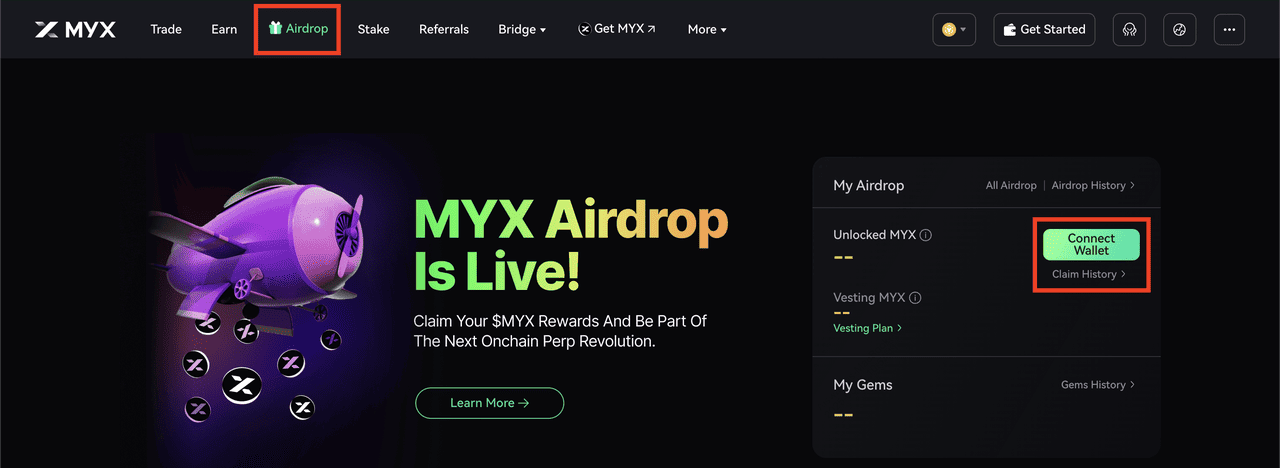

To reward early supporters and ecosystem contributors, MYX Finance is distributing 14.7% of its total 1 billion MYX token supply through a multi-phase airdrop campaign. This includes allocations for users who participated in MYX’s early activities, testnet campaigns, and holders of BMYX, a pre-launch representation token.

The airdrop claim portal went live at the official

MYX Finance airdrop claim page on May 6, 2025, and eligible participants can begin claiming their rewards directly on the BNB Chain. If you're eligible, you could receive a portion of the 67,036,090 MYX designated for the initial drop.

Who Is Eligible for $MYX Airdrop?

1. Early contributors who interacted with MYX testnet or community tasks

2. BMYX token holders who purchased via Binance Wallet IDO

3. Users selected through snapshot-based distribution rounds

Note: BMYX holders will receive their tokens automatically, no claim is required.

MYX Finance Airdrop Snapshot Dates and Release Schedule

• May 6, 2025, 08:00 UTC – Eligibility preview began

• May 6, 2025, 12:00 UTC – Airdrop claim portal opened

• Initial Release – 30% of each eligible user's airdrop available immediately

• Remaining 70% – Unlocked linearly over the next 5 months, with 14% released on the 6th of each month

• Redemption Deadline – Each unlocked portion must be claimed within 90 days of release, or it will be forfeited and sent to the treasury

