BNB Chain’s DeFi has witnessed considerable growth in Q4 2025, with total value locked (TVL) exceeding $8 billion as of late October 2025. Daily DEX turnover peaked around $6.05 billion on Oct 7, 2025, with

PancakeSwap alone handling roughly $4.29 billion that day as memecoins pumped liquidity across pools. BNB Chain has also challenged

Solana on daily fees and app revenue several times this quarter as per public dashboards and recaps.

Below are the 7 DEXs that matter most on BNB Chain in 2025, including how they work, who they’re best for, key metrics to watch, and how to trade on BNB DEXs safely.

An Overview of Decentralized Exchanges (DEXs) on BNB Chain

A

decentralized exchange (DEX) on BNB Chain lets you trade crypto directly from your wallet through smart contracts, no centralized exchange or custody required. Liquidity comes from user-funded pools via

automated market makers or AMMs, so anyone can swap tokens or provide liquidity to earn fees.

BNB Chain DEXs benefit from fast, low-fee trading, with proposals targeting ~0.05 gwei gas and thousands of swaps per second. This has fueled $4–6 billion in daily DEX volume during peak memecoin activity, where PancakeSwap captures most of the flow and Aster’s growth has sparked a competitive “perp war” with

Hyperliquid. Broad wallet, launchpad, and token-creation integrations keep liquidity circulating on-chain, making BNB Chain a retail-friendly venue for new token launches, speculative trading, and high-turnover DEX activity.

Why Are DEXs on BNB Chain Rising in Popularity in 2025?

Several converging factors are fuelling the growth of DEXs on BNB Chain this year:

