Privacy-focused cryptocurrencies have become one of the strongest movers in late 2025. Since August 2025, Zcash (ZEC) has surged over +1,800%, rising to around $688, while Dash (DASH) has climbed +194% year-to-date to roughly $84. With both assets sharply outperforming major market benchmarks, privacy coins are once again drawing investor attention.

Two veteran projects,

Zcash (ZEC) and

Dash (DASH), stand out as contenders in the so-called “

privacy coin” category. Zcash focuses on advanced

zero-knowledge cryptography to enable fully shielded transactions, while Dash combines fast settlement, on-chain governance, and optional privacy features. With their contrasting designs and privacy approaches, the comparison between Zcash and Dash offers one of the clearest ways to understand how the privacy-coin sector is evolving in 2025.

Zcash vs. Dash: Why Privacy Coins Are Popular in 2025

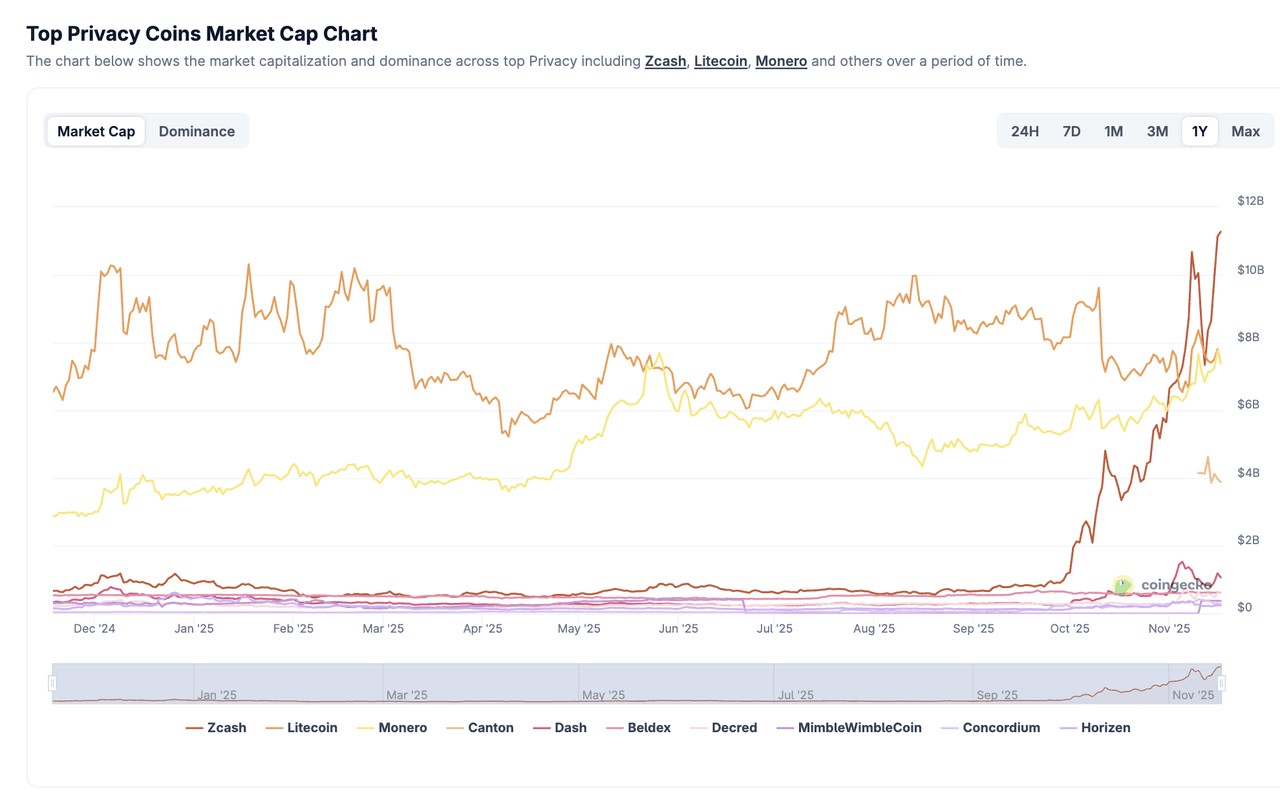

Privacy coins have re-entered mainstream attention in the second half of 2025, driven by narrative catalysts, on-chain accumulation and shifting regulatory conditions. Among them, Zcash and Dash delivered some of the strongest returns of the year, making their performance a key indicator of how the market views the future of privacy in crypto.

