Aster (ASTER) is a next-generation

decentralized perpetual exchange that has become one of the fastest-growing names in crypto trading in Q4 2025. Created after the merger of Astherus and APX Finance, Aster combines yield-generating products with advanced perpetual markets, stock perps, and MEV-resistant high-leverage trading to form a unified, capital-efficient DeFi platform.

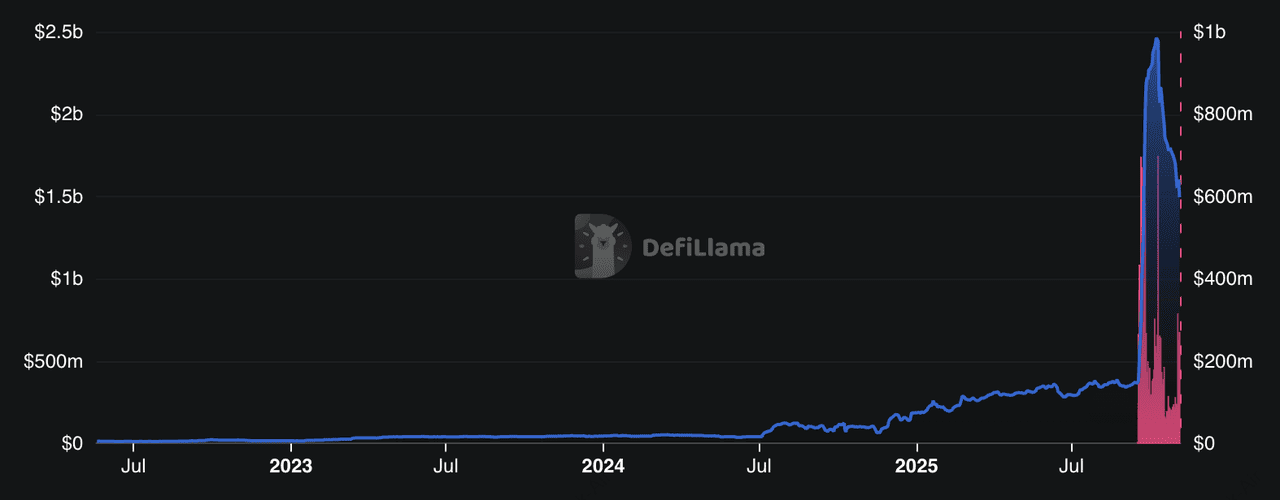

Aster TVL and DEX volume | Source: DefiLlama

Momentum further accelerated after Binance founder Changpeng “CZ” Zhao purchased 2 million ASTER tokens, triggering a 20% price jump and a surge in speculative demand on November 2, 2025. Following its Binance listing and the debut of Aster’s Rocket Launch campaigns, perpetual trading volume on the platform recorded an 8x increase throughout October 2025.

With features like 1001x leverage, Pro Mode order-book trading, hidden orders, stock perpetuals, and yield-bearing collateral, Aster has positioned itself as a leading competitor to giants like

Hyperliquid in the decentralized derivatives market.

In this article, we’ll break down what Aster DEX is, how the platform works, why traders and whales are rushing toward it in 2025, and how its tokenomics and airdrops fuel ecosystem growth.

What Is Aster (ASTER) Perp DEX?

Aster DEX is a decentralized perpetual exchange (Perp DEX) launched in late 2024 after the merger of Astherus and APX Finance. The platform integrates Astherus’ yield-bearing products with APX’s advanced perpetuals infrastructure, creating a one-stop DeFi ecosystem for spot trading, perpetual futures,

yield farming, and on-chain incentives.

Since its Token Generation Event (TGE) on September 17, 2025, $ASTER has surged over 2,700%, rising from $0.08 to an all-time high of $2.42 on September 24, 2025, and hit a fully diluted valuation (FDV) of above $7 billion as of November 2025. Total value locked (TVL) has climbed to $1.48 billion, while 24-hour trading volume has exceeded $1.32 billion.

