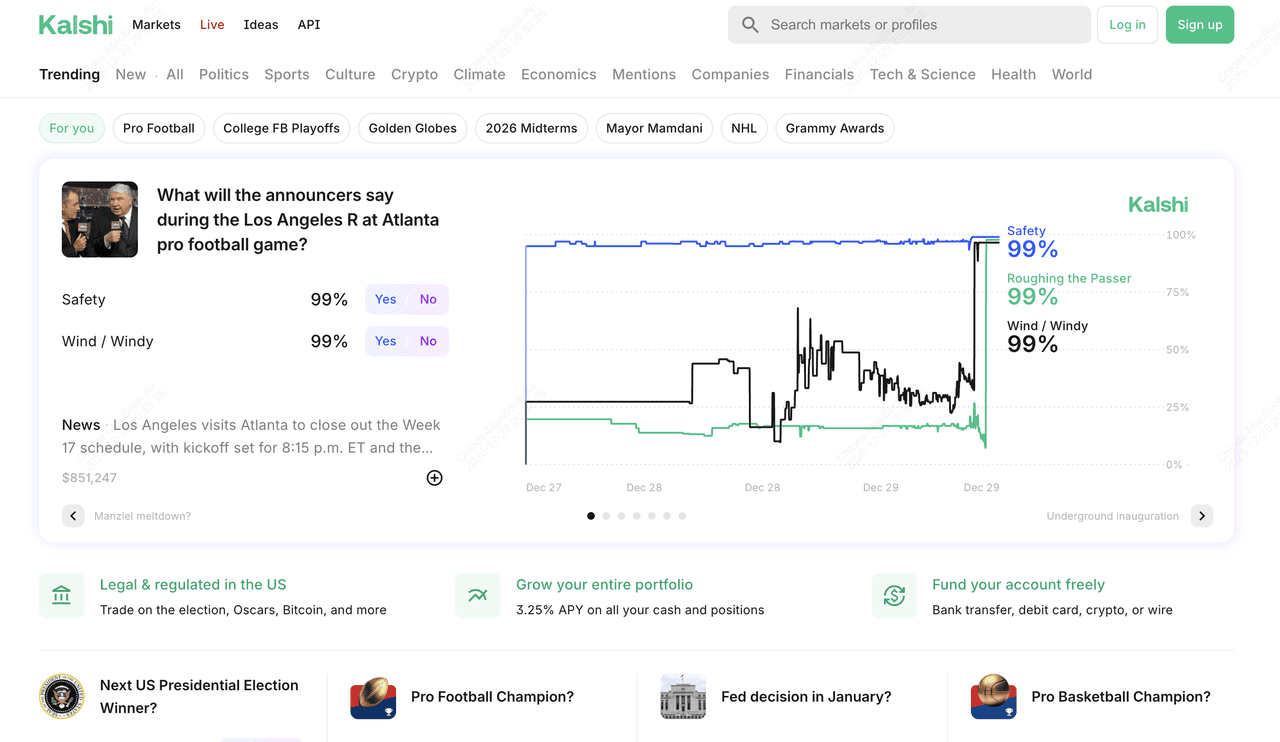

Launched publicly in recent years, Kalshi democratizes access to sophisticated forecasting tools previously reserved for institutions, turning opinions into tradable assets with contracts settling at $1 for correct predictions. In 2026, Kalshi boasts over 85,000 active markets, weekly volumes surpassing $2 billion, and partnerships like live odds on CNBC, while earning revenue through low transaction fees (typically under 2%) without taking positions against users.

What Are the Key Features of Kalshi?

