LayerZero (ZRO) is an omnichain interoperability protocol designed to connect multiple blockchains into a unified network. Instead of operating in isolation, blockchains integrated with LayerZero can share data, tokens, and commands as if they were one system. This breakthrough addresses one of crypto’s biggest challenges, blockchain fragmentation, unlocking a new generation of decentralized applications (dApps) that work seamlessly across ecosystems.

In August 2025, LayerZero made headlines with a $110 million proposal to acquire

Stargate (STG) and merge its token economy into the ZRO ecosystem. The announcement sent ZRO prices surging nearly 30% in 24 hours, while STG gained around 20%, as traders reacted to the possibility of uniting two of the most active interoperability platforms in the crypto market.

Since its launch in 2021 by Bryan Pellegrino, Ryan Zarick, and Caleb Banister, LayerZero has connected over 120 blockchains, processed $50 billion+ in transferred value, and powered more than 300 applications in DeFi, NFTs, and gaming. Its architecture is lightweight, secure, and developer-friendly, making it one of the most adopted cross-chain solutions in Web3.

Learn what LayerZero (ZRO) is, how it works, and why the proposed

$110M LayerZero-Stargate token merger sent ZRO prices soaring, plus its features, use cases, and how you can trade ZRO tokens on BingX.

What Is LayerZero, the Future of Cross-Chain Communication?

LayerZero is an omnichain interoperability protocol designed to let decentralized applications (OApps) send data, value, and commands across multiple blockchains as if they were one network. This means tokens, NFTs, and smart contract functions can move seamlessly between chains, solving one of blockchain’s biggest limitations: fragmentation.

LayerZero's idea was born in late 2020 when the trio, while building an NFT game, needed to bridge assets from

Ethereum to

Binance Smart Chain (BSC). Frustrated with the high fees, slow speeds, and security risks of existing bridges, they decided to create a faster, safer, and more developer-friendly alternative. That solution became LayerZero, a protocol now powering some of the biggest cross-chain projects in DeFi,

gaming, and NFTs.