Key Features of Aster Decentralized Exchange

Aster is built to make derivatives trading faster, cheaper, and more capital-efficient. It operates across multiple chains, including

BNB Chain,

Ethereum,

Solana, and

Arbitrum, and introduces a hybrid model that blends centralized-exchange performance with decentralized custody. The platform supports:

• Spot markets

• Perpetual futures with up to 1001x leverage

• Stock perpetuals (24/7 equities trading on-chain)

• MEV-resistant execution

• Order-book Pro Mode with deep liquidity

• Hidden Orders for whale-size execution with reduced front-running risk

Unlike many

DEXs, Aster allows users to post yield-bearing collateral such as asBNB and USDF, meaning traders can earn yield while keeping margin positions open. This model makes capital more productive and has become a major reason liquidity providers and active traders are shifting onto the platform.

By combining derivatives, yield generation, and multichain support, all wrapped in a CEX-style trading experience, Aster is positioning itself as a next-generation DeFi infrastructure designed to rival centralized exchanges and challenge leading perp protocols like Hyperliquid and

MYX Finance.

How Does Aster Perpetual DEX Work?

Aster DEX combines a CEX-style trading experience with full on-chain execution. Its architecture is built around high-performance order books, MEV-resistant execution, multichain access, and yield-bearing collateral, features that have attracted whales, professional traders, and everyday users. The platform operates through several core trading modes:

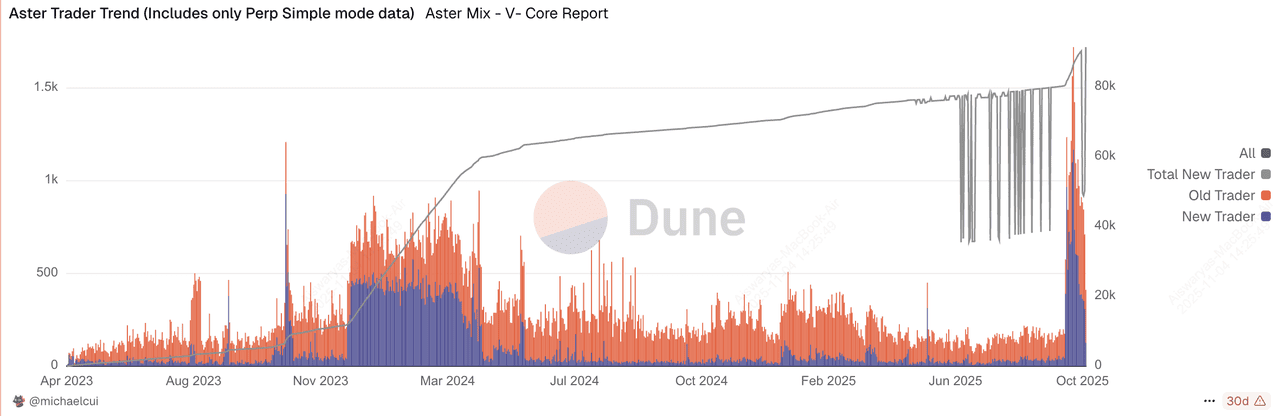

Aster new and old trader trends | Source: Dune Analytics

1. Pro Mode: Order Book + Multi-Asset Margin

Aster’s Pro Mode offers a deep-liquidity order book with low fees and multi-asset margin. Traders can post USDF, asBNB, ASTER, and other supported assets as collateral, enabling flexible position management. Advanced features such as grid trading and conditional orders give users a CEX-like interface while keeping custody of their own funds.

2. Hidden Orders: Private Execution for Whales

Hidden Orders function like decentralized dark pools. Large orders stay invisible until execution, preventing front-running and reducing price impact, a major draw after recent cases of targeted liquidation on rival platforms. This feature is frequently used by whales, high-frequency traders, and funds seeking stealth accumulation. On-chain data shows multiple large ASTER positions executed using Hidden Orders throughout October 2025.

3. 1001x Mode: MEV-Resistant High Leverage

Aster introduced one-click leverage up to 1001x, powered by its ALP cross-asset liquidity pool. Orders are matched and settled fully on-chain using oracles from

Pyth,

Chainlink, and Binance Oracle. This gives users extreme exposure without sacrificing transparency. The feature has become a major traffic driver, especially after Aster’s Binance listing and Rocket Launch campaigns.

