Vanguard Digital Reserve (VDR) is a

Solana-based cryptocurrency that operates at a unique intersection: it adopts the sophisticated aesthetic of Traditional Finance (

TradFi) while following the high-volatility trends typical of

meme coins. Rather than relying on internet humor, VDR uses the visual language and authoritative tone of legacy financial institutions to build a narrative-driven community. Built on the Solana blockchain for high-speed execution, it positions itself as an "on-chain reserve index," though investors should approach the project with an analytical lens given its hybrid nature and early-stage development.

In this article, you’ll learn what Vanguard Digital Reserve is, how its institutional-themed narrative functions, the token's current utility, and the critical factors investors must consider before interacting with this anonymous project.

What Is Vanguard Digital Reserve (VDR)?

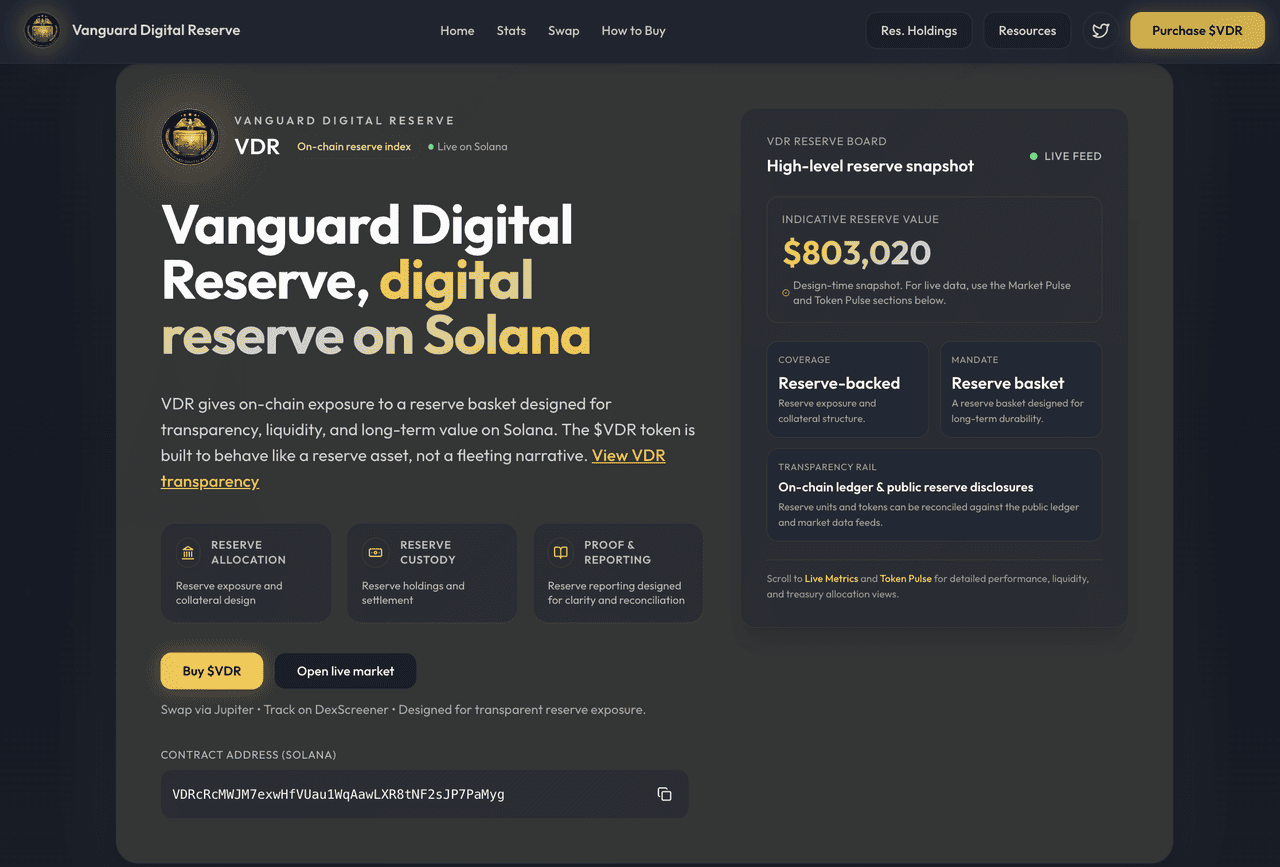

Source: vdr-us.com

Vanguard Digital Reserve presents itself as a decentralized project that parodies the branding of legacy asset management firms. While the name and tone pay homage to traditional finance giants, VDR has no official affiliation with the Vanguard Group. Instead, the project operates as a "TradFi-narrative" experiment: it uses the presentation of a structured fund to build trust and community engagement in an otherwise speculative market.