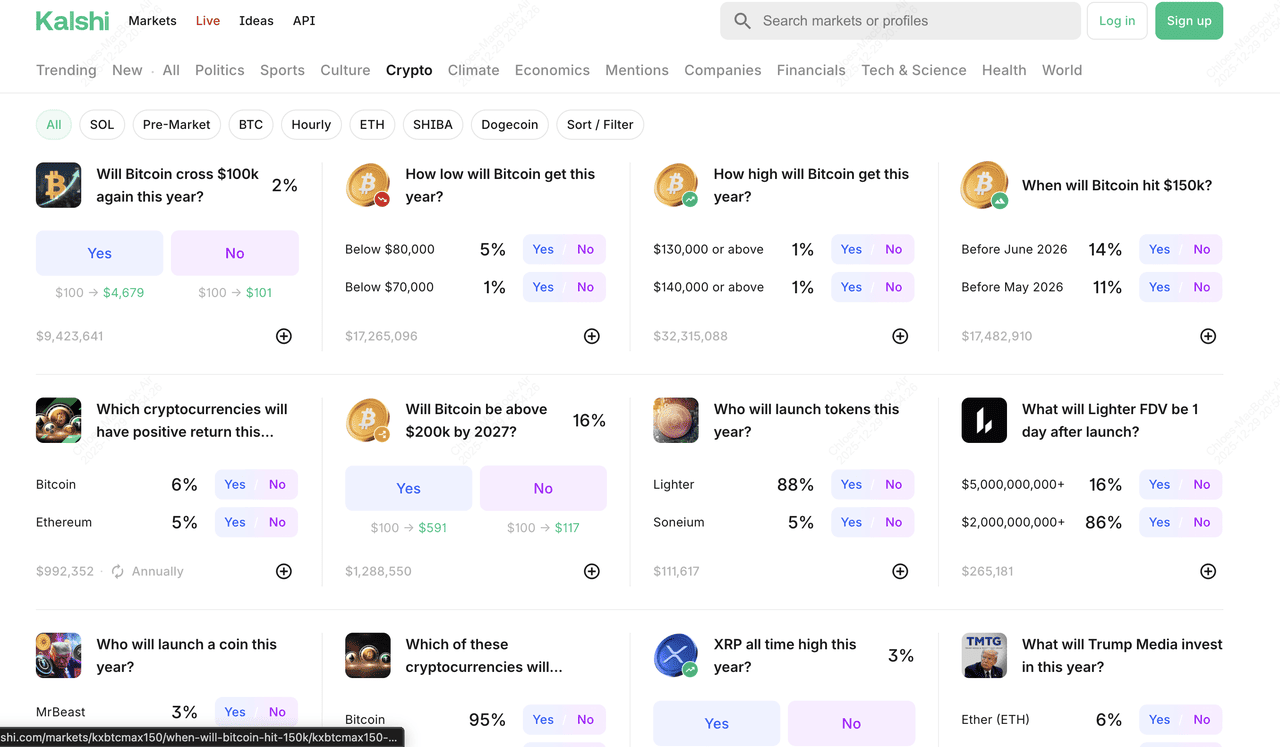

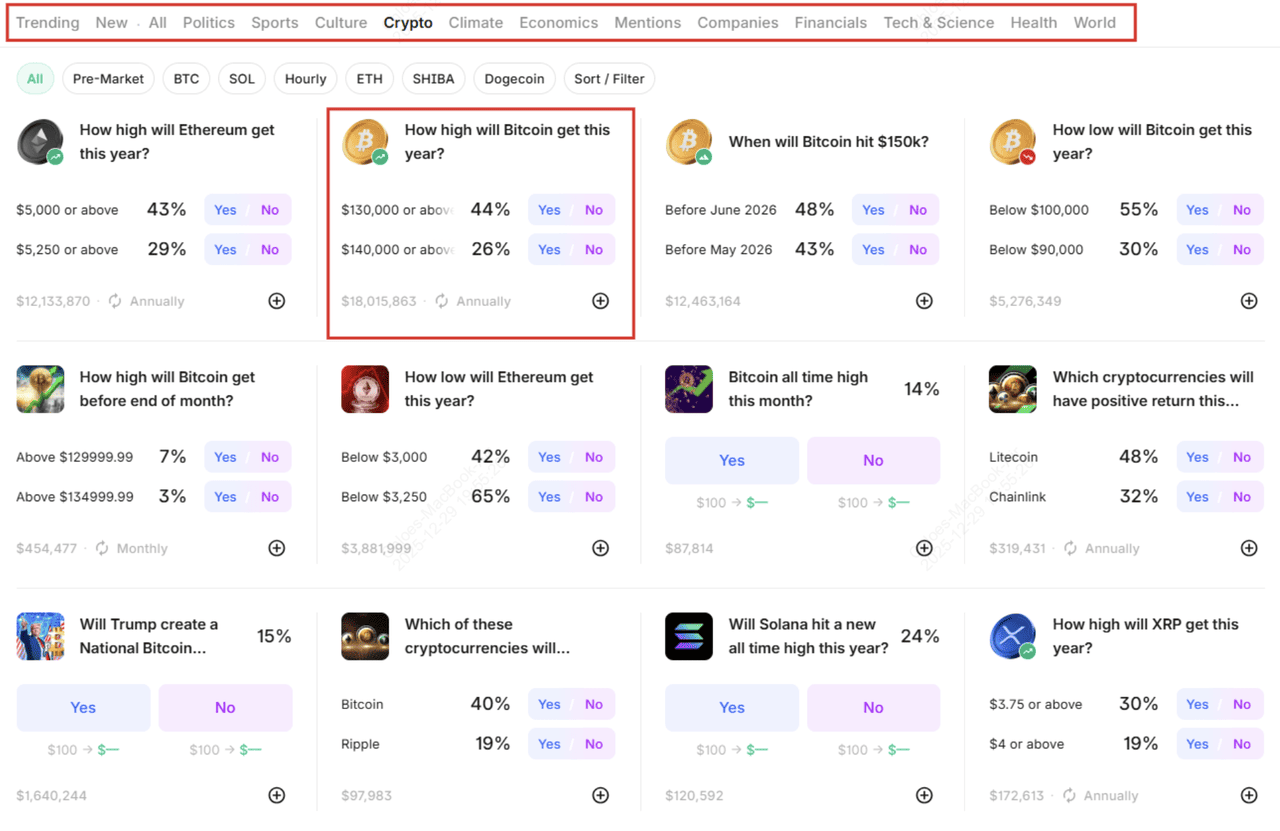

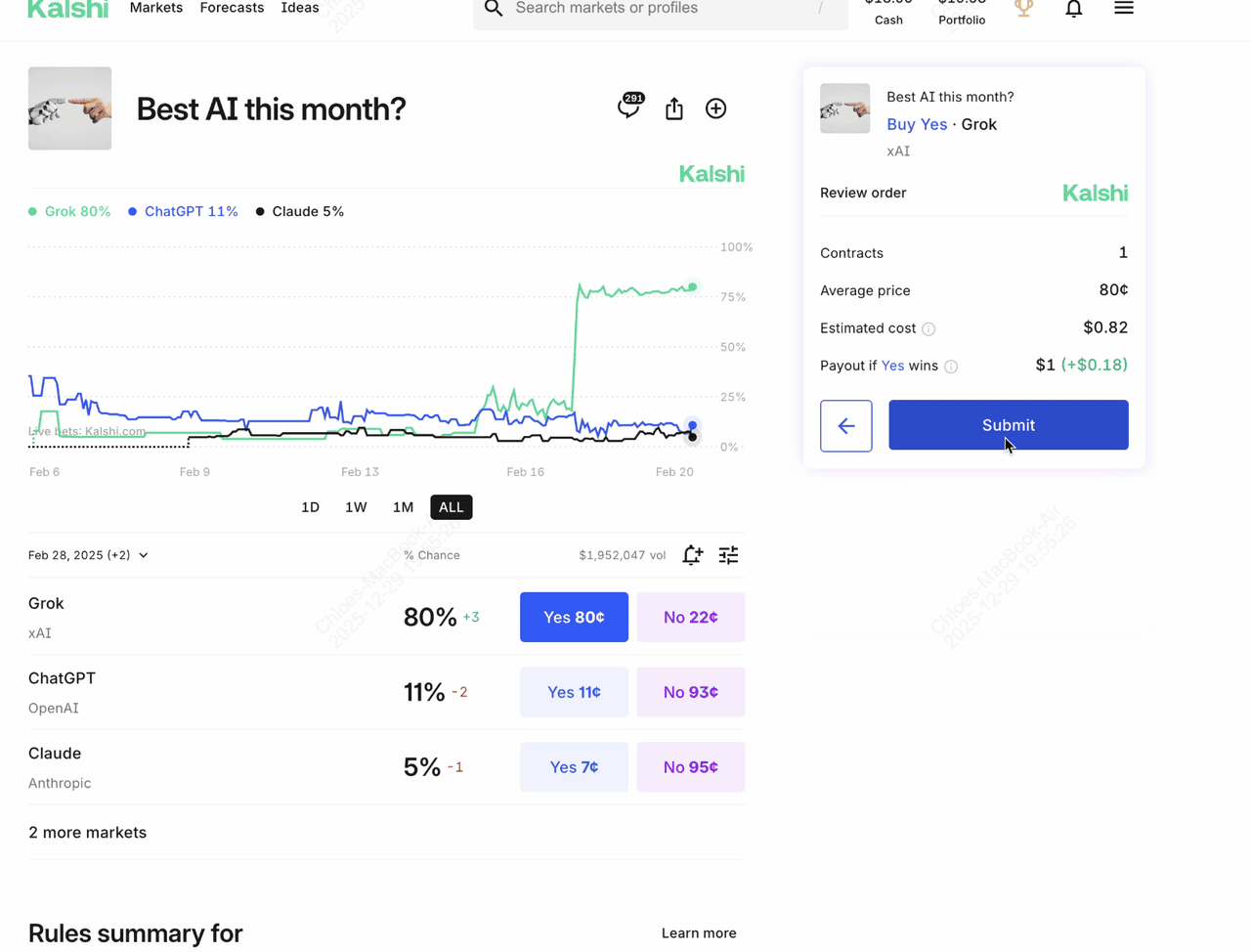

Kalshi stands out with its intuitive Yes/No contract structure, expansive categories including financials (Fed rates, recession odds), politics, sports (game winners, championships), entertainment (Oscars, Grammys), crypto, and RWAs, plus innovative combos for parlays.

