After three years of engineering and a $244 million war chest led by Paradigm and Coinbase Ventures, the

Monad mainnet and

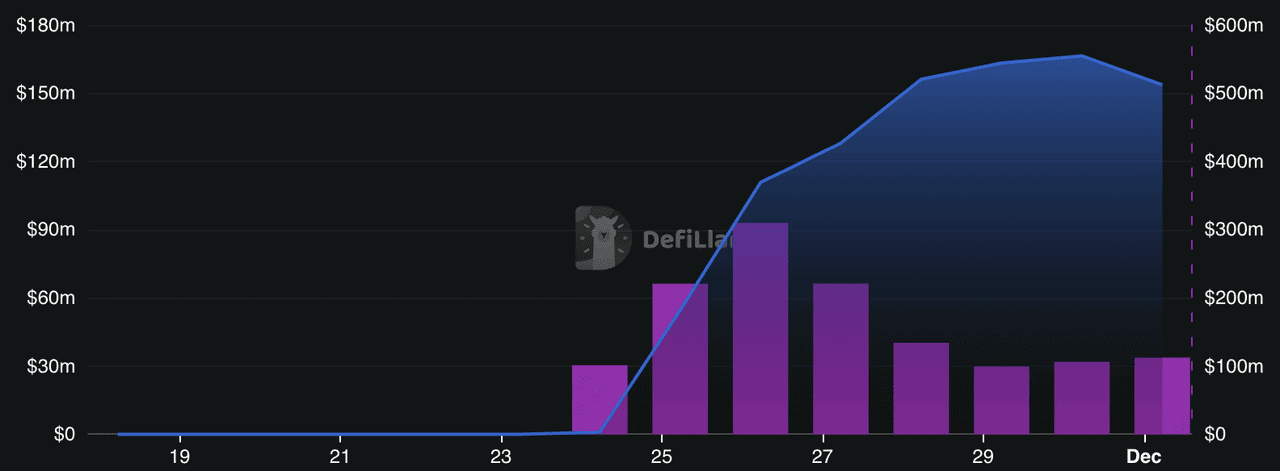

MON token finally went live on November 24, 2025. The launch has already pushed network activity into the millions of transactions, with total value locked (TVL) crossing the $150 million range in its first week as DeFi blue chips deploy on the chain.

Monad DeFi TVL | Source: DefiLlama

Behind the headlines is a fast-growing ecosystem that mixes battle-tested infrastructure like

USDC,

Chainlink,

Uniswap with newer native projects like Lumiterra and Monad-focused cross-chain bridges such as

deBridge. Together, they show how Monad is positioning itself as an EVM chain for high-frequency trading,

gaming, and on-chain finance.

This guide explores 7 key crypto projects in the Monad ecosystem to watch in 2025, and how they may shape the chain’s growth, from

stablecoins and oracles to

NFT markets and cross-chain liquidity.

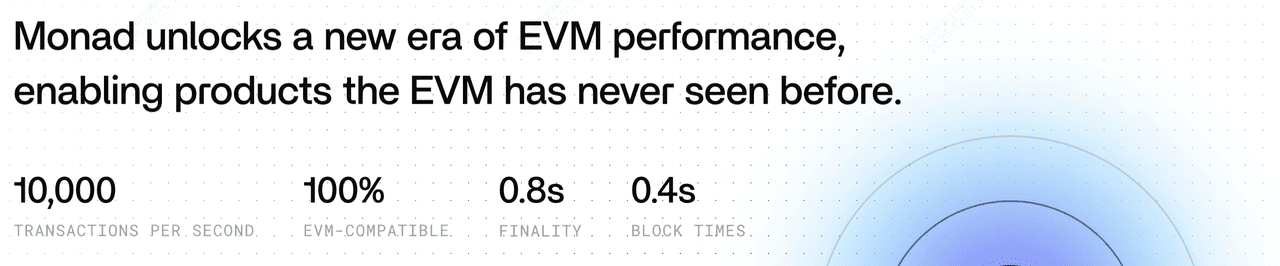

What Is Monad Layer-1 EVM Blockchain?

Monad (MON) is a high-performance, EVM-compatible

Layer 1 blockchain that targets 10,000+ transactions per second, 0.4s block times, and 0.8s finality, while maintaining full bytecode-level compatibility with

Ethereum smart contracts.