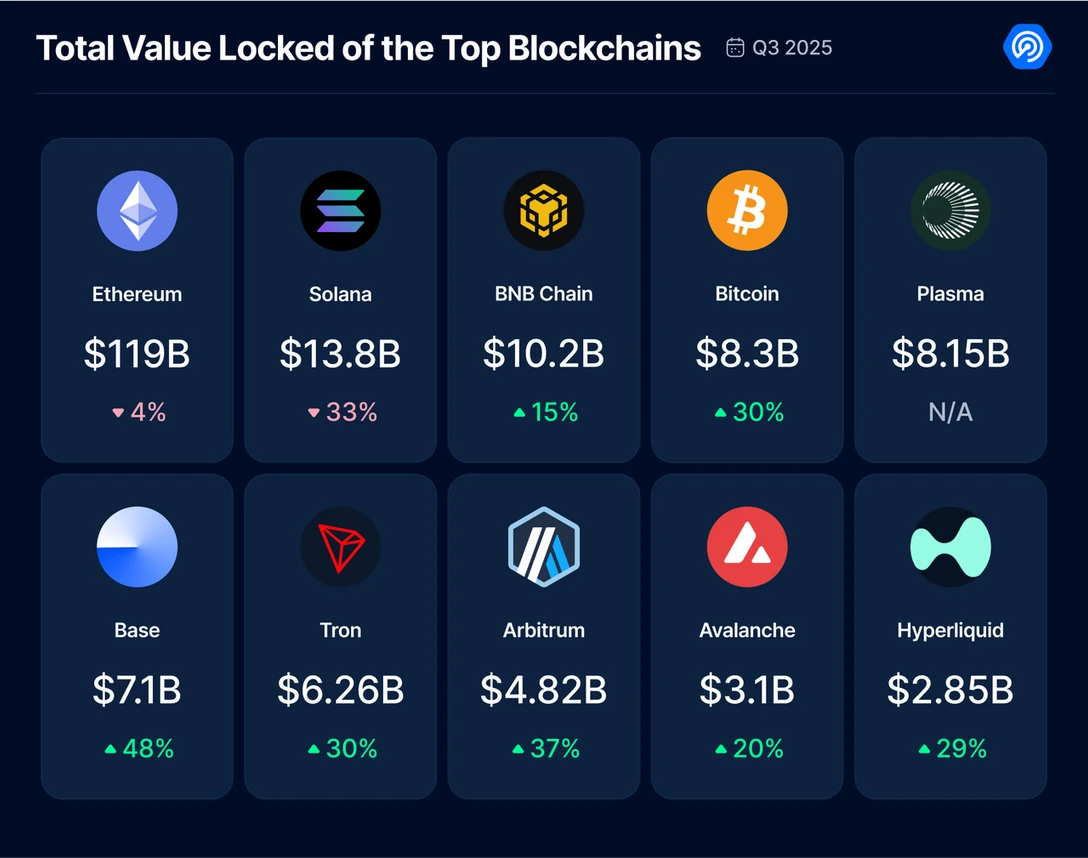

TVL growth leading blockchain ecosystems | Source: DappRadar

BNB Chain’s DEX boom is grounded in data. DappRadar reports BNB Chain’s TVL reached $10.2 billion in 2025, up 15% YoY, while DeFiLlama logged $6.05 billion in 24-hour DEX volume on October 7, 2025, with PancakeSwap alone clearing $4.29 billion. Cheaper swaps and faster settlement have accelerated this trend; validators have pushed proposals to cut gas to around 0.05 gwei and tighten block intervals, helping the network support thousands of swaps per second and making it attractive for high-frequency retail flows. Add a

memecoin-heavy retail wave on top, where new tokens launch hourly and traders rotate between pools, and you get a sustained surge in daily volume and wallet activity.

The structural tailwinds are just as important. Because BNB Chain is EVM-compatible, builders can easily port contracts, dashboards, and bots from Ethereum, expanding liquidity and tooling without a steep learning curve. Liquidity providers are drawn by yield farming, LP rewards, and fee-sharing mechanics, while traders use aggregators and

perp DEXs to hunt for edge across majors and meme tokens. Together with visible roadmap upgrades around UX, chain performance, and security, BNB Chain has positioned its DEX ecosystem as fast, cheap, liquid, and retail-friendly, creating momentum that has kept both TVL and DEX turnover trending upward in 2025.

The 7 Best DEXs on BNB Chain in 2025

We selected DEXs that are live on BNB Chain, show strong user traction and liquidity, and offer useful products like spot swaps, perps, aggregation, or yield tools. We also considered security, audits, and ecosystem reliability, favoring mature projects with proven infrastructure. Here's a look at the 7 most popular decentralized exchanges in the BNB Chain ecosystem:

1. PancakeSwap (CAKE)

PancakeSwap is the largest and most liquid DEX on BNB Chain, offering spot swaps, liquidity pools, yield farming, staking, prediction markets, NFTs, and even decentralized perpetuals. It consistently dominates on-chain trading, during peak memecoin activity on October 7, 2025, PancakeSwap processed about $4.29 billion of $6.05 billion total BNB DEX volume, while late-October data showed $2.78 billion in 24h volume and $99.3 billion over 30 days across deployments. With over $2.7 million in TVL, hundreds of thousands of daily users, and a steady stream of upgrades like fee-earning

limit orders, CAKE.PAD token launches, and automatic fee burns, PancakeSwap remains the core liquidity engine of the BNB ecosystem.

For beginners, PancakeSwap is easy to use: connect a BNB Chain wallet, verify the token contract, and keep a little BNB for gas. To avoid bad fills during hype cycles, set slippage limits around 0.1–0.5% or use limit orders on volatile pairs. Many users choose PancakeSwap because it offers the deepest liquidity on BNB Chain, broad token coverage, and clear earning options, such as farming LP tokens, staking CAKE in Syrup Pools, or joining early token events through CAKE.PAD. Frequent product updates and deflationary tokenomics also make

CAKE attractive to long-term ecosystem participants.

2. Uniswap (UNI)

Uniswap v3 is live on BNB Chain, bringing its concentrated liquidity model and advanced LP tooling to the ecosystem. Using price ranges, liquidity providers can target specific price zones to earn higher fee APRs, although this introduces greater impermanent loss risk if the price moves outside the selected range. For simple swaps, PancakeSwap is usually more beginner-friendly, but Uniswap remains a reliable choice for users who want fine-tuned liquidity strategies, solid routing across major assets, and battle-tested smart contracts. As of late October 2025, Uniswap holds around $5.23 billion TVL across chains, with nearly $90 million deployed on BNB Chain, showing steady adoption among traders and builders.