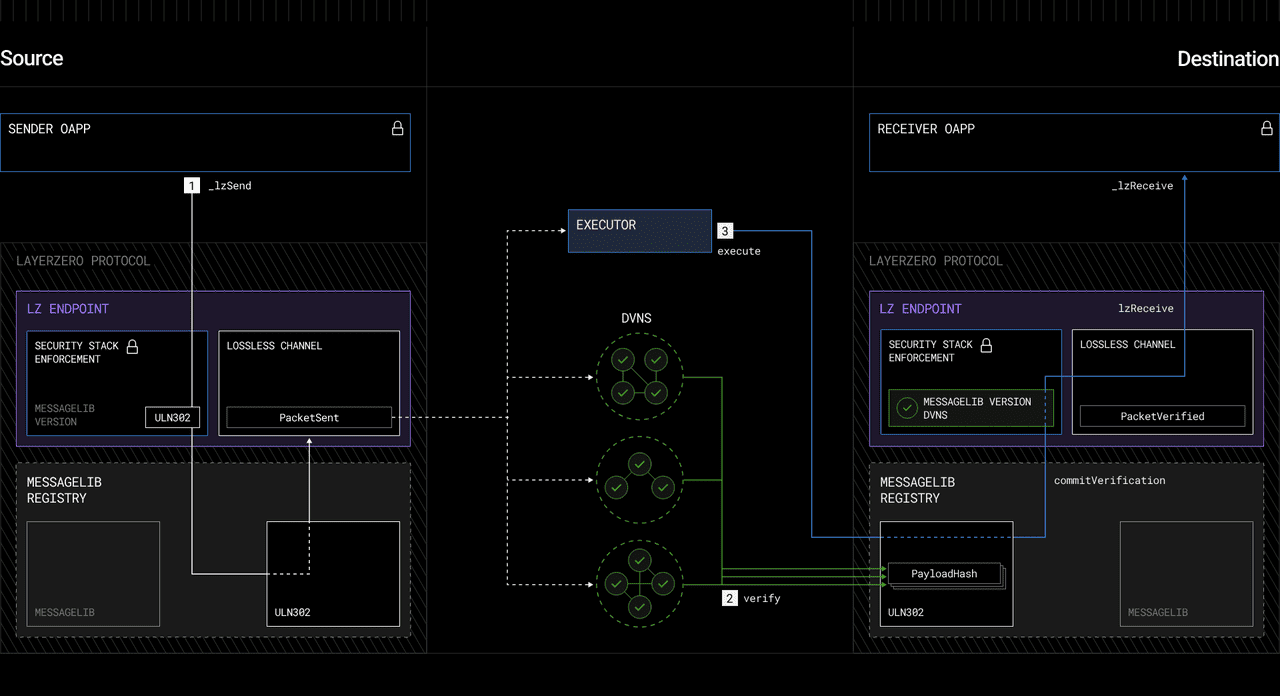

How LayerZero works | Source: LayerZero docs

At its core, LayerZero works through a secure, lightweight messaging system built on four main components:

• Immutable Endpoints – Smart contracts deployed on each supported blockchain that serve as permanent, tamper-proof gateways for sending and receiving messages.

• Ultra-Light Nodes (ULNs) – Efficient verification modules that remove the need for resource-heavy full nodes while keeping security intact.

• Oracles – Independent services, like

Chainlink or

Band Protocol, that relay blockchain data between networks.

• Relayers – Separate entities that deliver transaction proofs to the destination chain, ensuring messages can’t be faked or altered.

LayerZero’s design ensures censorship resistance, permissionless participation, and instant scalability, capable of supporting over 120 blockchains and already securing more than $50 billion in transferred value as of August 2025.

Key Features, Use Cases, and Benefits of LayerZero

LayerZero is designed to make cross-chain communication secure, scalable, and developer-friendly, setting it apart from traditional blockchain bridges. It uses:

1. Immutable Endpoints – Permanent smart contracts on each supported chain that can’t be altered, ensuring consistent, trusted message delivery.

2. Ultra-Light Nodes (ULNs), Oracles & Relayers – ULNs enable efficient off-chain validation, oracles (e.g., Chainlink, Band Protocol) fetch block data, and relayers provide transaction proofs. Both must agree before execution, reducing single points of failure.

3. Decentralized Verifier Networks (DVNs) – In V2, multiple independent verifiers replace the single-oracle model, while Executors handle execution for greater decentralization and customizable security.

4. Message Channels & Modular Libraries – Unique channels ensure ordered delivery and nonce tracking, with customizable message formats via blockchain-specific libraries.

With 120+ supported blockchains, over $50B in value transferred, and 300+ integrated applications, LayerZero powers a wide range of omnichain solutions, including:

• Cross-Chain DEXs like Stargate and SushiSwap enable direct token swaps without wrapped assets.

• Multi-Chain Lending lets users post collateral on one chain and borrow on another.

• Omnichain NFTs (ONFTs) allow NFTs to move natively across chains for broader trading and utility.

• Cross-Chain Governance unifies DAO voting and execution across networks.

• Game Asset Portability enables players to transfer items, tokens, and characters between ecosystems without duplication.

LayerZero's benefits include a trust-minimized design with no central authority, a standardized framework for EVM and non-EVM chains, access to unified liquidity and state across networks, and scalable infrastructure that keeps costs low even as cross-chain activity grows.

LayerZero (ZRO) Token Utility and Tokenomics

The ZRO token is the native asset of the LayerZero protocol, designed to govern, secure, and power its omnichain ecosystem. It plays multiple roles within the network:

1. Governance – ZRO holders can vote on protocol upgrades, parameter changes, and ecosystem funding proposals, shaping the future of LayerZero.

