Opinion is a

decentralized prediction market that lets you trade directly on real-world events such as interest-rate decisions, inflation data, elections, and crypto news, rather than using noisy proxies like BTC, gold, or stocks. Built initially on the

Monad testnet and now launching its mainnet exclusively on

BNB Chain, Opinion combines an

AI oracle, on-chain orderbook infrastructure, and DeFi-ready contracts to turn economic beliefs into tradeable assets.

Alongside trading, Opinion runs the OPINION Point System (PTS), a weekly rewards program that gives points to active traders, liquidity providers, and holders of conditional tokens. These points are expected to play a central role in future incentive and Opinion airdrop distributions, so early users who meet the activity thresholds may capture outsized upside.

In this guide, you’ll learn what the Opinion prediction market is, how the trading and pricing model works, and exactly how to earn points on the platform through PTS, liquidity farming, and referral campaigns.

What Is Opinion Prediction Market by Opinion Labs?

Opinion Labs is a prediction-market and oracle protocol launched in 2024 to build decentralized prediction markets, opinion markets, and consensus oracles. Its core product, the Opinion prediction exchange, often referred to via Opinion.Trade or O.LAB, lets you trade “Yes/No” style contracts on macro data, policy decisions, and other real-world events.

Instead of betting indirectly via BTC or bonds, you trade the event itself, for example, “

Fed cuts rates by 25 bps at the next meeting,” or “US CPI prints above 3%.” Each contract has a clear rule set and resolves to $1 if the outcome happens, or $0 if it does not. This gives you clean exposure to your view on the data, without the extra noise of broader market swings.

Opinion’s vision is to “democratize economic trading” by standardizing macro risk as an on-chain asset class. The platform targets both retail traders who want simple, direct macro trades and institutions who need clean probability curves for hedging, pricing, and research.

What Can You Trade on Opinion?