Key advantages include nationwide U.S. legality, interest in cash balances (up to 4% APY), high liquidity with tight spreads, and advanced tools like limit orders and real-time order books. The platform supports mobile trading, offers competitive fees capped low per contract, and launched Kalshi Research in late 2025 for academic insights into market accuracy, which often outperforms traditional forecasts during volatile events.

Who Founded Kalshi?

Kalshi was co-founded in 2018 by Tarek Mansour (CEO) and Luana Lopes Lara, two former hedge fund traders who aimed to create a regulated alternative to unregulated prediction platforms. Mansour, from an Algerian background, and Lopes Lara, from Brazil, built Kalshi to empower everyday users with institutional tools, securing landmark CFTC approval in 2020. Their vision has propelled Kalshi to an $11 billion valuation in 2025 through major funding from Paradigm, Sequoia, and others, establishing it as a pioneer in compliant event contract trading.

How Does Kalshi Prediction Market Platform Work?

Kalshi functions as a peer-to-peer exchange where users trade binary contracts on event outcomes, buy Yes if you believe it will happen, No if not, with prices fluctuating between $0.01 and $0.99 based on market sentiment. Contracts settle at $1 (win) or $0 (loss) post-event, verified by reliable sources like NCAA.com or official data providers.

The platform aggregates crowd wisdom for accurate probabilities, charges low fees on trades, and offers instant settlements, combos for multi-event bets, and tools like order books for advanced strategies, all while maintaining neutrality without a "house edge."

How Is Kalshi Regulated?

Kalshi operates under strict oversight from the Commodity Futures Trading Commission (CFTC) as a Designated Contract Market (DCM), the same regulatory framework governing major futures exchanges. This federal regulation ensures transparency, fairness, fraud protection, and user safeguards, distinguishing Kalshi from unregulated platforms and enabling nationwide U.S. access (unlike state-restricted sportsbooks). CFTC approval provides integrity through audited operations and public verification, fostering trust amid 2026's growing scrutiny on prediction markets.

