Plasma(XPL) is redefining what it means to build infrastructure for stablecoins. Designed from the ground up to support high-volume, low-cost digital dollar movement, Plasma delivers zero-fee

USDT transfers, thousands of transactions per second, native

EVM compatibility, and deep launch liquidity.

The timing could not be more urgent. In 2024,

stablecoins processed more than $32.8 trillion in transaction volume and now account for over 50% of all onchain activity. Yet most of this value still flows through general-purpose blockchains that were never built with stablecoins in mind. These networks often struggle with high fees, congestion, and limited scalability.

Plasma takes a different approach. By focusing entirely on stablecoin payments and designing everything from first principles, it aims to become the settlement layer where money can move freely, efficiently, and securely.

With the launch of its native token XPL, Plasma is opening the door for early supporters to take part. The upcoming XPL public sale offers a rare opportunity to join a project that is not only solving real infrastructure challenges, but also shaping the future of global money movement.

What Is Plasma and How Does It Work?

Plasma is a new blockchain built from the ground up to make stablecoin payments faster, cheaper, and easier to use. While most blockchains today were created long before stablecoins became popular, Plasma was designed specifically with digital dollars in mind.

Here’s how Plasma stands out:

• No transfer fees for USDT: You can send USDT without needing to pay gas fees or hold any other tokens. Plasma covers the cost directly.

• High throughput with low latency: Powered by PlasmaBFT, a pipelined consensus protocol, the network can process thousands of transactions per second with confirmation in seconds.

• Secured by Bitcoin: Every transaction on Plasma is anchored to

Bitcoin, the most secure blockchain in the world. This gives Plasma strong protection against tampering or censorship.

• Custom gas tokens and confidential payments: Projects can use stablecoins or other approved tokens to pay for

gas, and upcoming privacy modules will enable shielded transfers for sensitive financial flows.

In short, Plasma is not trying to do everything. It is focused on doing one thing really well: making stablecoin payments work smoothly at global scale.

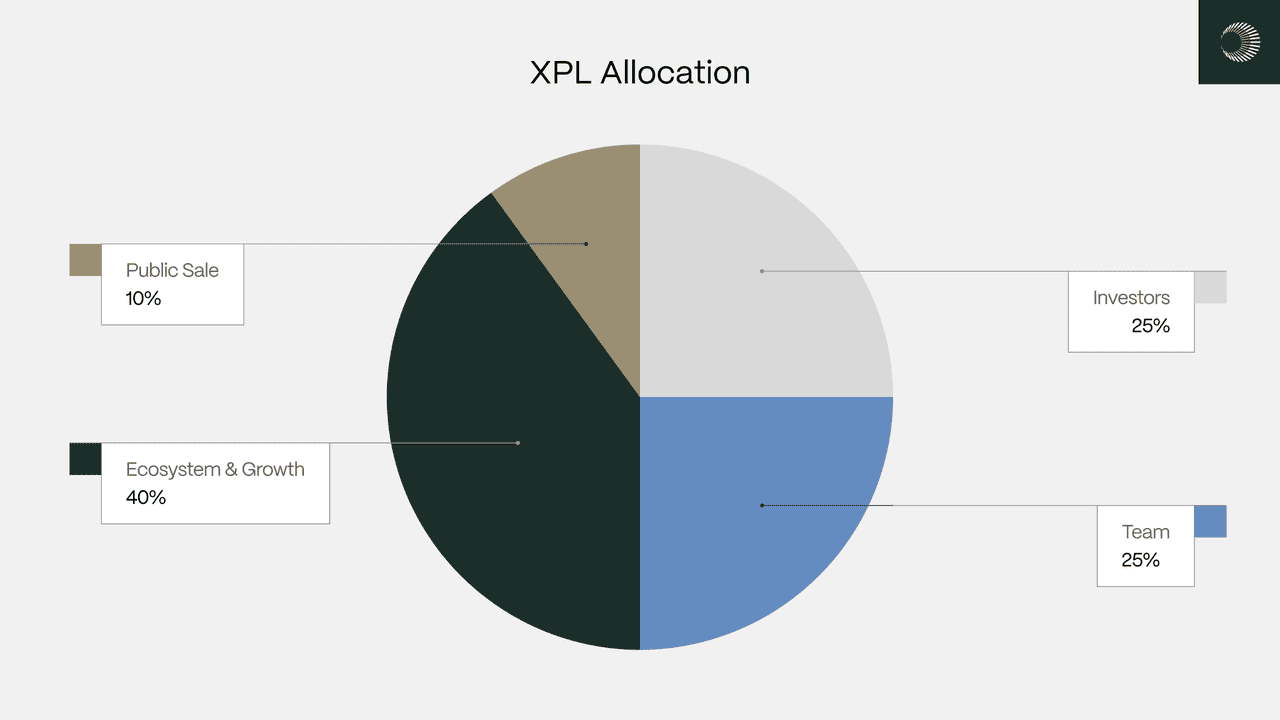

What Is XPL Tokenomics?