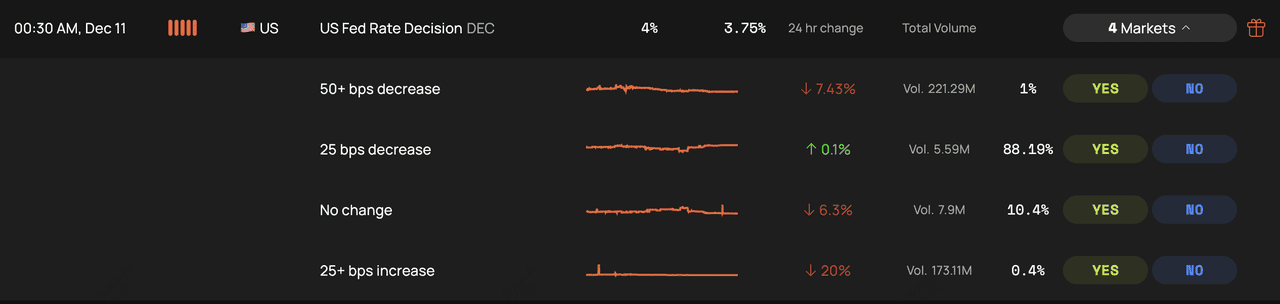

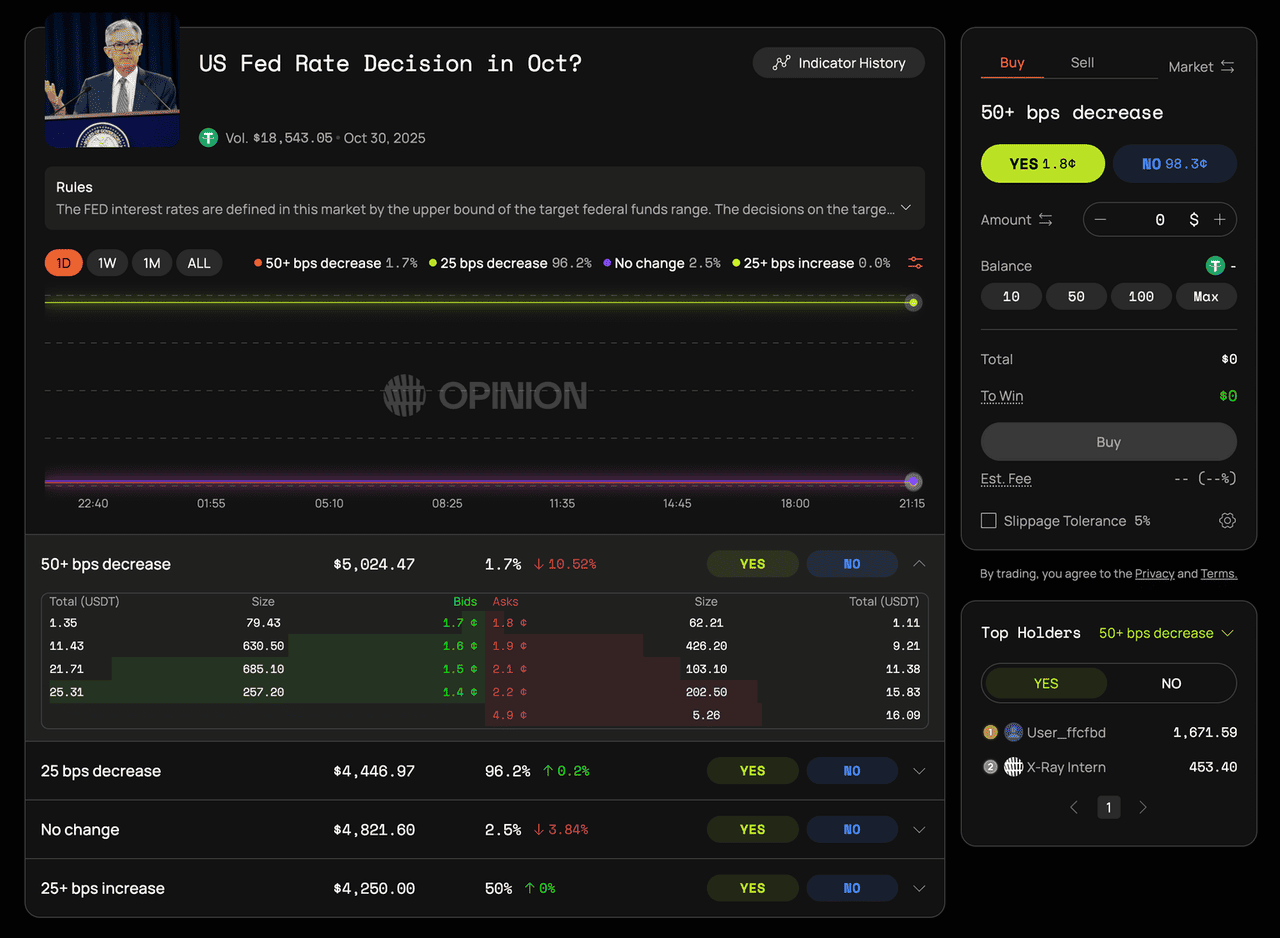

Fed rate decision poll on Opinion prediction market platform | Source: Opinion

Opinion lets you trade Yes/No markets on macro data, crypto moves, political outcomes, and community events, each with clear rules, transparent AI-oracle resolution, and share prices that reflect the live probability of the outcome.

• Macro and Central Banks:

- “Will the US FOMC cut rates by 25 bps at the December meeting?”

- “Will Eurozone CPI exceed 3.0% year-over-year in Q1?”

• Crypto and Markets:

- “Will BTC close above $100,000 on 31 Dec 2025?”

- “Will ETH ETFs be approved in the US by Q2 2026?”

• Politics and Policy: Election outcomes, policy votes, regulatory announcements.

• Community Events: Platform-specific or social events with well-defined outcomes.

How Opinion Prediction Exchange Works: The Opinion Stack

Opinion is built as a four-layer “Opinion Stack” that powers its prediction exchange and ecosystem:

1. Opinion.Trade – The live prediction exchange where you browse markets, trade Yes/No shares, and manage your portfolio.

2. Opinion AI – A decentralized multi-agent AI oracle that helps design market rules, enforces resolvability standards, and resolves complex, unstructured data, e.g., narrative-heavy economic releases or policy statements.

3. Opinion Metapool – Unified liquidity infrastructure that links liquidity across markets and increases depth, so you can trade macro themes with tighter spreads and better price discovery.

4. Opinion Protocol – A universal token/contract standard so prediction markets can plug into other DeFi protocols as collateral, structured products, or hedging instruments.

Together, these layers aim to make “economic risk” a clean, programmable primitive. In the long run, DeFi apps could adjust parameters based on CPI expectations, lenders could price risk using Opinion-derived probabilities, and institutions could package prediction contracts into structured products.

