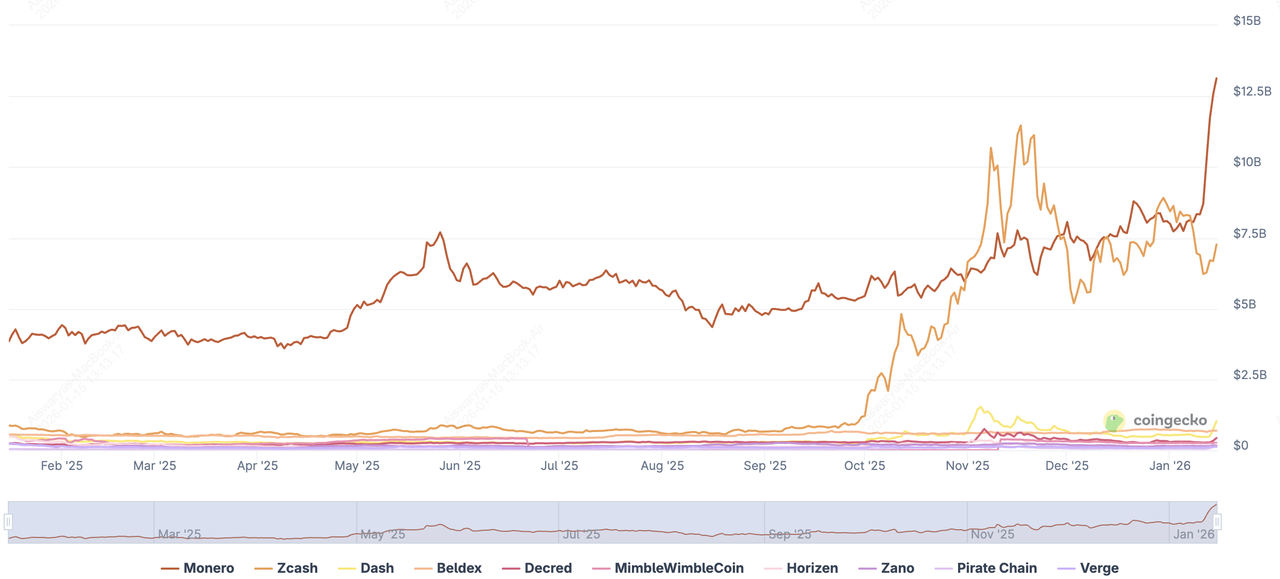

Privacy-focused cryptos are back on the radar in 2026, and the category has real liquidity behind it. CoinGecko’s Privacy Coins category shows a market cap around $23.5 billion with multi-billion daily volume as of Januay 2026, highlighting that privacy is no longer a niche narrative but an actively traded sector.

Market cap of leading privacy-focused coins | Source: CoinGecko

Below are the top 7 privacy-focused coins to watch in 2026, including how each one approaches privacy, what makes it relevant now, and the key risks you should price in before trading them.

What Are Privacy Coins and How Do They Work?

Privacy coins are cryptocurrencies built to protect your financial data on public blockchains by hiding who sent a transaction, who received it, and how much was transferred. Unlike

Bitcoin or

Ethereum, where every wallet balance and transaction is fully visible

on-chain, privacy coins use cryptographic tools such as ring signatures of

Monero,

Zcash's

zero-knowledge proofs, and

Dash's transaction mixing to break the link between wallets and payments. This makes it far harder for blockchain analytics firms, governments, or third parties to track your activity or build a financial profile from your on-chain history.

In 2026, privacy is no longer just about sending “anonymous payments.” The market is shifting toward programmable and compliance-ready privacy, where sensitive data can stay private while still allowing selective disclosure when required. Projects like

Horizen and

Midnight are building systems that let businesses, institutions, and users prove transactions are valid without exposing their underlying details, a model that fits regulated DeFi, private smart contracts, and enterprise use cases. This evolution is why privacy coins now represent a $23+ billion market, attracting both everyday users who want confidentiality and larger players who need privacy without breaking the rules.