How to Claim Your MYX Airdrop

1. Visit the MYX Finance airdrop claim page on the app at https://app.myx.finance/integral

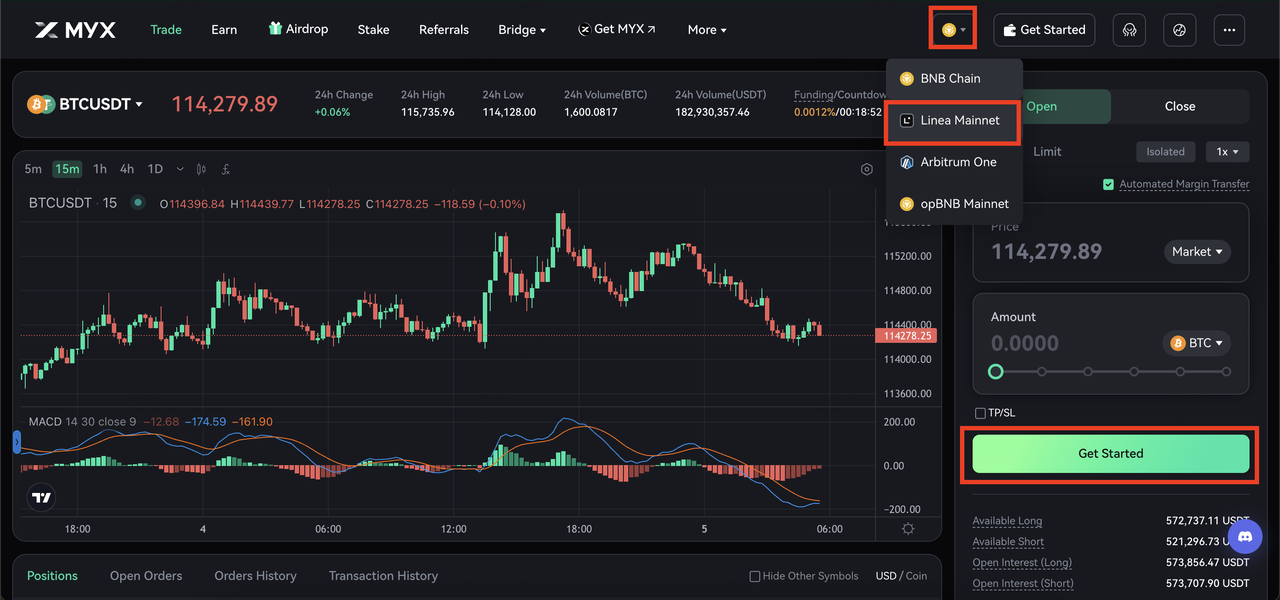

3. Switch your wallet network to BNB Chain (BEP-20)

4. The site will auto-detect your eligibility and display the claimable amount

5. Click Claim, approve the transaction, and pay a small

BNB gas fee

6. Once confirmed, the airdropped MYX tokens will appear in your wallet

Key Considerations Before Claiming MYX Tokens

Before claiming, make sure you’re using the official MYX airdrop page to

avoid phishing scams or fake links. Keep at least 0.01–0.02 BNB in your wallet to cover gas fees during the transaction. If you're not eligible for this round, stay engaged with upcoming MYX campaigns for future airdrop opportunities. Remember, each unlocked token phase must be claimed within 90 days, or it will be permanently forfeited; set reminders so you don’t miss out.

