What Is Shardeum (SHM)?

Key Features of the Shardeum Network

How Shardeum Works: Solving the Blockchain Trilemma with Core Technology

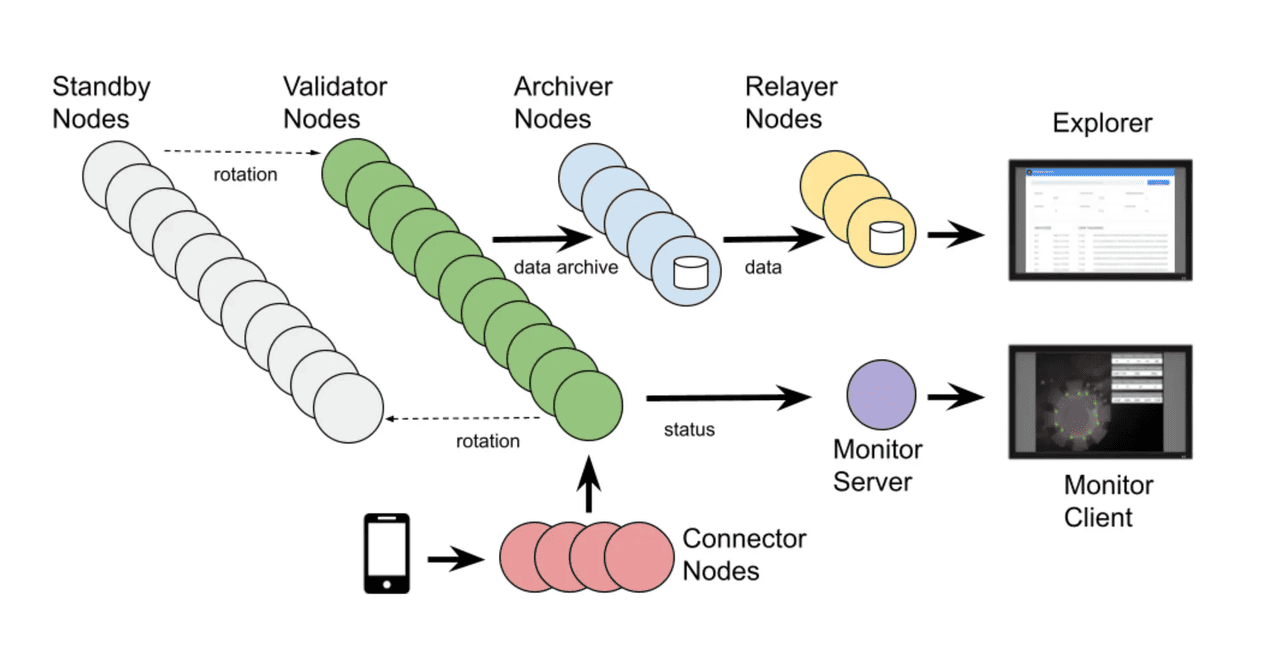

An overview of nodes in the Shardeum network | Source: Shardeum whitepaper

An overview of nodes in the Shardeum network | Source: Shardeum whitepaper

Most blockchains must sacrifice one of three pillars - scalability, security, or decentralization, to optimize the others, a challenge known as the “blockchain trilemma.” Shardeum shatters this trade-off by weaving together three core technologies:

1. Scalability via Dynamic State Sharding & Auto-Scaling: Shardeum splits its network into many parallel “shards,” each processing its own subset of transactions and smart contracts. Rather than funneling every transaction down a single chain, shards work simultaneously, so as you add more validator nodes, throughput scales linearly. On top of that, Shardeum measures network load every minute and automatically spins shards up or down to match real-time demand. The result? Throughput and fees remain stable even under heavy load.

2. Security through Hybrid PoS + PoQ Consensus: To secure these parallel shards, Shardeum combines Proof-of-Stake (PoS) for Sybil-resistance with Proof-of-Quorum (PoQ) for instant, trustless validation within each shard. Validators stake SHM to participate, then collect “quorum receipts” from over 50% of shard members to finalize transactions. An automatic validator rotation mechanism further hardens the network against targeted attacks, ensuring fast finality without compromising safety.

3. Decentralization with Permissionless Validator Access: Anyone - from students to seasoned developers, can run a Shardeum node with minimal hardware. There are no gatekeepers or special requirements: just stake the minimum SHM and join a shard. This open access boosts the number of active validators, spreads transaction processing across a global community, and guarantees that no single party can dominate the network.

Key Projects in the Shardeum Ecosystem

What Is SHM Tokenomics and Utility?

