The summer of 2025 has been full of surprises in the crypto market, but one token quietly turned heads with a steady and meaningful rally:

API3 (API3). Over the past month, the token has climbed over 70%, outpacing many DeFi tokens and re-establishing itself as one of the top oracle projects in the market.

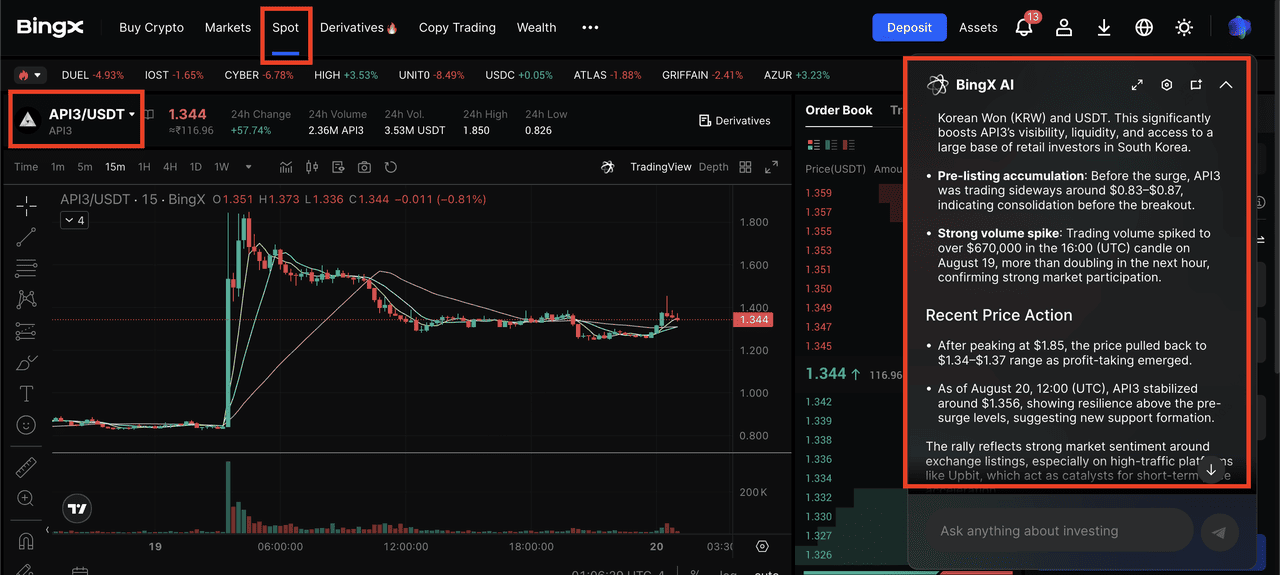

API3 price surged over 78% in one month | Source: BingX

Unlike meme-fueled pumps, API3’s rally is tied to real fundamentals, from its role in powering DeFi data infrastructure to growing adoption of its Oracle Extractable Value (OEV) system. New exchange listings on Upbit in August 2025 further amplified demand, driving trading volume to record highs.

In this article, we break down what API3 is, why it’s rallying now, technical and ecosystem catalysts, how to earn OEV rewards on API3, what to watch next, and how you can trade API3 tokens on BingX.

What Is API3 (API3) Oracle and How Does It Work??

API3 is a decentralized oracle network designed to solve one of DeFi’s biggest challenges: bringing real-world data onto blockchains in a secure, transparent way.