Instead of inventing a new smart contract stack, Monad re-architects the EVM itself using techniques like optimistic parallel execution and a custom database (MonadDB). This allows Solidity developers and existing Ethereum tooling to migrate with minimal changes, while benefiting from higher throughput and lower fees.

The native token MON powers gas fees and

staking and is central to Monad’s security and incentive model. At mainnet launch, the initial supply was set at 100 billion MON, with 7.5% sold via a public sale on Coinbase’s token sales platform and 3.3% airdropped to early community users.

What’s Driving Monad Ecosystem Momentum in 2025?

Several early trends are pushing activity and attention toward Monad’s ecosystem in late 2025:

1. High-Speed EVM Performance with Familiar Tooling

Monad performance overview | Source: Monad

Monad aims to solve the blockchain “trilemma” by delivering speed and scalability without sacrificing decentralization. Its parallel execution engine and pipelined architecture allow high throughput while keeping hardware requirements accessible for validators, supporting a globally distributed network rather than a data-center-only. For developers, bytecode-level EVM equivalence means existing Ethereum contracts, wallets like

MetaMask, and infra can be reused. This drastically reduces the cost and friction of deploying to Monad compared with non-EVM chains.

2. Fast Liquidity Bootstrapping from DeFi Blue Chips

Within days of launch, major DeFi protocols including Uniswap,

Curve,

Morpho and Upshift deployed on Monad, bringing immediate TVL and volumes. Early data shows that a large share of Monad’s first-week TVL sits in these established protocols, giving traders deep liquidity and familiar interfaces on day one. At the same time, native Monad projects like Kintsu for staking, Kuru order book

DEX and Lumiterra game are starting to leverage the chain’s low latency to build new experiences that are harder to run on slower networks.

3. Strong Infrastructure Stack: Oracles, Bridges, and NFT Rails

Monad launched with a mature infrastructure layer, including:

• Chainlink for price feeds, Data Streams and CCIP cross-chain messaging.

• Bridges like

Wormhole,

LayerZero, Orbiter and deBridge, enabling MON, USDC and other assets to move between Ethereum,

Solana,

NEAR and Monad.

• NFT and gaming rails via

Magic Eden and other marketplaces integrating Monad NFTs and launchpads.

This stack makes Monad more than just a fast chain, turning it into a plug-and-play execution layer for cross-chain DeFi, gaming, and NFTs.

What Are the 7 Best Crypto Projects in the Monad Ecosystem to Watch in 2025?

As Monad’s ecosystem expands, a few projects stand out for their strategic importance, network effects, and potential to shape on-chain activity in 2025 and beyond.