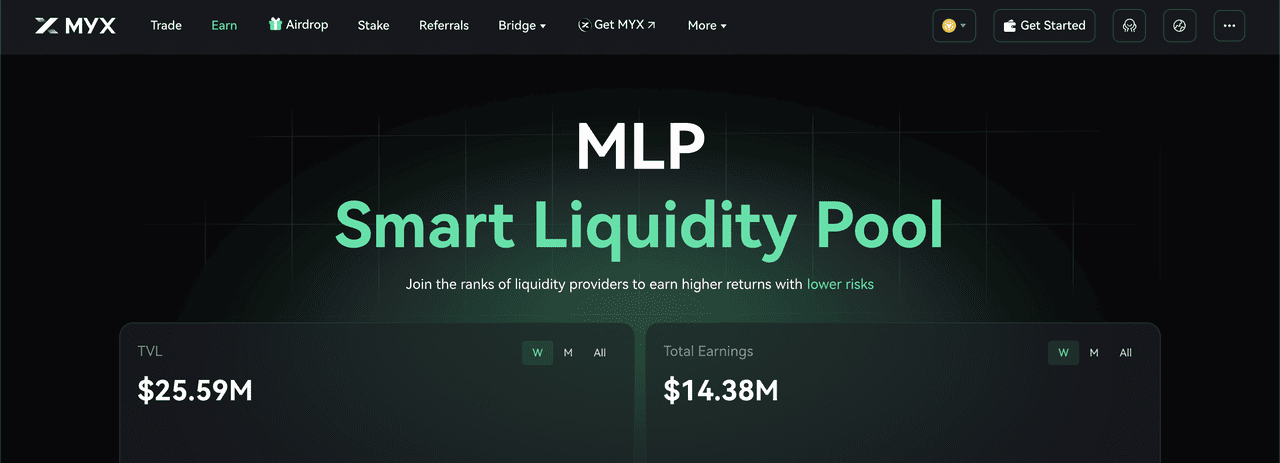

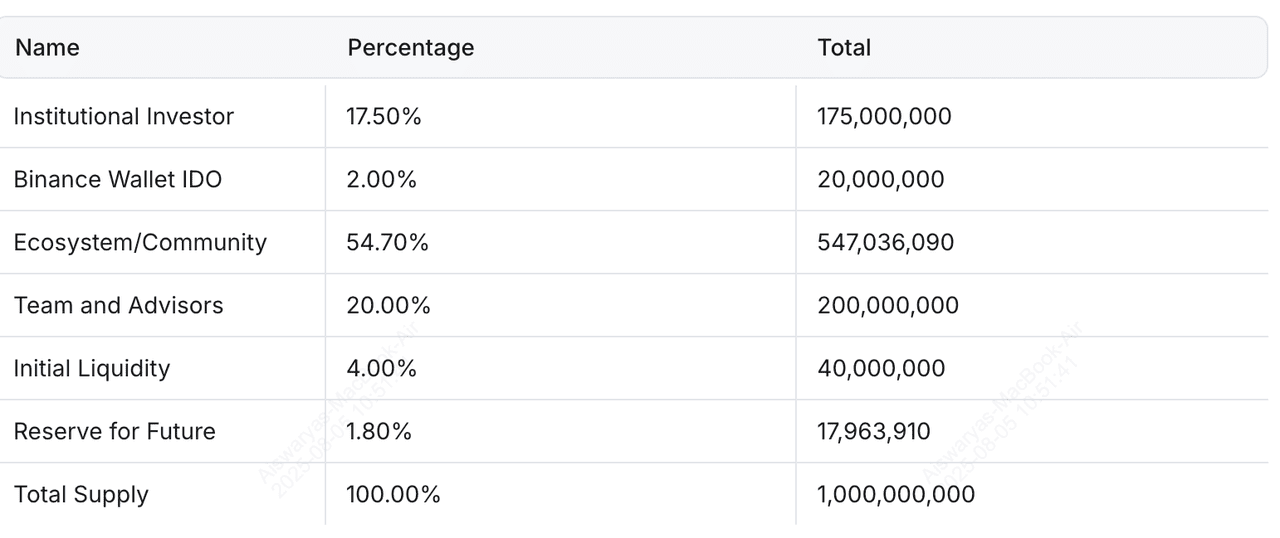

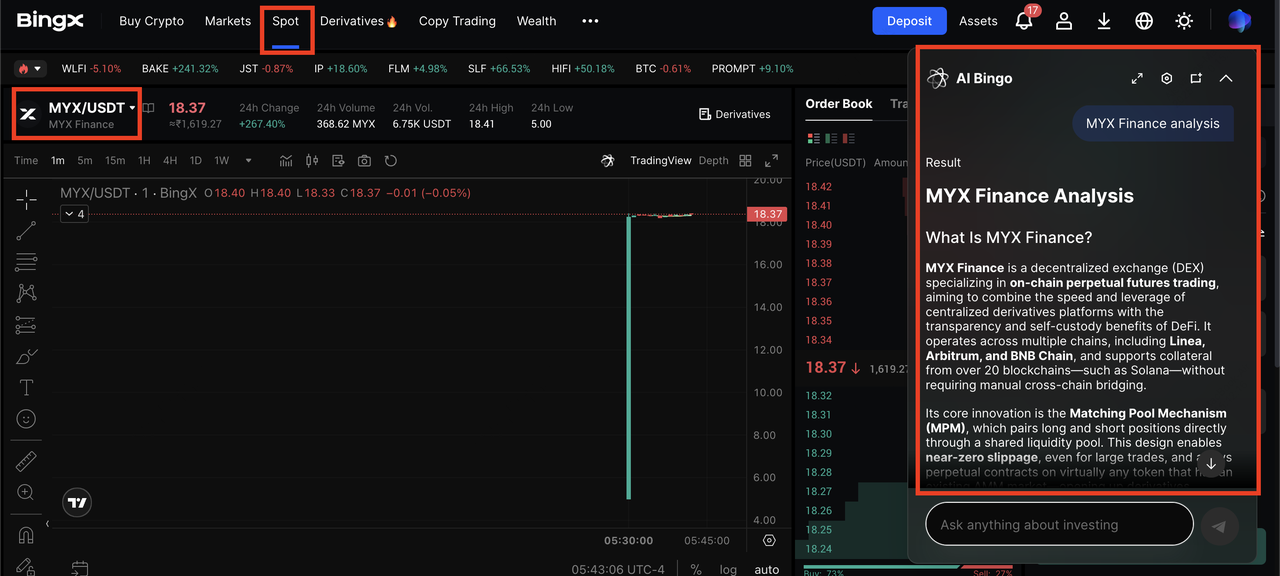