How Do Prices and Probabilities Work on Opinion?

On Opinion, each share’s price reflects the market’s estimated probability of an outcome, for example, a Yes price of $0.65 suggests a 65% chance it happens. If the event resolves in your favor, your share settles at $1; if not, it goes to $0. You can also sell early if prices move your way, since odds update constantly based on live trading.

How Do Opinion's Order Book, Market Orders, and Limit Orders Work?

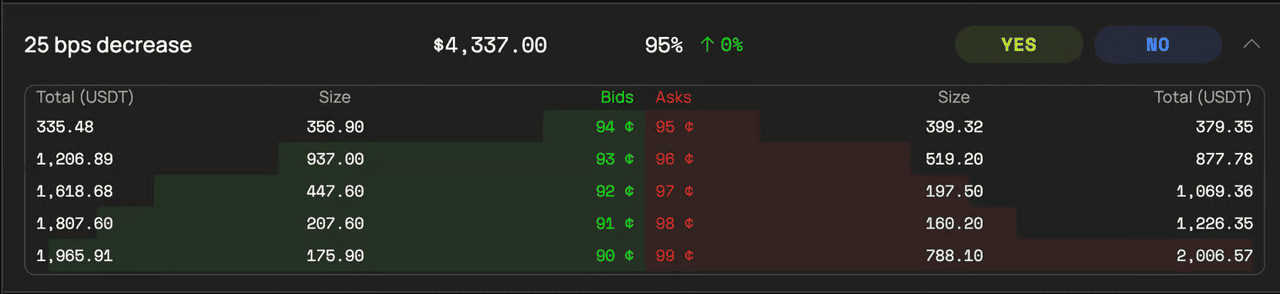

Order book on Opinion | Source: Opinion docs

Opinion uses a central limit order book (CLOB) similar to centralized exchanges:

• Market orders (takers): Execute instantly at the best available price. You “take” liquidity from existing orders in the book.

• Limit orders (makers): You set your desired price and quantity. Your order rests on the book until another trader matches it. Orders can fill partially over time.

The bid (green) shows top buyer prices, the ask (red) shows top seller prices, and the gap between them is the spread. For advanced users, placing tight, well-sized limit orders near the current odds not only improves your fills but is also the main way to farm higher PTS scores.

What Are the Fees to Trade on Opinion's Decentralized Prediction Market?

Opinion’s fee design is unusual: it charges only takers, while makers generally trade fee-free.

• Takers pay, makers free: Market orders or any order that executes immediately pay a fee. Resting limit orders that add liquidity typically pay 0 fees, even if you signed a transaction including fee terms.

• Dynamic fee curve: Fees range from 0% to ~2% of notional trade size. Fees are highest around 50% probability, where uncertainty and matching load are greatest. Fees taper toward 0% and 100%, where outcomes are more certain and trading is more one-sided.

• Minimums and thresholds: Minimum order size around $5 and minimum fee of $0.50 to prevent micro-transactions from burning gas. Fees are denominated in the settlement asset, e.g., USDT.

• Stackable discounts: User tier, promotional campaigns, and referral discounts multiply together for up to 100% fee reduction (floor $0.50 still applies).

Because of this structure, active makers providing depth can both trade more cheaply and earn more points under PTS, while takers pay higher fees for instant execution during high-uncertainty moments.

What Blockchain Network Does Opinion.Trade Run on?

Opinion began on a Monad testnet in early 2025 and later confirmed its mainnet deployment exclusively on BNB Chain, chosen for its low fees, fast finality, and

BNB's strong DeFi ecosystem, providing efficient execution, better liquidity integration, and alignment with key BNB-native backers like YZi Labs.

How to Start Trading on Opinion Exchange

Here’s a simple, beginner-friendly walkthrough to help you start trading on the Opinion exchange safely and confidently, even as the interface evolves.