Launched on January 30, 2026, VDR surfaced during a wave of "professionalized" assets on Solana. Unlike standard stealth-launch tokens, VDR utilized a polished social media presence from the start, declaring itself "America's Reserve for the Digital Age." This branding was a deliberate strategic choice to contrast the project with the visual chaos of traditional animal-themed memes.

While the project has successfully rebranded from its initial launch phase into a "Digital Reserve" identity, it is important to note that the founding team remains entirely unknown. There is no public-facing leadership or doxxed developers. This pseudonymity is common in the Solana ecosystem but represents a significant risk factor for participants who are used to the accountability of traditional corporate structures.

How Does the Vanguard Digital Reserve Ecosystem Work?

The VDR platform is organized around three pillars designed to mimic the operations of a traditional reserve fund:

1. Reserve Allocation: A focus on exposure strategies and collateral design to maintain on-chain value.

2. Reserve Custody: The management and settlement of reserve holdings via decentralized rails.

3. Proof & Reporting: An on-chain transparency rail designed to allow users to reconcile reserve units against the public ledger, though the efficacy of this reporting depends on continued developer maintenance.

Vangard Digital Reserve Jumped nearly 170% in 1 Week: Why Is VDR Trending in Feb 2026?

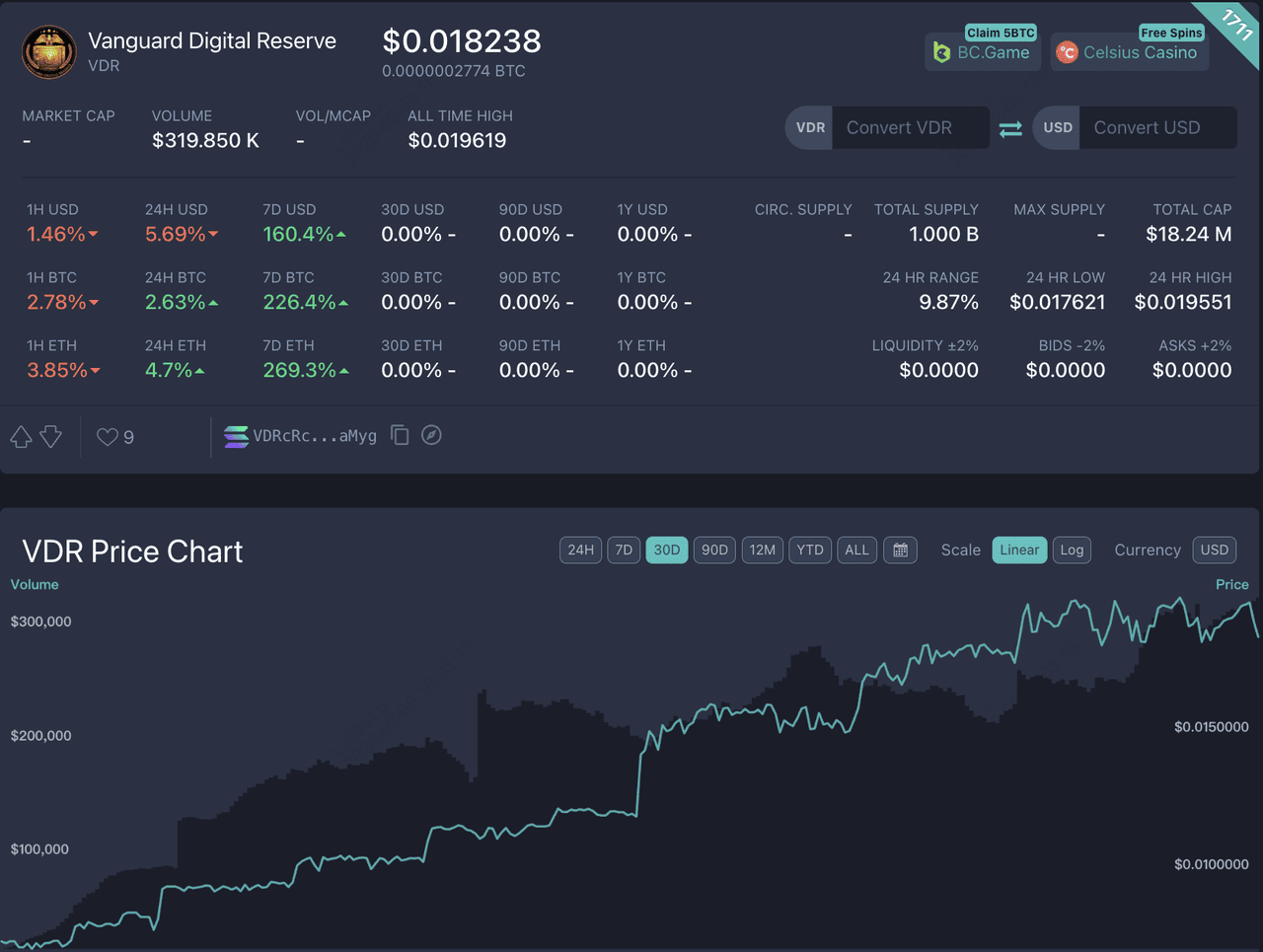

Source: Live Coin Watch

As of February 9, 2026, VDR has seen its price reach $0.018427, marking a 168.5% increase over the last seven days. This momentum is driven by a convergence of narrative trends and skyrocketing commodity prices in the real world.

1. The "Resource Meta" Momentum: Early 2026 has been defined by a rotation into assets that parody physical reserves. As global prices for

Gold,

Silver,

Copper, and

Oil hit multi-year highs, projects like the

U.S. Oil Reserve (USOR) and

