Worldcoin (WLD) ripped higher after Eightco Holdings unveiled a plan to raise $250 million to accumulate WLD as its primary treasury reserve asset, while naming tech analyst Dan Ives as chairman and targeting a ticker change to “ORBS” on Sept 11, 2025. The announcement, backed by investors including World Foundation, Kraken, Pantera, GSR and others, marked the first corporate treasury strategy centered on WLD, and sent both WLD and Eightco’s stock sharply higher.

This guide explores Eightco’s Worldcoin (WLD) treasury plan, its impact on holders, key risks, and how to trade WLD effectively on BingX.

What Is the Eightco “Worldcoin Treasury” Plan?

Eightco's Worldcoin treasury plan aims to raise $250 million, along with $20 million from BitMine, and use it to buy and hold Worldcoin (WLD) as the main asset in its company reserves, with some

ETH and cash kept as backups. This would be the first public company to make WLD its treasury asset, which could mean fewer WLD on exchanges and sharper short-term price moves as the market reacts.

Eightco Holdings (Nasdaq: OCTO) is a small U.S. holding company with roots in e-commerce financing as Forever 8, and packaging/logistics as Ferguson Containers. It’s pivoting part of its strategy toward crypto treasury management. The company named Dan Ives as Chairman, aims to close the deal around Sept 11, 2025, and plans to change its Nasdaq ticker to ORBS after closing. Its backers include World Foundation, Kraken, Pantera, GSR, and others.

WLD (an ERC-20 token) is tied to World ID, a “

proof-of-human” system. After the Apr 30, 2025 U.S. rollout of World ID, Eightco is betting that digital identity becomes a major driver for institutional adoption in the

AI era.

As of September 2025, World reports 15.88 million verified humans, 34.20 million World App users, about 2.10 million daily and 605.42 million total wallet transactions, 738.25 million tokens distributed, and 1,680 active Orbs. If Eightco keeps buying on schedule, WLD gains a steady buyer that isn’t trading every wiggle, which can support prices, but that support depends on Eightco following through and on regulatory clarity, so look for confirmed purchases and policy updates.

What Does the Worldcoin Treasury Mean for WLD Holders?

For WLD holders, Eightco’s plan means a new, steady buyer could soak up a chunk of the coins normally available on exchanges. The company secured $250 million and an additional $20 million from BitMine to buy and hold WLD as its main reserve asset, with ETH and cash as backups; if the deal closes around September 11, 2025, those purchases can tighten circulating supply, spotlight Worldcoin’s proof-of-human narrative, and potentially make price moves sharper in the short run, up or down. This is the first time a public company has chosen WLD for its treasury, a signal that may draw more institutional attention to the project.