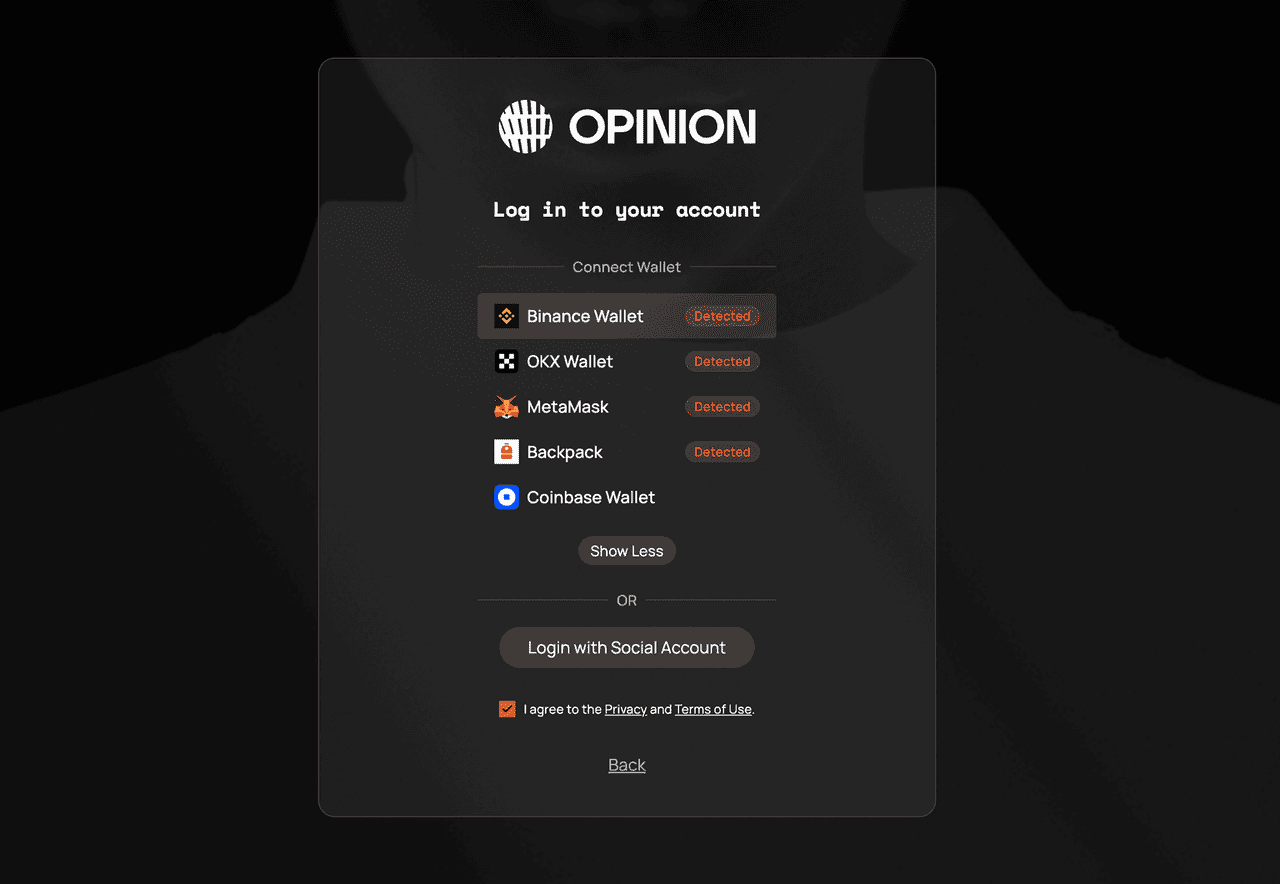

Step 1: Connect Your Wallet or Social Account

Visit the Opinion app and click “Connect Wallet.” Supported

web3 wallets include

MetaMask,

Base App, and other

EVM wallets compatible with BNB Chain. Approve the connection and sign the message to log in.

Source: Opinion docs

Alternatively, you can log in with a Google or X (Twitter) account, then bind your wallet later.

Step 2: Fund Your Trading Balance

Ensure your wallet holds a supported settlement asset, e.g.,

USDT,

USDC or chain-specific

stablecoins, depending on the current configuration. You can buy crypto on BingX, and bridge or transfer funds to BNB Chain if necessary. Deposit or approve token spending as prompted in the Opinion UI.

Step 3: Choose a Prediction Market

Go to the Market or Trending page to browse open markets. Use filters like macro, crypto, politics, etc., and sorting tools to find events you care about. Click into a specific market to view:

• Description and rules

• Graph of historical prices

• Current Yes/No odds and order book

Step 4: Place Your First Trade

In the trading panel:

1. Choose Yes or No.

2. Select Market if you want instant execution, or Limit if you prefer a specific price.

3. Enter your dollar amount or quantity of shares.

4. Confirm the trade and sign the transaction.

After execution, your position appears in your portfolio, where you can track size, average buy price, current mark price, and unrealized P&L (profit and loss).

