In August 2025, LayerZero Foundation made big news in the crypto world, with its plan to acquire Stargate (STG) for $110 million and combine the two projects. The proposed STG-ZRO token merger aims to unite two major cross-chain platforms under a single token. If approved, STG would be phased out and swapped for ZRO at a fixed rate of 1 STG = 0.08634 ZRO, creating a unified token for governance, liquidity, and infrastructure in the LayerZero ecosystem.

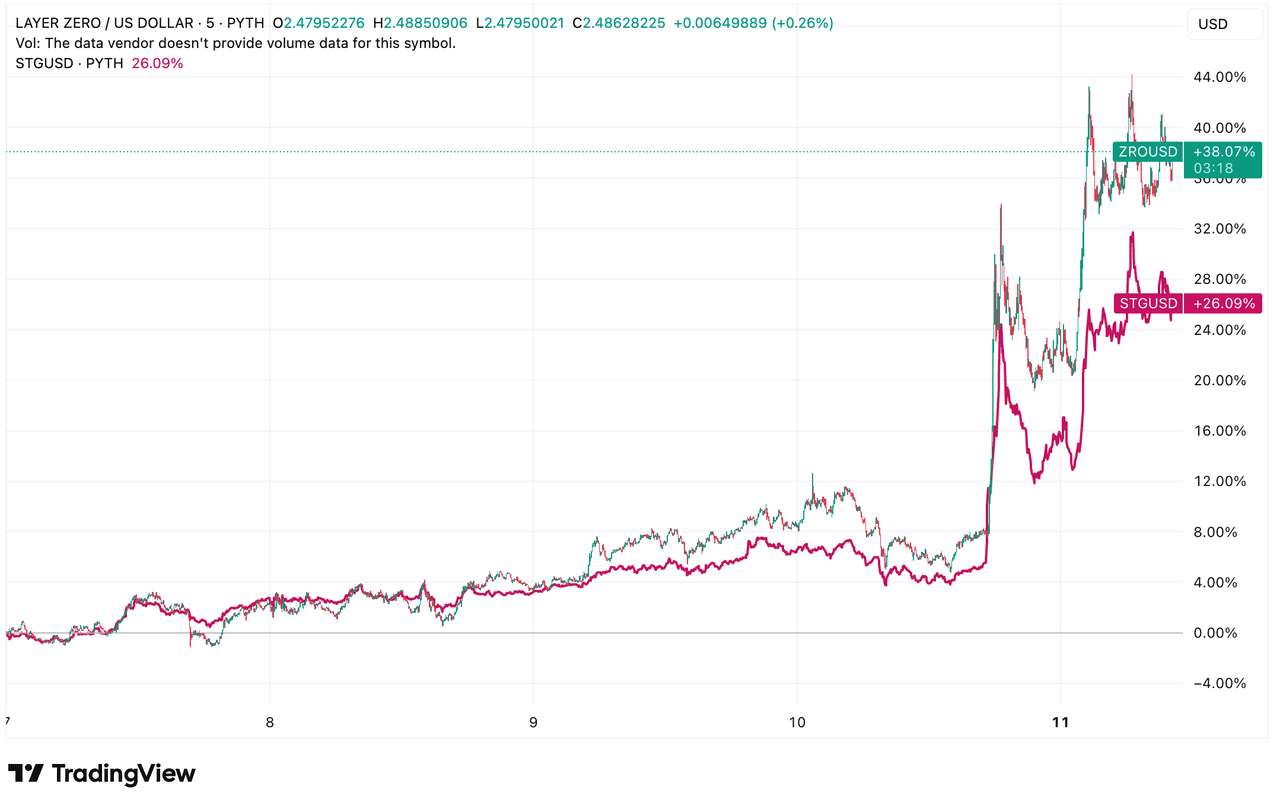

ZRO, STG tokens prices surge | Source: TradingView

Launched in 2021 by Bryan Pellegrino, Ryan Zarick, and Caleb Banister, LayerZero is an omnichain messaging protocol created to solve the high fees, slow speeds, and security risks of existing cross-chain bridges. It now connects over 120 blockchains, powers 300+ applications, and has secured more than $50 billion in transferred value, underpinning major projects in DeFi, gaming, and NFTs.