1. USD Coin (USDC)

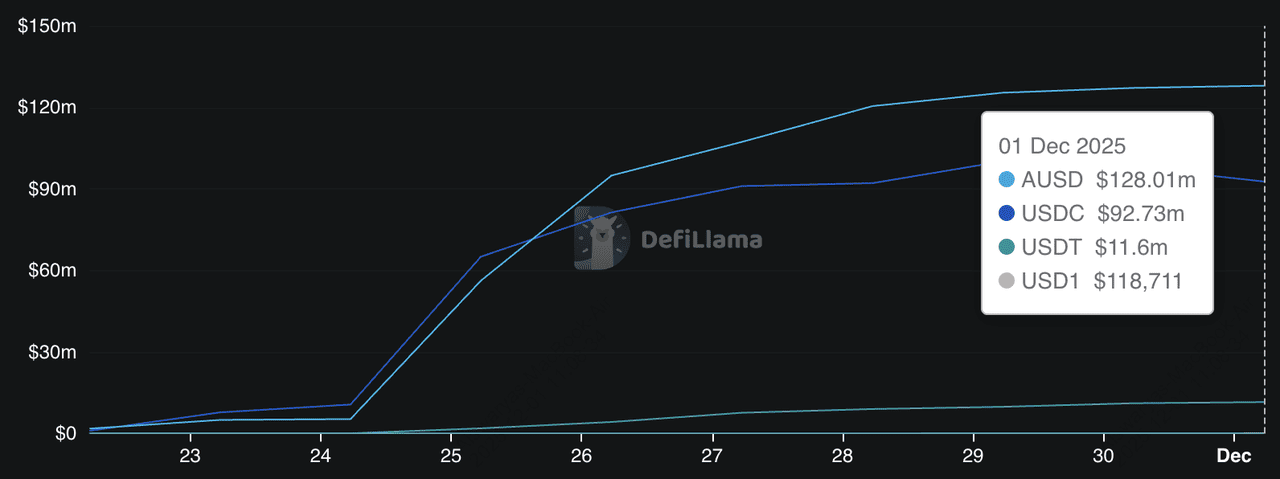

USDC market cap on Monad network | Source: DefiLlama

USDC is a core liquidity pillar on Monad, accounting for over $92 million in market cap, or roughly 40% of the $232.45 million stablecoin supply on the network as of December 2025, second only to AUSD with 55% dominance. As a fully collateralized dollar stablecoin issued by

Circle and already entrenched across major chains and CEXs, USDC serves as primary base collateral for Monad DeFi: it backs key trading pairs on DEXs like Uniswap, anchors lending and money markets that need low-volatility assets, and underpins payments and remittance flows that benefit from Monad’s sub-second finality and high TPS, making it one of the most systemically important assets in the Monad ecosystem.

On BingX, you can already

trade USDC on both the Spot and Perpetual Futures markets, making it easy to hedge, rotate into stablecoins, or bridge exposure between centralized and on-chain positions.

2. Chainlink (LINK)

Chainlink is now one of Monad’s most critical infrastructure layers, going live on November 24, 2025 with full support for Data Streams, Price Feeds, and CCIP, making it the network’s primary source of verifiable market data. Chainlink Data Streams, built for low-latency, high-frequency trading, fit directly into Monad’s sub-second finality and 10,000 TPS design, giving developers access to offchain market data that can be verified onchain with minimal delay.

Its Price Feeds now secure markets for assets like MON, USDC, WETH, and bridged tokens, enabling lending, perps, and structured products to function safely. With CCIP, Chainlink also provides the backbone for cross-chain liquidity and messaging between Ethereum, Solana, and Monad. As Monad’s DeFi activity scales, demand for oracle infrastructure rises accordingly, making LINK a key ecosystem asset and already tradeable on BingX Spot for users looking to gain exposure to Chainlink’s growing role across multi-chain markets.

For traders, the

LINK token represents exposure to the growth of the Chainlink network as demand for oracle services grows across chains, including Monad. LINK is already available on BingX Spot and Futures, making it easier to trade or accumulate outside on-chain environments.

3. Tether Gold Tokens (XAUT0)

Tether Gold Tokens (XAUT0) have quickly become one of the largest

real-world asset (RWA) positions on Monad, reaching over $36.6 million in market cap as of December 2025. As a bridged representation of Tether’s physically backed gold (

XAUT), XAUT0 gives Monad users direct,

on-chain exposure to gold, an asset traditionally used as a hedge during market volatility. Its integration alongside USD₮0 at Monad’s mainnet launch shows how RWA assets are being positioned as core collateral on the chain. Practically, XAUT0 enables users to diversify portfolios, collateralize loans, and participate in structured DeFi products using gold-backed tokens, making it especially valuable for regions where accessing physical bullion is costly or impractical.

On BingX,

XAUT/USDT Spot trading, giving you centralized liquidity and tools like historical data, calculators, and predictions to manage gold-backed exposure while tracking how RWA tokens migrate to chains like Monad.

4. Lumiterra

Lumiterra has emerged as Monad’s first major gaming anchor, recording over 105,000 daily unique active wallets and nearly 2 million on-chain transactions per day, making it one of the most active applications on the network during launch month. Designed as an open-world survival MMORPG with AI-powered companions that adapt to each player’s behavior, Lumiterra leverages Monad’s 0.4s block times and high-TPS execution to support real-time combat, farming, crafting, and fully on-chain item trading without congestion.

Its “Survival Season,” which rolled out alongside Monad mainnet, functions as the chain’s first large-scale economic stress test, rewarding players with LVMON tokens, Resident Card Puzzles, and tradable items while seeding the upcoming Lumi multi-chain ecosystem. With rapidly growing UAW metrics, an active referral-driven economy, and NFT-linked identity progression, Lumiterra is positioned to become a cultural and economic driver for Monad, offering a practical benchmark for whether the chain can capture meaningful share in the 2025

GameFi cycle.