Source: Opinion docs

Step 5: Manage Your P&L and Open Orders

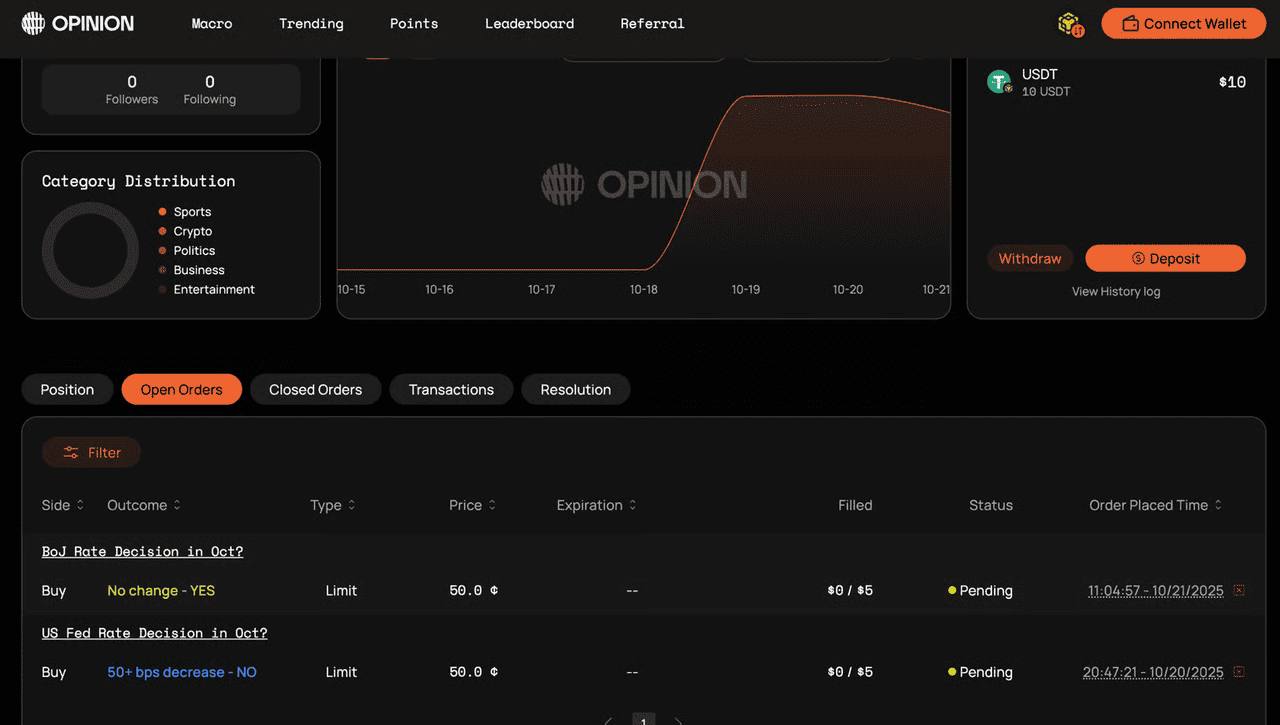

Open orders on Opinion | Source: Opinion docs

• Open Orders tab: View, edit, or cancel limit orders that haven’t fully filled.

• Portfolio / Positions: See your unrealized P&L, either in dollars or percentage terms, based on the current market price or oracle price.

Portfolio on Opinion | Source: Opinion docs

• Net worth in the interface equals current holdings’ market value + available balance.

You can close out positions early by selling your shares back into the order book, or hold them until the oracle resolves the market.

What Is the OPINION Point System (PTS)?

The OPINION Point System (PTS) is the platform’s core incentive mechanism. It rewards users who actively contribute to liquidity and price discovery with points that are expected to convert into future rewards, for example, token allocations, fee rebates, or other incentives, based on future announcements. There is no fixed conversion rate yet, but your share of points will likely determine your share of any future distributions.

Key design goals:

• Incentivize profitable and informed trading strategies.

• Reward quality liquidity provision and long-term participation, not just short-term noise.

• Build a “truth machine” that uses trading activity to generate high-quality prediction data for institutions and DeFi protocols.