2. Fee Payments – In certain LayerZero-powered applications, ZRO can be used to pay for cross-chain message fees, incentivizing adoption across integrated dApps.

3. Incentives – Developers, relayers, and Decentralized Verifier Network (DVN) operators may receive ZRO rewards for providing infrastructure and security to the ecosystem.

4. Ecosystem Growth – ZRO can fund grants, hackathons, and developer tooling to encourage more projects to adopt LayerZero’s omnichain messaging standard.

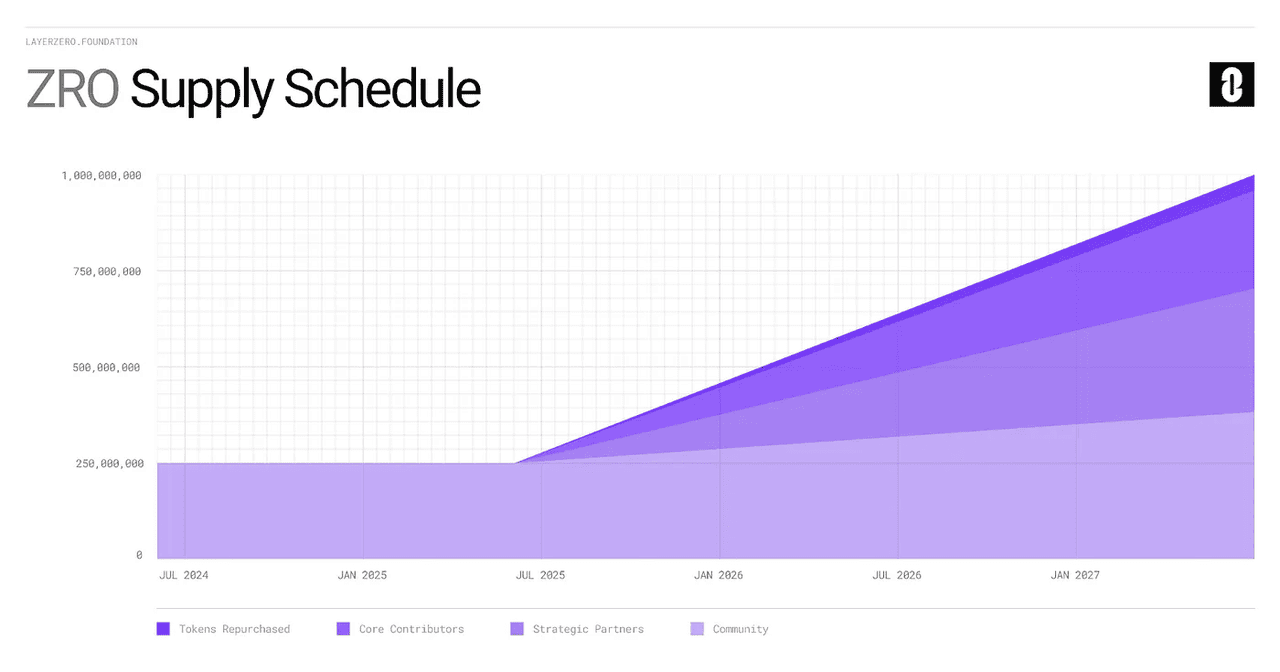

ZRO Token Distribution

ZRO officially launched in June 2024 after months of anticipation, accompanied by an 8.5% supply airdrop to reward early adopters and contributors. Of this allocation, 5% went to core community members who actively used the protocol before the snapshot, 3% was awarded to developers and projects through Request for Proposal (RFP) submissions, and 0.5% was reserved for the community pool to fund future incentive programs and initiatives.

ZRO token vesting schedule | Source: LayerZero blog

• Community & Airdrops (8.5%) – Distributed through the initial 2024 airdrop to early users, developers, and contributors.

• Ecosystem Growth Fund (20–25%) – Supports grants, strategic partnerships, and liquidity incentive programs to expand adoption.