5. Uniswap (UNI)

Uniswap fees paid on Monad network | Source: DefiLlama

Uniswap has become the single largest liquidity hub on Monad, capturing nearly $60 million in TVL, almost 40% of the chain’s total DeFi TVL of ~$153 million as of December 2025. Following its late-November mainnet deployment, Uniswap now powers the deepest pools for MON, USDC, WETH, and AUSD, enabling low-slippage swaps and acting as the default liquidity venue for new Monad tokens. Its V4 architecture, including programmable hooks and concentrated liquidity, maps directly onto Monad’s high-throughput, low-latency design, supporting advanced features like on-chain limit orders and MEV-resistant routing. This combination of deep liquidity, strong user familiarity, and technical alignment makes Uniswap the most influential DeFi protocol accelerating early capital inflows, trading activity, and project launches across the Monad ecosystem.

On BingX, Uniswap (UNI) already trades on the Spot and Futures markets, with detailed guides on how to buy and

trade UNI using

BingX AI. This lets you participate in Uniswap’s broader ecosystem growth while using Monad itself for on-chain trading.

6. Magic Eden (ME)

Magic Eden has quickly become Monad’s dominant NFT marketplace, onboarding 45,000+ daily unique active wallets and processing over 19.7 million incoming transactions per day, an 84% weekly surge that highlights growing demand for Monad-native NFTs. Already ranked #13 globally among NFT marketplaces, Magic Eden has launched early Monad collections like Monad Nomads and gMON derivatives, while lining up more than 11 new Monad mints in a single week. With $18 million in 24h trading volume across its multi-chain platform and seamless discovery across Solana, Ethereum,

Base, and

BNB Chain, Magic Eden gives Monad projects instant exposure to one of the largest NFT user bases in crypto. Its low-fee (2%) marketplace, integrated launchpad, and high-frequency transaction support make it a key driver of NFT liquidity and cultural activity as Monad scales its gaming and digital asset ecosystem.

On BingX, you can trade

ME/USDT on Spot trading, giving you access to the Magic Eden governance token and capture value from its multi-chain expansion, including Monad.

7. deBridge (DBR)