How to Qualify for PTS Rewards on Opinion Exchange

Before you earn any points, you must meet a minimum weekly activity threshold:

• Reach at least $200 in total trading volume per week across your Opinion trades.

• This requirement filters out wash-trading and ultra-small accounts and ensures rewards go to users who actually contribute to markets.

Once you hit the threshold, you compete for a fixed pool of points distributed weekly, for example, around 100,000 points per week in many seasons, with your share based on your relative contribution versus other users. Leaderboards update each week to show rankings.

How to Participate in Opinion Airdrop: Three Main Ways to Earn Points

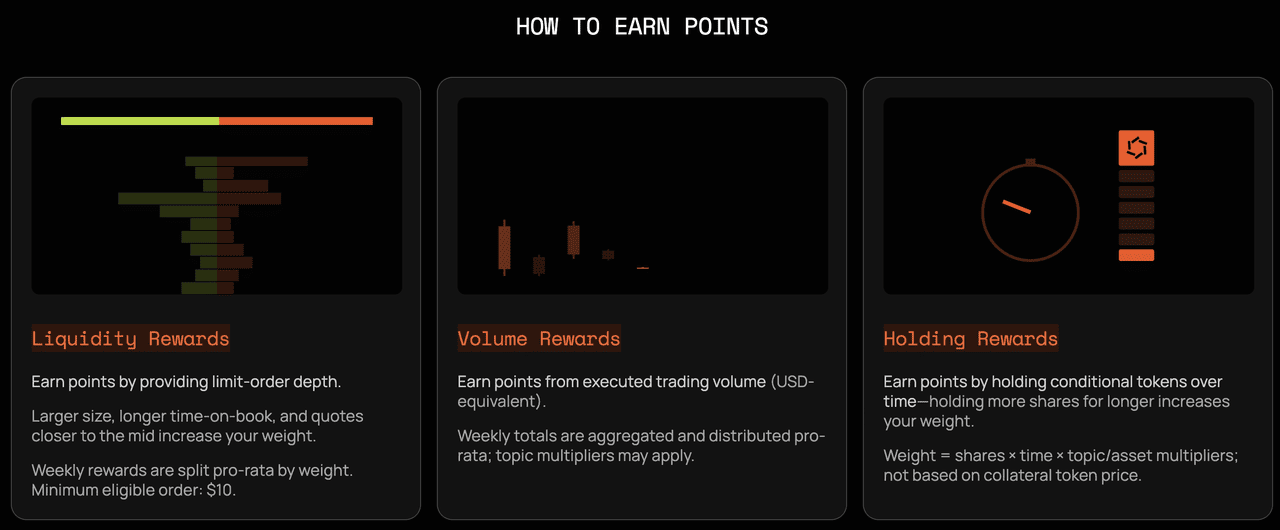

How to earn points and participate in Opinion airdrop | Source: Opinion

Opinion’s PTS framework scores you across three main behaviours:

1. Provide Liquidity with Limit Orders

This is usually the most efficient way to farm points.

• Place limit orders or maker orders near the current market price.

• The closer your order is to the mid-price, and the larger and longer it stays on the book, the more weight it carries.

• Orders over roughly $10 notional are typically classified as meaningful liquidity and eligible for rewards.

Example: If the market odds for “Fed cuts rates in December” are 0.20, a limit buy at 0.19 earns more points than an order far away at 0.10, because it improves price discovery and actual depth at live prices.

Maker orders both earn you PTS and often pay zero trading fees, creating a strong compounding effect over time.

2. Trade with Conviction for Volume Rewards

You also earn points based on your executed trading volume:

• Larger, well-timed trades that reflect genuine information or conviction earn more PTS.

• Volume is usually measured in USD-equivalent notional across all markets you trade.

• Some topics, e.g., flagship macro markets, may have multipliers that boost volume rewards.

This design aims to reward traders who actually move markets toward fair value, rather than spam small orders.

3. Hold Positions Over Time to Earn Holding Rewards

Opinion also rewards holding conditional tokens:

• Points scale with number of shares × holding duration × topic multipliers.

• Longer holding periods in designated markets can earn more PTS than extremely short-term flips.

This encourages users to back their beliefs with time, not just quick trades, and it stabilizes liquidity around key economic events.