XPL Token Distribution

Source: Plasma Announcement

• Total Supply: 10 billion XPL at mainnet beta launch.

• Public Sale: 10% (1 billion XPL). Unlocked at launch for non-US participants. US participants are subject to a 12-month lockup ending July 28, 2026.

• Ecosystem and Growth: 40% (4 billion XPL). 800 million unlocked at launch. The remaining 3.2 billion vests monthly over 3 years.

• Team: 25% (2.5 billion XPL). One-third unlocks after 12 months. The rest vests monthly over the next 2 years.

• Investors: 25% (2.5 billion XPL). Follows the same vesting schedule as the team.

XPL Token Utility and Mechanism

1. Securing the Network and Aligning Incentives

XPL powers Plasma’s Proof-of-Stake system, where

validators stake tokens to participate in consensus and earn rewards. Holders can also delegate their XPL to validators. Rewards begin at 5% annual inflation and gradually decrease to 3%, but only activate when external validators and delegation go live. Locked team and investor tokens are excluded from staking until unlocked.

2. Powering Transactions and Protocol Operations

While USDT transfers are gasless, XPL is required for smart contract execution and advanced transactions. Developers can register custom gas tokens for smoother user experiences. Plasma also burns base transaction fees using an EIP-1559-style model, helping to offset inflation and support long-term token value.

3. Fueling Ecosystem Growth and Future Governance

XPL is used to fund ecosystem incentives, liquidity programs, integrations, and strategic partnerships. In the future, it may also be used for protocol governance as Plasma moves toward broader community participation.

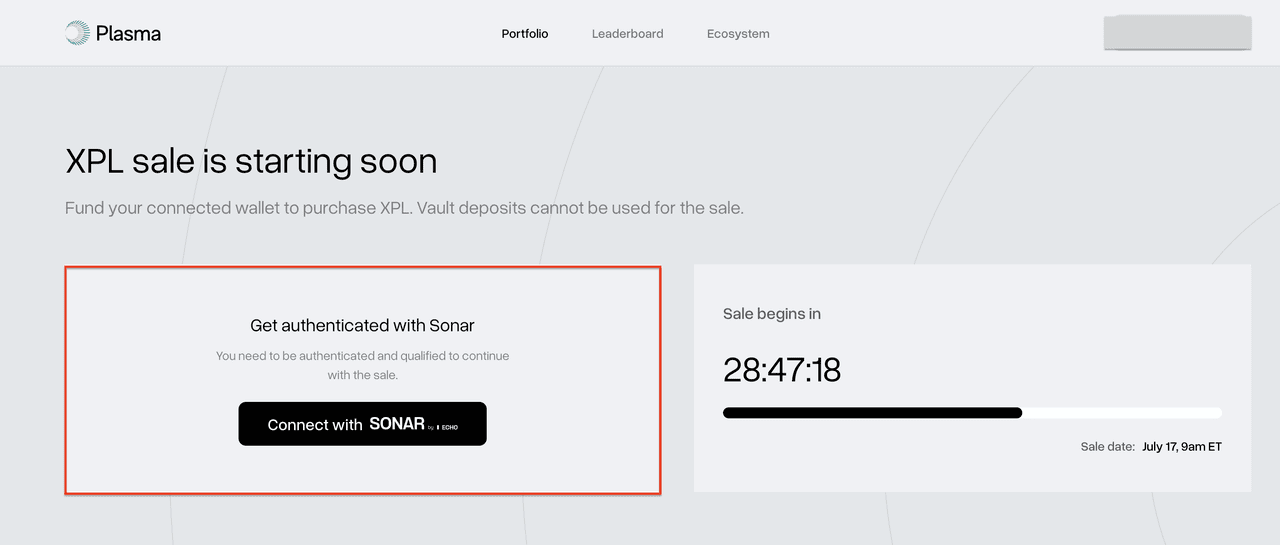

When Is the XPL Public Sale?

The XPL public sale marks a major milestone for Plasma, offering early supporters a chance to secure tokens ahead of mainnet beta. A total of 1 billion XPL (10% of total supply) is allocated for this event.

Source: Plasma X (Twitter)

XPL Public Sale Key Dates and Unlock Schedule

• Sale opens: Thursday, July 17, 2025, at 9:00 AM ET

• Sale closes: Monday, July 28, 2025, at 9:00 AM ET

• Non-US participants: Tokens are fully unlocked at mainnet beta

• US participants: Tokens are locked for 12 months and unlock on July 28, 2026

Who Is Eligible for XPL Public Sale

Participants must meet the following criteria:

• Joined the earlier Plasma deposit campaign

• Completed identity verification through Sonar by Echo

• Not located in a restricted jurisdiction (including the UK, China, Russia, Iran, Cuba, Syria, North Korea, or Ukraine)

• US participants must verify accredited investor status

Allocation and Token Delivery

Each participant’s XPL allocation is based on their time-weighted share of stablecoin deposits made during the Plasma vault campaign. This determines your guaranteed purchase amount for the public sale.

If some participants do not use their full allocation, the remaining tokens will be redistributed to those who committed above their guaranteed amount, proportionally based on the total overage. Any excess funds that are not used will be refunded after the sale ends.