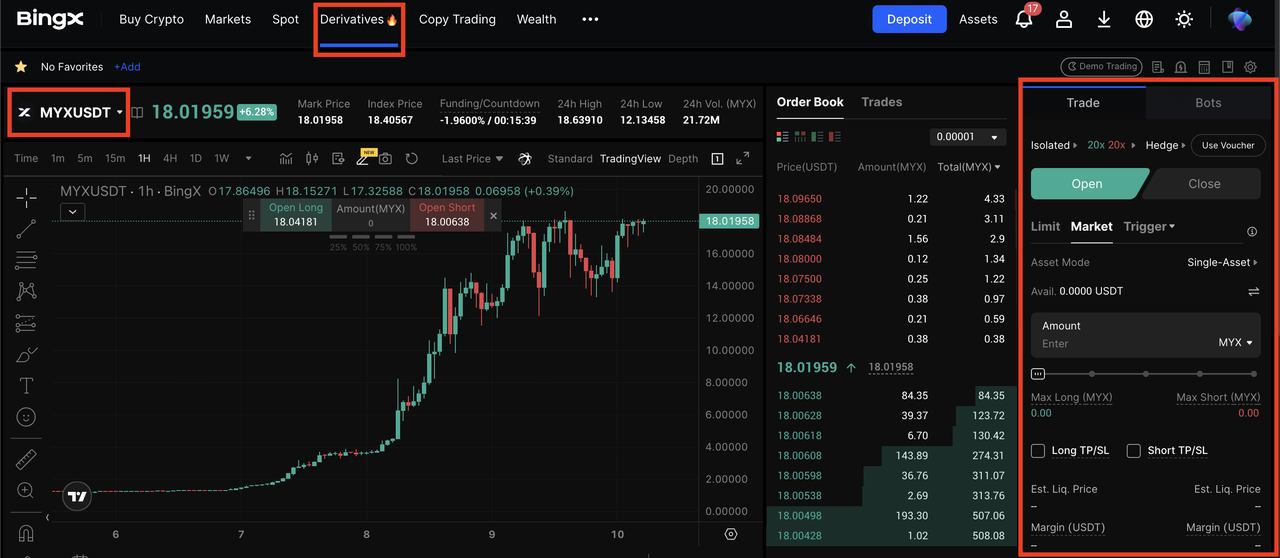

What Is the MYX Token Utility and Tokenomics?