4. Stock Perpetuals: 24/7 TradFi On-chain

Aster enables 24/7 trading of stock perpetuals, letting users trade traditional equities with crypto-style leverage and collateral. This bridges TradFi and DeFi on one platform, and has been one of the fastest-growing product verticals. During the Rocket Launch events, Aster captured over 90% of the AT stock-perp market within the first five days.

5. Yield-Bearing Collateral: asBNB + USDF

Unlike most DEXs, Aster lets users use yield-bearing assets as collateral. Positions remain active while the collateral continues earning yield, making margin trading more capital-efficient. This is a key reason liquidity providers and DeFi stakers have migrated to Aster.

As a result of these key features, Aster has recorded over $1.32 billion in 24-hour trading volume, more than $933 million in perpetual volume during Rocket Launch, and $1.48 billion in TVL, metrics that place it among the fastest-growing perp DEXs of Q4 2025.

Aster vs. Hyperliquid: Which Perp DEX Is Winning in 2025?

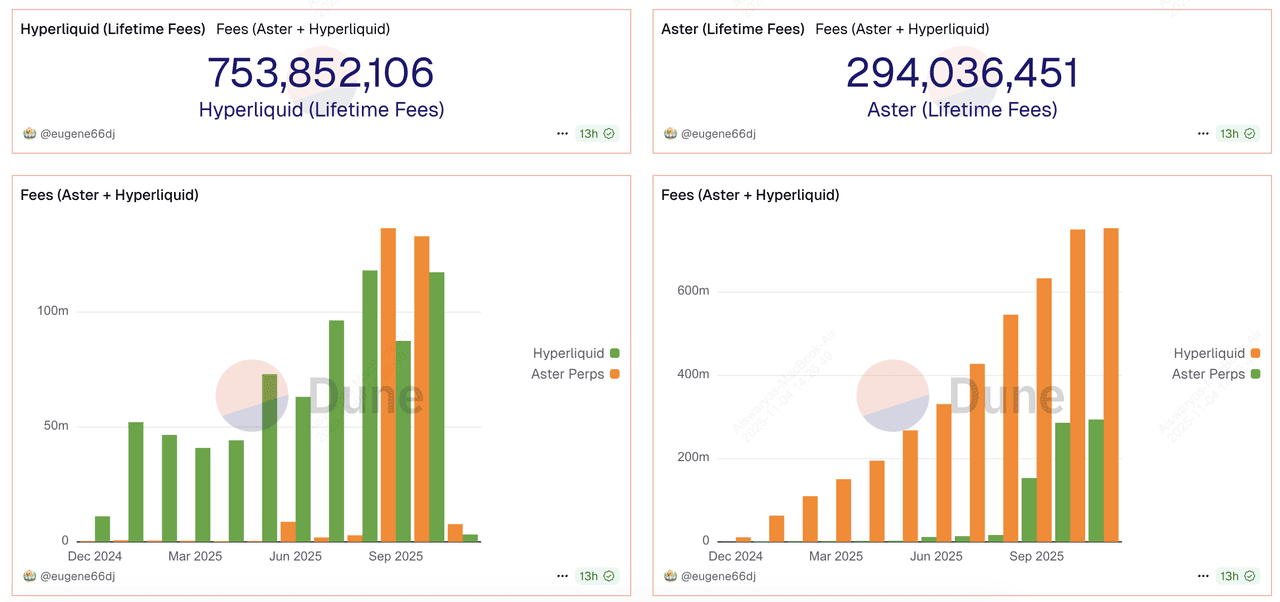

Aster vs. Hyperliquid lifetime fees | Source: Dune Analytics

The decentralized derivatives market is the fastest-expanding category in DeFi, and Aster is now one of the main challengers to Hyperliquid’s dominance.