All purchased XPL will be distributed at mainnet beta launch. At that time, tokens will be claimable through the Plasma dashboard. Stablecoins used in the sale will be bridged into Plasma as USDT₀, and vault receipt tokens will become redeemable on-chain. This ensures your XPL and stablecoin balances are available and usable as soon as the network goes live.

How to Participate in the XPL Public Sale: A Step-by-Step Guide

The Plasma launch is structured into four key stages, from early deposits to full token distribution at mainnet. To take part in the public sale, users go through five simple steps, each aligned with a specific stage in the rollout.

If you missed the deposit phase, you can still get access to XPL. After the sale, XPL will be available for trading on BingX, offering another way to join the Plasma ecosystem.

Step 1: Deposit Stablecoins (Stage 1 – Completed)

In the first stage, early participants went to the

Plasma Deposit page, connected the wallets and deposited USDT, USDC, USDS, or DAI into the Plasma Vault. This earned them units based on their time-weighted share of deposits, which determine their guaranteed allocation in the XPL public sale.

Step 2: Complete KYC

All participants must complete identity verification through Sonar by Echo. Users in restricted jurisdictions are not eligible. U.S. participants must also verify accredited investor status.

Step 3: Wait Through Lock-Up (Stage 2 – Now Live)

After the deposit window closed, all vault positions were locked for a minimum of 40 days. Stablecoins are now being converted to USDT in preparation for mainnet. No changes or actions are needed during this time.

Step 4: Join the Public Sale (Stage 3 – Coming Next)

When the sale opens, participants will be able to purchase XPL using new stablecoins. Allocations are based on the units earned during the deposit phase. Users can also commit extra funds to access any unclaimed tokens. Unused overcommitments will be refunded.

Step 5: Receive Tokens at Mainnet Launch (Stage 4)

At mainnet beta, non-U.S. participants will receive their XPL immediately. U.S. participants will receive theirs after a 12-month lockup. Stablecoin deposits from the vault will be bridged to Plasma and made available as USD₮₀.

Why Plasma Is One of the Most Watched Stablecoin Projects in 2025

In a saturated Layer 1 landscape,

Plasma stands out by doing one thing well: building infrastructure specifically for stablecoins at scale. As stablecoins become a central pillar of crypto adoption, and with regulatory momentum growing through initiatives like the

GENIUS Act in the U.S., the need for purpose-built settlement infrastructure has never been clearer.

Here’s why Plasma is gaining serious traction:

1. Solving a massive use case: Stablecoins processed over $32.8 trillion in 2024. Plasma is one of the few networks designed to handle that scale from day one.

2. Backed by top-tier investors: Plasma has raised funding from Founders Fund, Framework Ventures, Bitfinex, Nomura, and other major players across crypto and traditional finance.

3. Native USDT₀ integration: Direct alignment with USDT₀ ensures Plasma launches with seamless access to the world’s largest stablecoin.

4. Launch-ready liquidity: Over $1 billion in stablecoins are already lined up to enter the network at launch.

5. Focused go-to-market: Plasma is integrating with wallets, fintech platforms, and payment providers to support real-world usage in emerging markets.

With strong investor confidence, strategic positioning, and a clear product-market fit, Plasma is emerging as a credible settlement layer for the next era of digital money.

Future Outlook for Plasma

With its foundation in place, Plasma is now focused on execution and real-world adoption. The network is built for utility at scale, and its next phase is all about making that utility accessible.

What’s Next

• Mainnet beta will activate token claims, validator staking, and fee-free USDT transfers

• Developer support will include full EVM compatibility, stablecoin-native contracts, and onboarding resources

• Global integration efforts will prioritize real-world stablecoin use cases such as remittances, FX flows, and cross-border payments

Final Thoughts

After years of experimentation, crypto is entering a more practical era. Utility now matters as much as innovation. Stablecoins are leading that shift, but the infrastructure around them is still catching up.

Plasma arrives with a clear goal, and the groundwork is already in motion. The deposit phase is done. The lock-up is live. The public sale is around the corner. Mainnet will follow soon after.

For early supporters, this is more than a token launch. It is a chance to help shape how stablecoins move across networks and borders, not as theory, but as working infrastructure.

Related Reading

FAQs on Plasma (XPL)

Which chain does XPL run on?

XPL is the native token of Plasma, a new Layer 1 blockchain purpose-built for stablecoins. It does not run on Ethereum or other existing chains. All XPL tokens and transactions will live on the Plasma network after mainnet launch.

Which wallets support XPL?

Since Plasma is fully EVM-compatible, you can use any major Ethereum wallet to interact with it. This includes MetaMask, Rabbi, and other EVM-standard wallets. At mainnet, you’ll be able to connect directly to Plasma through these tools.

Will there be an XPL airdrop?

There is no separate airdrop planned at this time. XPL is being distributed through the deposit-based public sale, which ensures participants earn their allocation by contributing to the network’s early growth. The only way to receive XPL so far is by participating in the sale.