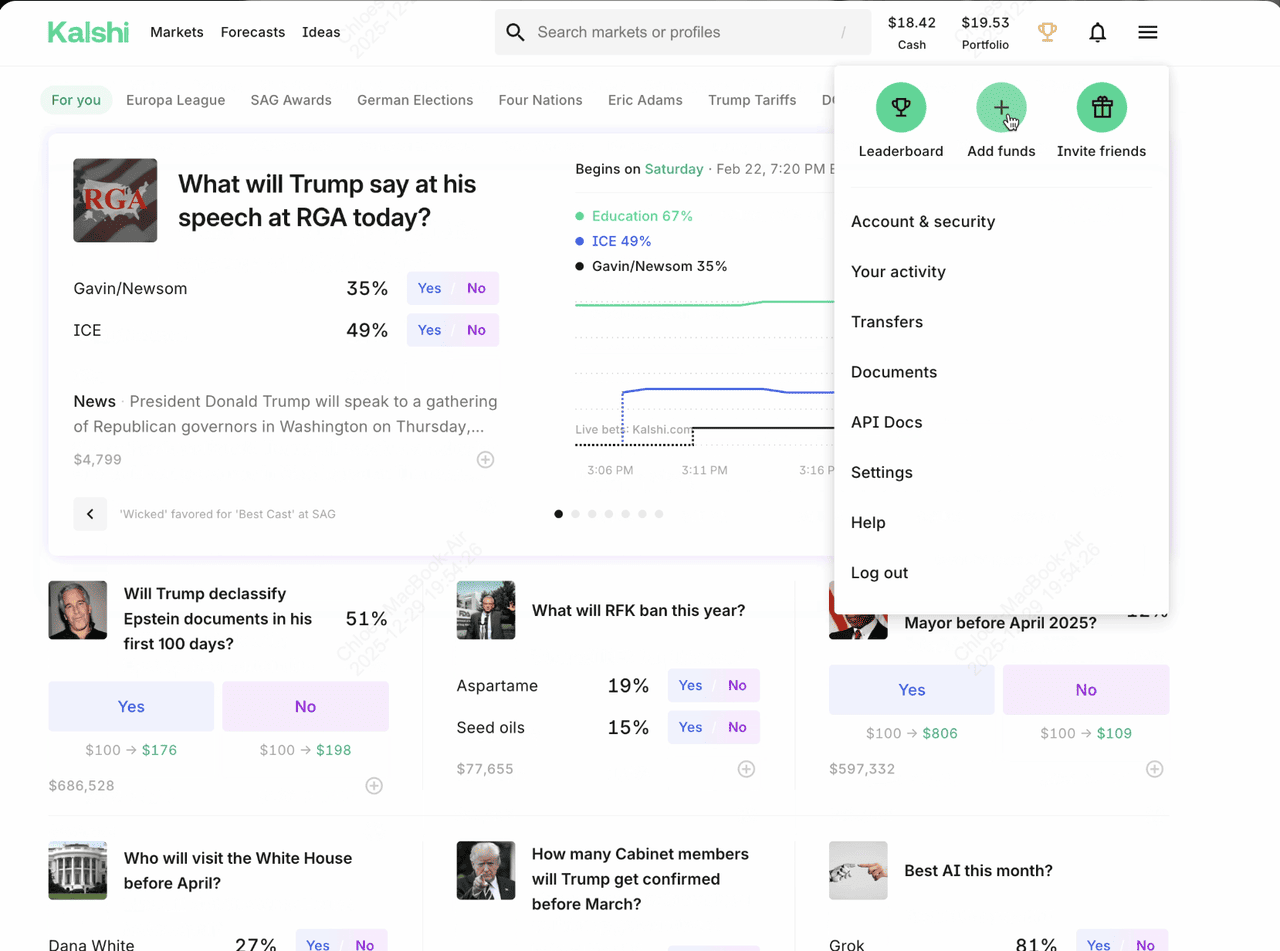

How to Trade on Kalshi: A Step-by-Step Guide

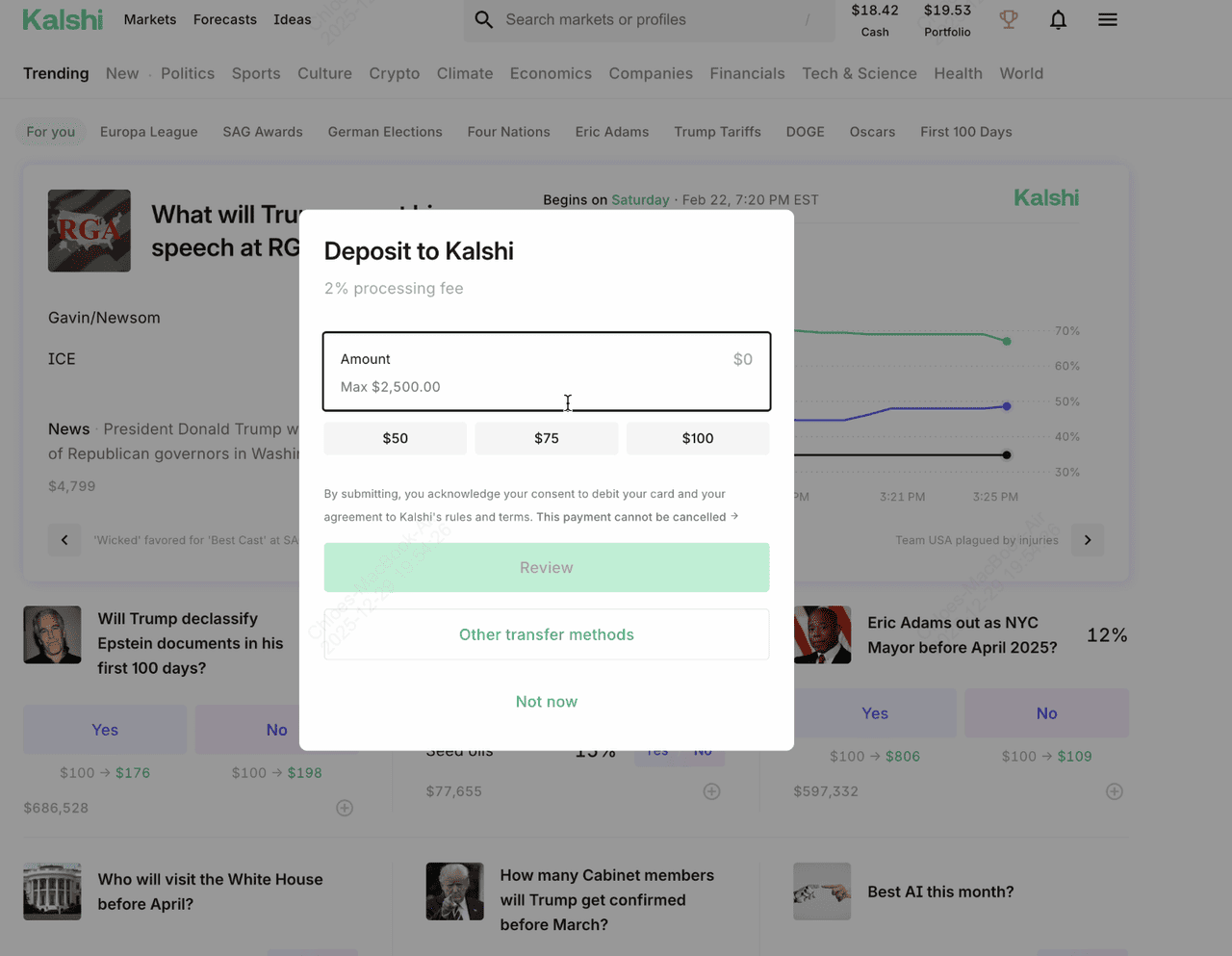

Kalshi makes it simple to engage with regulated event-based predictions. You can trade on curated markets across politics, economics, sports, entertainment, finance, and more, with new users often eligible for bonuses like $10 after initial trades. To start trading, you need a verified account with fiat funds deposited via bank transfer, debit card, or wire. No crypto required, though interest accrues on cash balances.

Step 1: Sign Up on Kalshi and Complete Verification

Visit kalshi.com, click "Sign Up," enter your email/phone/details, and complete CFTC-mandated KYC by submitting a government ID and selfie. Approval is usually quick for U.S. residents.

Step 2: Deposit Funds or Crypto

Link your bank account or use a debit card to deposit USD (minimum low, often $10+), earning competitive interest on idle balances while funds clear instantly for trading. You can bet with crypto on Kalshi, a regulated prediction market, by depositing supported cryptos like

Bitcoin (BTC),

Ethereum (ETH),

BNB, or

TRX, which get converted to your account balance, allowing you to trade on event contracts, including those for crypto price movements. Kalshi also supports tokenized versions of contracts on Solana, letting you trade directly on-chain for more anonymity, making it easier to use digital assets for these "event contracts" that predict future outcomes.