Why Are Privacy Coins Gaining Traction in 2026?

Privacy coins are gaining traction in 2026 because rising surveillance, tighter regulation, and growing on-chain liquidity are pushing traders and users toward assets that protect financial privacy.

1. The privacy-coin sector is now worth $23.5 billion, with over $3.1 billion in daily trading volume, showing strong and sustained market demand.

2. Blockchain analytics firms can now track most Bitcoin and Ethereum transactions in real time, reducing anonymity and increasing demand for privacy-focused alternatives.

3. Governments are rolling out stricter AML rules and CBDCs with full transaction visibility, driving users toward coins that offer confidentiality.

4. During periods of macro fear and regulatory pressure, coins like Monero, Zcash, and Dash often see sharp capital inflows as traders rotate into privacy assets.

5. These rotations create fast, high-momentum price moves, making privacy coins one of the most volatile but opportunity-rich sectors in crypto in 2026.

What Are the 7 Best Privacy Coins to Keep an Eye On in 2026?

These seven privacy-focused cryptocurrencies stand out in 2026 for their technology, market relevance, and ability to capture rising demand for secure and confidential digital transactions.

1. Zcash (ZEC)

Zcash (ZEC) is the most institutionally visible privacy coin going into 2026, combining Bitcoin-style scarcity with zero-knowledge privacy. It uses zk-SNARKs to enable shielded transactions that hide the sender, receiver, and amount, while still allowing transparent transactions for compliance. As of January 2026, ZEC trades with a $7.1 billion market cap and roughly $788 million in daily trading volume, making it the most liquid and tradable asset in the privacy-coin sector.

Zcash’s relevance is being driven by real adoption and institutional demand. About 25–30% of the circulating ZEC supply is now held in shielded addresses, showing that users are actively using its privacy layer. At the same time, Grayscale holds nearly 394,000 ZEC, valued at around $190–200 million, in its Zcash Trust, which is in the process of being converted into a

spot Zcash ETF (ZCSH), a move that could bring mainstream capital into privacy coins for the first time. ZEC also posted a 700%+ gain over the past year, fueled by ETF speculation, rising on-chain usage, and a tightening supply schedule after its halving.

For traders in 2026, Zcash sits in a rare sweet spot: it offers strong cryptographic privacy, deep exchange liquidity, and a compliance-friendly design that keeps it tradable even as regulators increase scrutiny on anonymity tools. That combination makes ZEC a core proxy for the privacy-coin narrative, but it also means traders must watch regulatory developments and shielded-transaction adoption closely, as both will shape how far the rally can run.

2. Monero (XMR)

Monero (XMR) is the purest expression of privacy in crypto, built so that every transaction is private by default using ring signatures, stealth addresses, and RingCT. As of mid-January 2026, XMR trades with a $12.9 billion market cap and over $520 million in daily volume, making it not only the largest privacy coin but also one of the most actively traded altcoins overall. Its breakout to a new all-time high near $798 in January 2026 reflects a surge in demand as investors rotate into assets that cannot be easily tracked or censored.

XMR’s strength in 2026 is coming from both real usage and capital rotation. Regulatory changes like the EU’s DAC8 reporting rules and rising blockchain surveillance are pushing users toward default-private money, while turmoil in competing projects has sent capital flowing into Monero as the “safe haven” of the privacy sector. For traders, this gives XMR a rare profile: deep liquidity, strong narrative momentum, and unmatched fungibility, but also higher regulatory and exchange-listing risk than optional-privacy coins like Zcash.

3. Dash (DASH)

Dash (DASH) is the most payments-oriented name in the privacy-coin sector, combining fast, low-fee transfers with optional privacy through its PrivateSend for CoinJoin-style mixing and InstantSend features. As of January 2026, DASH trades with a $1.03 billion market cap and an unusually high $1.36 billion in daily trading volume, showing that it remains one of the most liquid and actively rotated legacy privacy tokens. Its price has surged over 100% in the past 30 days and more than 115% year-on-year, reflecting renewed interest as traders rotate into privacy-focused assets.