1. Perp Market Growth Hits $408 Billion

The DeFi derivatives sector has exploded 654% year-on-year, reaching a $18.9 billion market cap by August 2025, with cumulative perp DEX volume surpassing $408 billion. Hyperliquid still leads with 70–80% market share, but platforms like Aster and MYX Finance are quickly gaining ground thanks to features such as 24/7 stock perpetuals, Hidden Orders, yield-bearing collateral, 1001x leverage, and multichain access. The momentum is visible on-chain: in November 2025, a whale deposited $500,000

USDC into

Hyperliquid to take a 3x leveraged long on ASTER, a clear sign of growing institutional interest in the rising DEX.

2. $ASTER Skyrockets After CZ Buys 2 Million Tokens

Aster’s post-TGE momentum turned explosive after Binance founder Changpeng “CZ” Zhao purchased 2 million ASTER tokens, publicly calling the launch a “strong start.” The endorsement triggered a nearly 20% intraday price spike, heavy inflows of

USDT into ASTER wallets, and even pushed one address to become one of the largest holders on BNB Chain outside Binance. Since then, $ASTER has surged over 2,700% from $0.08 to above $2.20, cementing its position as a multi-billion-dollar token and one of the fastest-rising assets in the perp DEX sector.

3. Pro Mode, 1001x Mode, and Stock Perps Are Changing the DEX UX

Aster differentiates itself with product innovation rather than just farming incentives:

• Product-first approach: Aster focuses on trading innovation rather than relying solely on token farming or

airdrop incentives.

• Hidden Orders: Allows stealth execution of large trades without slippage or front-running, similar to a decentralized dark pool.

• 1001x Mode: Offers one-click, MEV-resistant leverage up to 1001x powered by its ALP liquidity pool.

• Stock Perpetuals: Enables 24/7 perpetual trading of traditional equities on-chain.

• Yield-bearing collateral: Users can post assets like asBNB and USDF as margin and continue earning yield while positions stay open.

• Multichain access: Operates across BNB Chain, Ethereum, Solana, and Arbitrum, making it accessible to a wider trading base.

Combined, these features create a CEX-level trading experience on-chain, a major reason Aster is gaining traction with whales and active traders.

What Is $ASTER Token?

$ASTER is the native utility token powering Aster DEX. Beyond a tradable asset, the token is designed to align incentives across traders, liquidity providers, market makers, and governance participants. ASTER supports core functions of the exchange, including collateral efficiency, trading rewards, staking, and long-term ecosystem growth.

ASTER is listed on major exchanges, including BingX, starting September 16, 2025.

ASTER Token Utility

• Trading Collateral + Fees: ASTER can be used as margin for perpetual futures and as payment for trading fees. Users gain fee advantages when posting ASTER as collateral.

• Governance: Token holders vote on protocol parameters such as fee rates, supported markets, Rocket Launch listings, and future ecosystem upgrades.

• Incentives + Airdrops: A large portion of supply is reserved for trader rewards, loyalty campaigns, Rocket Launch payouts, and community airdrops. These programs drove massive participation, surpassing $933 million in perpetual volume within six days during Rocket Launch.

• Value Capture Mechanism: Aster’s reward engine includes revenue-funded buybacks. Fees collected from trading campaigns are used to repurchase ASTER on the open market before distribution, aligning user rewards with platform growth.

• Ecosystem Migration: Supports the APX token merger, liquidity partnerships, and long-term expansion across BNB Chain, Ethereum, Arbitrum, and Solana.

