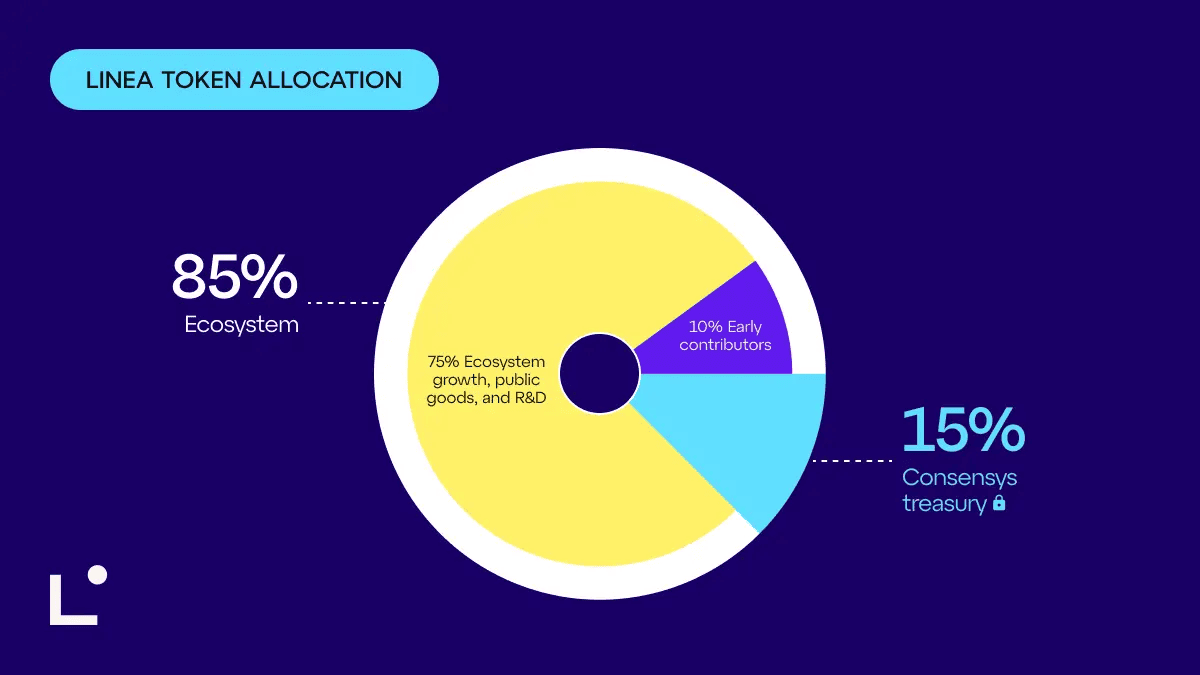

The $LINEA token is designed to fuel ecosystem growth through liquidity incentives and developer grants, reward early adopters via airdrops, and create long-term value with a deflationary burn model, with 72 billion tokens in total supply, of which around ~22% will be issued as its circulating supply at the time of TGE.

• 85% Ecosystem Fund – The largest fund of its kind, managed by the Linea Consortium (ENS Labs, Eigen Labs, Status,

SharpLink, and ConsenSys). Roughly 25% will support liquidity and builder activation in the first 12–18 months, with the rest released over 10 years to support long-term Ethereum public goods.

• 10% Community Airdrop & Rewards – Includes 9% for LXP airdrop recipients and 1% for strategic builders and core dApps. Fully unlocked at TGE.

• 15% ConsenSys Treasury – Locked for five years, ensuring no early insider sales. May later be used for staking capital or liquidity support.

This distribution is designed to mirror Ethereum’s early launch model: giving most tokens to builders and users while minimizing central control.

Linea Airdrop: Who Gets Tokens?

Linea’s airdrop inquiry opened on September 10, 2025 and will run until December 9, 2025. Up to 750,000 addresses can check eligibility.

• Eligibility: Users qualified by earning LXP points through Linea’s testnet and ecosystem activity.

• Sybil Protection: Data shared by the Linea team shows that over 50% of Sybil wallets were filtered out, mainly among accounts with fewer than 2,000 LXP points.