CopperInu saw massive inflows. VDR has absorbed significant capital by positioning itself as the "Index" or "Reserve" play for this resource-centric season.

3. High-Level Reserve Reporting: The project’s website recently published an indicative reserve value of $803,020. While this provides a snapshot of current holdings, investors should remember that these metrics are self-reported and currently serve more as a narrative tool than a guaranteed backing.

What Is the Vanguard Digital Reserve (VDR) Tokenomics?

The VDR economic model is designed to mimic the scarcity and structure of a traditional reserve asset while maintaining the high liquidity of a Solana SPL token.

Total Supply: 1,000,000,000 (1 Billion) VDR tokens.

• Circulating Supply: As of February 9 2026, 100% of the supply is in circulation, with the mint function officially revoked to prevent future inflation.

• Supply Capping: The contract contains no burn mechanism at the base layer, though community-led initiatives frequently involve manual liquidity burns to increase market depth.

• Distribution Trends: Market data suggests a healthy distribution, with the top 20 holders currently owning approximately 22% of the supply. This level of decentralization is significantly higher than many typical Solana "trenches" tokens, reducing the risk of large-scale market manipulation.

What Is the VDR Token Used For?

VDR is the native utility token of the Vanguard Digital Reserve ecosystem. Its usage is tied to the project's social and technical roadmap:

1. Social Access: Holding VDR often grants access to exclusive "alpha" groups on Discord and X that focus on the "TradFi-meme" and RWA meta. These communities prioritize sharing real-time market insights and collaborative research for on-chain participants.

2. Future RWA Integration: Under the "Rare Metals" roadmap, VDR is intended to serve as the base currency for interacting with tokenized physical resources. A major milestone for the tokenization of rare metal assets is scheduled for February 20, 2026, positioning VDR as a utility layer for commodity-backed tokens.