SHM Token Supply & Distribution

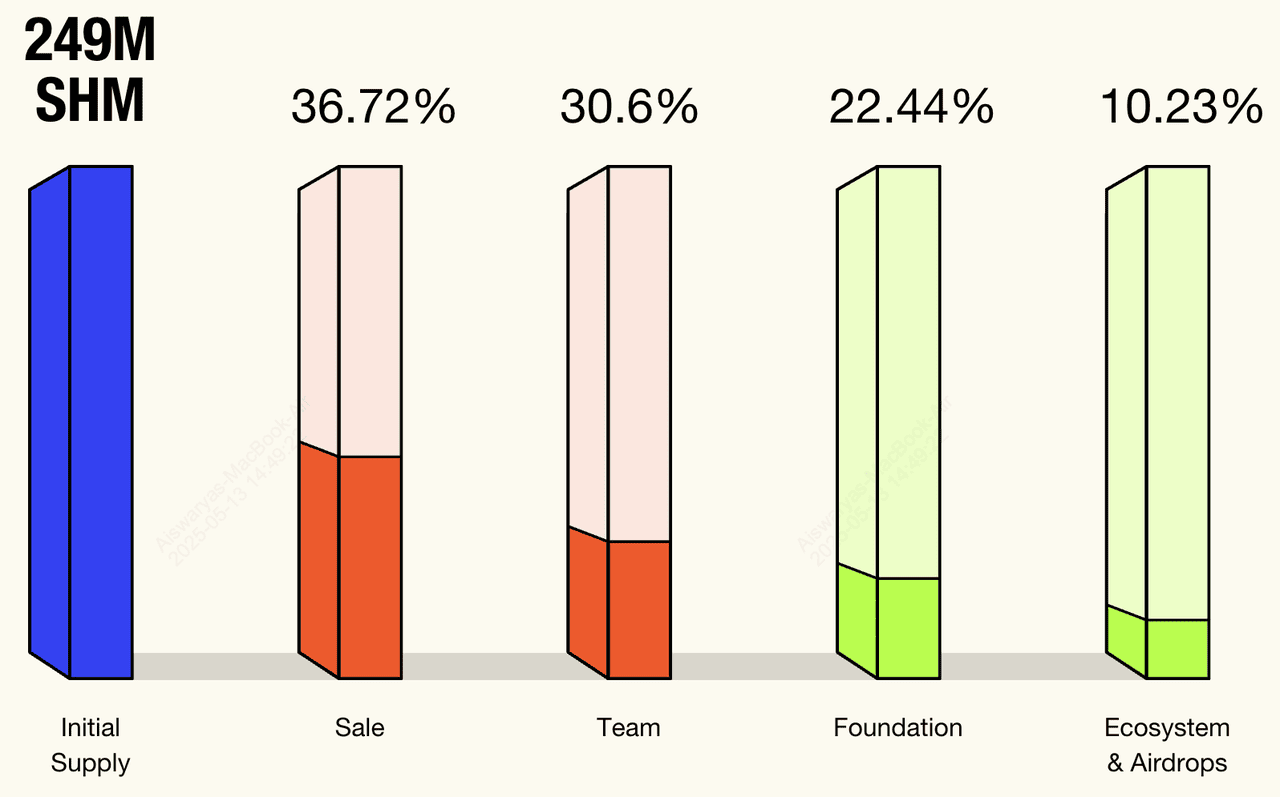

Shardeum (SHM) token allocation | Source: Shardeum

Shardeum (SHM) token allocation | Source: Shardeum

At launch, Shardeum issued 249 million SHM. These tokens are allocated to align incentives and fund growth:

• 36.72% (91.4 M) for public and private sale, vesting over 2 years after a 3-month cliff

• 30.60% (76.2 M) reserved for the core team, also vesting over 2 years after a 3-month cliff

• 22.44% (55.9 M) held by the foundation to support development and ecosystem grants

• 10.23% (25.5 M) dedicated to ecosystem incentives and airdrops

SHM Token Use Cases

Here are some of the key use cases for the SHM token within the Shardeum ecosystem:

1. Gas Fees: Every transaction and smart contract execution on Shardeum requires SHM, ensuring network operations remain sustainable.

2. Staking: Validators lock up SHM as collateral to secure the network and earn block rewards.

3. Governance: SHM holders vote on protocol upgrades and parameter changes, giving the community full control over Shardeum’s future.

4. Rewards: From validator payouts to developer grants, SHM is distributed to participants who contribute to network growth.

To maintain long-term value, 100% of on-chain fees are burned. As more transactions occur, the circulating SHM supply decreases, creating a deflationary pressure that can support price appreciation over time.