• LAM Boost: Some wallets also received LAM tokens, which are soul-bound, non-transferable multipliers that increase the size of airdrop rewards.

If you are eligible to receive the Linea airdrop, your claimable amount will be calculated using the formula: LXP × LAM Multiplier.

Practical Tip: Always confirm eligibility and claim only through the official Linea airdrop checker, which will be launched on mainnet before claims open. Never connect your wallet to unverified sites or share your seed phrase, official updates will be posted on Linea’s website and verified social channels.

What The $LINEA TGE and Airdrop Mean for Linea Tokens Investors

The Linea Token Generation Event (TGE) in Q3 2025 and its airdrop to 177,809 verified wallets mark a turning point for the network. For the first time, Linea’s economic layer goes live, creating opportunities but also short-term risks.

1. Claim and Trade Your $LINEA Tokens

If you are eligible, you can claim your $LINEA once the official airdrop dates are announced. Around 15.8 billion tokens (~22% of supply) will be circulating at launch, meaning liquidity will still be thin compared to the 72B total supply. Tokens are fully liquid at claim, so expect early claimers to sell while traders look to buy dips. This dynamic often creates sharp price swings in the first 24–48 hours, similar to other large airdrops.

Practical Tip: Beginners may want to wait until centralized exchanges like BingX list $LINEA, where liquidity is deeper and tools like stop-loss orders help manage risk.

2. Linea Ecosystem Growth Incentives

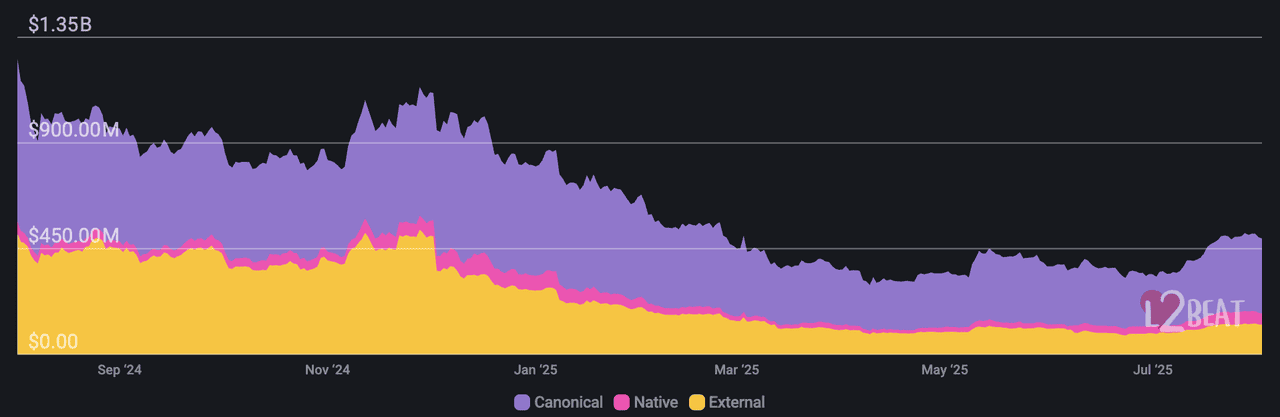

Right after the TGE, Linea will roll out its 10-week “Ignition Program”, targeting more than $1.8 billion in TVL through liquidity rewards and protocol incentives. For users, this means higher potential yields in DeFi pools, while traders can track inflows of capital that may support $LINEA’s price floor. Historically, incentive programs like these have triggered sudden spikes in daily active users and TVL, which can stabilize tokens after the initial volatility.

3. ETH Staking on Linea Begins in October 2025

In October, Linea will launch its native ETH staking vault. Users will be able to stake ETH directly on Layer 2, earning ETH rewards while enjoying ultra-low fees. For the network, this adds long-term stickiness: stakers provide security and liquidity, while traders benefit from reduced selling pressure as ETH gets locked in staking contracts.