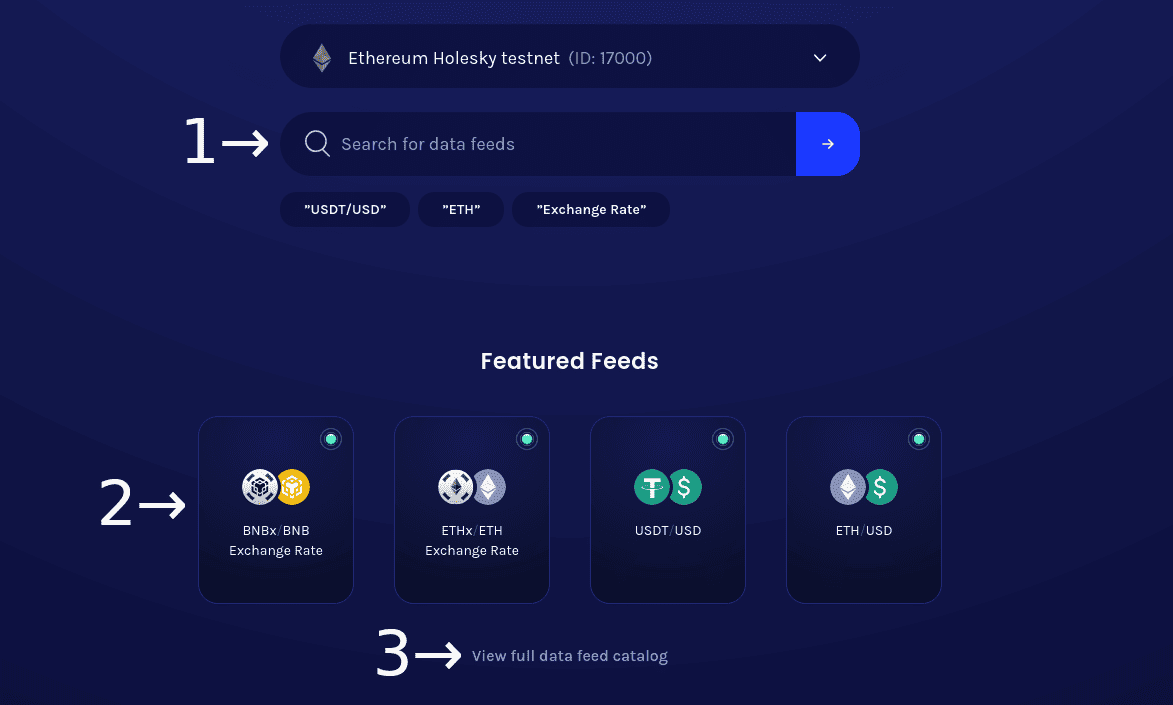

An overview of API3 Market | Source: API3 docs

Most smart contracts need price feeds or external data to function, such as lending platforms needing

ETH/USD prices to trigger liquidations. Traditionally, this job is handled by third-party oracles like

Chainlink. But the problem is, they act as middlemen between data providers and blockchains, creating opacity and value leakage.

API3 changes that model through first-party oracles. Instead of relying on third-party relayers, API3 enables API providers themselves (e.g., CoinGecko, financial data firms) to run oracles directly using its Airnode technology. This ensures:

• Transparency: Data comes straight from the original source.

• Verifiability: All updates are cryptographically signed.

• Lower Costs: No unnecessary intermediaries.

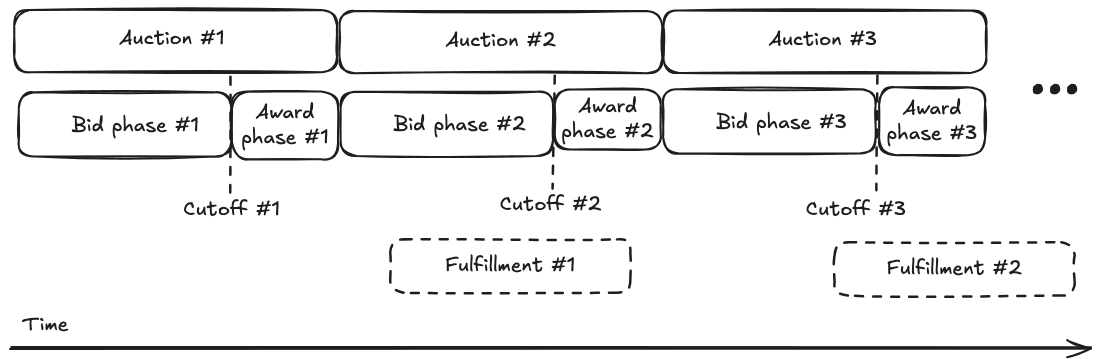

API3 also pioneered Oracle Extractable Value (OEV), a mechanism that allows DeFi protocols to earn revenue from their own oracle usage. Traditionally, MEV (Maximal Extractable Value) searchers profited from oracle-triggered events like liquidations. With API3’s OEV auctions, that value is redirected back to the dApp itself.

In short, API3 turns oracles from a cost center into a revenue stream.

What Are the Key Features of API3?

Here’s what makes API3 stand out in the crowded oracle market:

1. First-Party Oracles: API3 lets data providers like CoinGecko run their own nodes, so smart contracts get information directly from the source. This removes middlemen and makes the data more transparent and verifiable than legacy oracles.

2. OEV Rewards System: API3’s Oracle Extractable Value (OEV) system auctions off the right to update data feeds, creating a new revenue stream. 80% of the proceeds are paid back to dApps in native tokens, turning oracle usage into income rather than a hidden cost.

3. Wide Chain Coverage: API3 already powers over 200 feeds across 40+ blockchains, including

Ethereum,

Arbitrum, Base,

Mantle, and

Sei. Its infrastructure is built to expand quickly to new

L2 networks, giving developers flexibility and reach.

4. Airnode & dAPIs: Through its Airnode middleware, API3 allows developers to integrate decentralized APIs (dAPIs) in just a few clicks. With Api3 Market, anyone can activate and use feeds in minutes without complex contracts or negotiations.