News of its $110 million Stargate merger proposal sent ZRO up nearly 30% in 24 hours and STG up around 20%, as traders considered the potential impact of uniting two of the most active interoperability platforms in crypto.

What Is LayerZero and Why Does It Matter?

LayerZero is an omnichain interoperability protocol that allows decentralized applications (OApps) to send data, tokens, and commands across multiple blockchains as if they were one network. This capability eliminates the long-standing issue of blockchain fragmentation.

It’s powered by a secure, lightweight messaging system built on:

• Immutable Endpoints – Tamper-proof smart contracts on each chain.

• Ultra-Light Nodes (ULNs) – Efficient validators that avoid full-node costs.

• Oracles – Services like Chainlink or Band Protocol that relay block data.

• Relayers – Independent entities that deliver transaction proofs to target chains.

Key Features and Use Cases

LayerZero’s architecture makes cross-chain interaction secure, scalable, and developer-friendly:

• Decentralized Verifier Networks (DVNs) in V2 replace the single-oracle model with multiple independent verifiers.

• Message Channels & Modular Libraries allow customizable message formats and ordered delivery.

LayerZero's real-world applications include:

1. Cross-Chain DEXs like Stargate and SushiSwap for direct swaps without wrapped assets.

2. Multi-Chain Lending that lets users post collateral on one chain and borrow on another.

3. Omnichain NFTs (ONFTs) for cross-chain asset mobility.

4. Cross-Chain Governance for unified DAO decision-making.

5. Game Asset Portability so players can move items and tokens between ecosystems.

What Is the $110M LayerZero-Stargate Merger Proposal?

Source: LayerZero on X

On August 11, 2025, the LayerZero Foundation announced a bold $110 million plan to acquire Stargate Bridge and merge its token economy into the LayerZero ecosystem. If approved, the deal would retire Stargate’s native STG token and allow holders to swap their tokens at a fixed rate of 1 STG = 0.08634 ZRO. This move would effectively consolidate two of the most widely used interoperability platforms under one governance and infrastructure framework. Stargate, launched by LayerZero in 2022, has processed more than $70 billion in historical volume, making it one of the largest cross-chain liquidity protocols in the market.

The proposal seeks to:

• Streamline Development – Remove duplicate resources across both protocols.

• Unify Infrastructure – Integrate liquidity pools, transaction flows, and tech stacks.

• Concentrate Value – Make ZRO the central governance and utility token.

The proposed merger aims to streamline development, unify cross-chain infrastructure, and concentrate value in a single LayerZero token. By folding Stargate’s liquidity pools, transaction flows, and technology stack directly into LayerZero, the foundation expects to reduce duplication of resources while expanding ZRO’s role as the central governance and utility asset. For LayerZero, this is a strategy to strengthen its market position in the fast-growing blockchain interoperability sector, where speed, security, and liquidity are critical to adoption.