Why it Matters for Traders: ETH staking and fee burns tie $LINEA’s value directly to network activity. The more people transact and stake, the more ETH and $LINEA are burned, creating deflationary pressure that can support token price over time.

How to Trade Linea Tokens on BingX

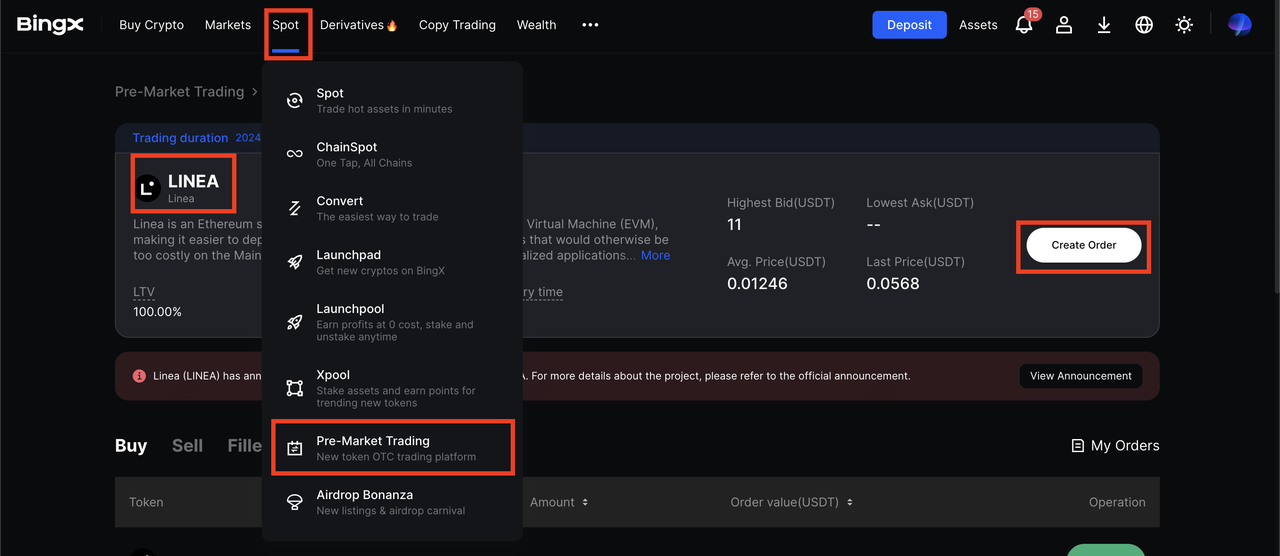

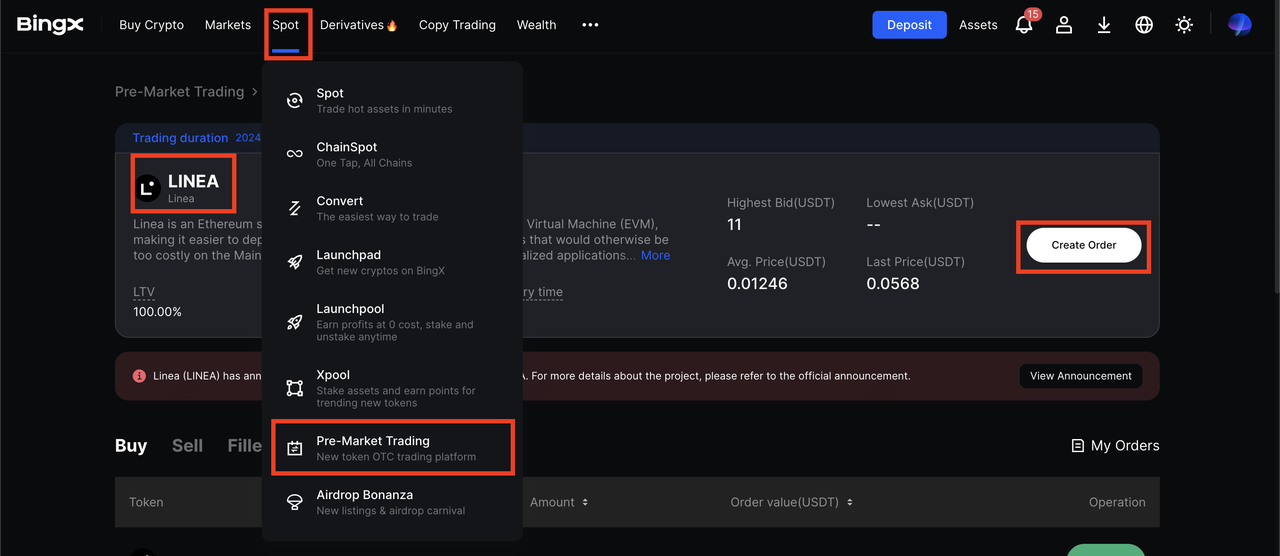

If you want exposure to $LINEA before its official exchange listings, BingX offers a

Pre-Market Trading feature where you can buy or sell tokens directly with other participants at negotiated prices. This lets you secure tokens early, but it also comes with wider spreads and higher volatility than regular

spot trading.

Trading $LINEA on BingX Pre-Market

Trade LINEA on BingX pre-market ahead of TGE

1. Create a BingX Account – Sign up on BingX and complete

KYC verification to unlock full trading access. Without KYC, you cannot participate in pre-market trading.

2. Navigate to Pre-Market Trading – From your dashboard, go to the Pre-Market section and search for “LINEA.” Here you’ll see active bids, asks, and recent trades.

3. Choose Maker or Taker –

• As a Maker, you can set your own buy or sell price and wait for someone to match it.

• As a Taker, you accept an existing order at the listed price for faster execution.

4. Delivery Stage – Once the TGE settlement is confirmed, sellers deposit their $LINEA into BingX, and buyers receive tokens in their BingX account automatically. Until then, your funds are safely held in escrow by BingX.

Trading on BingX Pre-Market gives you early exposure to $LINEA price discovery, which can be an advantage if demand surges after listing. But remember: pre-market order books are thinner than spot markets, so prices can swing sharply. Beginners should start small, set clear limits, and avoid chasing sudden moves.

What Is the LINEA Price Prediction Ahead of Official Token Launch?

