Cryptocurrency has evolved from a niche experiment into a cornerstone of modern finance. What began with

Bitcoin now spans a multi-trillion-dollar digital ecosystem of

stablecoins, tokenized funds, and blockchain-based financial products. For investors, these assets are no longer speculative, they’re part of a broader strategy for diversification, liquidity, and innovation.

In 2025, the crypto wealth landscape has reached a turning point. The approval of spot

Bitcoin ETFs, the rollout of the EU’s MiCA framework, and the rise of institutional custody solutions have pushed digital assets firmly into regulated territory. Wealth managers can no longer ignore this shift, as clients increasingly seek exposure to crypto as both an inflation hedge and a high-growth opportunity. Those who adapt early will define the next generation of wealth management.

What Are Digital Assets and Why They Matter

Digital assets are instruments that store, transfer, and generate value through blockchain networks, cutting out intermediaries and operating around the clock. They include:

• Bitcoin, the leading store of value with over $4 trillion in market capitalization.

•

Ethereum, powering decentralized finance (DeFi) and tokenized applications.

•

Tokenized assets such as real estate or bonds, enhancing liquidity and access.

Blockchain’s distributed ledger ensures transparency, faster settlement, and reduced costs, key advantages for investors seeking efficiency and compliance. With the total market surpassing $4 trillion, digital assets now rival entire equity sectors, underscoring their role as a core component of diversified wealth strategies.

The 5-Step Framework for Managing Digital Wealth

Digital assets demand structure, not speculation. BingX provides investors with tools to build, protect, and grow a balanced crypto portfolio. Here’s a five-step roadmap to managing digital wealth effectively in 2025.

1. Assess: Start by defining your investment goals and risk tolerance. Are you seeking long-term growth or stable returns? Use BingX’s

Market Overview and

News section to track trends, performance metrics, and volatility before choosing your entry points.

2. Allocate: Diversify across crypto assets to match your profile. Conservative investors may allocate 1–5% of total holdings to Bitcoin or stablecoins. With BingX

Spot Trading and

Convert, you can easily rebalance between

BTC,

ETH, and

USDT or shift into lower-risk assets when the market turns volatile.

3. Select: Choose investment products that match your style:

•

Derivatives (USDⓈ-M / Coin-M / Standard Futures) for active traders managing exposure or hedging risk.

•

Copy Trading to follow strategies of elite traders without managing positions manually.

• Auto tools like

Martingale and

Grid Trading under Wealth for systematic strategies that perform even in volatile markets.

4. Protect: Safeguard your assets using

BingX Earn, which offers yield opportunities through flexible savings and dual investment programs. Combine this with

Stop-Loss, Take-Profit, and Signal Trading tools to limit risk. Keep part of your portfolio in stablecoins like USDT or USDC for liquidity and downside protection.

5. Review: Track performance and rebalance periodically. The BingX Portfolio Tracker,

Rewards Hub, and

Proof of Reserves dashboard make it easy to monitor portfolio health, income generation, and platform transparency. Regular reviews ensure your strategy evolves alongside market trends and regulatory updates.

Once your foundation is set, understanding crypto’s role within broader portfolios becomes essential.

Why Does Crypto Matter in Modern Investment Portfolios?