• Team & Advisors (20%) – Reserved for the founding team and advisors, with multi-year vesting schedules to align long-term commitment.

• Investors (~20%) – Allocated to early venture backers and strategic partners who provided initial funding.

• Protocol Treasury (Remainder) – Managed by governance to fund ongoing operations, reserves, and future protocol initiatives.

What Is the $110M LayerZero-Stargate Merger Proposal?

On August 11, 2025, the LayerZero Foundation proposed acquiring Stargate (STG) for $110 million and merging its token economy with ZRO. If approved, STG would be retired and swapped at a fixed rate of 1 STG = 0.08634 ZRO, making ZRO the sole governance and utility token for both platforms.

The ZRO-STG token merger aim to:

• Streamline development by removing duplicate infrastructure.

• Consolidate liquidity from both ecosystems.

• Strengthen ZRO’s role in governance and cross-chain utility.

The market reacted quickly, with ZRO surging ~30% and STG gaining ~20% within 24 hours. Supporters see it as a step toward unifying two major interoperability protocols, while critics argue it could undervalue STG and remove its fixed-yield staking rewards.

How to Trade LayerZero (ZRO) on BingX

Whether you want to buy and hold ZRO or profit from short-term price movements, BingX offers both Spot and Futures markets with real-time pricing, deep liquidity, and AI-powered trading insights.

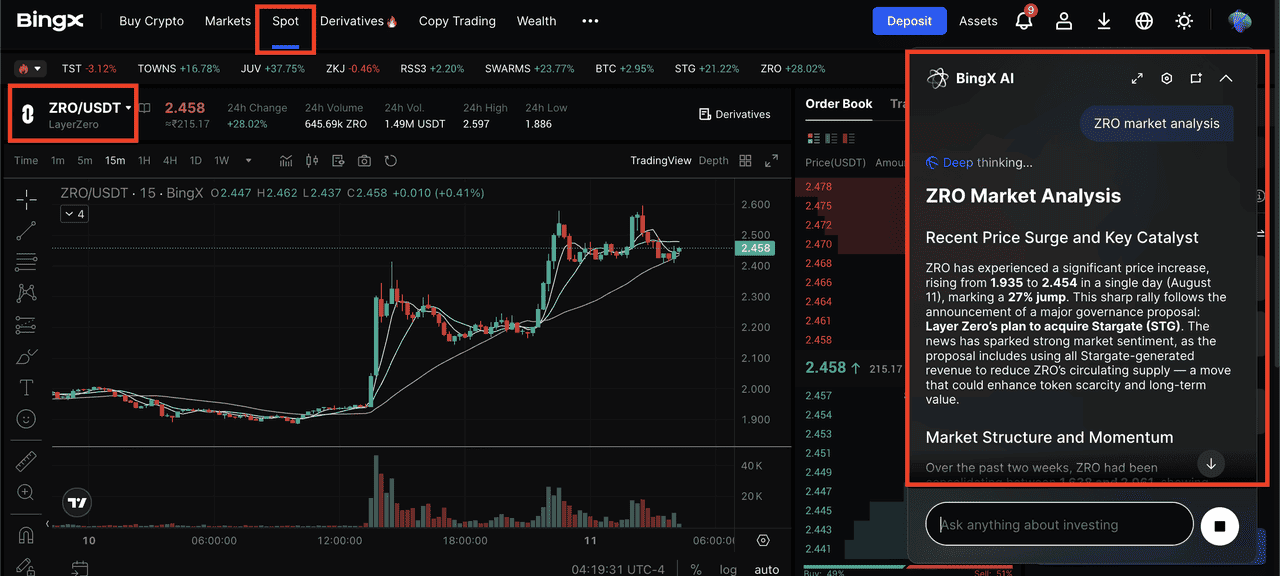

Option 1: Buy or Sell ZRO on the Spot Market

ZRO/USDT trading pair on BingX spot market, powered by BingX AI insights

Buy and sell ZRO instantly at current market prices on the BingX Spot Market.