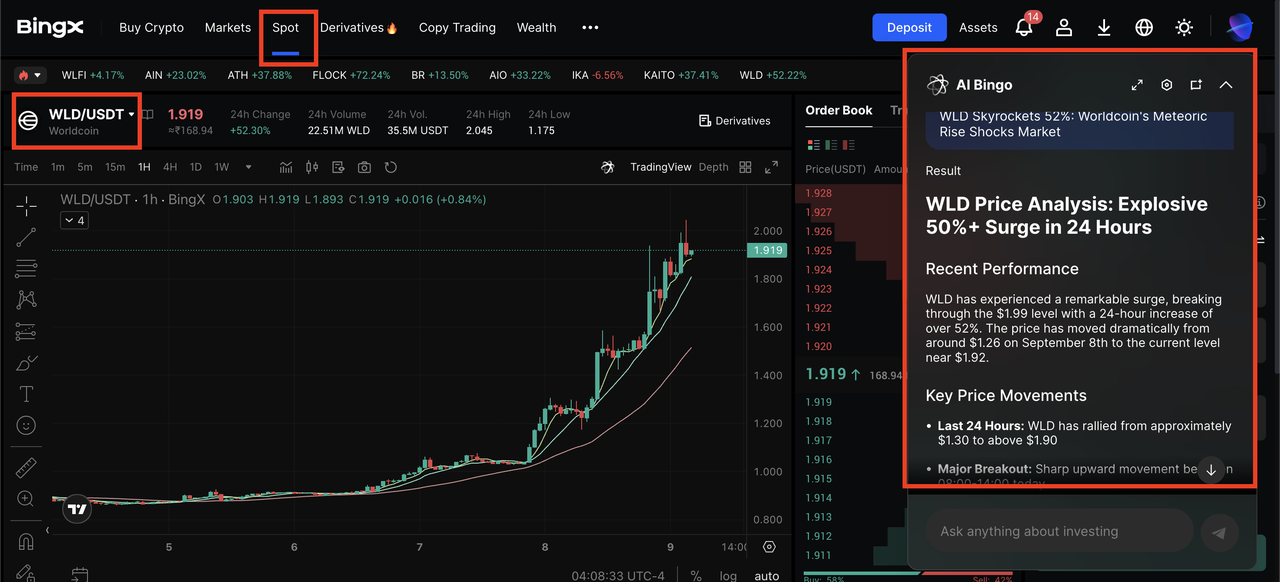

WLD token price surgest on Worldcoin treasury news | Source: BingX

Following this development, the WLD token surged over 50% in a day on the news and was up by nearly 120% in the past week while Eightco’s stock spiked intraday by ~3,000%, moves that can unwind just as fast as funding closes and buying starts. If you hold or trade WLD, watch for:

1. Confirmation that the offering closes and any on-chain accumulation that follows

2. Regulatory headlines around biometrics and privacy

3. Growth in World ID usage after the U.S. rollout, where World reports over 14 million verified humans, 30 million+ World App users, and 500 million transactions to date.

These adoption signals can reinforce (or weaken) the treasury narrative over time.

What Is Worldcoin (WLD) and How Does It Work?

World is a “real human network” made of four parts you’ll see referenced often: World ID, a private, anonymous proof that you’re a unique human, World App, the wallet that stores your World ID and crypto, World Chain, an Ethereum Layer-2 “blockchain for humans”, and Worldcoin (WLD), an ERC-20 token on Ethereum. World launched in the U.S. on Apr 30, 2025.

To get started with Worldcoin, users can download World App, visit an Orb once to verify you’re human, then use your World ID to sign in to apps without giving away who you are. The project is “private by design”: Personal Custody keeps your data on your device, and zero-knowledge proofs let you prove “I’m a real, unique person” without exposing identity details.

Worldcoin statistics as of September 2025 | Source: Worldcoin

Under the hood: the Orb creates a numerical code used only to prevent duplicate sign-ups; World says it does not store your eye image. A newer system called AMPC (Anonymized Multi-Party Computation) splits and anonymizes those codes and checks uniqueness at high speed, 50 million pairwise comparisons per second on NVIDIA GPUs, so the network can scale while keeping verification private.

World Chain, secured by Ethereum as part of the

Optimism Superchain, gives verified users perks like priority blockspace and gas savings, while developers get Sybil-resistant tools to reach millions of real users. Practically speaking: WLD behaves like other ERC-20 tokens, so you can hold it in compatible wallets and trade it on exchanges that list it; availability of WLD rewards in-app varies by region.

How Is WLD Different From Typical “Treasury Tokens”?

Most treasury assets (

BTC, ETH,

SOL,

stablecoins) are held mainly as “money.” WLD is different. It’s an ERC-20 token tied to World ID, a proof-of-human system used for bot-resistant logins, ticket drops, gaming, and more. So a WLD treasury bet isn’t just a bet on price but also on the adoption of human-verification rails. If more apps require World ID, the utility story behind WLD strengthens, which can shape demand beyond pure speculation.

The Apr 30, 2025 U.S. launch expanded verification to major cities, such as Atlanta, Austin, Los Angeles, Miami, Nashville, San Francisco, giving more people a path to get World ID via Orb visits and use World App. Practically, wider verification can attract more Mini Apps, more real users, and more developer interest, factors that can lift awareness, liquidity, and on-chain activity around WLD over time. For beginners, track simple signals: new verifications, World App users, daily transactions, and notable app/partner launches. These metrics show whether the identity network is growing in ways that could support a WLD treasury thesis.

How to Trade Worldcoin (WLD) on BingX

Use this step-by-step guide to trade Worldcoin (WLD) on BingX, either buy/sell

WLD/USDT on

Spot or take

WLDUSDT and

WLDUSDC Perpetual long/short positions with leverage, using

BingX AI and built-in risk controls along the way.

Buy or Sell WLD on the BingX Spot Market

WLD/USDT trading pair on the spot market powered by BingX AI

2. Add funds: deposit

USDT (bank card, P2P, or crypto transfer) or deposit WLD directly.