Dash’s appeal in 2026 comes from its balance of usability and adaptability. Unlike Monero, which enforces full anonymity, Dash allows users to choose when to use privacy, making it more accessible on exchanges and in regulated markets. This flexibility has helped it participate in the latest privacy-coin rally led by Zcash and Monero, while still attracting users who value instant payments and sub-cent fees for real-world transactions. The trade-off is that Dash’s privacy is not default, so during periods when investors want maximum anonymity, capital can still shift toward “pure privacy” networks, but DASH remains a high-liquidity proxy for the broader privacy narrative.

4. Horizen (ZEN)

Horizen (ZEN) has shifted from being a standalone privacy coin into privacy-first blockchain infrastructure built for real on-chain business. As of January 2026, ZEN trades with a $225 million market cap and nearly $270 million in daily trading volume, an unusually high turnover that shows active speculation around its ecosystem transition. The project now operates as a Layer-3 appchain on

Base, giving it EVM compatibility, Ethereum liquidity access, and low-cost execution, while still supporting zero-knowledge privacy for confidential smart contracts and transactions.

What makes Horizen relevant in 2026 is its push toward compliance-ready privacy, not just anonymous transfers. Using Zendoo sidechains and zk-SNARKs, developers can build private DeFi, regulated trading apps, healthcare data layers, and enterprise workflows where data stays hidden but can be selectively audited when required. With a fixed 21 million ZEN supply, DAO-governed funding, and a multi-year ecosystem incentive pool tied to its Base migration, ZEN is now being valued less as a payment coin and more as a privacy infrastructure token, though adoption of its new appchain stack will ultimately decide whether that re-rating holds.

5. Midnight (NIGHT)

Midnight (NIGHT) is one of the most closely watched privacy-layer projects of 2026 because it is not just hiding transactions but is also enabling programmable privacy for smart contracts. Built around zero-knowledge proofs and selective disclosure, Midnight allows apps to verify things like identity, solvency, or compliance without exposing underlying data. As of January 2026,

NIGHT trades with a $1.06 billion market cap and $28.7 million in daily volume, placing it among the largest new-generation privacy tokens. With a 24 billion max supply and over 16.6 billion already circulating, the token is already highly liquid compared with most early-stage ZK projects.

What makes Midnight structurally different is its two-token model: NIGHT is a public, unshielded asset used to secure the network and generate “DUST,” the private execution resource that powers confidential transactions and smart contracts. This design separates market speculation from on-chain privacy, making Midnight more compatible with DeFi, compliance, and enterprise use than traditional “private coins.” For traders, NIGHT represents a new-cycle ZK privacy narrative, one aimed at mainstream adoption, but it also carries early-ecosystem risk, since developer traction and real application usage must now catch up with the technology and valuation.

6. zkPass (ZKP)

zkPass (ZKP) is a privacy infrastructure protocol designed to let users prove real-world data, such as identity, employment, credit score, or website activity, without revealing the underlying information. It combines 3-party TLS (3P-TLS), multi-party computation (MPC), and zero-knowledge proofs (ZKPs) to generate verifiable cryptographic certificates directly from Web2 sites like banks, exchanges, and platforms, without APIs or data uploads. As of January 2026,

ZKP trades with a $26.9 million circulating market cap, $133.4 million fully diluted valuation, and roughly $27.7 million in daily trading volume, showing strong liquidity for an early-stage privacy protocol.

What makes zkPass important for 2026 is that it is not trying to hide transactions but is trying to make private data usable on-chain. Its TransGate SDK allows dApps to verify things like

KYC status, creditworthiness, or eligibility through ZK-based certificates or soul-bound zkSBTs that can be shared selectively or sent directly to a smart contract. Backed by Binance Labs, Sequoia, OKX Ventures, dao5, and Cypher Capital, zkPass is positioned as the identity and compliance layer for privacy-preserving Web3, which is why it is increasingly grouped with ZK-infrastructure tokens rather than privacy coins in market rotations.