3. Reserve Exposure: Holding VDR provides a social and cultural connection to a curated reserve basket.

How to Buy Vanguard Digital Reserve (VDR) on Solana

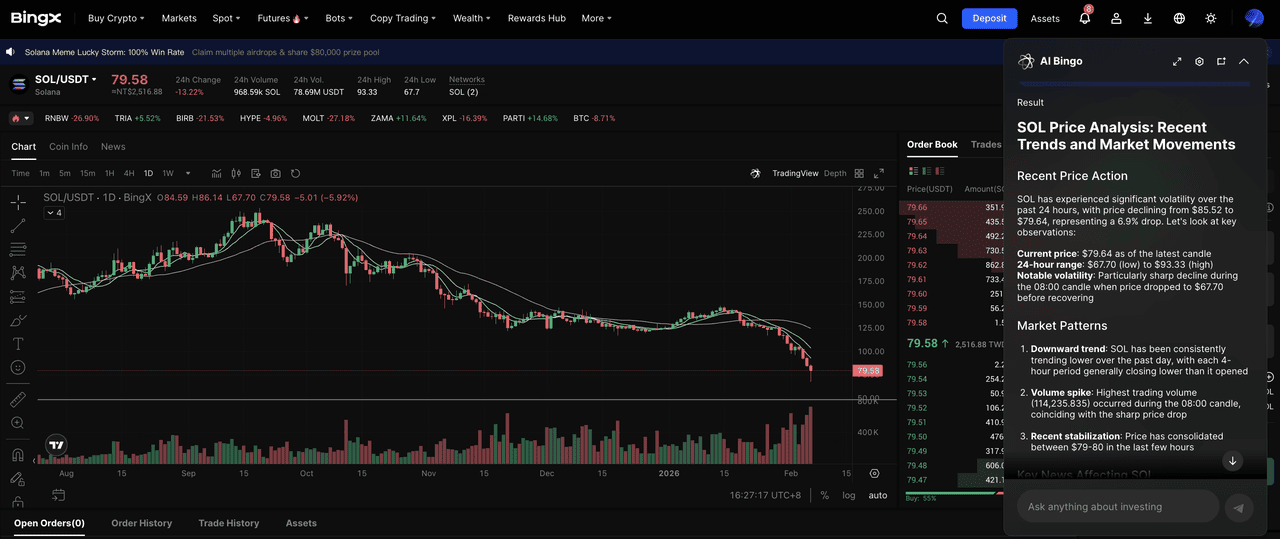

To acquire VDR, you must interact with the Solana decentralized ecosystem. The most secure way to do this is using SOL as the base currency.

Step 1: Create a Solana Wallet

Download and install a self-custody wallet like

Phantom or

Solflare. Ensure you store your recovery phrase offline and never share it.