Privacy Coins See Triple-Digit Growth across Key Catalysts

The privacy coin sector became one of the strongest performers in late 2025. Since October, sector-wide market capitalization surged as traders rotated into assets offering stronger transactional anonymity. The catalyst arrived on October 1 when tech investor Naval Ravikant described Zcash as “insurance against Bitcoin,” sending ZEC up more than 60% in 24 hours and lifting the privacy segment over 35% for the month. Rising regulatory scrutiny, upcoming 2026 tax-reporting rules and tighter European restrictions on anonymity-enhanced tokens added momentum as investors sought privacy-focused alternatives during a weak broader market.

One of the clearest signals came from Zcash’s shielded pool, the part of the network where coins are held in fully private addresses that hide sender, receiver and amount details on-chain. In October, the shielded pool expanded past 4.5 million ZEC, reaching roughly 27% of supply, after more than 1 million ZEC were shielded within three weeks. Such a rapid rise in private balances indicated that investors were actively opting into deeper privacy, suggesting sustained accumulation rather than speculative rotation.

Zcash Leads with a +1,800% Narrative-Driven Rally, Becoming the Largest Privacy Coin

ZEC price has surged 1,800% in the past 3 months | Source: BingX

ZEC Price

Zcash was the strongest performer in the privacy coin sector, gaining more than +1,800% from August to mid-November and rising from under $40 to about $688. Naval Ravikant’s endorsement pushed ZEC into the spotlight by highlighting its zero-knowledge privacy model and positioning it as a hedge against growing transparency on major chains. Institutional participation added momentum. The Grayscale Zcash Trust grew from $4.9 million to $13.8 million in one month, a 180% rise reflecting renewed institutional appetite for privacy exposure.

On-chain activity reinforced the breakout. The shielded pool surpassed 4.9 million ZEC in early November, the highest level recorded. Messari reported a 1,000% increase in ZEC’s mindshare, and analysts noted that rising regulatory oversight encouraged some Bitcoin holders to rotate part of their funds into ZEC to preserve transactional privacy.

By early November, Zcash’s market capitalization had climbed past

Monero’s for the first time, marking a notable power shift in the privacy-coin landscape and reinforcing ZEC’s position as the sector’s new benchmark asset.

Dash Gains Nearly +200% as Traders Rotate into Mature Privacy Coin Networks

DASH price has jumped over 200% in the past 3 months | Source: BingX

DASH Price

Dash also delivered a strong performance in 2025, climbing roughly +194% year-to-date and trading near $84 in mid-November. Its momentum accelerated in early November, including a single-day rally of more than 60% as liquidity flowed into privacy assets following ZEC’s breakout. Dash benefited from its wide exchange availability, established user base and its hybrid model that blends fast settlement with optional privacy, making it a practical choice for traders seeking user-controlled privacy.

Capital rotation played a key role. After the September correction, investors favored mature privacy coin networks with consistent liquidity and long-standing communities. While Monero faced ongoing delistings across Europe, Dash remained widely supported, giving it an edge during renewed interest in privacy technologies. Analysts also noted that with EU AMLR 2027 on the horizon, adaptable privacy architectures may gain relative strength. This combination of accessibility, utility and sector-wide momentum helped Dash achieve its strongest multi-week performance in years.

What Is Zcash and How Does It Work?