Why Has API3 Token Surged Over 70% in the Past Month?

API3’s 73% rally over the past month is driven by more than short-term speculation. A key catalyst was its listing on Upbit in South Korea, which boosted liquidity and drew strong regional investor demand. API3 currently powers over 200 live price feeds across 40+ blockchains, from Ethereum and Arbitrum to Base, Sei, and

Polygon zkEVM. More than 40 decentralized applications actively use its first-party oracle feeds, with 12 of them already receiving payouts from its Oracle Extractable Value (OEV) system.

To date, over $281,000 in OEV rewards has been redistributed back to protocols, value that would otherwise have been lost to MEV bots. Integrations with lending and DeFi platforms such as

Compound Finance,

Yearn Finance, Moonwell, Lendle, and INIT Capital showcase its role as revenue-generating infrastructure rather than passive middleware.

Finally, API3’s surge reflects a broader trend in the 2025 bull market: the outperformance of infrastructure-driven tokens. Investors are increasingly rewarding projects that deliver measurable utility, verifiable data, and sustainable economic alignment. In this environment, API3’s narrative of “oracles that pay you” stands out. By turning data feeds into both a critical service and a revenue source for dApps, API3 fits squarely into the shift toward DeFi platforms that generate real value for their users and ecosystems.

How to Earn OEV Rewards on API3

How OEV Auctioneer works | Source: API3 docs

One of API3’s biggest innovations is Oracle Extractable Value (OEV) Rewards, which turn data usage into income for DeFi protocols. Instead of MEV bots capturing profits around oracle updates, API3 auctions off the right to perform those updates and sends 80% of the proceeds back to the dApp in the chain’s native token. Here’s how projects can start earning:

1. Integrate API3 Feeds Through Api3 Market: Developers can visit

Api3 Market and activate a price feed by purchasing a subscription plan. Once activated, the feed can be dropped into a smart contract just like any traditional oracle, with no major code changes needed.

2. Enable OEV Rewards: When setting up the integration, developers can choose the “Earn OEV Rewards” option instead of the default. This deploys a dedicated Api3ReaderProxyV1 contract for the dApp, ensuring that its oracle updates are included in OEV auctions.

3. Register Your dApp for Rewards: The dApp must be registered with API3 so that the OEV Network can run auctions on its behalf. This step also ensures that the dApp’s name appears in Api3 Market, making it discoverable for searchers.

4. Receive Monthly Payouts: At the end of each month, 80% of the auction proceeds are automatically paid out to the dApp in the native token of its chain (e.g., ETH on Ethereum,

POL on Polygon). The remaining 20% is retained as protocol fees.

For developers, the process is as simple as switching from a traditional data feed to an API3 feed and toggling on OEV Rewards. From that point forward, oracle updates generate ongoing revenue, helping protocols reinvest in liquidity, incentives, or ecosystem growth.

API3 Token Utility and Tokenomics

The API3 token (API3) is the native asset of the API3 ecosystem and serves multiple purposes that go beyond simple trading. Its primary role is in governance, where holders participate in the API3 DAO, the decentralized organization that oversees upgrades, protocol parameters, and partnerships. This ensures the project’s infrastructure remains community-driven rather than controlled by a central entity.

Another core utility is

staking. Holders can stake API3 into the insurance pool, which secures dApps against potential oracle failures. In return, stakers receive weekly rewards while also gaining voting power in the DAO. Staking aligns incentives across data providers, developers, and token holders by rewarding long-term commitment.

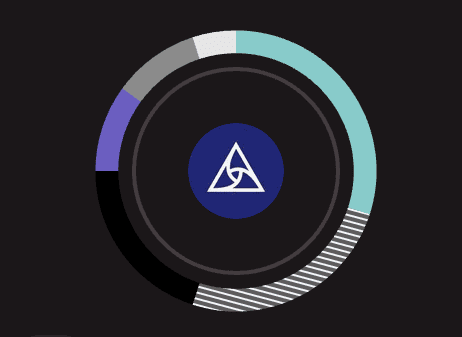

API3 Token Distribution

API3 token allocation | Source: Tokenomist.ai

The total supply of API3 tokens is capped at 150.72 million. Allocation is structured to support long-term development, incentivize ecosystem growth, and align the founding team with community interests:

• Founding Team – 30%: Reserved for the project’s core team, with vesting schedules in place to ensure long-term commitment.

• Ecosystem Fund – 25%: Dedicated to partnerships, integrations, grants, and other initiatives that expand API3 adoption across chains and DeFi protocols.

• Public Distribution – 20%: Made available through token sales and listings to ensure broad market participation and liquidity.