Uniswap v4, announced earlier and now in progressive rollout phases, aims to introduce “hooks” that extend customizationm like on-chain limit orders, dynamic fees, or automated strategies, directly inside the pools. Developers value Uniswap because the codebase is audited, widely integrated into wallets and aggregators, and supported by rich analytics platforms. UNI remains the governance token for upgrades, fee structures, and treasury decisions, making it a long-standing pillar for cross-chain DEX liquidity, even on BNB Chain, where PancakeSwap dominates retail flow but Uniswap serves more advanced users and liquidity managers.

3. Aster (ASTER)

Aster has quickly become one of the biggest stories in DeFi this year, rising from a post-TGE newcomer to a leading perpetuals venue with multichain support and a strong foothold on BNB Chain. Designed to rival Hyperliquid, it offers high-leverage trading, spot markets, hidden orders, and yield-bearing collateral, giving traders a CEX-style experience without giving up custody. In late 2025, Aster regularly posted some of the strongest growth metrics in the ecosystem, including snapshots where BNB-chain perps volume hit $21.6 billion in 24h, temporarily surpassing Hyperliquid’s $10.7 billion on the same day, though monthly rankings still place Hyperliquid ahead, signaling an ongoing “perp war” driven by incentives, retail flow, and rapid listings.

With $1.75 billion TVL, deep incentive programs, and an active community during

BNB memecoin season, traders pick Aster for its fast-moving listings, high liquidity, and features like Pro Mode, stock perpetuals, and hidden orders. But perps are high-risk; new users should learn about funding rates, liquidation levels, and leverage sizing before opening positions, and always set stop losses. Aster’s combination of volume, product depth, and aggressive expansion makes it the breakout perp DEX to watch on BNB Chain in 2025.

4. Superp (SUP)

Superp is a BNB-native perpetuals DEX known for its bold marketing: up to 10,000× leverage and a “No-Liquidation” design that replaces forced liquidations with fixed-duration contracts, volatility buffers, and time-based PnL. It rebranded from Vanilla Finance and gained momentum through the MVB/CMCap programs, with a SUP token airdrop and TGE in August. Despite the branding, traders can still take real mark-to-market losses, fees, funding, and time decay can erode PnL quickly, so “no liquidation” doesn’t mean risk-free, especially at high leverage.

Why users pick Superp comes down to culture and speed: meme-perps, fast listings, and a UX tuned for retail speculation on BNB Chain. The platform reports over 1.4 million traders and $37 billion+ cumulative trading volume, though on-chain TVL remains modest at around $120,000. Its token, SUP, sits near a $19 million market cap with strong retail participation and frequent listing updates. For beginners, start with tiny size, read expiry rules carefully, and test PnL math in low-volatility conditions, Superp is built for high-energy meme seasons, but the risks scale as fast as the opportunity.

5. 1inch (1INCH)

1inch is a DEX aggregator that scans and routes trades across multiple BNB Chain exchanges, such as PancakeSwap, Biswap, Sushi, and others—to secure the best available execution. Instead of swapping on a single DEX, 1inch splits your order across different pools if it results in a better price. Its relevance on BNB Chain grew sharply in 2025: according to Messari, daily routed volume jumped from $21 million to $611 million in Q2 2025 (+2,796% QoQ), with 73% of all 1inch routing happening on BNB that quarter. This shows how much BNB liquidity and token discovery now flows through 1inch’s smart routing engine.

Users choose 1inch for price discovery, path-finding, and built-in limit orders, especially for mid-cap and long-tail tokens where prices can differ across pools. Beginners can start by comparing a quote on 1inch with PancakeSwap directly to see if routing improves execution. Just keep an eye on gas + aggregator fees + DEX fees, the “best price” isn’t always the best net outcome after costs. With a TVL of about $5 million and a long-running track record across chains, 1inch remains a practical tool for traders who want better fills without manually checking multiple DEXs.

6. Biswap (BSW)

Biswap is a long-running BNB Chain DEX known for low swap fees and generous revenue-sharing for liquidity providers. Its docs highlight that LPs receive up to 80% of trading-fee revenue on v3, which is higher than many AMM peers, and external reviews note 0.1%–0.2% swap fees plus fee-mining mechanics (always verify the latest rate in-app). Beginners providing liquidity can start with wide price ranges on v3 to reduce active management, while swappers can compare Biswap’s quotes against PancakeSwap and 1inch to see if routing improves their execution. Users often choose Biswap for its simple UX, low advertised fees, and LP-friendly revenue split, supported by a TVL of roughly $16 million and a long history of retail participation on BNB Chain.