Zcash is a privacy-focused cryptocurrency built as a fork of Bitcoin that enables both transparent and fully private transactions. It introduces zero-knowledge proofs (zk-SNARKs) to the

Bitcoin model, allowing users to verify transaction validity without revealing the sender, receiver or amount on-chain. This gives Zcash the rare ability to offer full confidentiality while maintaining the integrity and auditability of a public blockchain.

Zcash operates with two address types: transparent addresses (t-addresses), which behave similarly to Bitcoin, and shielded addresses (z-addresses), which provide complete privacy. Funds stored in z-addresses reside in the shielded pool, where transaction details are encrypted but still cryptographically verified by the network. Protocol upgrades such as Sapling and Orchard have made private transactions significantly faster and easier to support, leading to a major increase in shielded usage throughout 2025.

2025 Zcash Economic and Ecosystem Outlook

• Market leadership: Zcash became the leading privacy coin in 2025, surpassing Monero (XMR) in market capitalization for the first time as inflows concentrated around ZEC.

• On-chain adoption: The shielded pool exceeded 4.9 million ZEC, reaching a record share of circulating supply and signaling sustained demand for fully private balances.

• Institutional inflows: Grayscale’s Zcash Trust expanded more than 180% in one month, reflecting renewed institutional interest in privacy-focused assets.

• Regulatory fit: With global reporting rules tightening in 2026, Zcash’s optional privacy model is increasingly viewed as a balanced approach that supports confidentiality while remaining compatible with compliance requirements.

ZEC Tokenomics Overview

• Fixed supply: Zcash has a maximum supply of 21 million ZEC, mirroring Bitcoin’s scarcity model and reinforcing its role as a capped digital asset.

• Proof-of-Work consensus: The network uses PoW, with miners validating blocks and earning ZEC rewards for securing the chain.

• Halving schedule: Block rewards decline every four years; the 2024 halving tightened issuance and reduced new supply entering circulation.

• Growing shielded supply: More than 25–27% of circulating ZEC now resides in the shielded pool, highlighting rising adoption of fully private balances.

• Sustainable development funding: The Electric Coin Company and Zcash Foundation receive protocol-defined allocations to support ongoing development, research and ecosystem maintenance.

What Is Dash and How Does It Work?

Dash is a digital currency launched in 2014 that focuses on fast, low-cost and reliable payments with user-controlled privacy. Originally forked from Bitcoin, Dash modifies the base design to create a more efficient transaction network, offering near-instant settlement and predictable fees. Its architecture blends Bitcoin’s security model with enhancements tailored for payments, making Dash one of the earliest blockchain networks optimized for everyday transactions.

Dash operates through a two-tier system. Miners secure the blockchain using

Proof-of-Work, while masternodes provide advanced features such as InstantSend for rapid settlement, PrivateSend for optional privacy, and on-chain governance. Instead of fully private addresses, Dash uses a decentralized coin-mixing mechanism that obscures transaction history without replacing the transparency of its base layer. This design balances user privacy with compliance-friendly transparency, supporting both personal payments and merchant integrations.

2025 Dash Economic and Ecosystem Outlook

• Strong performance: Dash gained nearly +200% year-to-date in 2025, supported by renewed investor rotation into mature transaction-focused privacy assets.

• Usage momentum: Demand for fast settlement and user-controlled privacy increased during the broader privacy coin rally in October–November.

• Accessibility strength: Dash maintained wide exchange and wallet availability, giving it a liquidity advantage as other privacy coins faced regional delistings.

• Regulatory positioning: With AMLR 2027 approaching, Dash’s opt-in privacy model is viewed as more compliant than fully anonymous networks.

DASH Tokenomics Overview

• Maximum supply: Approximately 18.9 million DASH, with a capped long-term emission schedule.

• Consensus structure: Dash combines Proof-of-Work mining with a masternode layer that supports governance and advanced network functions.

• Block reward split: Rewards are distributed between miners, masternodes and the treasury to fund security, operations and ecosystem development.

• Emission curve: Block rewards decrease by about 7% annually, gradually reducing supply inflation over time.