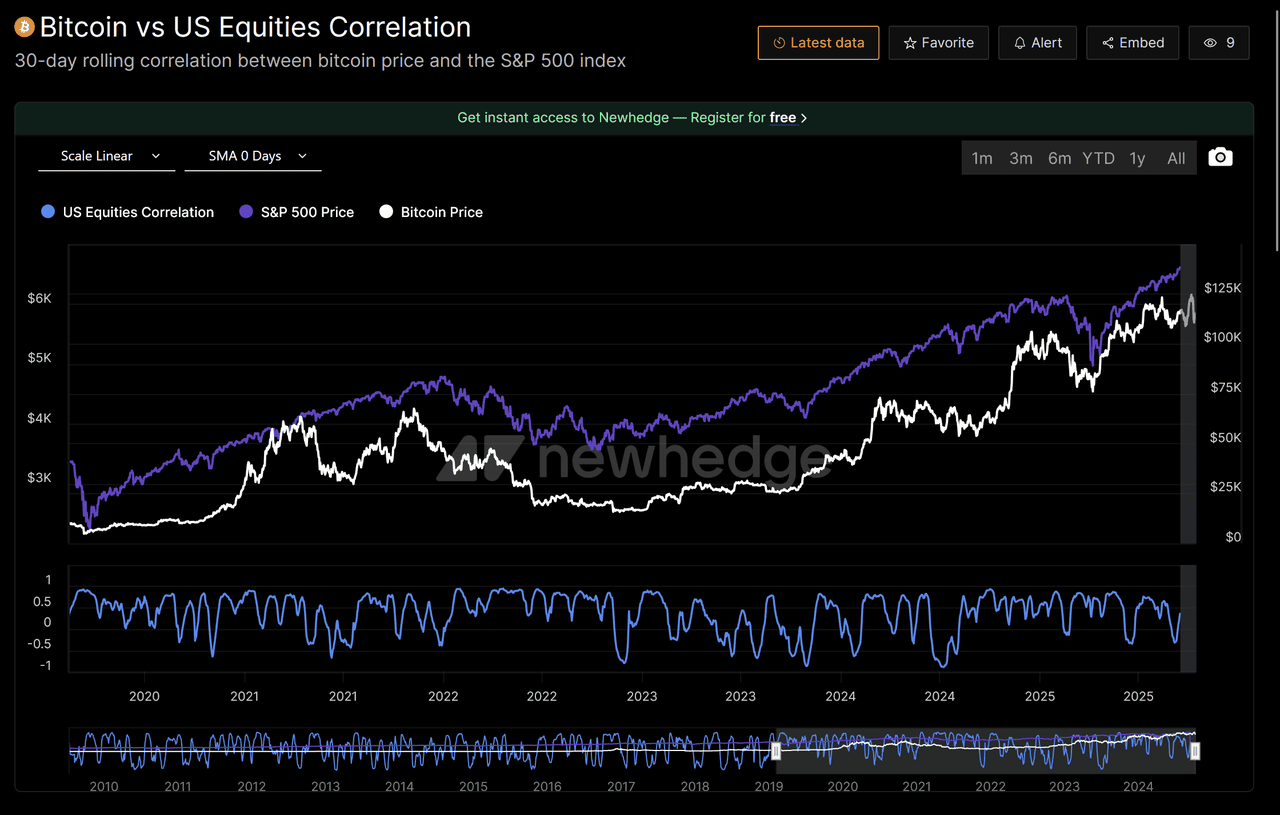

Cryptocurrencies have evolved into a meaningful component of diversified portfolios, offering exposure to an alternative growth engine that often behaves independently from traditional assets. While not entirely uncorrelated, Bitcoin’s relationship with U.S. Equities has become cyclical; periods of rising inflation or policy tightening often reduce correlation, while liquidity-driven rallies temporarily align it with risk assets.

Based on data from NewHedge (2025), Bitcoin’s 30-day rolling correlation with the S&P 500 has hovered between 0.1 and 0.35, averaging around 0.25 over the past three years, lower than gold’s long-term correlation near 0.5. This suggests that crypto continues to act as a portfolio diversifier during market stress and macro volatility.

Bitcoin vs S&P 500 Correlation, 2019–2025 - Source: Newhedge

Institutional adoption continues to accelerate:

• BlackRock’s IBIT now exceeds $93 billion in AUM, becoming the world’s largest Bitcoin ETF.

• Fidelity’s Wise Origin Bitcoin Fund and ARK 21Shares products have deepened access for retail and retirement accounts.

• Goldman Sachs and J.P. Morgan offer custody and trading services to wealthy clients.

• Family offices and CIOs allocate 1–5% of portfolios to crypto for asymmetrical upside and inflation hedging.

For wealth managers, digital assets now provide more than speculative upside; they introduce innovation, liquidity, and non-traditional risk exposure that can strengthen long-term portfolio resilience.

The Role of Wealth Managers in the Digital Asset Era

Client expectations are shifting rapidly as digital assets move into mainstream finance. High-net-worth investors, family offices, and even conservative institutions now expect their wealth managers to offer informed views and secure access to crypto exposure. This new demand challenges traditional advisory models, requiring a deeper understanding of blockchain technology, custody solutions, and tax implications.