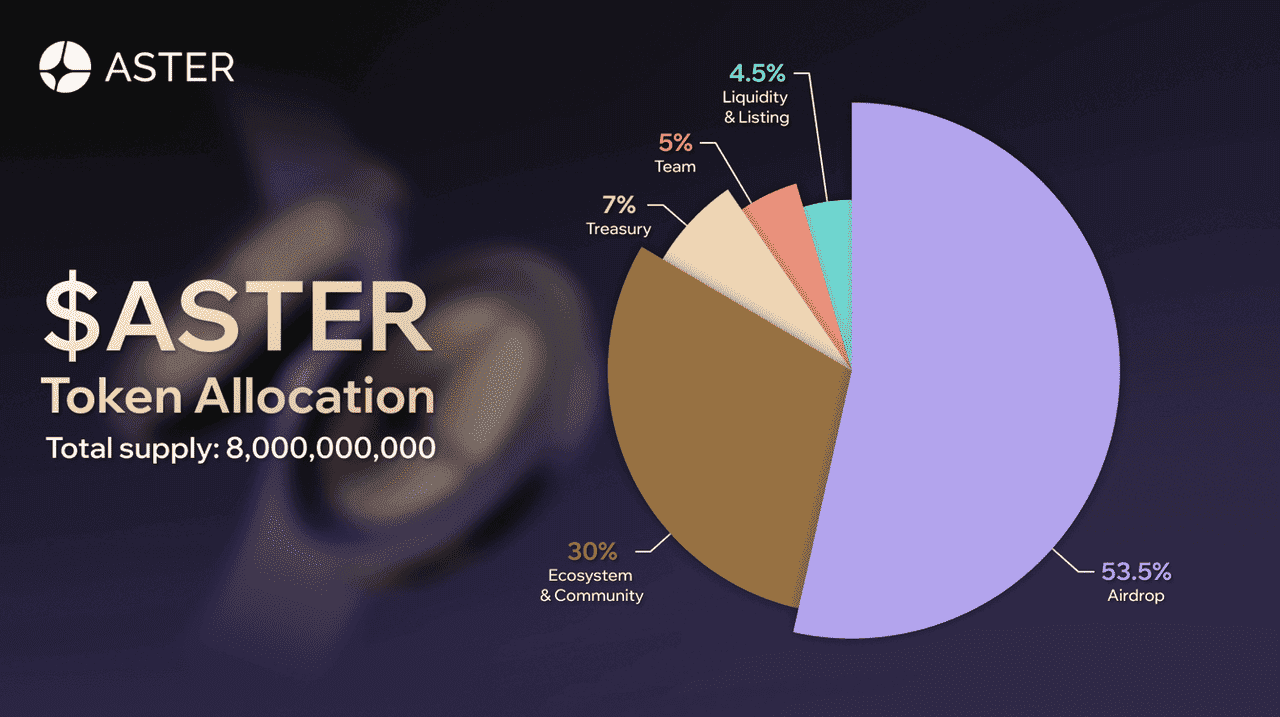

$ASTER Token Allocation

ASTER token distribution | Source: Aster docs

Aster follows a community-first model: more than 80% of the total supply of 8 billion ASTER tokens is dedicated to users, growth incentives, and ecosystem development. This prevents short-term speculation and keeps rewards tied to real usage and trading volume.

• Airdrop & Community Rewards – 53.5% (4.28 billion): For traders, stakers, Rocket Launch participants, and active community members.

• Ecosystem & Grants – 30% (2.4 billion): APX migration, partnerships, liquidity incentives, and developer grants.

• Treasury – 7% (560 million): Long-term reserves for governance and protocol sustainability.

• Team and Advisors – 5% (400 million): Cliff and multi-year vesting to align contributor incentives with platform growth.

• Liquidity and Listings – 4.5% (360 million): Market-making, exchange listings, and liquidity depth across chains.

With the token heavily weighted toward community growth, Rocket Launch buybacks, and trading incentives, ASTER is structured to reward real users, not just early insiders, while reinforcing platform adoption and TVL expansion.