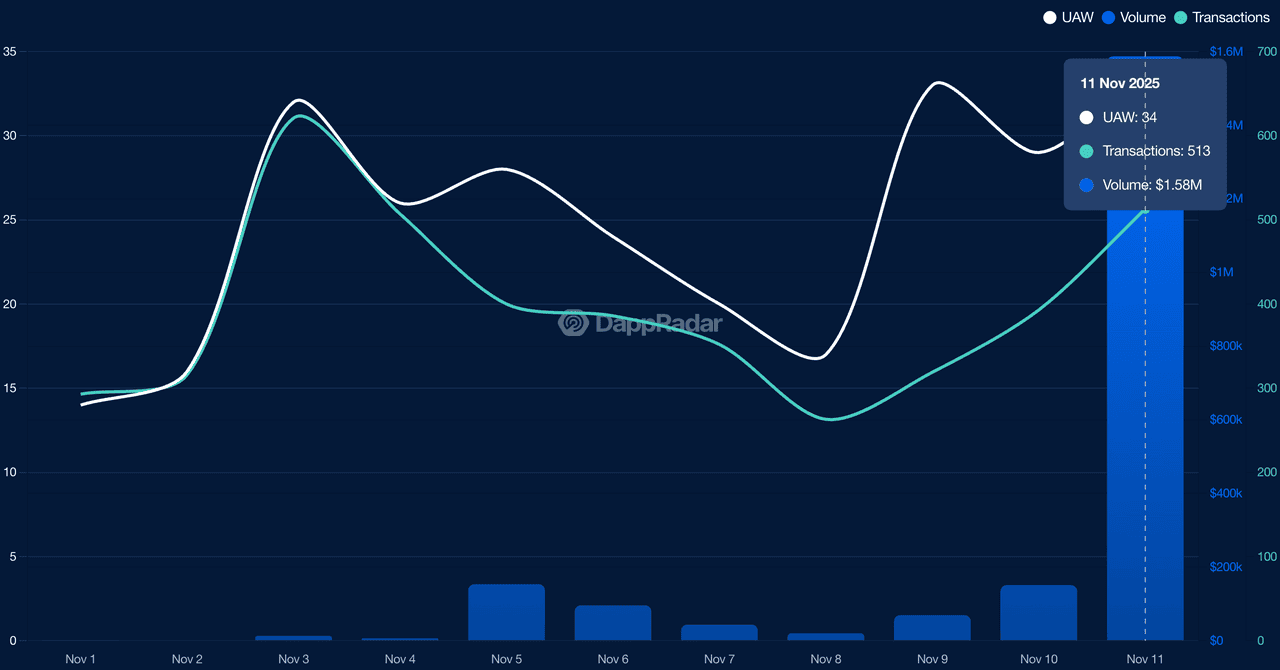

deBridge on-chain activity in November 2025 | Source: DappRadar

deBridge has become one of Monad’s most important liquidity entry points, processing $5+ million in daily cross-chain volume and securing over $20.4 million in contract balances, a 139% monthly increase, while enabling fast, low-slippage transfers between major ecosystems like Ethereum, Solana, Base, and Monad. With a median settlement time of 1.96 seconds, $17.88 billion in lifetime volume, and 0 security incidents across 26+ audits, deBridge gives Monad users a reliable way to

bridge assets such as

ETH,

SOL, USDC, and MON without multi-hop routing. As DeFi farmers increasingly rotate capital into Monad, deBridge’s role in powering cross-chain strategies, liquidity migration, and on-chain intents has made DBR a rapidly growing infrastructure token.

You can

trade DBR on BingX Spot and Futures to capture volatility and ecosystem growth as cross-chain activity accelerates.

How to Buy and Trade Monad Ecosystem Tokens on BingX

Whether you are positioning for long-term ecosystem growth or trading short-term volatility around Monad-related narratives, BingX offers multiple ways to gain exposure to key tokens like USDC, LINK, XAUT, UNI and ME. With BingX AI built directly into the trading interface, you can view real-time support and resistance zones, volatility metrics, and momentum signals before entering a position.

1. Buy or Sell Monad Ecosystem Tokens on the Spot Market

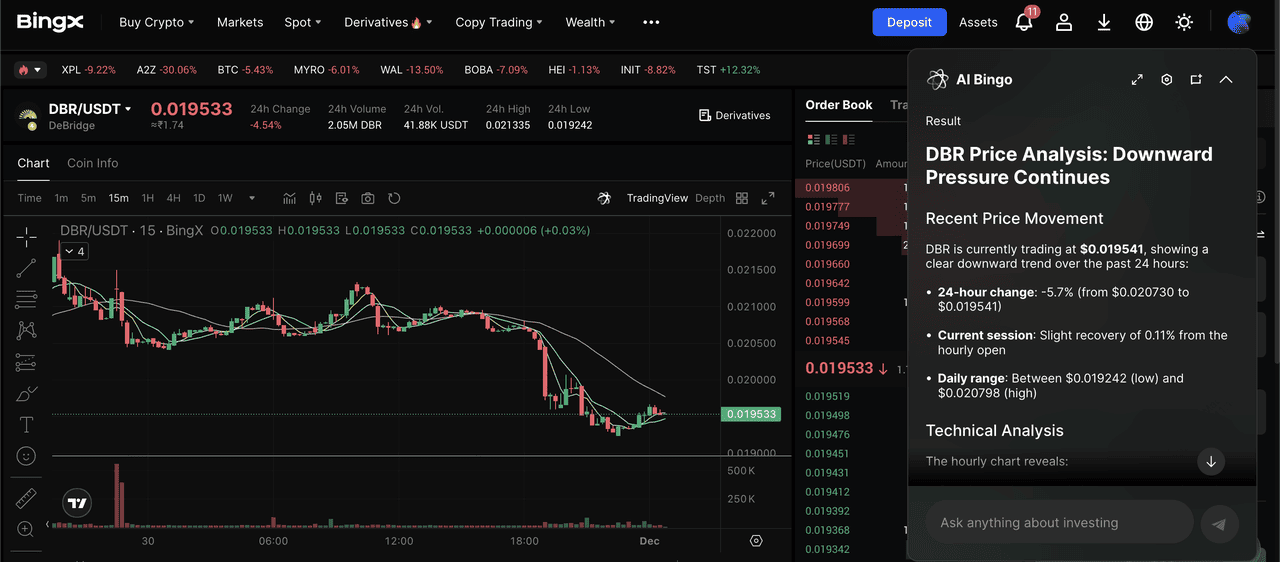

DBR/USDT trading pair on the spot market powered by BingX AI insights

Use Spot if you want to accumulate tokens or rotate between ecosystem assets without leverage.