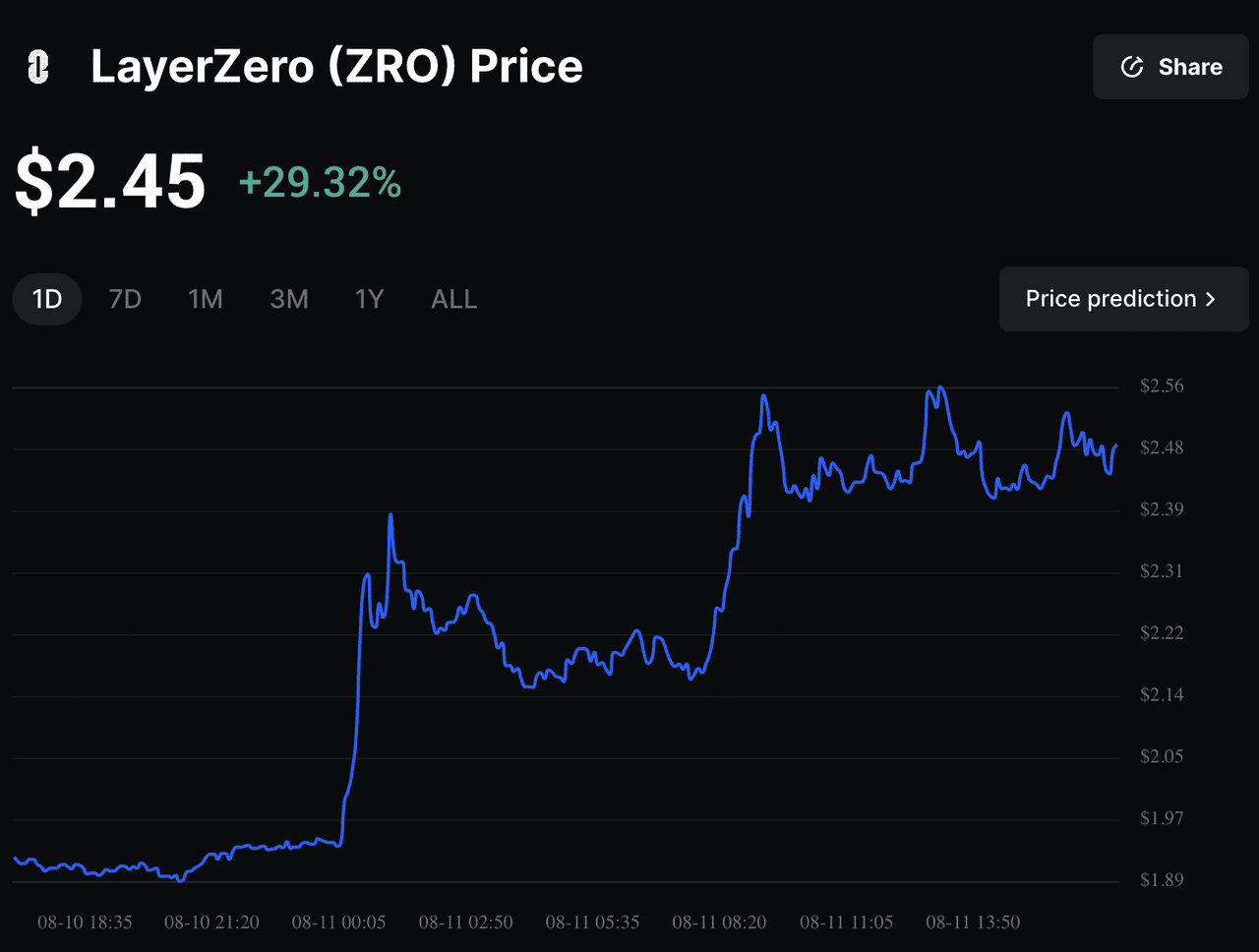

LayerZero (ZRO) price chart on BingX

The market responded swiftly to the news.

STG surged by around 20%, while ZRO climbed nearly 30% in 24 hours, briefly pushing the implied deal value to nearly $127 million.

However, community feedback is mixed. Supporters welcome the idea, citing the complexity of maintaining two tokens and the benefits of unified governance. On the other hand, critics argue the swap undervalues STG, noting Stargate paid out $939,000 to stakers in just the past three months, and that the merger would remove fixed-yield staking benefits.

What Does the Stargate Merger Proposal Mean for ZRO Holders?

If the $110 million Stargate (STG) merger passes, it could significantly reshape the role of ZRO within the LayerZero ecosystem. By retiring STG and unifying both protocols under one token, ZRO would become the sole governance and utility asset for one of the largest cross-chain infrastructures in crypto, now combining LayerZero’s $50 billion+ in transferred value with Stargate’s $70 billion+ historical volume.

For $ZRO token holders, this could mean:

1. Greater Token Utility – ZRO could be used across more dApps, bridges, and DeFi protocols as LayerZero integrates Stargate’s liquidity pools and cross-chain routing.

2. Consolidated Liquidity – Instead of splitting liquidity and governance between two tokens, all value and activity would center on ZRO, potentially improving market depth and trading efficiency.

3. Stronger Governance Influence – As the only governance token, ZRO holders would have direct say over protocol upgrades, fee structures, and ecosystem funding for both LayerZero and Stargate-powered applications.

What could be the potential risks of Stargate-LayerZero Token Merger

However, the merger also comes with risks and trade-offs, such as:

• Short-Term Price Volatility – Market reactions around the DAO vote and integration phase could create price swings, as seen with ZRO’s recent 30% daily surge after the announcement.

• Loss of STG Staking Yields – Stargate paid out roughly $939,000 to stakers in the past three months; under the merged system, this fixed-yield model would be removed, and returns could depend more on market performance and protocol activity.