7. Decred (DCR)

Decred (DCR) is one of the few long-running crypto networks that combines optional on-chain privacy with full on-chain governance, giving it a unique position in the 2026 privacy cycle. It uses CoinShuffle++ (CSPP), a non-custodial CoinJoin-style mixing system, to let users obscure transaction trails while keeping total supply auditable. As of January 2026,

DCR trades with a $473 million market cap, $34.4 million in daily volume, and about 17.22 million coins in circulation out of a 21 million max supply, putting it at 82% issuance with inflation already falling.

What makes Decred stand out for traders is its resilience and governance model. About 62% of all DCR is staked, giving holders direct voting power over network upgrades and treasury spending, while the protocol diverts 10% of every block reward into a self-funded treasury of around 869,000 DCR valued at $22 million that pays developers without relying on VC or token inflation. This makes DCR trade more like a “quality privacy-enabled

Layer-1” than a speculative anonymity coin, though its privacy is opt-in, and liquidity is thinner than leaders like XMR or ZEC, which can amplify moves during both rallies and sell-offs.

How to Trade Privacy Coins on BingX

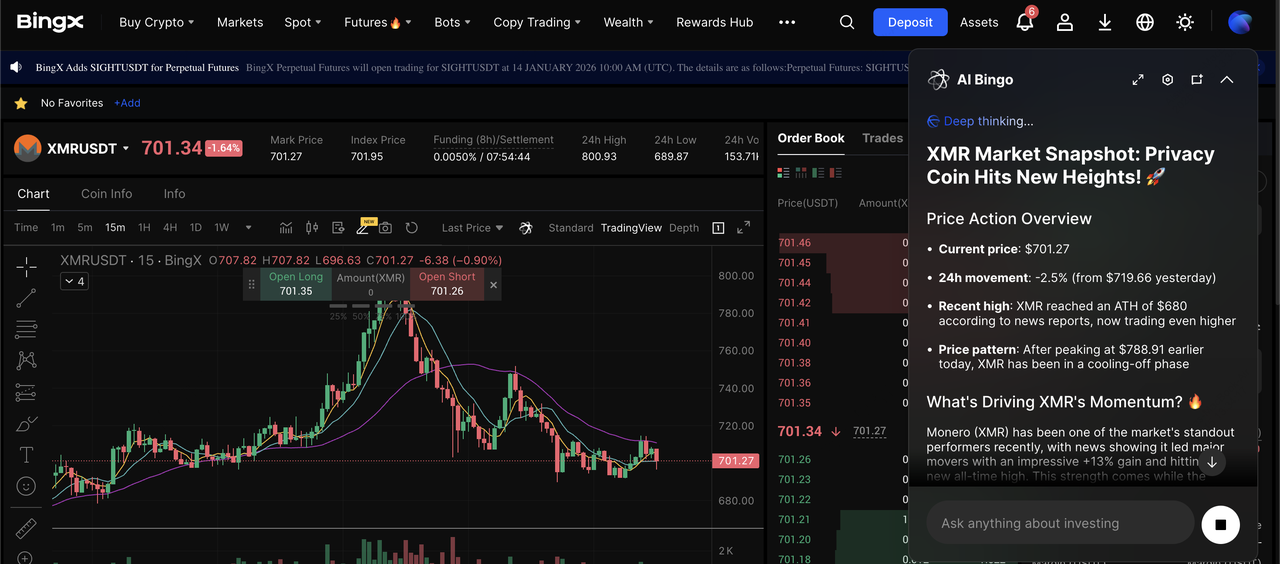

BingX AI helps you trade privacy coins like XMR, ZEC, DASH, ZEN, and NIGHT with real-time market signals, smart risk controls, and deep-liquidity spot and perpetual futures, making it easier to navigate one of crypto’s most volatile sectors in 2026.