Buy Bitcoin (BTC) on BingX and Fund Your Kalshi Account

BingX lets you buy, hold, and actively trade Bitcoin through both spot markets and

BTC/USDT perpetual futures, giving you flexible exposure to long-term growth or short-term price movements with

BingX AI–powered risk and market insights.

BTC/USDT trading pair on the spot market powered by BingX AI insights

2. Choose a

market order for instant execution or a limit order to set your preferred price.

3. Now you can fund your Kalshi account with your BingX account by sending BTC to your Kalshi deposit address. You can also hold BTC for long-term exposure or trade price swings without leverage.

With balance in your account, you can use your balance to trade event contracts on Bitcoin, Ether, and other crypto-related events (e.g., "Will BTC hit $100k by Dec 31?"). Buy and sell tokenized versions of wagers directly on the Solana blockchain, offering on-chain, non-custodial trading for crypto users and deposit and withdraw TRX and USDT via the Tron network for more liquidity.

Step 3: Browse and Select Markets

Explore thousands of live markets categorized by topic, such as "Will the Fed cut rates?" or "Who wins Best Picture?" Prices reflect real-time probabilities.

Step 4: Place Your Trade (Buy Yes/No)

Select your predicted outcome, enter quantity, and confirm. Buy Yes to back the event occurring or No against it, with low fees applied.