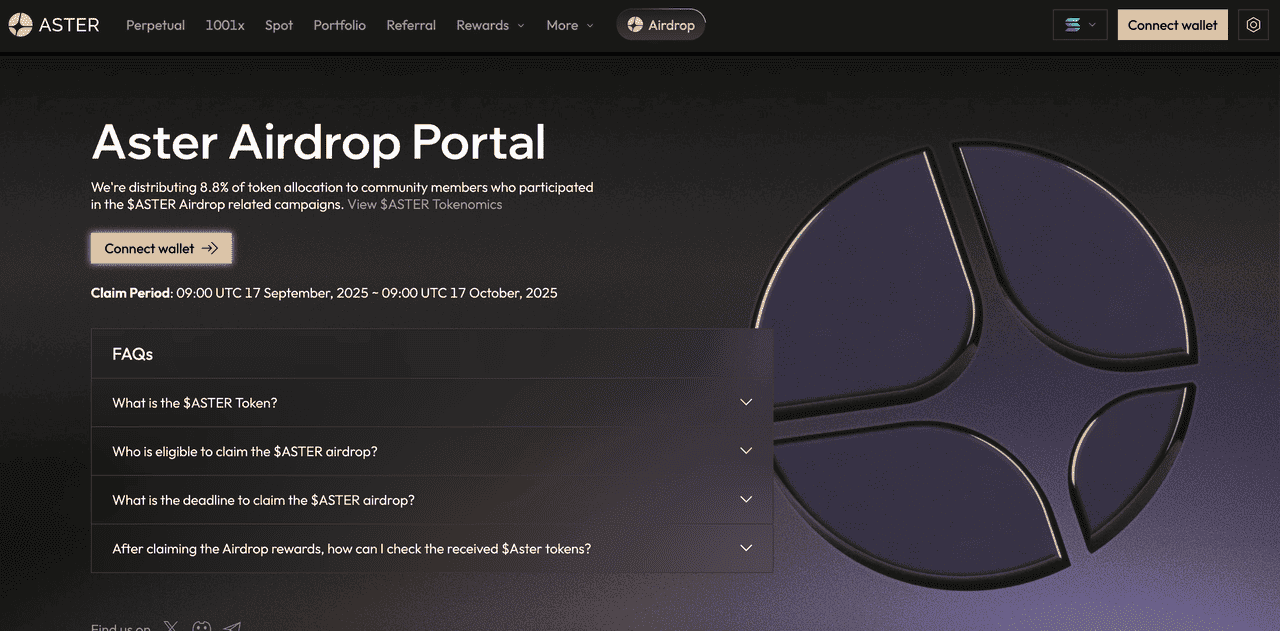

What Is the Aster Airdrop and Who Is Eligible?

Source: Aster

Aster launched its first airdrop alongside the Token Generation Event (TGE) on September 17, 2025, distributing a large share of tokens to early users. Eligibility covered Aster Spectra participants, community campaign members, and APX holders transitioning into the unified ASTER ecosystem.

Users could claim rewards directly through Aster Spot or withdraw to external wallets on BNB Chain. The claim period remained open until October 17, 2025, mirroring Aster’s community-first token design: more than 53% of total supply is reserved for airdrops and user incentives. The event successfully migrated the APX community, boosted on-chain activity, and helped push ASTER to a multi-billion-dollar market cap within weeks of launch.

ASTER's Upcoming Airdrop: Stage 3 “Dawn” Begins October 6, 2025

After the initial

$ASTER airdrop, Aster launched Stage 3: Dawn on October 6, 2025, the next phase of its reward distribution program. This stage introduces the Rh Points system, which distributes tokens based on real activity across the platform:

• Trading perpetuals or spot

• Staking assets

• Providing liquidity

• Participating in campaigns and team missions

Rh Points are calculated weekly and converted into ASTER token rewards at the end of the campaign. The system also ties rewards to Rocket Launch activity, where trading fees are used to buy back ASTER from the open market before redistribution, giving users direct exposure to protocol growth.

To stay eligible for future airdrops, users should:

• Trade on Aster Spot or Perpetuals

• Join Rocket Launch campaigns

• Provide liquidity or stake assets

• Track progress on the Aster Dashboard

Consistent engagement increases reward multipliers and boosts future distribution potential as Aster expands across BNB Chain, Ethereum, Solana, and Arbitrum.

How to Buy and Trade ASTER on BingX

If you're building a long-term ASTER position or want to trade short-term volatility after its Binance listing and Rocket Launch surge, BingX offers the easiest way to start. ASTER is available on both Spot and Futures markets on BingX, and with

BingX AI integrated directly into the trading interface, users get real-time support and market intelligence before placing any order.