7. SushiSwap (SUSHI)

SushiSwap remains a familiar, multichain AMM with an active BNB Chain deployment, so users who already trade on Sushi across Ethereum,

Arbitrum, or

Polygon can keep the same interface when swapping BEP-20 tokens. It’s simple to use, just connect a wallet, select the BNB router, and pay gas in BNB making it a convenient option for cross-chain portfolios that want one consistent dashboard. With over $140 million in TVL chain-wide and around $557,000 on BNB, and broad integration across wallets, portfolio trackers, and DeFi dashboards, users often choose Sushi when they want a trusted UI, basic swaps, and multichain familiarity rather than learning a new exchange from scratch.

How to Start Trading on a BNB DEX: A Beginner’s Guide

Getting started on a BNB DEX is easy, even if you’re new to DeFi. First, you’ll need a

crypto wallet such as

MetaMask,

Trust Wallet, or any other web3 wallet that supports the BNB Chain network. Next, fund it with BNB for gas fees and swaps. The simplest way to do this is by

buying BNB on BingX Spot Market, then withdrawing it to your wallet’s BNB address.

Once your wallet has BNB, visit a trusted DEX like PancakeSwap, 1inch, or Biswap, and connect your wallet through the official website. Select the token pair you want to trade, set your slippage, and approve the transaction. After swapping, the tokens will appear directly in your wallet. Always start with small amounts, double-check token contract addresses, and keep a little extra BNB for future transaction fees.

How to Trade BNB DEX Tokens on BingX

You don’t need to use a DeFi wallet to access BNB ecosystem tokens. BingX lets you buy or trade them directly on a centralized exchange with deep liquidity and simpler execution. Even better,

BingX AI is built into the trading interface, giving you real-time support and resistance levels, trend detection, and volatility signals to help you make faster, more informed decisions.

Spot Trade BNB DEX Tokens

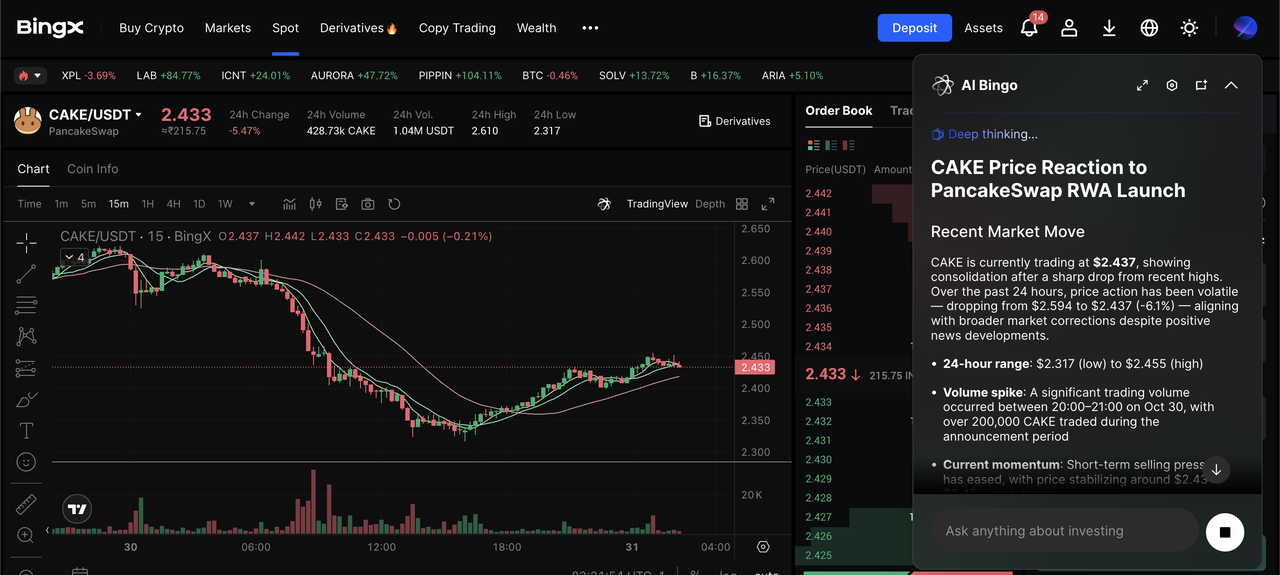

CAKE/USDT trading pair on the spot market powered by BingX AI insights

2. Tap the AI icon on the chart to activate BingX AI and view support zones, breakout signals, and suggested levels.

3. Choose a Market Order for instant execution or a Limit Order to buy at your preferred price. Once filled, tokens will appear in your Spot balance and can be held, staked, or withdrawn to a

Web3 wallet.