• Partners & Contributors – 10%: Allocated to strategic partners, advisors, and contributors who support the growth of the API3 ecosystem.

• Seed Investors – 10%: Early backers who provided funding during the project’s initial development stages.

• Pre-Seed Investors – 5%: Allocated to the earliest investors who supported API3 before its public launch.

How to Trade API3 on BingX

You can trade API3 (API3) easily on BingX through the Spot Market or the Futures Market. Both options are available in the BingX app or website, and BingX AI can guide you with real-time insights and suggestions at every step.

1. Buy or Sell API3 on BingX Spot Market

API3/USDT trading page on the spot market, powered by BingX AI's insights

Spot trading is the simplest way to buy and own API3.

• Once the trade is complete, your API3 tokens will appear in your Spot Wallet, ready to hold, transfer, or stake.

If you’re new to trading,

BingX AI can help by showing you current price trends, suggesting entry levels, and alerting you to potential support and resistance zones before you place your order.

2. Go Long or Short on API3 on BingX Futures Market

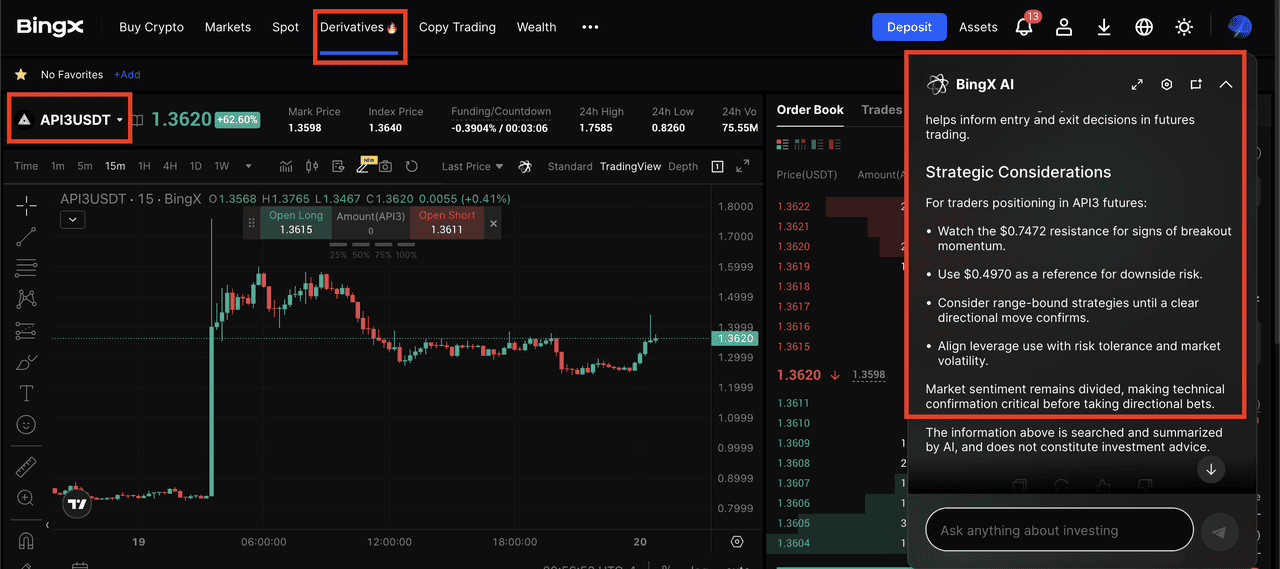

API3/USDT futures contract on BingX powered by BingX AI

Futures trading lets you speculate on API3’s price without holding the token.

• Choose whether to go long (if you expect the price to rise) or go short (if you expect it to fall).

• You can also set leverage to increase your exposure; but remember, higher leverage means higher risk.

Here, BingX AI is especially useful. It provides real-time funding rate updates, trading signals, and risk-control suggestions, such as recommended stop-loss and take-profit levels, so you don’t get caught off guard by volatility.

API3's Future Outlook: Should You Invest in the Oracle Project?

API3 has positioned itself as more than just another oracle token. Its first-party data feeds, wide chain coverage, and OEV rewards system give it a unique value proposition in the DeFi ecosystem. The project continues to expand, with integrations across major chains and growing adoption by protocols that want verifiable, revenue-generating data feeds. If OEV payouts scale beyond the current $280,000+ and surpass the team’s $1 million target by year-end, API3 could strengthen its role as a core piece of infrastructure.

For investors, API3 offers exposure to a project with tangible utility and a growing ecosystem, but like all digital assets, it carries high volatility and risk. Prices can swing sharply with market sentiment, and adoption milestones may take time to materialize. If you are considering API3, approach it with a balanced strategy: monitor its adoption metrics, keep an eye on OEV rewards growth, and only invest what you can afford to lose.

Related Reading