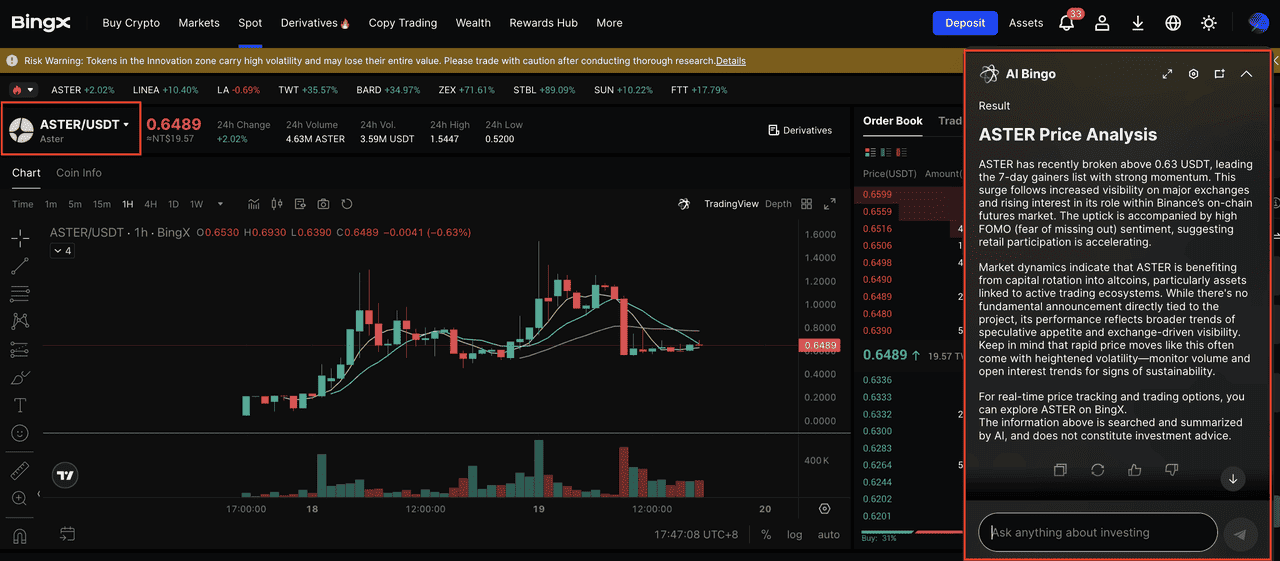

1. Buy or Sell ASTER on the Spot Market

ASTER/USDT trading pair on the spot market powered by BingX AI

Spot trading is ideal if you want to accumulate ASTER, buy dips after price pullbacks, or hold the token long-term as the Aster ecosystem expands.

Step 1: Open the BingX Spot Market and search for

ASTER/USDT.

Step 2: Click the AI icon on the chart to activate BingX AI. It will display support and resistance zones, trend signals, liquidity pockets, and breakout probabilities in real time.

Step 3: Choose a

Market Order for instant execution, or set a Limit Order at your preferred price. Once filled, ASTER appears in your BingX balance and can be held or withdrawn to any

Web3 wallet supporting BNB Chain.