• Integration Challenges – Merging two large-scale protocols requires technical alignment, community coordination, and liquidity migration, all of which carry execution risks.

For traders and long-term investors, the next few weeks are critical. The 7-day discussion period is underway, and 70% DAO approval is needed for the proposal to pass.

Whether you see this as a growth catalyst or a structural risk, monitoring DAO developments, market sentiment, and price action will be essential for making informed decisions.

How to Trade LayerZero (ZRO) on BingX

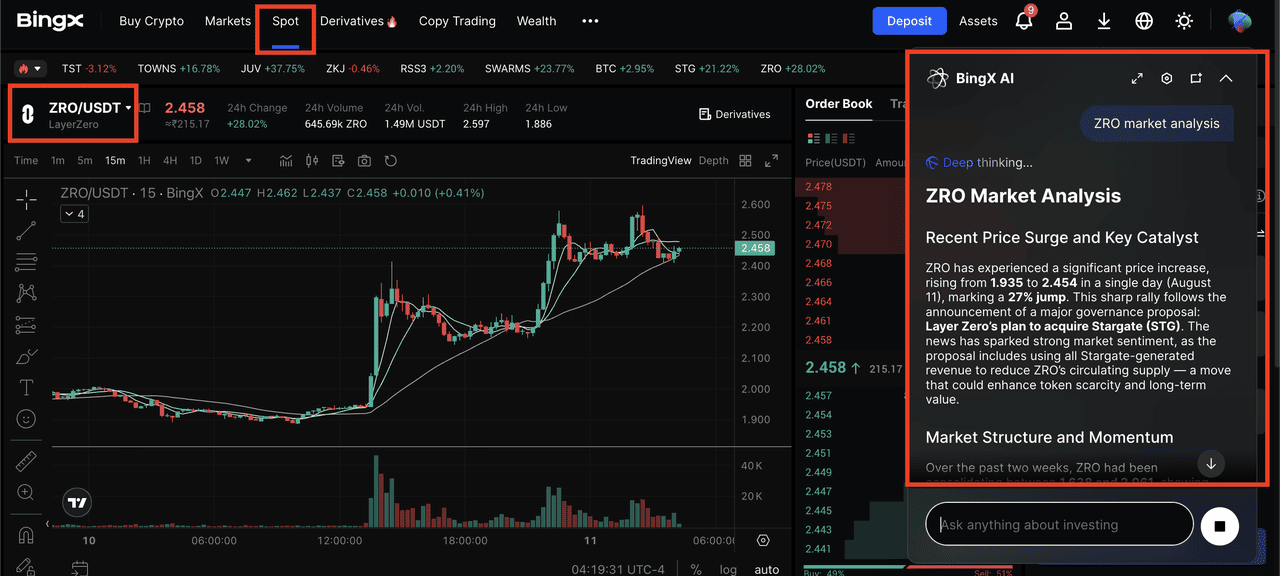

ZRO/USDT trading page on the spot market, powered by BingX AI insights

You can trade LayerZero (ZRO) directly on the BingX Spot Market with real-time pricing, deep liquidity, and low trading fees. Simply create or log in to your BingX account, deposit

USDT or other supported cryptocurrencies, and search for the

ZRO/USDT trading pair. From there, you can place market or limit orders depending on your preferred strategy.

For smarter decision-making, use

BingX AI to access advanced market analytics, price trend forecasts, and real-time sentiment insights. This

AI-powered tool can help you identify optimal entry and exit points, monitor volatility, and manage risk more effectively when trading ZRO in volatile market conditions.

Why the LayerZero-Stargate Token Merger Matters for Innovators & Traders

LayerZero remains a key player in advancing the omnichain vision, offering developers and users a more unified, efficient, and scalable way to interact across multiple blockchains. The proposed $110 million integration with Stargate, if approved, could further strengthen this position by consolidating liquidity, streamlining infrastructure, and centralizing governance under the ZRO token.

However, as with any major protocol change, the outcome depends on community approval and the market’s response. Traders and investors should be mindful that while the merger has potential long-term benefits, it also carries risks, including possible short-term volatility, changes to token utility, and uncertainties in execution. As always, thorough research and careful risk management are essential before making any investment decisions.

Related Reading