Option 1: Buy or Sell Privacy Cryptos on the Spot Market

ZKP/USDT trading pair on the spot market powered by BingX AI insights

1. Go to bingx.com or open the BingX app. Sign up and complete KYC if required in your region.

2. Fund your account

USDT to start trading.

4. Choose Market (instant) or Limit (your price).

5. Enter the amount and click Buy or Sell.

6. Your coins appear in your Spot Wallet.

Option 2: Long or Short Privacy Coins with Leverage on the Futures Market

XMR/USDT perpetual contract on the futures market powered by BingX AI

1. Deposit or buy USDT: Futures trading uses USDT as collateral. You can deposit crypto, buy with a card, or use BingX P2P.

2. Transfer funds to your Futures Wallet: Open Assets, Transfer, and move USDT from your Spot Wallet to your Futures Wallet.

4. Choose your leverage and margin mode: Select Isolated or Cross margin. Beginners should start with low leverage (2x–5x).

5. Go Long or Short

• Buy / Long if you expect the price to rise

• Sell / Short if you expect the price to fall or want to hedge

6. Place your order: Use a

Market Order to enter instantly or a Limit Order to enter at your chosen price.

7. Set risk controls: Add a

Stop-Loss to cap downside and a Take-Profit to lock in gains. BingX AI can help identify key levels and volatility zones.

8. Monitor and manage your position: Track PnL, margin, and funding rates in the Positions tab. Adjust or close your trade at any time.

9. Close your trade: Click Close when you’re ready to exit. Your profit or loss is settled in USDT instantly.

Risk Reminder: Privacy coins can move fast. Use low leverage, keep position sizes small, and always use stop-losses when trading futures.

What Are the Top Risks of Investing in Privacy Coins in 2026?

Privacy coins offer strong upside in a surveillance-driven market, but in 2026 they also carry distinct structural and regulatory risks traders must manage.

1. Regulatory and delisting risk – Rules like EU DAC8, which goes live in Jan 2026, and AMLR 2027 increase pressure on exchanges to restrict or delist default-privacy assets such as XMR and BDX.

2. Liquidity shocks and fragmentation – When major venues pull support, trading shifts to smaller exchanges, leading to wider spreads, thinner order books, and higher slippage.

3. Extreme volatility – Privacy coins frequently see 30–100% moves in weeks during regulation or surveillance headlines, followed by sharp pullbacks.

4. Token unlock and supply risk – Newer projects like NIGHT and ZKP still have large portions of supply unlocking, which can pressure prices even during adoption growth.

5. Technology and cryptography risk – These networks depend on complex systems like zk-SNARKs, MPC, and RingCT; any exploit or failure could severely damage trust.

6. Exchange-driven price discovery – With limited DeFi liquidity, CEX listings, funding rates, and policy changes have an outsized impact on prices.

7. Narrative divergence – Capital rotates between “hard privacy” like XMR, BDX and “compliance-ready privacy” like ZEC, ZEN, NIGHT, meaning not all privacy coins rally together.

Final Thoughts: Should You Buy Privacy Coins in 2026?

Privacy coins sit at the center of one of the most important trends shaping crypto in 2026: the tension between on-chain transparency, financial surveillance, and personal data protection. From battle-tested networks like Monero, Zcash, Dash, and Decred to newer platforms such as Midnight, Horizen, and Beldex, the sector now offers a wide range of approaches, from hard, default privacy to compliance-ready, programmable confidentiality. This diversity means investors are no longer just betting on “anonymity,” but on how privacy will be integrated into payments, DeFi, identity, and enterprise blockchains.

At the same time, privacy coins remain high-risk, high-volatility assets. Regulation, exchange listings, token unlocks, and shifting narratives can move prices faster than fundamentals. If you choose to invest or trade them, keep position sizes conservative, diversify across different privacy models, and use clear risk controls, especially when trading leveraged products. Privacy is becoming more valuable in the digital economy, but in crypto markets, price risk always comes first.

Related Reading