1. Log in or sign up for a BingX account.

2. Deposit

USDT in your BingX account and transfer to your Trading account.

3. Search for the

ZRO/USDT trading pair.

4. Place a

market order for instant execution or a limit order to set your preferred price.

For smarter trades, use

BingX AI to get real-time sentiment analysis, volatility tracking, and price trend forecasts, helping you optimize entry and exit points in volatile market conditions.

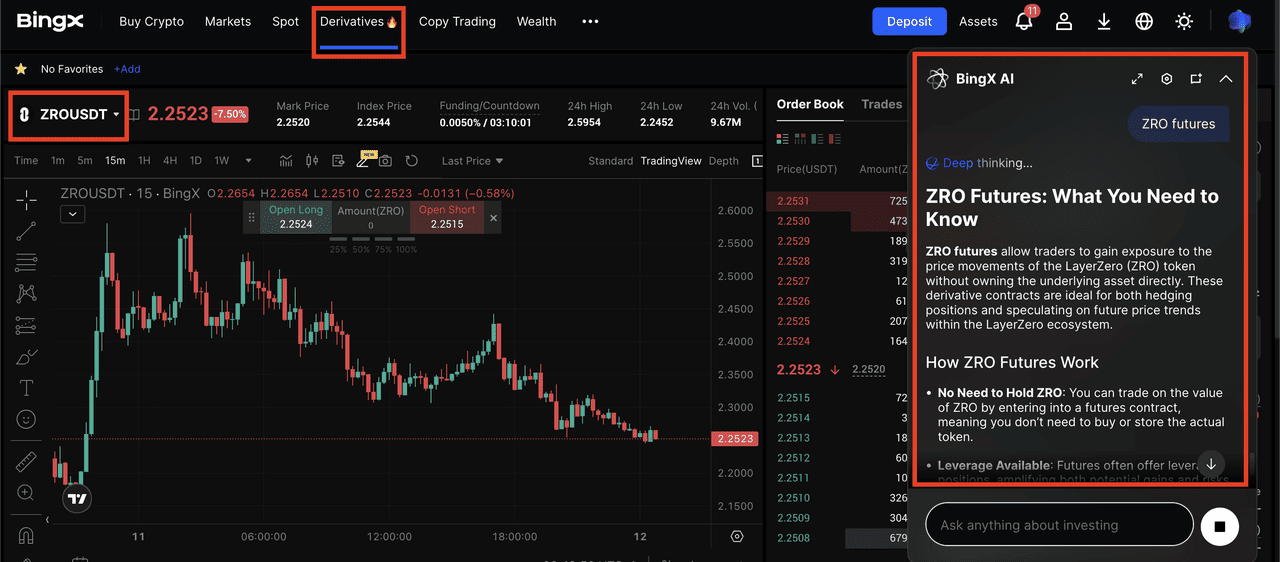

Option 2: Long or Short ZRO on BingX Futures

ZRO/USDT perpetual futures contract on BingX futures market, powered by BingX AI

1. Log in or sign up for a BingX account.

2. Transfer USDT to your Futures account.

4. Go Long if you expect ZRO’s price to rise or Go Short if you expect it to fall.

5. Adjust leverage to match your risk tolerance and place a market or limit order.

Note: Futures trading carries higher risks due to leverage. Use stop-loss orders and proper risk management.

Final Thoughts

LayerZero is shaping the future of blockchain interoperability by making cross-chain transactions more secure, scalable, and accessible. The proposed Stargate merger could further solidify ZRO’s position as the go-to token for one of the most advanced cross-chain ecosystems in crypto.

Still, as with any major upgrade, there are uncertainties, especially around community approval, market reaction, and execution. Traders and investors should stay informed, manage risk, and track DAO updates closely before making decisions.

Related Reading