• Utility: DASH is used for transactions, InstantSend settlements, PrivateSend mixing and masternode staking, making it both a payment asset and a governance token.

Zcash vs. Dash: Which Is the Better Privacy Coin in 2025?

As privacy-focused assets gained momentum in 2025, Zcash and Dash emerged as the two most discussed networks in the sector. Both belong to the broader privacy coin category, yet they were built for different purposes and offer distinct levels of confidentiality, speed and ecosystem support.

Zcash centers on advanced zero-knowledge cryptography and is designed for users who require strong, mathematically proven confidentiality. Dash, by contrast, focuses on instant payments with optional privacy, making it more practical for everyday transactions. This difference in architecture explains why investors treat the two assets differently and why they attract different user groups in 2025.

• Choose Zcash if you want fully private transactions backed by zero-knowledge proofs, strong institutional access and a growing shielded supply.

• Choose Dash if you need fast, low-cost payments with optional privacy and broad exchange availability.

• Choose either if you want established, battle-tested privacy assets that outperformed during the 2025 rotation into alternative stores of value.

Both assets remain relevant in 2025, but they excel in different roles. Zcash is stronger as a privacy-preserving store of value, while Dash is better suited as a transaction-focused payment network.

| Category |

Zcash (ZEC) |

Dash (DASH) |

| Launch Year |

2016 |

2014 |

| Bitcoin-Forked |

Yes (Bitcoin fork with zk-SNARK layer) |

Yes (Bitcoin fork with masternode layer) |

| Supply Cap |

21 million |

~18.9 million |

| Consensus Mechanism |

Proof-of-Work |

Proof-of-Work + Masternode layer |

| Key Technology |

zk-SNARKs, Orchard shielded pool |

InstantSend, Masternodes, PrivateSend |

| Halving Period |

~every 4 years |

Reward reduction ~7.14% every ~210,240 blocks (≈383 days) |

| Privacy Model |

Fully private shielded transactions |

Coin-mixing based optional privacy |

| Address Types |

Transparent + Shielded |

Single address type with optional mixing |

| Transaction Speed |

Standard PoW timing |

Seconds with InstantSend |

| Institutional Access |

Strong (Grayscale ZEC Trust) |

Moderate but widely listed |

| Best For |

Users who need full confidentiality |

Users who want fast payments with optional privacy |

Risks and Considerations Before Trading Privacy Coins

1. Higher Regulatory Uncertainty: Privacy coins often face stricter oversight due to their confidentiality features, and future policy changes or exchange rules may impact liquidity and accessibility.

2. Greater Price Volatility: Privacy-focused assets can experience sharper price swings driven by narrative catalysts, liquidity imbalances and sudden shifts in market sentiment.

3. Potential Listing Changes: Exchange availability for privacy coins can evolve with regulatory updates, which may affect where and how they can be traded.

4. Technical Complexity: Shielded transactions and privacy-focused wallets require proper setup and understanding, and errors may lead to delayed or failed transfers.

5. Liquidity and Slippage Risk: Lower liquidity during volatile periods can widen spreads and increase slippage, especially when using leverage.

6. Operational Privacy Limits: Strong privacy does not guarantee complete anonymity, as poor wallet hygiene or mixing with transparent addresses can weaken privacy protections.

Final Thoughts

The privacy coin sector became one of the most active areas of the market in 2025 as traders, developers and institutions paid more attention to on-chain confidentiality. Zcash and Dash both played a central role in this trend, supported by renewed demand for private transactions and stronger interest in alternative store-of-value models.

Zcash offers advanced zero-knowledge cryptography and fully shielded transactions, while Dash focuses on fast payments with optional privacy. The choice between them depends on the level of privacy a user needs, the type of network design they prefer and how they plan to use the asset.

For anyone exploring this category, understanding the differences between major privacy coins is essential. As the regulatory environment changes and the market continues to evolve, clarity on how each protocol works will help you make more informed decisions.

Related Reading