3. Search for

WLD/USDT on the Spot market.

4. Choose Market (instant) or Limit (your price). Enter the amount of WLD or USDT to spend and Buy.

5. To sell, switch to Sell, choose

Market/Limit, and confirm.

6. Use BingX AI for quick reads on volatility, news, and sentiment before placing orders.

Trade WLD Perpetual Futures on BingX

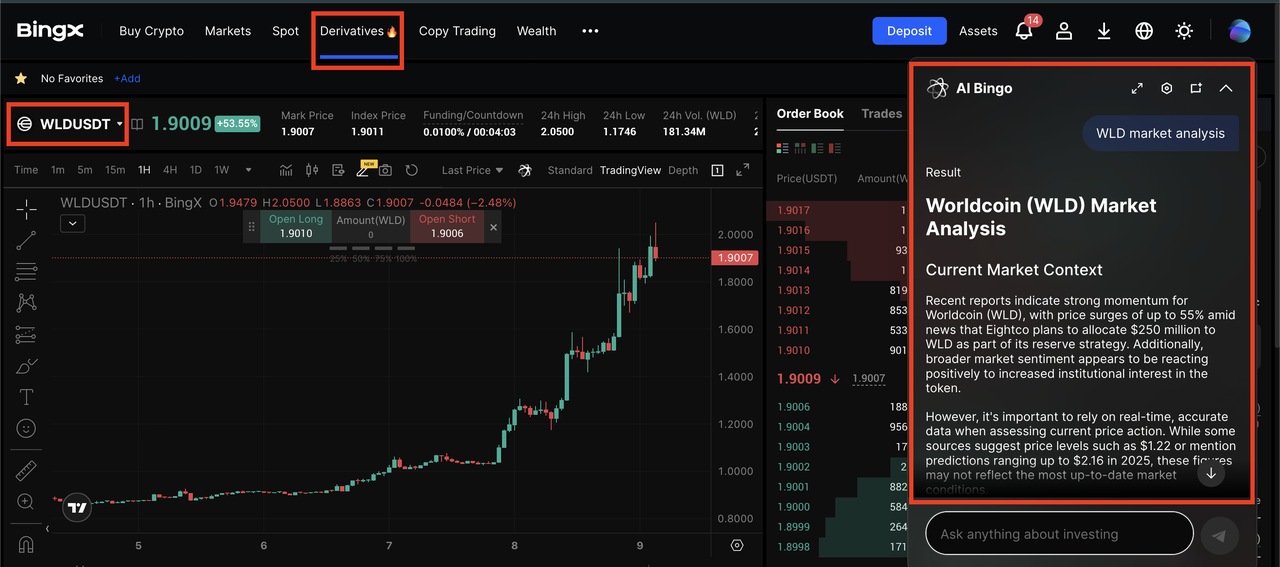

WLDUSDT perpetual contract on the futures market powered by BingX AI

1. Enable

Futures trading in your account, then transfer USDT from Spot → Futures.

2. Open

WLDUSDT Perpetual. Choose Isolated margin (safer for beginners) and low leverage (e.g., 2–5×).

3. Pick Market or Limit, set size, then place Long (Buy) if you think price will rise or Short (Sell) if you think it will fall.

Practical tips: keep leverage modest, avoid holding through major announcements if you’re new, and remember that futures may be restricted by region and carry a real risk of loss.

Conclusion

Eightco’s plan puts a spotlight on Worldcoin and its proof-of-human network, but the real test is execution: deal closing, steady accumulation, and continued growth in World ID usage. For now, the focus remains on three key issues: an institutional buyer, a U.S. rollout, and a maturing app stack. The outcome depends on policy developments, user adoption, and disciplined execution over time.

If Eightco completes and systematically accumulates WLD, it would mark the first public-company treasury built around Worldcoin, potentially a template for identity-linked tokens in the AI era. Combined with World’s U.S. rollout, a growing Mini App ecosystem, and ongoing privacy tech like AMPC, the narrative sits at the intersection of identity + liquidity + institutions. Still, regulatory clarity and operational execution will determine how durable this story becomes.

Risk reminder: Crypto is volatile and headline-driven. The private placement may not close as planned, buy schedules can change, and biometric/identity regulations could affect access and sentiment. Start small, use stops and modest leverage, monitor funding and liquidity, and only trade what you can afford to lose.

Related Reading