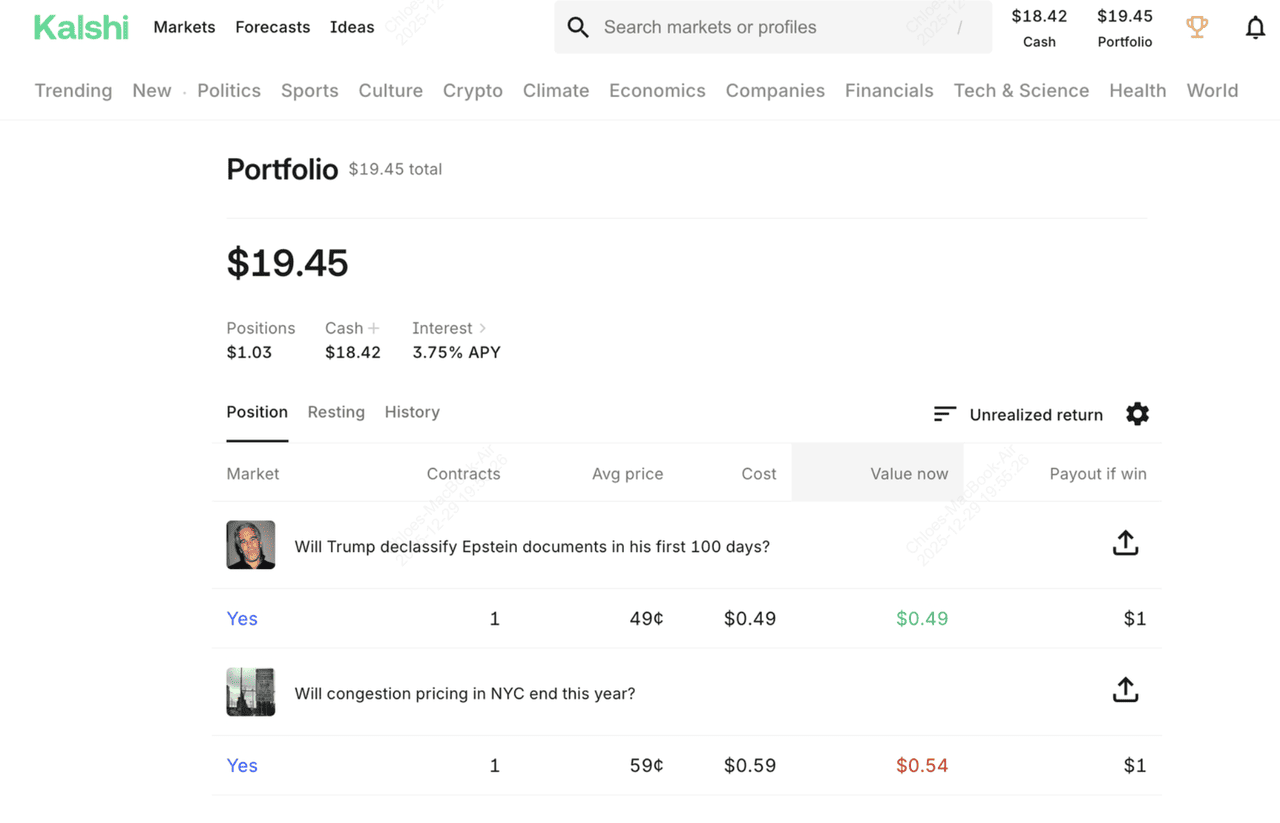

Step 5: Monitor and Manage Positions

Track open trades in your portfolio dashboard, sell early to lock profits/cut losses, or hold until resolution for full $1 payout on winners.