Leading firms are integrating crypto within multi-asset portfolios, typically allocating 1–5 percent through regulated ETFs, custody accounts, or tokenized funds. These strategies aim to balance upside potential with prudent diversification rather than speculative trading.

For wealth managers, due diligence and education are now as vital as asset selection. Understanding client risk tolerance, regulatory boundaries, and liquidity considerations ensures responsible participation in this emerging asset class. Those who combine innovation with discipline will not only retain clients but also lead the next generation of digital wealth advisors.

How to Manage Risks in Crypto Investing

Crypto assets remain one of the most volatile components of modern portfolios, making

risk management central to any wealth strategy.

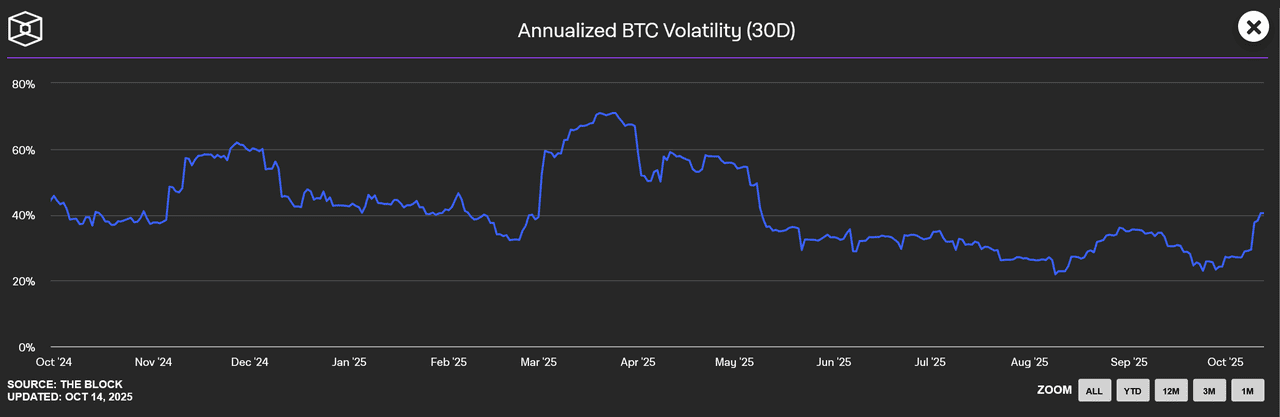

According to The Block, as of October 2025, Bitcoin’s 30-day annualized volatility has ranged between 35% and 65% over the past year, far above gold or the S&P 500.

While volatility has moderated since 2022, it still reflects sensitivity to liquidity shocks, leverage, and regulatory headlines.

Annualized Bitcoin Volatility, 2024–2025 - Source: The Block

Major risks wealth managers must address include:

• Market volatility: 15–25% intraday swings remain common during liquidation events.

• Liquidity and slippage: Smaller tokens see spreads widen sharply in corrections.

• Security and counterparty risk: Hacks and exchange failures still test trust.

• Regulatory uncertainty: Evolving rules on staking, stablecoins, and DeFi increase compliance complexity.

Key risk-management strategies:

• Using futures and options for downside hedging.

• Building diversified crypto baskets across BTC, ETH, and tokenized assets.

• Holding stablecoin reserves such as USDC or PYUSD for liquidity.

• Partnering with institutional custodians like BitGo or Fidelity Digital Assets for insured cold storage and proof-of-reserves audits.

Aligning exposure with each client’s risk tolerance and horizon turns crypto from a speculative play into a disciplined component of a multi-asset wealth strategy.

Regulation, Tax Treatment, and Compliance for Digital Assets

As digital assets gain legitimacy, regulators worldwide are racing to establish clearer frameworks.

In the European Union, the Markets in Crypto-Assets Regulation (MiCA), fully implemented in 2024, enforces strict licensing for exchanges, stablecoin issuers, and custodians, making Europe the first region with comprehensive oversight.

In the United States, the SEC continues to evaluate token classifications, while the CFTC supervises derivatives and futures markets.

Tax treatment remains crucial. Most jurisdictions classify crypto as property or a capital asset, meaning every sale, swap, or transfer can trigger taxable events. With tighter data-sharing between exchanges and tax authorities, meticulous recordkeeping is essential.

For investors, regulatory compliance and professional guidance are vital. Consulting licensed advisors ensures digital allocations meet both legal obligations and long-term wealth goals.