Step 2: Click the AI icon on the top-right side of the page to enable BingX AI. It will highlight key price zones, potential breakout areas, and trend direction to help you plan entries and exits.

Step 3: Choose a

Market Order for instant execution or a Limit Order at your preferred price. Once filled, your tokens appear in your BingX Spot Wallet, ready to hold, swap, or withdraw to a

Web3 wallet if you want to interact with Monad directly.

2. Trade Monad Ecosystem Coins with Leverage on Futures

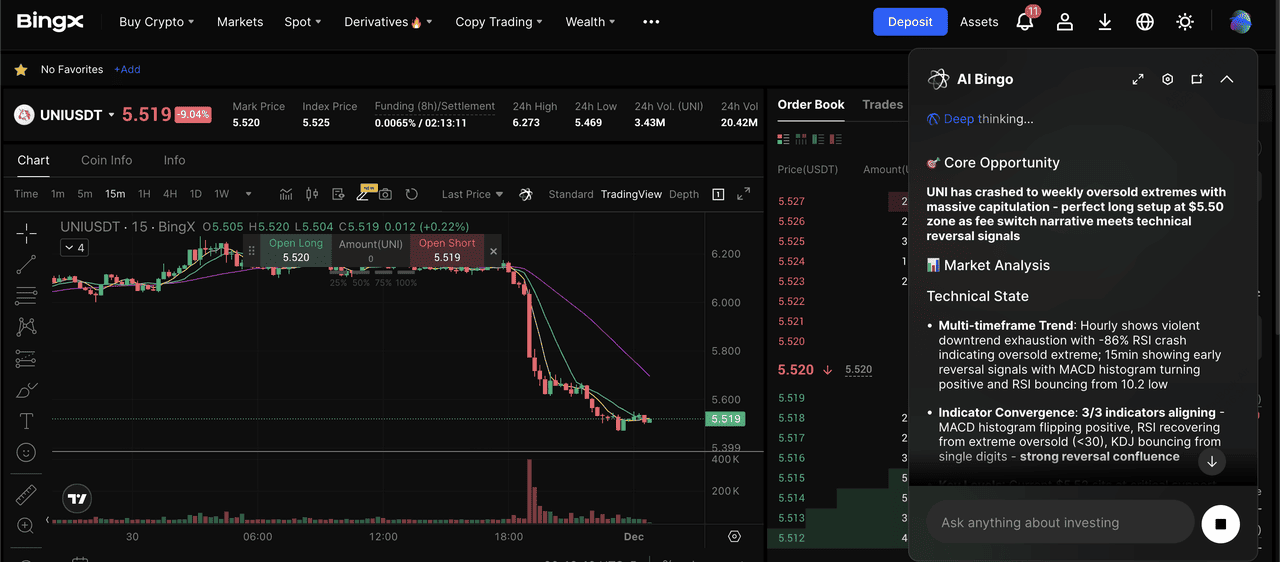

UNI/USDT perpetual contract on the futures market powered by BingX AI

For active traders, BingX also offers

perpetual futures on core ecosystem assets like LINK and USDC, with flexible leverage.

Step 2: Activate BingX AI on the futures chart to analyze momentum,

funding rates, and volatility in real time.

Step 3: Set your leverage level, choose an entry price, and place a Long (Buy) or Short (Sell) order based on your market view. Use

Stop-Loss and Take-Profit orders to control downside risk and lock in gains.

Reminder: Leverage amplifies both profits and losses. Always size your positions carefully and avoid over-leveraging on highly volatile narratives like new L1 launches.

Final Thoughts

Monad’s mainnet launch has positioned it as one of the most closely watched EVM Layer 1s heading into 2026. Its blend of high throughput, Ethereum-compatible tooling, and early support from major infrastructure players creates a strong foundation, but the real test will be whether native applications and sustainable on-chain economies emerge.

Projects like USDC, Chainlink, XAUT0, Lumiterra, Uniswap, Magic Eden, and deBridge show how diverse the Monad opportunity set already is, spanning DeFi, RWAs, NFTs, gaming, and cross-chain infrastructure. Tracking their traction, TVL, volumes, and user growth can offer early signals about whether Monad will remain a speculative narrative or evolve into a core execution layer for the next wave of on-chain apps.

Related Reading