Step 2: Buy SOL on BingX

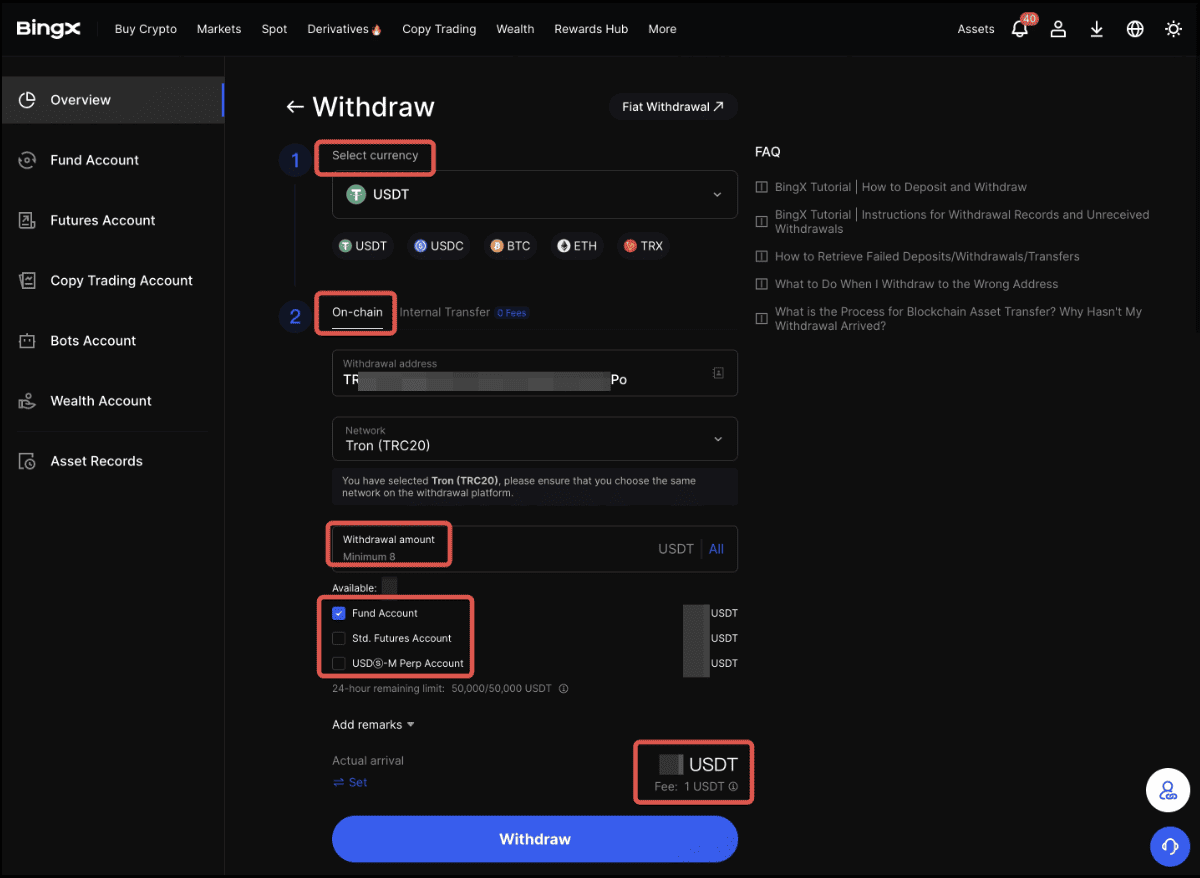

Step 3: Withdraw to Your Wallet

1. Navigate to Assets in your BingX account and select Withdraw.

2. Choose SOL, then copy and paste your Phantom or Solflare wallet address.

3. Set the network to Solana and confirm the transfer.

Step 4: Swap for VDR

1. Visit a Solana DEX aggregator

Jupiter.

2. Connect your wallet.

3. Paste the VDR contract address in the search bar: VDRcRcMWJM7exwHfVUau1WqAawLXR8tNF2sJP7PaMyg.

4. Swap your SOL for VDR.

Note: Make sure to paste the address manually, as many unrelated tokens use similar names and can cause accidental swaps.

5 Key Considerations Before Interacting with VDR

1. The "Meme-Utility" Paradox: While VDR uses institutional language, its price movement is currently driven by the same social hype that fuels meme coins. Investors should not mistake a professional website for a regulated financial product.

2. Anonymous Team Risks: The lack of a known, doxxed team means there is no legal recourse or accountability if the project's direction changes. This is a critical risk factor for anyone allocating significant capital.

3. Valuation Premium: With a market cap of over $18M and a reported reserve of $803K, VDR trades at a massive premium. This valuation is built on the narrative of future utility, not current asset backing.

4. Technical RWA Hurdles: Tokenizing physical commodities is legally and technically complex. The upcoming February 20th milestone will be a major test of whether the anonymous team can deliver on its promises.

5. Extreme Volatility: Despite its "reserve" branding, VDR is subject to the extreme price swings typical of the Solana ecosystem. A shift in the "resource meta" or sudden profit-taking by large holders can result in double-digit percentage drops within minutes.

Final Thoughts: Should You Buy VDR in 2026?

Vanguard Digital Reserve (VDR) is a sophisticated entry into the 2026 Solana market, masterfully blending TradFi aesthetics with the viral potential of on-chain narratives. While the 170% weekly surge is impressive, it highlights the project's high-risk, high-reward nature. Whether VDR matures into a functional RWA index or remains a clever parody of the establishment will depend on the team's ability to execute their roadmap transparently. For now, it remains a speculative asset that requires rigorous personal research and careful risk management.

Disclaimer: This article is for informational purposes only and is not investment advice. VDR is a high-risk, speculative asset with no guaranteed backing or regulatory oversight. Crypto markets are volatile. Always do your own research and never invest more than you can afford to lose.

Related Reading

FAQs on Vanguard Digital Reserve (VDR)

1. Is Vanguard Digital Reserve (VDR) affiliated with Vanguard Group?

No. VDR has no official connection to Vanguard Group or any traditional asset manager. Its branding intentionally mirrors TradFi aesthetics as part of a narrative strategy.

2. Is VDR a meme coin or a utility token?

VDR is a hybrid. While it uses institutional-style language, its price behavior is currently driven more by narrative momentum than by established on-chain utility.

3. Does VDR represent real asset backing or reserves?

No audited or legally enforceable backing exists. Any published reserve figures are self-reported and should be viewed as narrative signals rather than guaranteed collateral.

4. Who is behind the VDR project?

The team remains fully anonymous, with no publicly identified founders or developers, which introduces additional execution and accountability risk.

5. Is Vanguard Digital Reserve (VDR) a scam? Is it legit?

There are no clear signs of an outright scam, but VDR is not a regulated or institution-backed product. It should be treated as a high-risk, narrative-driven on-chain project.

6. Is VDR part of the Real-World Asset (RWA) sector?

Conceptually yes, but not in live implementation. Current exposure is narrative-based, with RWA integration still on the roadmap.

7. Where can I buy VDR?

VDR is available within the Solana ecosystem. Users typically buy SOL on BingX, then transfer it to a self-custody wallet and swap for VDR on a Solana DEX aggregator such as Jupiter.