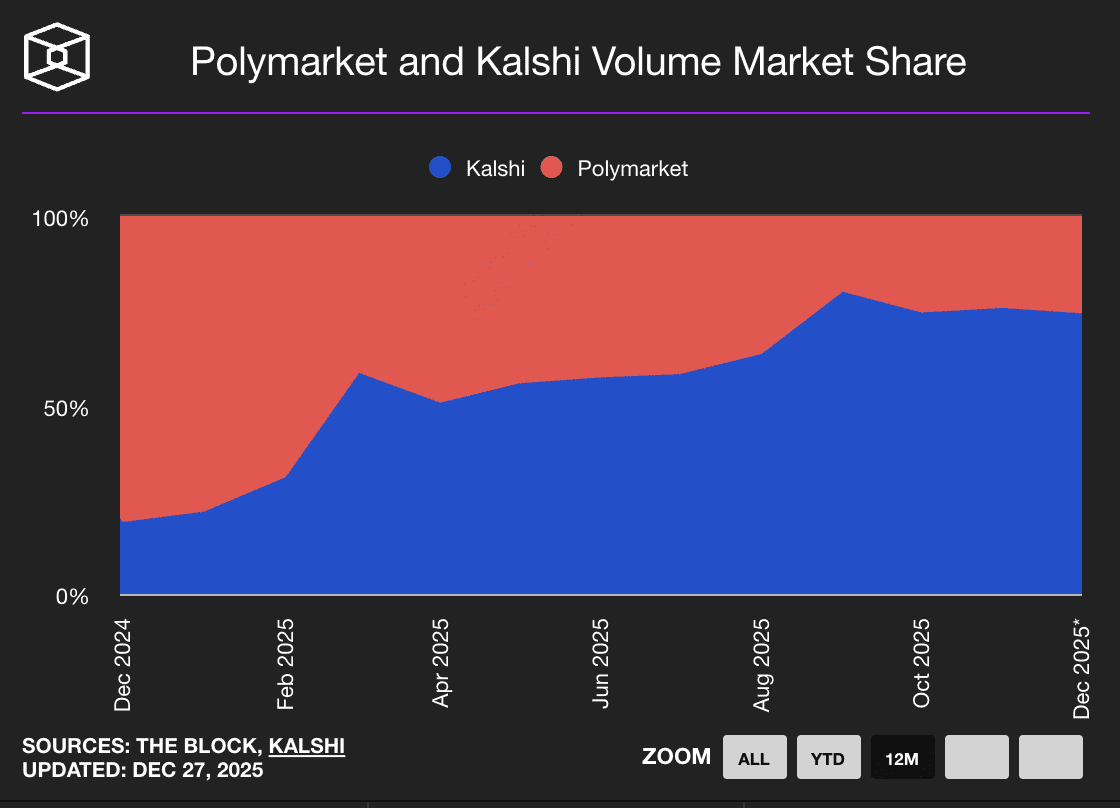

Kalshi vs. Polymarket: Similarities and Differences

In 2026, Kalshi dominates U.S.-regulated trading with fiat support, nationwide access, sports focus (75% volume), and high limits, ideal for compliance-minded users, volumes hit $5.8 billion monthly in late 2025. Polymarket, a decentralized crypto platform on Polygon, offers global access, zero fees, and niche markets but restricts U.S. users (often via VPN) and lacks regulation. Kalshi provides superior liquidity in structured events and partnerships (ex., Robinhood integration), while Polymarket excels in speed and crypto events; combined, they drive the sector's $10 billion+ monthly activity.

Key Considerations Before Engaging in Kalshi

While Kalshi offers a regulated and accessible way to trade on real-world events, there are several important factors users should understand before getting started.

1. Regulatory Compliance and U.S. Focus: Kalshi is fully available nationwide in the U.S. thanks to CFTC oversight, but it is restricted or unavailable in many international jurisdictions. Always verify local laws and confirm eligibility based on your location before signing up.

2. Market Volatility: Contract prices fluctuate between $0.01 and $0.99 in response to news and sentiment, creating opportunities for substantial gains but also potential losses, especially in fast-moving events like elections or economic announcements.

3. Liquidity Variations: High-profile markets such as Fed rate decisions, major elections, and championship outcomes enjoy deep liquidity and tight spreads, while niche or less popular events may have lower volume, making entry/exit less efficient.

4. Settlement and Verification Risk: Outcomes are resolved using trusted public sources, such as official data or NCAA.com, with Kalshi's regulated status minimizing disputes. However, rare delays or clarifications can occur, so review resolution rules for each market.

5. Research and Informed Decisions: Prices aggregate crowd wisdom and often prove highly accurate, yet they can deviate from fundamentals. Thorough personal research on underlying events remains essential for improving decision quality and long-term success.

Conclusion

Kalshi has transformed prediction markets into a mainstream, regulated asset class in 2026, offering accessible trading on diverse events with CFTC-backed security and impressive volumes exceeding rivals in key categories. Whether hedging economic risks, speculating on sports, or forecasting culture, Kalshi empowers users with transparent, efficient tools that harness collective intelligence. As partnerships expand (ex., CNBC tickers) and research validates superior accuracy and Kalshi continues democratizing finance.

Related Reading

FAQs on Kalshi Prediction Market

1. Is Kalshi Legit?

Yes. Kalshi is a legally regulated platform approved by the CFTC, making it one of the few prediction markets legally available in the United States. Many users report successful withdrawals, with some noting that payouts are processed quickly once markets settle.

2. Why Do People Use Kalshi?

Users are drawn to Kalshi for its unique market offerings, which go beyond traditional sports betting and include politics, economics, weather, and social trends. For some, it provides a way to hedge real-world risks or express informed views on future events. Others use it as a speculative trading venue, citing opportunities for arbitrage and short-term profit.

3. What Are the Risks of Using Kalshi?

While legitimate, Kalshi carries risks. Some users report that the platform’s complexity can be difficult for beginners, and others warn that the constant availability of markets can encourage overtrading. There are also complaints about platform bugs, occasional downtime, and customer support delays. As with any speculative product, losses are possible, and users should trade responsibly.

4. Is Kalshi Right for Everyone?

Kalshi may appeal to users interested in data-driven speculation or alternative markets, but it may not be suitable for everyone. Those unfamiliar with derivatives, probability-based trading, or

risk management should proceed cautiously and treat it as a high-risk financial product rather than a traditional investment.