How to Maximize Earning Points on Opinion

Within these three pillars, some behaviours earn extra weight:

• Early Maker Liquidity:

- Providing deep order-book liquidity in newly listed or early-stage markets.

- Often comes with higher multipliers that gradually converge to normal rates.

• Designated Markets: Opinion may flag special markets, e.g., major Fed decisions, with boosted rewards.

• “Quality Trading” Patterns: Orders and positions that improve price accuracy and reduce noise. For example, informed limit orders around important data releases.

You can track your scores and rewards in the Points or PTS dashboard, with weekly snapshots and rankings.

What Is the Opinion Referral Program to Earn Discounts and Potential Bonus Rewards?

Opinion also runs a referral program tied to trading volume:

• Once your total trading volume reaches around $1,000, you can generate a unique referral code/link.

• Invitees who bind your code get up to 10% trading-fee discounts on their taker orders.

• Referrers may receive a percentage of invitees’ fees as rebates, plus potential bonus points or other campaign-based incentives.

Note: Discounts stack with other fee promotions but cannot reduce fees below the minimum. You cannot change your bound referral code later, so choose carefully.

This system aligns with PTS by rewarding users who bring in active, long-term traders, not just one-time sign-ups.

How Is Opinion Different From Polymarket and Kalshi?

Opinion,

Polymarket, and Kalshi are all event-trading platforms, but they differ in design, regulation, and the type of user they target:

Opinion vs. Polymarket

Polymarket runs on

Polygon and uses a market-maker model for pricing, while Opinion uses a full on-chain order book (CLOB), an AI oracle for complex resolutions, and a points system that rewards liquidity provision. Opinion also focuses heavily on macro-economic markets and DeFi composability, whereas Polymarket emphasizes fast retail-friendly prediction markets across broader categories.

Opinion vs. Kalshi

Kalshi is a fully regulated, CFTC-approved prediction exchange for U.S. users, operating entirely within traditional finance rails and restricting crypto-based trading. Opinion, by contrast, is a decentralized platform on BNB Chain with permissionless access, crypto settlement, and an incentive system (PTS) that rewards market participation, making it more flexible but also subject to typical Web3 risks rather than U.S. regulatory protections.

In short, Kalshi is regulated TradFi, Polymarket is a retail-friendly on-chain prediction platform, and Opinion positions itself as a macro-focused, AI-oracle-powered InfoFi infrastructure with DeFi-native incentives.

What Are the Key Benefits of Using Opinion Prediction Markets?

Opinion aims to solve the “proxy trading problem” in macro and crypto: instead of guessing how BTC or stocks will react to a Fed move, you can just trade the event itself. Some potential advantages:

• Direct macro exposure: Trade CPI, rate decisions, employment data, and policy outcomes without layering multiple proxies.

• Cleaner signals for trading and research: Implied probabilities from Opinion can feed into your broader trading strategies on other platforms.

• Institution-friendly data: Institutions can use probability curves for hedging, pricing structured products, and research.

• DeFi composability: Over time, prediction tokens could be used as collateral in lending, automated hedging, or structured DeFi strategies.

For traders, Opinion is both a venue to express macro views and a source of data on how the market is pricing key events.

As with any prediction market, Opinion comes with important risks:

• Regulatory uncertainty: Prediction markets occupy a grey area in many jurisdictions. Future regulatory actions could restrict access, change product design, or impact incentives.

• Smart-contract and oracle risk: Bugs or oracle failures could mis-resolve markets or cause loss of funds, even with an AI-oracle and multi-agent design.

• Liquidity risk: Some markets may have shallow liquidity or wide spreads, making it costly to open or close larger positions.

• No guaranteed token/airdrop: While points are strongly implied to be tied to future incentives, there is no guaranteed conversion rate or timeline. Points are a speculative upside, not a sure reward.

• Market risk: Even if your macro thesis is right, you can still lose money due to bad timing, leverage, or mis-sized positions.

You should treat Opinion like any other high-risk trading venue and only trade with funds you can afford to lose.

Closing Thoughts

Opinion brings a new approach to on-chain trading by letting users trade real-world events directly and earn PTS for contributing liquidity and price accuracy, offering a more precise way to express macro views than traditional crypto assets. If you’re comfortable with Web3 tools, you can connect a wallet on BNB Chain, trade Yes/No markets, and use limit orders to earn points, while staying mindful of regulatory uncertainty, contract risks, and the experimental nature of reward systems.

Related Reading