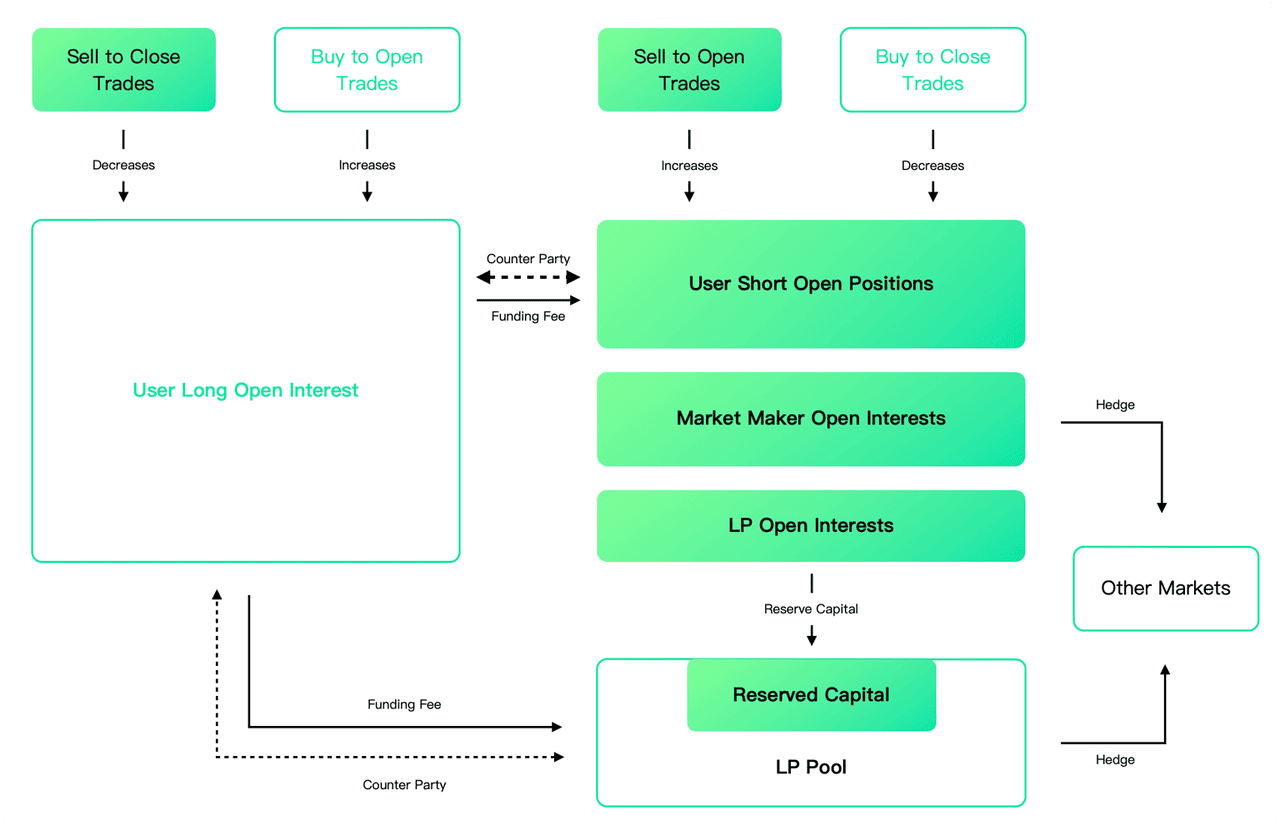

The $MYX token is the core utility and governance asset of the MYX Finance ecosystem. Beyond being a speculative asset, MYX plays an essential role in enabling secure trading, incentivizing liquidity providers, powering governance, and rewarding ecosystem participants.

The $MYX token unlocks several important functions within the MYX protocol:

1. Staking & Governance: MYX holders can stake their tokens to participate in governance proposals that influence trading fees, system upgrades, and treasury allocations. This allows the community to steer the future of the protocol in a decentralized and transparent manner.

2. Keeper Network Participation: Running a Keeper node, responsible for executing trades, submitting price data, and maintaining trading history, requires staking at least 300,000 MYX. Users who prefer a passive role can delegate their MYX to active nodes and earn a share of their rewards, including execution rebates and fee distributions.

3. VIP Trading Tiers: Holding MYX unlocks reduced trading fees through a tiered VIP structure. For example, users with over 100,000 MYX can qualify for maker fees as low as 0.01% or even receive negative maker fees (rebates) at the highest tiers.

4. Buyback Yield for Stakers: A portion of MYX Finance’s protocol revenue, generated through trading fees and liquidation penalties, is used to buy back MYX tokens from the open market. These tokens are then redistributed to stakers, creating a real yield mechanism for long-term holders.

MYX Token Allocation