Linea’s token is already seeing action in pre-market sessions, giving traders an early look at its volatility and potential trading ranges. On BingX Pre-Market, the last traded price was around $0.0568, with bids ranging from $0.012 to $0.11, highlighting just how wide spreads can get when liquidity is thin.

LINEA Token Price Outlook

• Short-Term (Post-TGE, September 2025): Based on pre-market trends, analysts expect a listing range of $0.05–$0.08. If buying pressure builds, the price could briefly test $0.10–$0.15, though sharp pullbacks are likely as airdrop recipients sell.

• Mid-Term (6–12 Months): With the 10-week Ignition Program and ETH staking vault live, $LINEA could find stability in the $0.20–$0.30 range, provided TVL grows toward or above $2 billion.

• Long-Term (2026+): If Linea ecosystem's adoption accelerates and burn mechanics drive scarcity, analysts see potential for $0.30–$0.50. In a strong bull market, even capturing 10% of its $3.6 billion FDV (fully diluted valuation) or ~$360 million market cap would represent significant upside from early prices.

Caution: These projections are speculative. Actual price action will depend on liquidity, exchange listings, incentive program success, and broader Ethereum Layer-2 adoption.

Final Word

Linea is entering the market with a clear structure: most tokens allocated to ecosystem growth, a dual burn model that reduces both ETH and $LINEA supply, and upcoming ETH staking to add real utility. These features position Linea as a Layer-2 designed to strengthen Ethereum while rewarding authentic users and builders.

For network users, this means lower fees, liquidity incentives, and new staking opportunities. For traders, the pre-market highlights both the potential for outsized gains and the reality of thin liquidity and sharp volatility.

Risk Reminder: New token launches often bring unpredictable price action, ranging from steep sell-offs to speculative spikes. Always manage your exposure carefully, set clear limits, and avoid chasing hype. Use only official Linea channels for airdrop claims and updates to

protect against phishing scams.

Related Reading