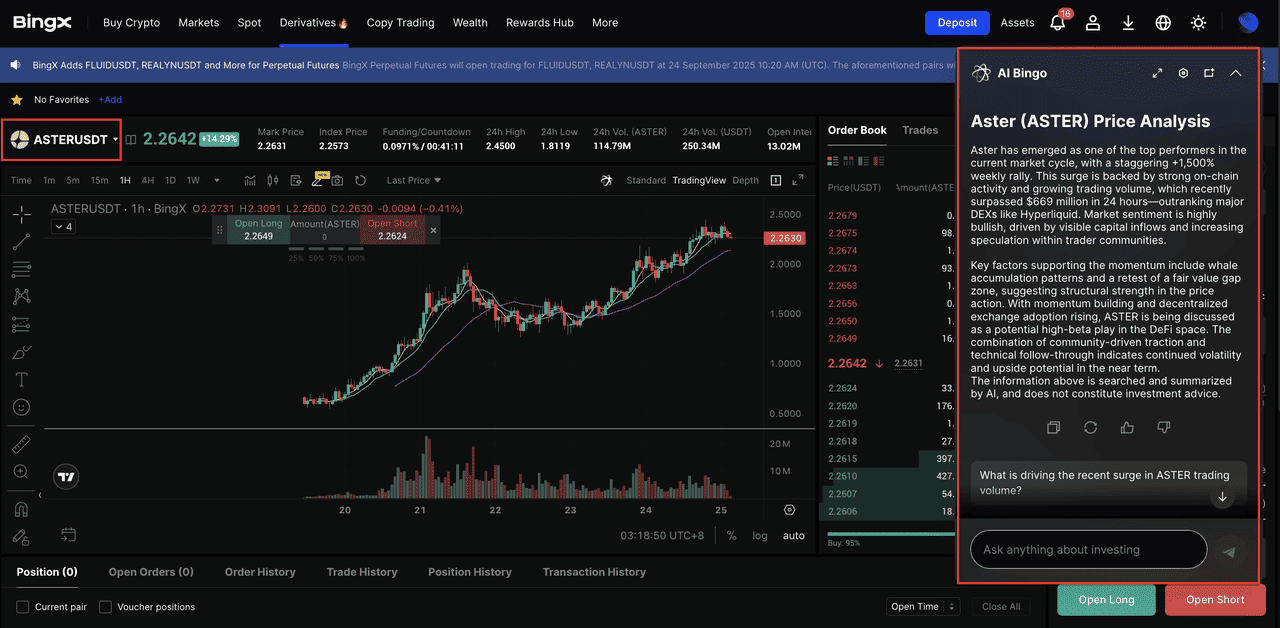

2. Trade ASTER With Leverage on Futures

ASTER/USDT perpetual contract on the futures market powered by BingX AI insights

For active traders, BingX Futures allows you to long or short ASTER with leverage, meaning you can profit whether the price rises or falls. This is especially useful during volatile periods, such as following CZ’s 2 million token purchase, the 20% intraday spike, and Rocket Launch trading bursts.

Step 2: Activate BingX AI to analyze momentum, volatility, funding rates, and trend strength.

Step 3: Select leverage, set your entry price, and place a Long (Buy) or Short (Sell) order. Use stop-loss and take-profit tools to manage risk effectively.

What’s Next for Aster: Future Roadmap

Aster’s next phase focuses on scaling beyond a single perpetual exchange. The team is developing Aster Chain, a dedicated Layer-1 network designed to integrate zero-knowledge privacy and intent-based trade routing. This would allow orders to move across chains and liquidity sources seamlessly, making execution smarter and more automated. Support for additional yield-bearing collateral, mobile-first upgrades, VIP tiers, and continued Rocket Launch campaigns all point toward a broader ecosystem rather than a standalone DEX.

While Aster’s growth in 2025 has been rapid, future performance will depend on whether these milestones are delivered and adopted by users. High leverage, volatile token prices, and competition from established perp DEXs mean traders should manage risk carefully and avoid overexposure. As with any emerging DeFi platform, it’s important to research, test with small amounts first, and use risk controls when trading or holding ASTER.

Related Reading

FAQs on Aster Decentralized Exchange

1. When was the ASTER token launched?

The ASTER token launched on September 17, 2025 during its Token Generation Event (TGE). The launch triggered rapid growth, with the token surging over 2,700% in the weeks following TGE.

2. When was the first ASTER airdrop?

The first Aster airdrop was released alongside the TGE on September 17, 2025, distributing a large portion of supply to early users, APX holders, and Aster Spectra participants. The claim window remained open until October 17, 2025.

3. When is the next Aster airdrop?

The next phase of the airdrop, Stage 3: Dawn, started on October 6, 2025. It uses a Rh Points system that rewards users for trading, staking, providing liquidity, and participating in Rocket Launch events. Additional airdrops are expected, but exact dates have not been announced.

4. What blockchain does Aster operate on?

Aster is multichain, supporting trading on BNB Chain, Ethereum, Solana, and Arbitrum. The ASTER token itself is a BEP-20 asset on BNB Chain.

5. Which wallets support ASTER tokens?

6. Does Aster support stock perpetuals?

Yes. Aster allows 24/7 stock perpetual trading, letting users trade crypto and traditional equities on the same platform.

7. How does Aster compare to Hyperliquid?

Hyperliquid still leads in overall market share, but Aster is gaining fast with features like Hidden Orders, 1001x leverage, yield-bearing collateral, Rocket Launch rewards, and multichain trading.