Institutional Adoption and Market Infrastructure

Institutional participation has turned crypto into a legitimate, regulated asset class backed by deep liquidity. The approval of spot Bitcoin ETFs in early 2024 redefined market access, attracting over $20 billion in net inflows within six months. BlackRock’s IBIT now exceeds $93 billion AUM, while Fidelity and ARK 21Shares have extended access to retirement and private-bank clients.

Traditional finance is embedding crypto across operations. Goldman Sachs, J.P. Morgan, and Deutsche Bank now provide custody and settlement, while Nasdaq Digital Assets builds a regulated trading infrastructure.

Meanwhile, DeFi has matured into a $60 billion ecosystem, processing billions in daily on-chain transactions through lending, trading, and yield protocols. Institutional and decentralized systems are beginning to converge, creating a unified, transparent financial architecture for the digital age.

How to Build a Future-Ready Crypto Investment Strategy

Future-ready portfolios balance innovation with evidence. As of 2025, over 70% of institutional investors surveyed by Fidelity include digital assets in long-term strategies.

This shift is driven by utility, not hype:

• Blockchain adoption in trade finance and settlements via J.P. Morgan’s Onyx and SWIFT tokenized trials proves scalability.

•

Stablecoins such as

USDC settle billions daily, offering instant, Treasury-backed liquidity.

• CBDC pilots in the EU, China, and the UAE are reshaping global money flows.

CIOs and asset managers now manage hybrid portfolios that combine equities, bonds, and regulated crypto exposure. The goal is not to replace traditional assets but to enhance diversification, transparency, and adaptability, key traits of wealth portfolios built for the next decade.

Conclusion: Moving Forward in a Digital Asset World

Digital assets have matured into a dynamic component of global wealth management. They offer diversification, innovation, and new return opportunities, but also demand discipline and regulatory awareness.

For investors and advisors alike, success now depends on informed decisions, prudent risk controls, and professional guidance.

Before allocating capital, consult licensed financial and tax experts to ensure each crypto investment supports your broader wealth strategy and long-term objectives.

Related Reading

FAQs on Cryptocurrency and Wealth Management

1. What is cryptocurrency wealth management?

Cryptocurrency wealth management is the process of integrating digital assets, such as Bitcoin, Ethereum, and tokenized funds, into diversified investment portfolios. It involves managing risk, regulation, tax implications, and long-term performance within a professional advisory framework.

2. Why are wealth managers investing in crypto?

Wealth managers are adding crypto exposure to meet growing client demand and diversify portfolios. Institutional adoption, spot Bitcoin ETFs, and improved custody solutions have made digital assets more accessible and regulated, turning them into legitimate wealth instruments.

3. How much crypto should be in a portfolio?

For most investors, a 1–5% allocation to regulated crypto products is considered balanced. The exact weight depends on risk tolerance, investment horizon, and liquidity needs, with higher exposure reserved for more risk-seeking investors.

4. What are the main risks of crypto investing?

Key risks include volatility, security breaches, liquidity shocks, and regulatory changes. Wealth managers mitigate these through diversification, hedging, insured custodians, and stablecoin reserves for liquidity protection.

5. How is cryptocurrency taxed?

In most jurisdictions, crypto is treated as property or a capital asset, meaning that selling, trading, or swapping tokens can trigger taxable gains or losses. Accurate transaction records and professional tax advice are essential to remain compliant.

6. What role do ETFs play in crypto wealth management?

Crypto ETFs, such as BlackRock’s IBIT or Fidelity’s Wise Origin Bitcoin Fund, offer investors secure, regulated exposure without directly holding digital assets. They simplify custody, improve liquidity, and align with institutional-grade compliance standards.

7. Is decentralized finance (DeFi) part of wealth management?

Yes. DeFi enables on-chain lending, staking, and yield strategies. However, it carries higher risk and requires strong due diligence. Some wealth managers now use regulated DeFi protocols to enhance yield within managed risk parameters.

8. How will crypto wealth management evolve by 2030?

By 2030, tokenized securities, CBDCs, and blockchain-based funds are expected to merge with traditional wealth systems. This hybrid approach will allow seamless movement between fiat, equities, and digital assets, redefining global portfolio diversification.