Trade BNB DEX Tokens with BingX Futures

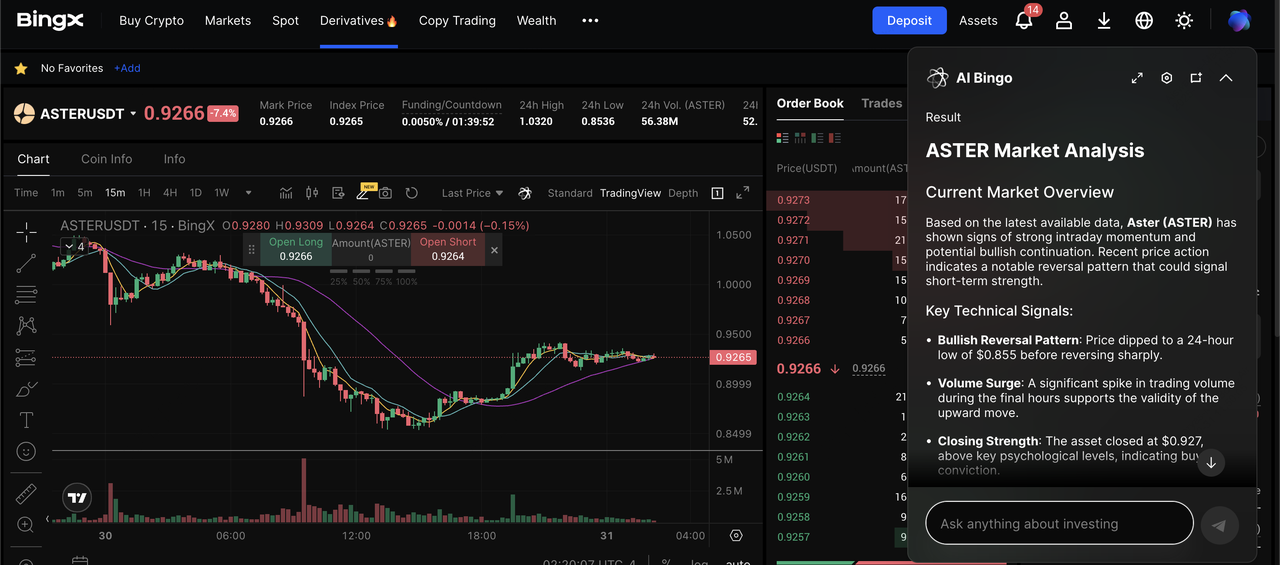

ASTER/USDT perpetual contract on the futures market powered by BingX AI

2. Enable BingX AI for real-time trend direction, volatility changes, and risk alerts.

3. Set your leverage, choose Long (price up) or Short (price down), and place the order. Add

Stop-Loss and Take-Profit levels to manage risk.

Whether you’re buying BNB to bridge into DeFi or trading short-term opportunities with leverage, BingX provides a user-friendly way to access BNB ecosystem tokens with built-in AI guidance and exchange-level security.

Closing Thoughts

BNB Chain has evolved into one of the most active on-chain trading environments in 2025, offering a mix of deep spot markets, rapid token launches, and increasingly competitive perpetuals. Platforms like PancakeSwap, Uniswap, Biswap, SushiSwap, Aster, Superp, and 1inch each play a different role in the ecosystem, giving traders plenty of choice depending on liquidity, asset type, or trading style. Beginners can start small with trusted DEXes, verify token contracts, and keep slippage settings conservative before exploring more advanced products.

For users who prefer exchange-grade execution, regulated custody, and built-in decision support, BNB-ecosystem tokens are also available on BingX Spot and Futures, where BingX AI helps highlight trend shifts, volatility spikes, and potential entry zones. As always, crypto markets carry risk, especially during high-volume memecoin cycles and leveraged trading, so only invest what you can afford to lose and double-check every transaction before confirming.

Related Reading